Deck 11: Credit Risk: Loan Portfolio and Concentration Risk

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/51

Play

Full screen (f)

Deck 11: Credit Risk: Loan Portfolio and Concentration Risk

1

In the use of modern portfolio theory (MPT), the sum of the credit risks of loans under estimates the risk of the whole portfolio.

False

2

The simple model of migration analysis tracks the credit ratings of companies that have borrowed from the FI.

True

3

Loan loss ratio models are based on historical loan loss ratios of specific sectors relative to the historic loan loss ratios of the FI's entire loan portfolio.

True

4

The concentration limit method of managing credit risk concentration involves estimating the minimum loan amount to a single customer as a percent of capital.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

5

Concentration limits are used to either reduce or increase exposure to specific industries.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

6

General diversification limits established by life and property and casualty insurance regulators are based on the concepts of modern portfolio theory.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

7

Included in the Moody's Analytics model are recovery rates on defaulted loans.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

8

Migration analysis is not appropriate for an FI to use in the analysis of credit risk of consumer loans and credit card portfolios.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

9

The all-in-spread (AIS) used in the Moody's Analytics model is the difference between the interest rate on a loan and the prime lending rate at the time the loan was originated.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

10

Banks whose loan portfolio composition deviates from the national benchmark should immediately implement policies to move toward benchmark alignment.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

11

Commercial bank call reports are provided by banks to the U.S. Federal Reserve and are useful in determining the proportion of loans in different classifications for the entire U.S. banking system.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

12

Most portfolio managers will accept some level of risk above the minimum risk portfolio if they expect to receive higher returns.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

13

OSFI policy for measuring credit concentration risk favours technical models over subjective analysis.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

14

Portfolio risk can be reduced through diversification only if the returns of the loans in the portfolio are negatively correlated.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

15

One advantage of portfolio diversification methods is that they are applicable to all FIs, regardless of their size.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

16

Comparing the loan mix of an individual FI to a national benchmark loan mix is useful in determining the extent that the individual FI may differ from an efficient portfolio composition.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

17

The variance of returns of a portfolio of loans normally is equal to the arithmetic average of the variance of returns of the individual loans.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

18

The expected return of a portfolio of loans is equal to the weighted average of the expected returns of the individual loans.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

19

A disadvantage to modern portfolio theory (MPT) is that small institutions generally hold significant amounts of regionally specific and illiquid loans.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

20

In the past, data availability limited the use of sophisticated portfolio models to set concentration limits.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

21

As part of measuring unobservable default risk between borrowers, the Moody's Analytics model decomposes asset returns into

A)credit risk and market risk.

B)systematic risk and unsystematic risk.

C)market risk and sovereign risk.

D)regional risk and maturity risk.

E)systematic risk and default risk.

A)credit risk and market risk.

B)systematic risk and unsystematic risk.

C)market risk and sovereign risk.

D)regional risk and maturity risk.

E)systematic risk and default risk.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

22

In the Moody's Analytics portfolio model, the expected return on a loan is the

A)annual all-in-spread minus the expected loss on the loan.

B)annual all-in-spread minus expected probability of the borrower defaulting over the next year.

C)annual all-in-spread minus the loss given default.

D)the interest and fees paid by the borrower minus the interest paid by the FI to fund the loan.

E)the interest and fees paid by the borrower minus the expected loss on the loan.

A)annual all-in-spread minus the expected loss on the loan.

B)annual all-in-spread minus expected probability of the borrower defaulting over the next year.

C)annual all-in-spread minus the loss given default.

D)the interest and fees paid by the borrower minus the interest paid by the FI to fund the loan.

E)the interest and fees paid by the borrower minus the expected loss on the loan.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

23

Which model involves estimating the systematic loan loss risk of a particular sector or industry relative to the loan loss risk of an FI's total loan portfolio?

A)Credit Metrics.

B)Credit Risk +.

C)Loan loss ratio-based model.

D)KMV portfolio manager model.

E)Loan volume-based model.

A)Credit Metrics.

B)Credit Risk +.

C)Loan loss ratio-based model.

D)KMV portfolio manager model.

E)Loan volume-based model.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

24

In the Moody's Analytics model, which of the following is a function of the historical returns of the individual assets.

A)The risk of a loan.

B)The expected default frequency.

C)The loss given default.

D)The correlation of default risk.

E)The volatility of the loan's default rate.

A)The risk of a loan.

B)The expected default frequency.

