Deck 6: Capital Allocation to Risky Assets

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/70

Play

Full screen (f)

Deck 6: Capital Allocation to Risky Assets

1

Which of the following statements regarding risk-averse investors is true

A)They only care about the rate of return.

B)They accept investments that are fair games.

C)They only accept risky investments that offer risk premiums over the risk-free rate.

D)They are willing to accept lower returns and high risk.

E)They only care about the rate of return, and they accept investments that are fair games.

A)They only care about the rate of return.

B)They accept investments that are fair games.

C)They only accept risky investments that offer risk premiums over the risk-free rate.

D)They are willing to accept lower returns and high risk.

E)They only care about the rate of return, and they accept investments that are fair games.

C

Explanation: Risk-averse investors only accept risky investments that offer risk premiums over the risk-free rate.

Explanation: Risk-averse investors only accept risky investments that offer risk premiums over the risk-free rate.

2

A portfolio has an expected rate of return of 0.15 and a standard deviation of 0.15.The risk-free rate is 6%.An investor has the following utility function: U = E(r) - (A/2)s2.Which value of A makes this investor indifferent between the risky portfolio and the risk-free asset

A)5

B)6

C)7

D)8

A)5

B)6

C)7

D)8

D

Explanation: 0.06 = 0.15 - A/2(0.15)2; 0.06 - 0.15 = -A/2(0.0225); -0.09 = -0.01125A; A = 8; U = 0.15 - 8/2(0.15)2 = 6%; U(Rf) = 6%.

Explanation: 0.06 = 0.15 - A/2(0.15)2; 0.06 - 0.15 = -A/2(0.0225); -0.09 = -0.01125A; A = 8; U = 0.15 - 8/2(0.15)2 = 6%; U(Rf) = 6%.

3

The presence of risk means that

A)investors will lose money.

B)more than one outcome is possible.

C)the standard deviation of the payoff is larger than its expected value.

D)final wealth will be greater than initial wealth.

E)terminal wealth will be less than initial wealth.

A)investors will lose money.

B)more than one outcome is possible.

C)the standard deviation of the payoff is larger than its expected value.

D)final wealth will be greater than initial wealth.

E)terminal wealth will be less than initial wealth.

B

Explanation: The presence of risk means that more than one outcome is possible.

Explanation: The presence of risk means that more than one outcome is possible.

4

Consider a risky portfolio, A, with an expected rate of return of 0.15 and a standard deviation of 0.15, that lies on a given indifference curve.Which one of the following portfolios might lie on the same indifference curve

A)E(r) = 0.15; Standard deviation = 0.20

B)E(r) = 0.15; Standard deviation = 0.10

C)E(r) = 0.10; Standard deviation = 0.10

D)E(r) = 0.20; Standard deviation = 0.15

E)E(r) = 0.10; Standard deviation = 0.20

A)E(r) = 0.15; Standard deviation = 0.20

B)E(r) = 0.15; Standard deviation = 0.10

C)E(r) = 0.10; Standard deviation = 0.10

D)E(r) = 0.20; Standard deviation = 0.15

E)E(r) = 0.10; Standard deviation = 0.20

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

5

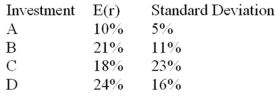

According to the mean-variance criterion, which of the statements below is correct

A)Investment B dominates investment A.

B)Investment B dominates investment C.

C)Investment D dominates all of the other investments.

D)Investment D dominates only investment B.

E)Investment C dominates investment A.

A)Investment B dominates investment A.

B)Investment B dominates investment C.

C)Investment D dominates all of the other investments.

D)Investment D dominates only investment B.

E)Investment C dominates investment A.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

6

In the mean-standard deviation graph an indifference curve has a ________ slope.

A)negative

B)zero

C)positive

D)vertical

E)cannot be determined

A)negative

B)zero

C)positive

D)vertical

E)cannot be determined

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

7

The exact indifference curves of different investors

A)cannot be known with perfect certainty.

B)can be calculated precisely with the use of advanced calculus.

C)although not known with perfect certainty, do allow the advisor to create more suitable portfolios for the client.

D)cannot be known with perfect certainty and although not known with perfect certainty, do allow the advisor to create more suitable portfolios for the client.

A)cannot be known with perfect certainty.

B)can be calculated precisely with the use of advanced calculus.

C)although not known with perfect certainty, do allow the advisor to create more suitable portfolios for the client.

D)cannot be known with perfect certainty and although not known with perfect certainty, do allow the advisor to create more suitable portfolios for the client.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

8

The certainty equivalent rate of a portfolio is

A)the rate that a risk-free investment would need to offer with certainty to be considered equally attractive as the risky portfolio.

B)the rate that the investor must earn for certain to give up the use of his money.

C)the minimum rate guaranteed by institutions such as banks.

D)the rate that equates "A" in the utility function with the average risk aversion coefficient for all risk-averse investors.

E)represented by the scaling factor "-.005" in the utility function.

A)the rate that a risk-free investment would need to offer with certainty to be considered equally attractive as the risky portfolio.

B)the rate that the investor must earn for certain to give up the use of his money.

C)the minimum rate guaranteed by institutions such as banks.

D)the rate that equates "A" in the utility function with the average risk aversion coefficient for all risk-averse investors.

E)represented by the scaling factor "-.005" in the utility function.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

9

In the mean-standard deviation graph, which one of the following statements is true regarding the indifference curve of a risk-averse investor

A)It is the locus of portfolios that have the same expected rates of return and different standard deviations.

B)It is the locus of portfolios that have the same standard deviations and different rates of return.

C)It is the locus of portfolios that offer the same utility according to returns and standard deviations.

D)It connects portfolios that offer increasing utilities according to returns and standard deviations.

E)None of the options

A)It is the locus of portfolios that have the same expected rates of return and different standard deviations.

B)It is the locus of portfolios that have the same standard deviations and different rates of return.

C)It is the locus of portfolios that offer the same utility according to returns and standard deviations.

D)It connects portfolios that offer increasing utilities according to returns and standard deviations.

E)None of the options

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

10

In a return-standard deviation space, which of the following statements is(are) true for risk-averse investors (The vertical and horizontal lines are referred to as the expected return-axis and the standard deviation-axis, respectively.)

I) An investor's own indifference curves might intersect.

II) Indifference curves have negative slopes.

III) In a set of indifference curves, the highest offers the greatest utility.

IV) Indifference curves of two investors might intersect.

A)I and II only

B)II and III only

C)I and IV only

D)III and IV only

E)None of the options

I) An investor's own indifference curves might intersect.

II) Indifference curves have negative slopes.

III) In a set of indifference curves, the highest offers the greatest utility.

IV) Indifference curves of two investors might intersect.

A)I and II only

B)II and III only

C)I and IV only

D)III and IV only

E)None of the options

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

11

A fair game

A)will not be undertaken by a risk-averse investor.

B)is a risky investment with a zero risk premium.

C)is a riskless investment.

D)will not be undertaken by a risk-averse investor and is a risky investment with a zero risk premium.

E)will not be undertaken by a risk-averse investor and is a riskless investment.

A)will not be undertaken by a risk-averse investor.

B)is a risky investment with a zero risk premium.

C)is a riskless investment.

D)will not be undertaken by a risk-averse investor and is a risky investment with a zero risk premium.

E)will not be undertaken by a risk-averse investor and is a riskless investment.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following statements is(are) true

I) Risk-averse investors reject investments that are fair games.

II) Risk-neutral investors judge risky investments only by the expected returns.

III) Risk-averse investors judge investments only by their riskiness.

IV) Risk-loving investors will not engage in fair games.

A)I only

B)II only

C)I and II only

D)II and III only

E)II, III, and IV only

I) Risk-averse investors reject investments that are fair games.

II) Risk-neutral investors judge risky investments only by the expected returns.

III) Risk-averse investors judge investments only by their riskiness.

IV) Risk-loving investors will not engage in fair games.

A)I only

B)II only

C)I and II only

D)II and III only

E)II, III, and IV only

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

13

Assume an investor with the following utility function: U = E(r) - 3/2(s2). To maximize her expected utility, she would choose the asset with an expected rate of return of _______ and a standard deviation of ________, respectively.

A)12%; 20%

B)10%; 15%

C)10%; 10%

D)8%; 10%

A)12%; 20%

B)10%; 15%

C)10%; 10%

D)8%; 10%

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

14

According to the mean-variance criterion, which one of the following investments dominates all others

A)E(r) = 0.15; Variance = 0.20

B)E(r) = 0.10; Variance = 0.20

C)E(r) = 0.10; Variance = 0.25

D)E(r) = 0.15; Variance = 0.25

E)None of these options dominates the other alternatives.

A)E(r) = 0.15; Variance = 0.20

B)E(r) = 0.10; Variance = 0.20

C)E(r) = 0.10; Variance = 0.25

D)E(r) = 0.15; Variance = 0.25

E)None of these options dominates the other alternatives.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

15

Elias is a risk-averse investor.David is a less risk-averse investor than Elias.Therefore,

A)for the same risk, David requires a higher rate of return than Elias.

B)for the same return, Elias tolerates higher risk than David.

C)for the same risk, Elias requires a lower rate of return than David.

D)for the same return, David tolerates higher risk than Elias.

E)Cannot be determined

A)for the same risk, David requires a higher rate of return than Elias.

B)for the same return, Elias tolerates higher risk than David.

C)for the same risk, Elias requires a lower rate of return than David.

D)for the same return, David tolerates higher risk than Elias.

E)Cannot be determined

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

16

Assume an investor with the following utility function: U = E(r) - 3/2(s2). To maximize her expected utility, which one of the following investment alternatives would she choose

A)A portfolio that pays 10% with a 60% probability or 5% with 40% probability.

B)A portfolio that pays 10% with 40% probability or 5% with a 60% probability.

C)A portfolio that pays 12% with 60% probability or 5% with 40% probability.

D)A portfolio that pays 12% with 40% probability or 5% with 60% probability.

A)A portfolio that pays 10% with a 60% probability or 5% with 40% probability.

B)A portfolio that pays 10% with 40% probability or 5% with a 60% probability.

C)A portfolio that pays 12% with 60% probability or 5% with 40% probability.

D)A portfolio that pays 12% with 40% probability or 5% with 60% probability.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following statements is(are) false

I) Risk-averse investors reject investments that are fair games.

II) Risk-neutral investors judge risky investments only by the expected returns.

III) Risk-averse investors judge investments only by their riskiness.

IV) Risk-loving investors will not engage in fair games.

A)I only

B)II only

C)I and II only

D)II and III only

E)III and IV only

I) Risk-averse investors reject investments that are fair games.

II) Risk-neutral investors judge risky investments only by the expected returns.

III) Risk-averse investors judge investments only by their riskiness.

IV) Risk-loving investors will not engage in fair games.

A)I only

B)II only

C)I and II only

D)II and III only

E)III and IV only

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

18

The utility score an investor assigns to a particular portfolio, other things equal,

A)will decrease as the rate of return increases.

B)will decrease as the standard deviation decreases.

C)will decrease as the variance decreases.

D)will increase as the variance increases.

E)will increase as the rate of return increases.

A)will decrease as the rate of return increases.

B)will decrease as the standard deviation decreases.

C)will decrease as the variance decreases.

D)will increase as the variance increases.

E)will increase as the rate of return increases.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

19

The riskiness of individual assets

A)should be considered for the asset in isolation.

B)should be considered in the context of the effect on overall portfolio volatility.

C)should be combined with the riskiness of other individual assets in the proportions these assets constitute the entire portfolio.

D)should be considered in the context of the effect on overall portfolio volatility and should be combined with the riskiness of other individual assets in the proportions these assets constitute the entire portfolio.

A)should be considered for the asset in isolation.

B)should be considered in the context of the effect on overall portfolio volatility.

C)should be combined with the riskiness of other individual assets in the proportions these assets constitute the entire portfolio.

D)should be considered in the context of the effect on overall portfolio volatility and should be combined with the riskiness of other individual assets in the proportions these assets constitute the entire portfolio.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

20

When an investment advisor attempts to determine an investor's risk tolerance, which factor would they be least likely to assess

A)The investor's prior investing experience

B)The investor's degree of financial security

C)The investor's tendency to make risky or conservative choices

D)The level of return the investor prefers

E)The investor's feelings about loss

A)The investor's prior investing experience

B)The investor's degree of financial security

C)The investor's tendency to make risky or conservative choices

D)The level of return the investor prefers

E)The investor's feelings about loss

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

21

An investor invests 70% of his wealth in a risky asset with an expected rate of return of 0.15 and a variance of 0.04 and 30% in a T-bill that pays 5%.His portfolio's expected return and standard deviation are __________ and __________, respectively.

A)0.120; 0.14

B)0.087; 0.06

C)0.295; 0.12

D)0.087; 0.12

A)0.120; 0.14

B)0.087; 0.06

C)0.295; 0.12

D)0.087; 0.12

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

22

An investor invests 40% of his wealth in a risky asset with an expected rate of return of 0.17 and a variance of 0.08 and 60% in a T-bill that pays 4.5%.His portfolio's expected return and standard deviation are __________ and __________, respectively.

A)0.114; 0.126

B)0.087; 0.068

C)0.095; 0.113

D)0.087; 0.124

E)None of the options

A)0.114; 0.126

B)0.087; 0.068

C)0.095; 0.113

D)0.087; 0.124

E)None of the options

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

23

You are considering investing $1,000 in a T-bill that pays 0.05 and a risky portfolio, P, constructed with two risky securities, X and Y.The weights of X and Y in P are 0.60 and 0.40, respectively.X has an expected rate of return of 0.14 and variance of 0.01, and Y has an expected rate of return of 0.10 and a variance of 0.0081. If you want to form a portfolio with an expected rate of return of 0.10, what percentages of your money must you invest in the T-bill, X, and Y, respectively, if you keep X and Y in the same proportions to each other as in portfolio P

A)0.25; 0.45; 0.30

B)0.19; 0.49; 0.32

C)0.32; 0.41; 0.27

D)0.50; 0.30; 0.20

E)Cannot be determined

A)0.25; 0.45; 0.30

B)0.19; 0.49; 0.32

C)0.32; 0.41; 0.27

D)0.50; 0.30; 0.20

E)Cannot be determined

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

24

Steve is more risk-averse than Edie.On a graph that shows Steve and Edie's indifference curves, which of the following is true Assume that the graph shows expected return on the vertical axis and standard deviation on the horizontal axis.

I) Steve and Edie's indifference curves might intersect.

II) Steve's indifference curves will have flatter slopes than Edie's.

III) Steve's indifference curves will have steeper slopes than Edie's.

IV) Steve and Edie's indifference curves will not intersect.

V) Steve's indifference curves will be downward sloping and Edie's will be upward sloping.

A)I and V

B)I and III

C)III and IV

D)I and II

E)II and IV

I) Steve and Edie's indifference curves might intersect.

II) Steve's indifference curves will have flatter slopes than Edie's.

III) Steve's indifference curves will have steeper slopes than Edie's.

IV) Steve and Edie's indifference curves will not intersect.

V) Steve's indifference curves will be downward sloping and Edie's will be upward sloping.

A)I and V

B)I and III

C)III and IV

D)I and II

E)II and IV

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

25

An investor invests 30% of his wealth in a risky asset with an expected rate of return of 0.13 and a variance of 0.03 and 70% in a T-bill that pays 6%.His portfolio's expected return and standard deviation are __________ and __________, respectively.

A)0.114; 0.128

B)0.087; 0.063

C)0.295; 0.125

D)0.081; 0.052

A)0.114; 0.128

B)0.087; 0.063

C)0.295; 0.125

D)0.081; 0.052

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

26

You invest $100 in a risky asset with an expected rate of return of 0.12 and a standard deviation of 0.15 and a T-bill with a rate of return of 0.05. A portfolio that has an expected outcome of $115 is formed by

A)investing $100 in the risky asset.

B)investing $80 in the risky asset and $20 in the risk-free asset.

C)borrowing $43 at the risk-free rate and investing the total amount ($143) in the risky asset.

D)investing $43 in the risky asset and $57 in the riskless asset.

E)Such a portfolio cannot be formed.

A)investing $100 in the risky asset.

B)investing $80 in the risky asset and $20 in the risk-free asset.

C)borrowing $43 at the risk-free rate and investing the total amount ($143) in the risky asset.

D)investing $43 in the risky asset and $57 in the riskless asset.

E)Such a portfolio cannot be formed.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

27

You invest $100 in a risky asset with an expected rate of return of 0.12 and a standard deviation of 0.15 and a T-bill with a rate of return of 0.05. The slope of the capital allocation line formed with the risky asset and the risk-free asset is equal to

A)0.4667.

B)0.8000.

C)2.14.

D)0.41667.

E)Cannot be determined

A)0.4667.

B)0.8000.

C)2.14.

D)0.41667.

E)Cannot be determined

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

28

The capital allocation line can be described as the

A)investment opportunity set formed with a risky asset and a risk-free asset.

B)investment opportunity set formed with two risky assets.

C)line on which lie all portfolios that offer the same utility to a particular investor.

D)line on which lie all portfolios with the same expected rate of return and different standard deviations.

A)investment opportunity set formed with a risky asset and a risk-free asset.

B)investment opportunity set formed with two risky assets.

C)line on which lie all portfolios that offer the same utility to a particular investor.

D)line on which lie all portfolios with the same expected rate of return and different standard deviations.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

29

You are considering investing $1,000 in a T-bill that pays 0.05 and a risky portfolio, P, constructed with two risky securities, X and Y.The weights of X and Y in P are 0.60 and 0.40, respectively.X has an expected rate of return of 0.14 and variance of 0.01, and Y has an expected rate of return of 0.10 and a variance of 0.0081. What would be the dollar values of your positions in X and Y, respectively, if you decide to hold 40% of your money in the risky portfolio and 60% in T-bills

A)$240; $360

B)$360; $240

C)$100; $240

D)$240; $160

E)Cannot be determined

A)$240; $360

B)$360; $240

C)$100; $240

D)$240; $160

E)Cannot be determined

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

30

The first major step in asset allocation is

A)assessing risk tolerance.

B)analyzing financial statements.

C)estimating security betas.

D)identifying market anomalies.

A)assessing risk tolerance.

B)analyzing financial statements.

C)estimating security betas.

D)identifying market anomalies.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

31

You invest $100 in a risky asset with an expected rate of return of 0.12 and a standard deviation of 0.15 and a T-bill with a rate of return of 0.05. What percentages of your money must be invested in the risk-free asset and the risky asset, respectively, to form a portfolio with a standard deviation of 0.06

A)30% and 70%

B)50% and 50%

C)60% and 40%

D)40% and 60%

E)Cannot be determined

A)30% and 70%

B)50% and 50%

C)60% and 40%

D)40% and 60%

E)Cannot be determined

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

32

A reward-to-volatility ratio is useful in

A)measuring the standard deviation of returns.

B)understanding how returns increase relative to risk increases.

C)analyzing returns on variable rate bonds.

D)assessing the effects of inflation.

E)None of the options

A)measuring the standard deviation of returns.

B)understanding how returns increase relative to risk increases.

C)analyzing returns on variable rate bonds.

D)assessing the effects of inflation.

E)None of the options

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

33

You are considering investing $1,000 in a T-bill that pays 0.05 and a risky portfolio, P, constructed with two risky securities, X and Y.The weights of X and Y in P are 0.60 and 0.40, respectively.X has an expected rate of return of 0.14 and variance of 0.01, and Y has an expected rate of return of 0.10 and a variance of 0.0081. What would be the dollar value of your positions in X, Y, and the T-bills, respectively, if you decide to hold a portfolio that has an expected outcome of $1,120

A)Cannot be determined

B)$568; $378; $54

C)$568; $54; $378

D)$378; $54; $568

E)$108; $514; $378

A)Cannot be determined

B)$568; $378; $54

C)$568; $54; $378

D)$378; $54; $568

E)$108; $514; $378

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

34

You invest $100 in a risky asset with an expected rate of return of 0.12 and a standard deviation of 0.15 and a T-bill with a rate of return of 0.05. What percentages of your money must be invested in the risky asset and the risk-free asset, respectively, to form a portfolio with an expected return of 0.09

A)85% and 15%

B)75% and 25%

C)67% and 33%

D)57% and 43%

E)Cannot be determined

A)85% and 15%

B)75% and 25%

C)67% and 33%

D)57% and 43%

E)Cannot be determined

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

35

You are considering investing $1,000 in a T-bill that pays 0.05 and a risky portfolio, P, constructed with two risky securities, X and Y.The weights of X and Y in P are 0.60 and 0.40, respectively.X has an expected rate of return of 0.14 and variance of 0.01, and Y has an expected rate of return of 0.10 and a variance of 0.0081. If you want to form a portfolio with an expected rate of return of 0.11, what percentages of your money must you invest in the T-bill and P, respectively

A)0.25; 0.75

B)0.19; 0.81

C)0.65; 0.35

D)0.50; 0.50

E)Cannot be determined

A)0.25; 0.75

B)0.19; 0.81

C)0.65; 0.35

D)0.50; 0.50

E)Cannot be determined

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

36

Given the capital allocation line, an investor's optimal portfolio is the portfolio that

A)maximizes her expected profit.

B)maximizes her risk.

C)minimizes both her risk and return.

D)maximizes her expected utility.

E)None of the options

A)maximizes her expected profit.

B)maximizes her risk.

C)minimizes both her risk and return.

D)maximizes her expected utility.

E)None of the options

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following statements regarding the capital allocation line (CAL) is false

A)The CAL shows risk-return combinations.

B)The slope of the CAL equals the increase in the expected return of the complete portfolio per unit of additional standard deviation.

C)The slope of the CAL is also called the reward-to-volatility ratio.

D)The CAL is also called the efficient frontier of risky assets in the absence of a risk-free asset.

A)The CAL shows risk-return combinations.

B)The slope of the CAL equals the increase in the expected return of the complete portfolio per unit of additional standard deviation.

C)The slope of the CAL is also called the reward-to-volatility ratio.

D)The CAL is also called the efficient frontier of risky assets in the absence of a risk-free asset.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

38

The change from a straight to a kinked capital allocation line is a result of

A)reward-to-volatility ratio increasing.

B)borrowing rate exceeding lending rate.

C)an investor's risk tolerance decreasing.

D)increase in the portfolio proportion of the risk-free asset.

A)reward-to-volatility ratio increasing.

B)borrowing rate exceeding lending rate.

C)an investor's risk tolerance decreasing.

D)increase in the portfolio proportion of the risk-free asset.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

39

An investor invests 30% of his wealth in a risky asset with an expected rate of return of 0.15 and a variance of 0.04 and 70% in a T-bill that pays 6%.His portfolio's expected return and standard deviation are __________ and __________, respectively.

A)0.114; 0.12

B)0.087; 0.06

C)0.295; 0.06

D)0.087; 0.12

E)None of the options

A)0.114; 0.12

B)0.087; 0.06

C)0.295; 0.06

D)0.087; 0.12

E)None of the options

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

40

Consider a T-bill with a rate of return of 5% and the following risky securities:

Security A: E(r) = 0.15; Variance = 0.04

Security B: E(r) = 0.10; Variance = 0.0225

Security C: E(r) = 0.12; Variance = 0.01

Security D: E(r) = 0.13; Variance = 0.0625

From which set of portfolios, formed with the T-bill and any one of the four risky securities, would a risk-averse investor always choose his portfolio

A)The set of portfolios formed with the T-bill and security A.

B)The set of portfolios formed with the T-bill and security B.

C)The set of portfolios formed with the T-bill and security C.

D)The set of portfolios formed with the T-bill and security D.

E)Cannot be determined

Security A: E(r) = 0.15; Variance = 0.04

Security B: E(r) = 0.10; Variance = 0.0225

Security C: E(r) = 0.12; Variance = 0.01

Security D: E(r) = 0.13; Variance = 0.0625

From which set of portfolios, formed with the T-bill and any one of the four risky securities, would a risk-averse investor always choose his portfolio

A)The set of portfolios formed with the T-bill and security A.

B)The set of portfolios formed with the T-bill and security B.

C)The set of portfolios formed with the T-bill and security C.

D)The set of portfolios formed with the T-bill and security D.

E)Cannot be determined

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

41

You invest $100 in a risky asset with an expected rate of return of 0.11 and a standard deviation of 0.21 and a T-bill with a rate of return of 0.045. What percentages of your money must be invested in the risk-free asset and the risky asset, respectively, to form a portfolio with a standard deviation of 0.08

A)301% and 69.9%

B)50.5% and 49.50%

C)60.0% and 40.0%

D)61.9% and 38.1%

E)Cannot be determined

A)301% and 69.9%

B)50.5% and 49.50%

C)60.0% and 40.0%

D)61.9% and 38.1%

E)Cannot be determined

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

42

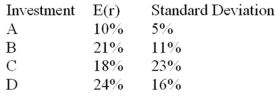

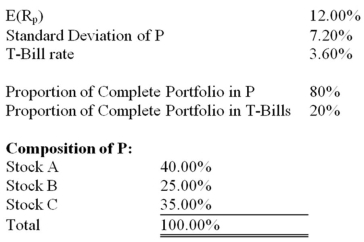

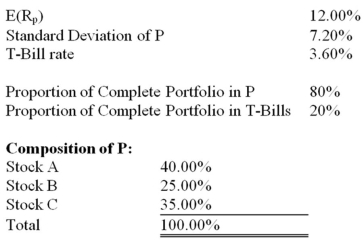

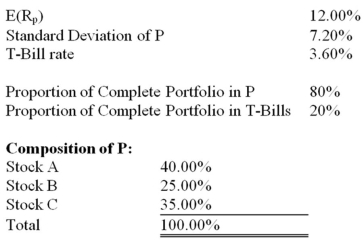

Your client, Bo Regard, holds a complete portfolio that consists of a portfolio of risky assets (P) and T-Bills.The information below refers to these assets.  What is the expected return on Bo's complete portfolio

What is the expected return on Bo's complete portfolio

A)10.32%

B)5.28%

C)9.62%

D)8.44%

E)7.58%

What is the expected return on Bo's complete portfolio

What is the expected return on Bo's complete portfolioA)10.32%

B)5.28%

C)9.62%

D)8.44%

E)7.58%

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

43

Based on their relative degrees of risk tolerance

A)investors will hold varying amounts of the risky asset in their portfolios.

B)all investors will have the same portfolio asset allocations.

C)investors will hold varying amounts of the risk-free asset in their portfolios.

D)investors will hold varying amounts of the risky asset and varying amounts of the risk-free asset in their portfolios.

A)investors will hold varying amounts of the risky asset in their portfolios.

B)all investors will have the same portfolio asset allocations.

C)investors will hold varying amounts of the risk-free asset in their portfolios.

D)investors will hold varying amounts of the risky asset and varying amounts of the risk-free asset in their portfolios.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

44

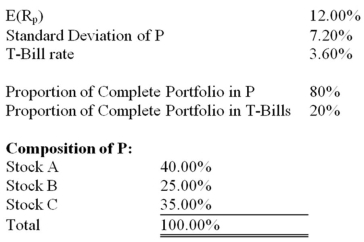

Your client, Bo Regard, holds a complete portfolio that consists of a portfolio of risky assets (P) and T-Bills.The information below refers to these assets.  What is the equation of Bo's capital allocation line

What is the equation of Bo's capital allocation line

A)E(rC) = 7.2 + 3.6 × Standard Deviation of C

B)E(rC) = 3.6 + 1.167 × Standard Deviation of C

C)E(rC) = 3.6 + 12.0 × Standard Deviation of C

D)E(rC) = 0.2 + 1.167 × Standard Deviation of C

E)E(rC) = 3.6 + 0.857 × Standard Deviation of C

What is the equation of Bo's capital allocation line

What is the equation of Bo's capital allocation lineA)E(rC) = 7.2 + 3.6 × Standard Deviation of C

B)E(rC) = 3.6 + 1.167 × Standard Deviation of C

C)E(rC) = 3.6 + 12.0 × Standard Deviation of C

D)E(rC) = 0.2 + 1.167 × Standard Deviation of C

E)E(rC) = 3.6 + 0.857 × Standard Deviation of C

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

45

An investor invests 30% of his wealth in a risky asset with an expected rate of return of 0.11 and a variance of 0.12 and 70% in a T-bill that pays 3%.His portfolio's expected return and standard deviation are __________ and __________, respectively.

A)0.086; 0.242

B)0.054; 0.104

C)0.295; 0.123

D)0.087; 0.182

E)None of the options

A)0.086; 0.242

B)0.054; 0.104

C)0.295; 0.123

D)0.087; 0.182

E)None of the options

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

46

Asset allocation may involve

A)the decision as to the allocation between a risk-free asset and a risky asset.

B)the decision as to the allocation among different risky assets.

C)considerable security analysis.

D)the decision as to the allocation between a risk-free asset and a risky asset and the decision as to the allocation among different risky assets.

E)the decision as to the allocation between a risk-free asset and a risky asset and considerable security analysis.

A)the decision as to the allocation between a risk-free asset and a risky asset.

B)the decision as to the allocation among different risky assets.

C)considerable security analysis.

D)the decision as to the allocation between a risk-free asset and a risky asset and the decision as to the allocation among different risky assets.

E)the decision as to the allocation between a risk-free asset and a risky asset and considerable security analysis.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

47

You invest $1,000 in a risky asset with an expected rate of return of 0.17 and a standard deviation of 0.40 and a T-bill with a rate of return of 0.04. What percentages of your money must be invested in the risk-free asset and the risky asset, respectively, to form a portfolio with a standard deviation of 0.20

A)30% and 70%

B)50% and 50%

C)60% and 40%

D)40% and 60%

E)Cannot be determined

A)30% and 70%

B)50% and 50%

C)60% and 40%

D)40% and 60%

E)Cannot be determined

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

48

You invest $100 in a risky asset with an expected rate of return of 0.11 and a standard deviation of 0.20 and a T-bill with a rate of return of 0.03. What percentages of your money must be invested in the risky asset and the risk-free asset, respectively, to form a portfolio with an expected return of 0.08

A)85% and 15%

B)75% and 25%

C)62.5% and 37.5%

D)57% and 43%

E)Cannot be determined

A)85% and 15%

B)75% and 25%

C)62.5% and 37.5%

D)57% and 43%

E)Cannot be determined

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

49

An investor invests 35% of his wealth in a risky asset with an expected rate of return of 0.18 and a variance of 0.10 and 65% in a T-bill that pays 4%.His portfolio's expected return and standard deviation are __________ and __________, respectively.

A)0.089; 0.111

B)0.087; 0.063

C)0.096; 0.126

D)0.087; 0.144

A)0.089; 0.111

B)0.087; 0.063

C)0.096; 0.126

D)0.087; 0.144

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

50

You invest $1,000 in a risky asset with an expected rate of return of 0.17 and a standard deviation of 0.40 and a T-bill with a rate of return of 0.04. What percentages of your money must be invested in the risky asset and the risk-free asset, respectively, to form a portfolio with an expected return of 0.11

A)53.8% and 46.2%

B)75% and 25%

C)62.5% and 37.5%

D)46.2% and 53.8%

E)Cannot be determined

A)53.8% and 46.2%

B)75% and 25%

C)62.5% and 37.5%

D)46.2% and 53.8%

E)Cannot be determined

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

51

To build an indifference curve we can first find the utility of a portfolio with 100% in the risk-free asset, then

A)find the utility of a portfolio with 0% in the risk-free asset.

B)change the expected return of the portfolio and equate the utility to the standard deviation.

C)find another utility level with 0% risk.

D)change the standard deviation of the portfolio and find the expected return the investor would require to maintain the same utility level.

E)change the risk-free rate and find the utility level that results in the same standard deviation.

A)find the utility of a portfolio with 0% in the risk-free asset.

B)change the expected return of the portfolio and equate the utility to the standard deviation.

C)find another utility level with 0% risk.

D)change the standard deviation of the portfolio and find the expected return the investor would require to maintain the same utility level.

E)change the risk-free rate and find the utility level that results in the same standard deviation.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

52

You invest $100 in a risky asset with an expected rate of return of 0.11 and a standard deviation of 0.21 and a T-bill with a rate of return of 0.045. What percentages of your money must be invested in the risky asset and the risk-free asset, respectively, to form a portfolio with an expected return of 0.13

A)130.77% and -30.77%

B)-30.77% and 130.77%

C)67.67% and 33.33%

D)57.75% and 42.25%

E)Cannot be determined

A)130.77% and -30.77%

B)-30.77% and 130.77%

C)67.67% and 33.33%

D)57.75% and 42.25%

E)Cannot be determined

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

53

You invest $100 in a risky asset with an expected rate of return of 0.11 and a standard deviation of 0.20 and a T-bill with a rate of return of 0.03. The slope of the capital allocation line formed with the risky asset and the risk-free asset is equal to

A)0.47.

B)0.80.

C)2.14.

D)0.40.

E)Cannot be determined

A)0.47.

B)0.80.

C)2.14.

D)0.40.

E)Cannot be determined

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

54

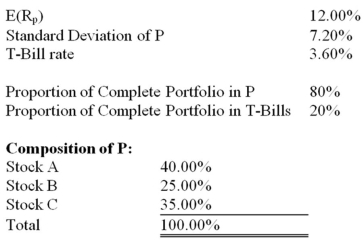

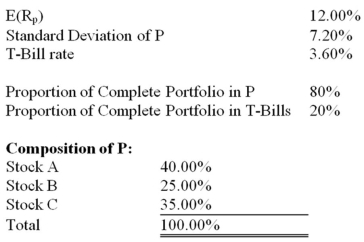

Your client, Bo Regard, holds a complete portfolio that consists of a portfolio of risky assets (P) and T-Bills.The information below refers to these assets.  What is the standard deviation of Bo's complete portfolio

What is the standard deviation of Bo's complete portfolio

A)7.20%

B)5.40%

C)6.92%

D)4.98%

E)5.76%

What is the standard deviation of Bo's complete portfolio

What is the standard deviation of Bo's complete portfolioA)7.20%

B)5.40%

C)6.92%

D)4.98%

E)5.76%

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

55

You invest $100 in a risky asset with an expected rate of return of 0.11 and a standard deviation of 0.20 and a T-bill with a rate of return of 0.03. What percentages of your money must be invested in the risk-free asset and the risky asset, respectively, to form a portfolio with a standard deviation of 0.08

A)30% and 70%

B)50% and 50%

C)60% and 40%

D)40% and 60%

E)Cannot be determined

A)30% and 70%

B)50% and 50%

C)60% and 40%

D)40% and 60%

E)Cannot be determined

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

56

The capital market line I) is a special case of the capital allocation line.

II) represents the opportunity set of a passive investment strategy.

III) has the one-month T-Bill rate as its intercept.

IV) uses a broad index of common stocks as its risky portfolio.

A)I, III, and IV

B)II, III, and IV

C)III and IV

D)I, II, and III

E)I, II, III, and IV

II) represents the opportunity set of a passive investment strategy.

III) has the one-month T-Bill rate as its intercept.

IV) uses a broad index of common stocks as its risky portfolio.

A)I, III, and IV

B)II, III, and IV

C)III and IV

D)I, II, and III

E)I, II, III, and IV

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

57

In the mean-standard deviation graph, the line that connects the risk-free rate and the optimal risky portfolio, P, is called

A)the security market line.

B)the capital allocation line.

C)the indifference curve.

D)the investor's utility line.

A)the security market line.

B)the capital allocation line.

C)the indifference curve.

D)the investor's utility line.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

58

You invest $1,000 in a risky asset with an expected rate of return of 0.17 and a standard deviation of 0.40 and a T-bill with a rate of return of 0.04. The slope of the capital allocation line formed with the risky asset and the risk-free asset is equal to

A)0.325.

B)0.675.

C)0.912.

D)0.407.

E)Cannot be determined

A)0.325.

B)0.675.

C)0.912.

D)0.407.

E)Cannot be determined

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

59

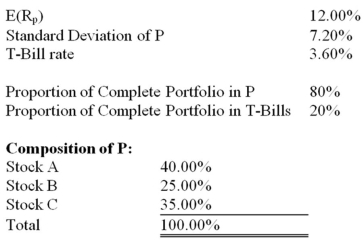

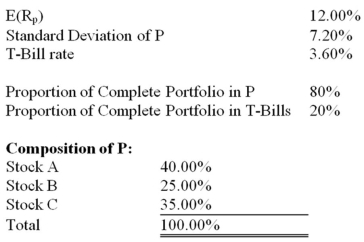

Your client, Bo Regard, holds a complete portfolio that consists of a portfolio of risky assets (P) and T-Bills.The information below refers to these assets.  What are the proportions of stocks A, B, and C, respectively, in Bo's complete portfolio

What are the proportions of stocks A, B, and C, respectively, in Bo's complete portfolio

A)40%, 25%, 35%

B)8%, 5%, 7%

C)32%, 20%, 28%

D)16%, 10%, 14%

E)20%, 12.5%, 17.5%

What are the proportions of stocks A, B, and C, respectively, in Bo's complete portfolio

What are the proportions of stocks A, B, and C, respectively, in Bo's complete portfolioA)40%, 25%, 35%

B)8%, 5%, 7%

C)32%, 20%, 28%

D)16%, 10%, 14%

E)20%, 12.5%, 17.5%

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

60

Treasury bills are commonly viewed as risk-free assets because

A)their short-term nature makes their values insensitive to interest rate fluctuations.

B)the inflation uncertainty over their time to maturity is negligible.

C)their term to maturity is identical to most investors' desired holding periods.

D)their short-term nature makes their values insensitive to interest rate fluctuations and the inflation uncertainty over their time to maturity is negligible.

E)the inflation uncertainty over their time to maturity is negligible and their term to maturity is identical to most investors' desired holding periods.

A)their short-term nature makes their values insensitive to interest rate fluctuations.

B)the inflation uncertainty over their time to maturity is negligible.

C)their term to maturity is identical to most investors' desired holding periods.

D)their short-term nature makes their values insensitive to interest rate fluctuations and the inflation uncertainty over their time to maturity is negligible.

E)the inflation uncertainty over their time to maturity is negligible and their term to maturity is identical to most investors' desired holding periods.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

61

Discuss the characteristics of indifference curves, and the theoretical value of these curves in the portfolio building process.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

62

Describe how an investor may combine a risk-free asset and one risky asset in order to obtain the optimal portfolio for that investor.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

63

You invest $100 in a risky asset with an expected rate of return of 0.11 and a standard deviation of 0.21 and a T-bill with a rate of return of 0.045. A portfolio that has an expected outcome of $114 is formed by

A)investing $100 in the risky asset.

B)investing $80 in the risky asset and $20 in the risk-free asset.

C)borrowing $46 at the risk-free rate and investing the total amount ($146) in the risky asset.

D)investing $43 in the risky asset and $57 in the risk-free asset.

E)Such a portfolio cannot be formed.

A)investing $100 in the risky asset.

B)investing $80 in the risky asset and $20 in the risk-free asset.

C)borrowing $46 at the risk-free rate and investing the total amount ($146) in the risky asset.

D)investing $43 in the risky asset and $57 in the risk-free asset.

E)Such a portfolio cannot be formed.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

64

In the utility function: U = E(r) - [-0.005As2], what is the significance of "A"

A.

A.This variable, as such, is not presented in most investments texts and it is important that the student understands how the investment advisor assigns a value to

A.

A.This variable, as such, is not presented in most investments texts and it is important that the student understands how the investment advisor assigns a value to

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

65

You invest $100 in a risky asset with an expected rate of return of 0.11 and a standard deviation of 0.21 and a T-bill with a rate of return of 0.045. The slope of the capital allocation line formed with the risky asset and the risk-free asset is equal to

A)0.4667.

B)0.8000.

C)0.3095.

D)0.41667.

E)Cannot be determined

A)0.4667.

B)0.8000.

C)0.3095.

D)0.41667.

E)Cannot be determined

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

66

Draw graphs that represent indifference curves for the following investors: Harry, who is a risk-averse investor; Eddie, who is a risk-neutral investor; and Ozzie, who is a risk-loving investor.Discuss the nature of each curve and the reasons for its shape.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

67

Toby and Hannah are two risk-averse investors.Toby is more risk-averse than Hannah.Draw one indifference curve for Toby and one indifference curve for Hannah on the same graph.Show how these curves illustrate their relative levels of risk aversion.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

68

What is a fair game

Explain how the term relates to a risk-averse investor's attitude toward speculation and risk and how the utility function reflects this attitude.

Explain how the term relates to a risk-averse investor's attitude toward speculation and risk and how the utility function reflects this attitude.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

69

The optimal proportion of the risky asset in the complete portfolio is given by the equation y* = [E(rP) - rf]/(.01A times the variance of P).For each of the variables on the right side of the equation, discuss the impact of the variable's effect on y* and why the nature of the relationship makes sense intuitively.Assume the investor is risk averse.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

70

Discuss the differences between investors who are risk averse, risk neutral, and risk loving.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck