Exam 11: Credit Risk: Loan Portfolio and Concentration Risk

Exam 1: Why Are Financial Institutions Special90 Questions

Exam 2: Deposit-Taking Institutions43 Questions

Exam 3: Finance Companies71 Questions

Exam 4: Securities, Brokerage, and Investment Banking91 Questions

Exam 5: Mutual Funds, Hedge Funds, and Pension Funds61 Questions

Exam 6: Insurance Companies80 Questions

Exam 7: Risks of Financial Institutions110 Questions

Exam 8: Interest Rate Risk I110 Questions

Exam 9: Interest Rate Risk II116 Questions

Exam 10: Credit Risk: Individual Loans112 Questions

Exam 11: Credit Risk: Loan Portfolio and Concentration Risk51 Questions

Exam 12: Liquidity Risk85 Questions

Exam 13: Foreign Exchange Risk87 Questions

Exam 14: Sovereign Risk89 Questions

Exam 15: Market Risk95 Questions

Exam 16: Off-Balance-Sheet Risk101 Questions

Exam 17: Technology and Other Operational Risks107 Questions

Exam 18: Liability and Liquidity Management38 Questions

Exam 19: Deposit Insurance and Other Liability Guarantees54 Questions

Exam 20: Capital Adequacy102 Questions

Exam 21: Product and Geographic Expansion114 Questions

Exam 22: Futures and Forwards234 Questions

Exam 23: Options, Caps, Floors, and Collars113 Questions

Exam 24: Swaps95 Questions

Exam 25: Loan Sales83 Questions

Exam 26: Securitization Index98 Questions

Select questions type

Portfolio risk can be reduced through diversification only if the returns of the loans in the portfolio are negatively correlated.

Free

(True/False)

4.8/5  (28)

(28)

Correct Answer:

False

In the past, data availability limited the use of sophisticated portfolio models to set concentration limits.

Free

(True/False)

4.9/5  (24)

(24)

Correct Answer:

True

If a bank's concentration limit (as a percent of capital) is 20 percent, and its expected recovery from defaulted loans is 50 percent, what is the maximum loss it permits to affect its capital in the event of a default?

Free

(Multiple Choice)

4.9/5  (38)

(38)

Correct Answer:

B

Concentration limits are used to either reduce or increase exposure to specific industries.

(True/False)

4.9/5  (40)

(40)

Under which model does an FI compare its own allocation of loans in any specific area with the national allocations across borrowers to measure the extent to which its loan portfolio deviates from the market portfolio benchmark?

(Multiple Choice)

4.8/5  (33)

(33)

A weakness of migration analysis to evaluate credit concentration risk is that the

(Multiple Choice)

4.7/5  (38)

(38)

In applying the loan loss ratio models, the loss rate "b" for the whole loan portfolio is

(Multiple Choice)

4.7/5  (27)

(27)

According to Moody's Analytics, default correlations tend to be _____ and lie between _______.

(Multiple Choice)

4.9/5  (33)

(33)

One advantage of portfolio diversification methods is that they are applicable to all FIs, regardless of their size.

(True/False)

4.9/5  (33)

(33)

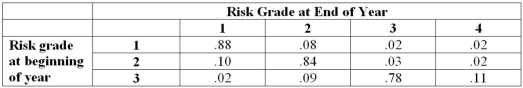

Matrix Bank has compiled the following migration matrix on consumer loans. Which of the following statements accurately summarizes this data?

(Multiple Choice)

4.8/5  (40)

(40)

What does Moody's Analytics Portfolio Manager Model use to identify the overall risk of the portfolio?

(Multiple Choice)

4.7/5  (38)

(38)

A Hypothetical Rating Migration, or Transition Matrix, reflects all of the following EXCEPT

(Multiple Choice)

4.7/5  (32)

(32)

The variance of returns of a portfolio of loans normally is equal to the arithmetic average of the variance of returns of the individual loans.

(True/False)

4.8/5  (37)

(37)

In the Moody's Analytics portfolio model, the risk of a loan measures

(Multiple Choice)

4.9/5  (39)

(39)

Commercial bank call reports are provided by banks to the U.S. Federal Reserve and are useful in determining the proportion of loans in different classifications for the entire U.S. banking system.

(True/False)

4.8/5  (30)

(30)

Most portfolio managers will accept some level of risk above the minimum risk portfolio if they expect to receive higher returns.

(True/False)

4.9/5  (31)

(31)

In the Moody's Analytics portfolio model, the expected loss on a loan is

(Multiple Choice)

4.9/5  (26)

(26)

Comparing the loan mix of an individual FI to a national benchmark loan mix is useful in determining the extent that the individual FI may differ from an efficient portfolio composition.

(True/False)

4.8/5  (41)

(41)

Included in the Moody's Analytics model are recovery rates on defaulted loans.

(True/False)

4.9/5  (39)

(39)

Showing 1 - 20 of 51

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)