C)The loss given default.

D)The correlation of default risk.

E)The volatility of the loan's default rate.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

25

In the Moody's Analytics portfolio model, the expected loss on a loan is

A)the product of the estimated loss given default and risk-free rate on a security of equivalent maturity.

B)annual all-in-spread minus the loss given default.

C)annual all-in-spread minus the expected default frequency.

D)the product of the expected default frequency and the estimated loss given default.

E)the volatility of the loan's default rate around its expected value.

A)the product of the estimated loss given default and risk-free rate on a security of equivalent maturity.

B)annual all-in-spread minus the loss given default.

C)annual all-in-spread minus the expected default frequency.

D)the product of the expected default frequency and the estimated loss given default.

E)the volatility of the loan's default rate around its expected value.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following methods measure loan concentration risk by tracking credit ratings of firms in particular sectors or ratings class for unusual downgrades?

A)Migration analysis.

B)Concentration limits.

C)Loan loss ratio-based model.

D)Moody's Analytics portfolio manager model.

E)Loan volume-based model.

A)Migration analysis.

B)Concentration limits.

C)Loan loss ratio-based model.

D)Moody's Analytics portfolio manager model.

E)Loan volume-based model.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

27

If a bank's concentration limit (as a percentage of capital) is 25.0 percent, and it does not permit a loss of any loan to impact more than 10 percent of its capital, what is the expected recovery on loans that are defaulted?

A)20 percent.

B)30 percent.

C)40 percent.

D)50 percent.

E)60 percent.

A)20 percent.

B)30 percent.

C)40 percent.

D)50 percent.

E)60 percent.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

28

If a bank's concentration limit (as a percent of capital) is 20 percent, and its expected recovery from defaulted loans is 50 percent, what is the maximum loss it permits to affect its capital in the event of a default?

A)5 percent.

B)10 percent.

C)15 percent.

D)20 percent.

E)25 percent.

A)5 percent.

B)10 percent.

C)15 percent.

D)20 percent.

E)25 percent.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

29

If the amount lost per dollar on a defaulted loan is 40 percent, then a bank that does not permit the loss of a loan to exceed 10 percent of its bank capital should set its concentration limit (as a percentage of capital) to

A)5 percent.

B)15 percent.

C)25 percent.

D)30 percent.

E)50 percent.

A)5 percent.

B)15 percent.

C)25 percent.

D)30 percent.

E)50 percent.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

30

What does Moody's Analytics Portfolio Manager Model use to identify the overall risk of the portfolio?

A)Maximum loss as a percent of capital.

B)Historical loan loss ratios.

C)Default probability on each loan in a portfolio.

D)Market value of an asset and the volatility of that asset's price.

E)Mean of the value of loans in a portfolio.

A)Maximum loss as a percent of capital.

B)Historical loan loss ratios.

C)Default probability on each loan in a portfolio.

D)Market value of an asset and the volatility of that asset's price.

E)Mean of the value of loans in a portfolio.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

31

Migration analysis is a tool to measure credit concentration risk and refers to

A)the identification of problem loans in sectors by observing periodic migration of industries.

B)the identification of credit concentration by observing trends in market borrowing by different sectors of the industry.

C)the identification of credit concentration by observing the downgrading or upgrading of credit ratings on securities in different sectors of industry by public rating agencies.

D)the identification of borrowing patterns such as long or short term debt by different sectors of industry.

E)the identification of shifts in debt/asset ratios of firms in specific industries.

A)the identification of problem loans in sectors by observing periodic migration of industries.

B)the identification of credit concentration by observing trends in market borrowing by different sectors of the industry.

C)the identification of credit concentration by observing the downgrading or upgrading of credit ratings on securities in different sectors of industry by public rating agencies.

D)the identification of borrowing patterns such as long or short term debt by different sectors of industry.

E)the identification of shifts in debt/asset ratios of firms in specific industries.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

32

According to Moody's Analytics, default correlations tend to be _____ and lie between _______.

A)Low; 0.002 and 0.15

B)High; 1.86 and 2.99

C)Low; 0.001 and 0.002

D)High; 2.99 and 3.50

E)Low; 0 and 0.001

A)Low; 0.002 and 0.15

B)High; 1.86 and 2.99

C)Low; 0.001 and 0.002

D)High; 2.99 and 3.50

E)Low; 0 and 0.001

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following is a measure of the sensitivity of loan losses in a particular business sector relative to the losses in an FI's loan portfolio?

A)Loss rate.

B)Systematic loan loss risk.

C)Concentration limit.

D)Loss given default.

E)Expected default frequency.

A)Loss rate.

B)Systematic loan loss risk.

C)Concentration limit.

D)Loss given default.

E)Expected default frequency.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

34

Any model that seeks to estimate an efficient frontier for loans, and thus the optimal proportions in which to hold loans made to different borrowers, needs to determine and measure the

A)expected return on each loan to a borrower.

B)risk of each loan made to a borrower.

C)correlation of default risks between loans made to borrowers.

D)expected return of the entire loan portfolio

E)All of these.

A)expected return on each loan to a borrower.

B)risk of each loan made to a borrower.

C)correlation of default risks between loans made to borrowers.

D)expected return of the entire loan portfolio

E)All of these.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following is a source of loan volume data?

A)Commercial bank call reports.

B)Data on shared national credits.

C)Commercial databases.

D)All of these.

E)Only OSFI has this data.

A)Commercial bank call reports.

B)Data on shared national credits.

C)Commercial databases.

D)All of these.

E)Only OSFI has this data.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following observations concerning concentration limits is not true?

A)Limits are set by assessing the borrower's current portfolio, its operating unit's business plans, its economists' economic projections, and its strategic plans.

B)FIs set concentration limits to reduce exposures to certain industries and increase exposures to others.

C)When two industry groups' performances are highly correlated, an FI may set an aggregate limit of less than the sum of the two individual industry limits.

D)FIs may set aggregate portfolio limits or combinations of industry and geographic limits.

E)Bank regulators in recent years have limited loan concentrations to individual borrowers to a maximum of 30 percent of a bank's capital.

A)Limits are set by assessing the borrower's current portfolio, its operating unit's business plans, its economists' economic projections, and its strategic plans.

B)FIs set concentration limits to reduce exposures to certain industries and increase exposures to others.

C)When two industry groups' performances are highly correlated, an FI may set an aggregate limit of less than the sum of the two individual industry limits.

D)FIs may set aggregate portfolio limits or combinations of industry and geographic limits.

E)Bank regulators in recent years have limited loan concentrations to individual borrowers to a maximum of 30 percent of a bank's capital.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

37

On loans fully secured by physical, non-real estate loans, the Basel Committee has set a loss given defaults (LGD) rate of

A)15 percent

B)25 percent

C)40 percent

D)45 percent

E)60 percent

A)15 percent

B)25 percent

C)40 percent

D)45 percent

E)60 percent

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

38

In the Moody's Analytics portfolio model, the risk of a loan measures

A)the product of the estimated loss given default and risk-free rate on a security of equivalent maturity.

B)annual all-in-spread minus the loss given default.

C)annual all-in-spread minus the expected default frequency.

D)the product of the expected default frequency and the estimated loss given default.

E)the volatility of the loan's default rate around its expected value times the amount lost given default.

A)the product of the estimated loss given default and risk-free rate on a security of equivalent maturity.

B)annual all-in-spread minus the loss given default.

C)annual all-in-spread minus the expected default frequency.

D)the product of the expected default frequency and the estimated loss given default.

E)the volatility of the loan's default rate around its expected value times the amount lost given default.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

39

A weakness of migration analysis to evaluate credit concentration risk is that the

A)information obtained for this analysis is usually ex-post (i.e. after the fact).

B)information obtained for this analysis is ex-ante (i.e. before the fact).

C)analysis makes use of historical data classified only by industries.

D)analysis makes use of historical data classified by individual firms.

E)migration of firms may only be temporary.

A)information obtained for this analysis is usually ex-post (i.e. after the fact).

B)information obtained for this analysis is ex-ante (i.e. before the fact).

C)analysis makes use of historical data classified only by industries.

D)analysis makes use of historical data classified by individual firms.

E)migration of firms may only be temporary.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

40

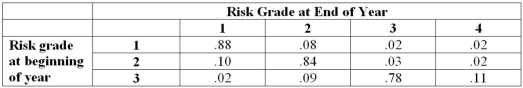

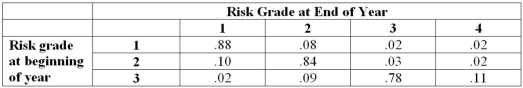

Matrix Bank has compiled the following migration matrix on consumer loans. Which of the following statements accurately summarizes this data?

A)Ten percent of grade two loans were upgraded during the year.

B)Grade one loans have a higher probability of downgrade than grades two or three.

C)Grade three loans have a higher probability of upgrade than grade two loans.

D)Grade three loans have a higher probability of downgrade than grade two loans.

E)All of these.

A)Ten percent of grade two loans were upgraded during the year.

B)Grade one loans have a higher probability of downgrade than grades two or three.

C)Grade three loans have a higher probability of upgrade than grade two loans.

D)Grade three loans have a higher probability of downgrade than grade two loans.

E)All of these.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

41

A regression of sectoral loan losses against total loans losses, both measured as a percentage of total loans, of a bank results in the following beta coefficients for the real estate (RE) and commercial (CL) loan variables: bRE = 1.2, bCL = 1.6. The intercept for both regressions is zero. The results indicate that for the bank

A)the real estate loan losses were systematically lower than the total loan losses.

B)the real estate loan losses were systematically higher than the total loan losses.

C)the commercial loan losses are systematically higher than the total loan losses.

D)the real estate loan losses were systematically lower than the total loan losses, and the commercial loan losses are systematically higher than the total loan losses.

E)the real estate loan losses were systematically higher than the total loan losses, and the commercial loan losses are systematically higher than the total loan losses.

A)the real estate loan losses were systematically lower than the total loan losses.

B)the real estate loan losses were systematically higher than the total loan losses.

C)the commercial loan losses are systematically higher than the total loan losses.

D)the real estate loan losses were systematically lower than the total loan losses, and the commercial loan losses are systematically higher than the total loan losses.

E)the real estate loan losses were systematically higher than the total loan losses, and the commercial loan losses are systematically higher than the total loan losses.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

42

Regina Bank has a policy of limiting their loans to any single customer so that the maximum loss as a percent of capital will not exceed 20 percent for both secured and unsecured loans. The limit has been adopted under the assumption that if the unsecured loan is defaulted, there will be no recovery of interest or principal payments. For loans that are secured (collateralized), it is expected that 40 percent of interest and principal will be collected. Suppose Kansas Bank wants to ensure that its maximum loss on a secured (collateralized) loan is 10 percent (as a percent of capital). If it wishes to keep a concentration limit at 40 percent for secured loans, what is the estimated amount lost per dollar of defaulted secured loan?

A)40 cents.

B)35 cents.

C)30 cents.

D)25 cents.

E)20 cents.

A)40 cents.

B)35 cents.

C)30 cents.

D)25 cents.

E)20 cents.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

43

A Hypothetical Rating Migration, or Transition Matrix, reflects all of the following EXCEPT

A)rating at which the portfolio ended the year.

B)transition probabilities.

C)rating at which the portfolio of loans began the year.

D)future migration expected in the portfolio.

E)the average proportions of loans that began the year.

A)rating at which the portfolio ended the year.

B)transition probabilities.

C)rating at which the portfolio of loans began the year.

D)future migration expected in the portfolio.

E)the average proportions of loans that began the year.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

44

Regina Bank has a policy of limiting their loans to any single customer so that the maximum loss as a percent of capital will not exceed 20 percent for both secured and unsecured loans. The limit has been adopted under the assumption that if the unsecured loan is defaulted, there will be no recovery of interest or principal payments. For loans that are secured (collateralized), it is expected that 40 percent of interest and principal will be collected. What is the concentration limit (as a % of capital) for secured loans made by this bank?

A)10 percent.

B)20 percent.

C)33 percent.

D)40 percent.

E)50 percent.

A)10 percent.

B)20 percent.

C)33 percent.

D)40 percent.

E)50 percent.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

45

Under which model does an FI compare its own allocation of loans in any specific area with the national allocations across borrowers to measure the extent to which its loan portfolio deviates from the market portfolio benchmark?

A)Credit Metrics.

B)Credit Risk +.

C)Loan loss ratio-based model.

D)Moody's Analytics portfolio manager model.

E)Loan volume-based model.

A)Credit Metrics.

B)Credit Risk +.

C)Loan loss ratio-based model.

D)Moody's Analytics portfolio manager model.

E)Loan volume-based model.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

46

In applying the loan loss ratio models, the loss rate "b" for the whole loan portfolio is

A)0.

B)0.5.

C)1.

D)2.

E)negative.

A)0.

B)0.5.

C)1.

D)2.

E)negative.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

47

Regina Bank has a policy of limiting their loans to any single customer so that the maximum loss as a percent of capital will not exceed 20 percent for both secured and unsecured loans. The limit has been adopted under the assumption that if the unsecured loan is defaulted, there will be no recovery of interest or principal payments. For loans that are secured (collateralized), it is expected that 40 percent of interest and principal will be collected. What is the concentration limit (as a percent of capital) for unsecured loans made by Kansas Bank?

A)5 percent.

B)10 percent.

C)15 percent.

D)20 percent.

E)25 percent.

A)5 percent.

B)10 percent.

C)15 percent.

D)20 percent.

E)25 percent.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

48

LNW Bank is charging a 12 percent interest rate on a $5,000,000 loan. The bank also charged $100,000 in fees to originate the loan. The bank has a cost of funds of 8 percent. The borrower has a five percent chance of default, and if default occurs, the bank expects to recover 90 percent of the principal and interest. What is the expected return on the loan using the Moody's Analytics model?

A)6.50 percent.

B)5.50 percent.

C)6.00 percent.

D)14.0 percent.

E)13.5 percent.

A)6.50 percent.

B)5.50 percent.

C)6.00 percent.

D)14.0 percent.

E)13.5 percent.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

49

In models that are based on loan loss ratios, a β that is found to be less than one for a particular loan sector indicates that

A)the loans in that sector will soon be downgraded soon.

B)the FI should increase its concentration in that loan sector due to the high rates of return.

C)the loan losses in that sector are systematically lower relative to total loan losses.

D)the FI should decrease its exposure to that sector because losses are higher than the rest of the portfolio

E)the calculation is in error because β is restricted to be greater than one.

A)the loans in that sector will soon be downgraded soon.

B)the FI should increase its concentration in that loan sector due to the high rates of return.

C)the loan losses in that sector are systematically lower relative to total loan losses.

D)the FI should decrease its exposure to that sector because losses are higher than the rest of the portfolio

E)the calculation is in error because β is restricted to be greater than one.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

50

LNW Bank is charging a 12 percent interest rate on a $5,000,000 loan. The bank also charged $100,000 in fees to originate the loan. The bank has a cost of funds of 8 percent. The borrower has a five percent chance of default, and if default occurs, the bank expects to recover 90 percent of the principal and interest. What is the risk of the loan using the Moody's Analytics model?

A)4.75 percent.

B)0.48 percent.

C)6.89 percent.

D)2.18 percent.

E)1.50 percent.

A)4.75 percent.

B)0.48 percent.

C)6.89 percent.

D)2.18 percent.

E)1.50 percent.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

51

A regression of sectoral loan losses against total loans losses, both measured as a percentage of total loans, of a bank results in the following beta coefficients for the real estate (RE) and commercial (CL) loan variables: bRE = 1.2, bCL = 1.6. The intercept for both regressions is zero. The results can be interpreted as

A)If the total loan losses of the bank measured as a percentage of total loans is 2 percent, the losses in the real estate sector, measured as a percentage of total loans, is 1.2 percent.

B)If the total loan losses of the bank measured as a percentage of total loans is 2 percent, the losses in the commercial sector, measured as a percentage of total loans, is 3.2 percent.

C)If the total loan losses of the bank measured as a percentage of total loans is 2 percent, the losses in the commercial sector, measured as a percentage of total loans, is 6.4 percent.

D)If the total loan losses of the bank measured as a percentage of total loans is 3 percent, the losses in the commercial sector, measured as a percentage of total loans, is 5.2 percent.

E)If the total loan losses of the bank measured as a percentage of total loans is 3 percent, the losses in the real estate sector, measured as a percentage of total loans, is 4 percent.

A)If the total loan losses of the bank measured as a percentage of total loans is 2 percent, the losses in the real estate sector, measured as a percentage of total loans, is 1.2 percent.

B)If the total loan losses of the bank measured as a percentage of total loans is 2 percent, the losses in the commercial sector, measured as a percentage of total loans, is 3.2 percent.

C)If the total loan losses of the bank measured as a percentage of total loans is 2 percent, the losses in the commercial sector, measured as a percentage of total loans, is 6.4 percent.

D)If the total loan losses of the bank measured as a percentage of total loans is 3 percent, the losses in the commercial sector, measured as a percentage of total loans, is 5.2 percent.

E)If the total loan losses of the bank measured as a percentage of total loans is 3 percent, the losses in the real estate sector, measured as a percentage of total loans, is 4 percent.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck