Deck 5: Time Value of Money

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/173

Play

Full screen (f)

Deck 5: Time Value of Money

1

The future value of $200 received today and deposited at 8 percent for three years is

A) $248.

B) $252.

C) $158.

D) $200.

A) $248.

B) $252.

C) $158.

D) $200.

$252.

2

Everything else being equal, the higher the interest rate, the higher the future value.

True

3

The amount of money that would have to be invested today at a given interest rate over a specified period in order to equal a future amount is called

A) future value.

B) present value.

C) future value of an annuity.

D) present value of an annuity.

A) future value.

B) present value.

C) future value of an annuity.

D) present value of an annuity.

present value.

4

Calculate the present value of $89,000 to be received in 15 years, assuming an opportunity cost of 14 percent.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

5

The future value of a dollar ________ as the interest rate increases and ________ the farther in the future an initial deposit is to be received.

A) decreases; decreases

B) decreases; increases

C) increases; increases

D) increases; decreases

A) decreases; decreases

B) decreases; increases

C) increases; increases

D) increases; decreases

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

6

The present value of $100 to be received 10 years from today, assuming an opportunity cost of 9 percent, is

A) $236.

B) $699.

C) $ 42.

D) $ 75.

A) $236.

B) $699.

C) $ 42.

D) $ 75.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

7

Everything else being equal, the longer the period of time, the lower the present value.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

8

The future value of $100 received today and deposited at 6 percent for four years is

A) $126.

B) $ 79.

C) $124.

D) $116.

A) $126.

B) $ 79.

C) $124.

D) $116.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

9

Future value increases with increases in the interest rate or the period of time funds are left on deposit.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

10

The greater the interest rate and the longer the period of time, the higher the present value.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

11

The present value of $200 to be received 10 years from today, assuming an opportunity cost of 10 percent, is

A) $ 50.

B) $200.

C) $518.

D) $ 77.

A) $ 50.

B) $200.

C) $518.

D) $ 77.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

12

Everything else being equal, the higher the discount rate, the higher the present value.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

13

If you expect to retire in 30 years, are currently comfortable living on $50,000 per year and expect inflation to average 3% over the next 30 years, what amount of annual income will you need to live at the same comfort level in 30 years?

A) $121,363

B) $95,000

C) $20,599

D) $51,500

A) $121,363

B) $95,000

C) $20,599

D) $51,500

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

14

The annual rate of return is variously referred to as the

A) discount rate.

B) opportunity cost.

C) cost of capital.

D) all of the above.

A) discount rate.

B) opportunity cost.

C) cost of capital.

D) all of the above.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

15

Calculate the future value of $4,600 received today if it is deposited at 9 percent for three years.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

16

Future value is the value of a future amount at the present time, found by applying compound interest over a specified period of time.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

17

When the amount earned on a deposit has become part of the principal at the end of a specified time period the concept is called

A) discount interest.

B) compound interest.

C) primary interest.

D) future value.

A) discount interest.

B) compound interest.

C) primary interest.

D) future value.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

18

For a given positive interest rate, the future value of $100 increases with the passage of time. Thus, the longer the period of time, the greater the future value.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

19

Since individuals are always confronted with opportunities to earn positive rates of return on their funds, the timing of cash flows does not have any significant economic consequences.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

20

Time-value of money is based on the belief that a dollar that will be received at some future date is worth more than a dollar today.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

21

Indicate which of the following is true about annuities.

A) An ordinary annuity is an equal payment paid or received at the beginning of each period.

B) An annuity due is a payment paid or received at the beginning of each period that increases by an equal amount each period.

C) An annuity due is an equal payment paid or received at the beginning of each period.

D) An ordinary annuity is an equal payment paid or received at the end of each period that increases by an equal amount each period.

A) An ordinary annuity is an equal payment paid or received at the beginning of each period.

B) An annuity due is a payment paid or received at the beginning of each period that increases by an equal amount each period.

C) An annuity due is an equal payment paid or received at the beginning of each period.

D) An ordinary annuity is an equal payment paid or received at the end of each period that increases by an equal amount each period.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

22

Dan and Jia are newlyweds and have just purchased a condominium for $70,000. Since the condo is very small, they hope to move into a single-family house in 5 years. How much will their condo worth in 5 years if inflation is expected to be 8 percent?

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

23

Bill plans to fund his individual retirement account (IRA) with the maximum contribution of $2,000 at the end of each year for the next 20 years. If Bill can earn 12 percent on his contributions, how much will he have at the end of the twentieth year?

A) $19,292

B) $14,938

C) $40,000

D) $144,104

A) $19,292

B) $14,938

C) $40,000

D) $144,104

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

24

The future value of a $10,000 annuity due deposited at 12 percent compounded annually for each of the next 5 years is

A) $36,050.

B) $63,530.

C) $40,376.

D) $71,154.

A) $36,050.

B) $63,530.

C) $40,376.

D) $71,154.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

25

The present value of a $20,000 perpetuity at a 7 percent discount rate is

A) $186,915.

B) $285,714.

C) $140,000.

D) $325,000.

A) $186,915.

B) $285,714.

C) $140,000.

D) $325,000.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

26

An annuity with an infinite life is called a(n)

A) perpetuity.

B) primia.

C) indefinite.

D) deep discount.

A) perpetuity.

B) primia.

C) indefinite.

D) deep discount.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

27

The present value of a $25,000 perpetuity at a 14 percent discount rate is

A) $178,571.

B) $285,000.

C) $350,000.

D) $219,298.

A) $178,571.

B) $285,000.

C) $350,000.

D) $219,298.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

28

The future value of an ordinary annuity of $2,000 each year for 10 years, deposited at 12 percent, is

A) $35,098.

B) $20,000.

C) $39,310.

D) $11,300.

A) $35,098.

B) $20,000.

C) $39,310.

D) $11,300.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

29

Colin has inherited $6,000 from the death of Grandma Anna. He would like to use this money to buy his mom Hayley a new scooter costing $7,000 2 years from now. Will Colin have enough money to buy the gift if he deposits his money in an account paying 8 percent compounded semi-annually?

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

30

In comparing an ordinary annuity and an annuity due, which of the following is true?

A) The future value of an annuity due is always greater than the future value of an otherwise identical ordinary annuity.

B) The future value of an ordinary annuity is always greater than the future value of an otherwise identical annuity due.

C) The future value of an annuity due is always less than the future value of an otherwise identical ordinary annuity, since one less payment is received with an annuity due.

D) All things being equal, one would prefer to receive an ordinary annuity compared to an annuity due.

A) The future value of an annuity due is always greater than the future value of an otherwise identical ordinary annuity.

B) The future value of an ordinary annuity is always greater than the future value of an otherwise identical annuity due.

C) The future value of an annuity due is always less than the future value of an otherwise identical ordinary annuity, since one less payment is received with an annuity due.

D) All things being equal, one would prefer to receive an ordinary annuity compared to an annuity due.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

31

An ordinary annuity is an annuity in which cash flows occurs at the beginning of each period.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

32

The future value of an ordinary annuity of $1,000 each year for 10 years, deposited at 3 percent, is

A) $11,808.

B) $11,464.

C) $ 8,530.

D) $10,000.

A) $11,808.

B) $11,464.

C) $ 8,530.

D) $10,000.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

33

________ is an annuity with an infinite life making continual annual payments.

A) An amortized loan

B) A principal

C) A perpetuity

D) An APR

A) An amortized loan

B) A principal

C) A perpetuity

D) An APR

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

34

China Manufacturing Agents, Inc. is preparing a five-year plan. Today, sales are $1,000,000. If the growth rate in sales is projected to be 10 percent over the next five years, what will the dollar amount of sales be in year five?

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

35

An annuity due is an amount that occurs at the beginning of each period.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

36

Congratulations! You have just won the lottery! However, the lottery bureau has just informed you that you can take your winnings in one of two ways. Choice X pays $1,000,000. Choice Y pays $1,750,000 at the end of five years from now. Using a discount rate of 5 percent, based on present values, which would you choose? Using the same discount rate of 5 percent, based on future values, which would you choose? What do your results suggest as a general rule for approaching such problems? (Make your choices based purely on the time value of money.)

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

37

Dan plans to fund his individual retirement account (IRA) with the maximum contribution of $2,000 at the end of each year for the next 10 years. If Dan can earn 10 percent on his contributions, how much will he have at the end of the tenth year?

A) $12,290

B) $20,000

C) $31,874

D) $51,880

A) $12,290

B) $20,000

C) $31,874

D) $51,880

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

38

The future value of a $2,000 annuity due deposited at 8 percent compounded annually for each of the next 10 years is

A) $28,974.

B) $31,292.

C) $14,494.

D) $13,420.

A) $28,974.

B) $31,292.

C) $14,494.

D) $13,420.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

39

Aunt Tillie has deposited $33,000 today in an account which will earn 10 percent annually. She plans to leave the funds in this account for seven years earning interest. If the goal of this deposit is to cover a future obligation of $65,000, what recommendation would you make to Aunt Tillie?

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

40

The future value of an annuity due is always greater than the future value of an otherwise identical ordinary annuity for interest rates greater than zero.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

41

The present value of an ordinary annuity of $350 each year for five years, assuming an opportunity cost of 4 percent, is

A) $288.

B) $1,896.

C) $1,750.

D) $1,558.

A) $288.

B) $1,896.

C) $1,750.

D) $1,558.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

42

Calculate the present value of a $10,000 perpetuity at a 6 percent discount rate.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

43

Jia has just won a $20 million lottery, which will pay her $1 million at the end of each year for 20 years. An investor has offered her $10 million for this annuity. She estimates that she can earn 10 percent interest, compounded annually, on any amounts she invests. She asks your advice on whether to accept or reject the offer. What will you tell her? (Ignore Taxes)

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

44

To pay for her college education, Gina is saving $2,000 at the beginning of each year for the next eight years in a bank account paying 12 percent interest. How much will Gina have in that account at the end of 8th year?

A) $16,000

B) $17,920

C) $24,600

D) $27,552

A) $16,000

B) $17,920

C) $24,600

D) $27,552

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

45

Nico establishes a seven-year, 8 percent loan with a bank requiring annual end-of-year payments of $960.43. Calculate the original principal amount.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

46

The present value of an ordinary annuity of $2,350 each year for eight years, assuming an opportunity cost of 11 percent, is

A) $ 1,020.

B) $27,869.

C) $18,800.

D) $12,093.

A) $ 1,020.

B) $27,869.

C) $18,800.

D) $12,093.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

47

A generous philanthropist plans to make a one-time endowment to a renowned heart research center which would provide the facility with $250,000 per year into perpetuity. The rate of interest is expected to be 8 percent for all future time periods. How large must the endowment be?

A) $2,314,814

B) $2,000,000

C) $3,125,000

D) $3,000,000

A) $2,314,814

B) $2,000,000

C) $3,125,000

D) $3,000,000

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

48

You have been offered a project paying $300 at the beginning of each year for the next 20 years. What is the maximum amount of money you would invest in this project if you expect 9 percent rate of return to your investment?

A) $ 2,738.70

B) $ 2,985.18

C) $15,347.70

D) $ 6,000.00

A) $ 2,738.70

B) $ 2,985.18

C) $15,347.70

D) $ 6,000.00

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

49

Mary will receive $12,000 per year for the next 10 years as royalty for her work on a finance book. What is the present value of her royalty income if the opportunity cost is 12 percent?

A) $120,000

B) $ 67,800

C) $ 38,640

D) None of the above.

A) $120,000

B) $ 67,800

C) $ 38,640

D) None of the above.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

50

Dottie has decided to set up an account that will pay her granddaughter (Lexi) $5,000 a year indefinitely. How much should Dottie deposit in an account paying 8 percent annual interest?

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

51

Calculate the future value of an annuity of $5,000 each year for eight years, deposited at 6 percent.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

52

In their meeting with their advisor, Mr. and Mrs. O'Rourke concluded that they would need $40,000 per year during their retirement years in order to live comfortably. They will retire 10 years from now and expect a 20-year retirement period. How much should Mr. and Mrs. O'Rourke deposit now in a bank account paying 9 percent to reach financial happiness during retirement?

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

53

Mr. Knowitall has been awarded a bonus for his outstanding work. His employer offers him a choice of a lump-sum of $5,000 today, or an annuity of $1,250 a year for the next five years. Which option should Mr. Knowitall choose if his opportunity cost is 9 percent?

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

54

A wealthy industrialist wishes to establish a $2,000,000 trust fund which will provide income for his grandchild into perpetuity. He stipulates in the trust agreement that the principal may not be distributed. The grandchild may only receive the interest earned. If the interest rate earned on the trust is expected to be at least 7 percent in all future periods, how much income will the grandchild receive each year?

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

55

James plans to fund his individual retirement account, beginning today, with 20 annual deposits of $2,000, which he will continue for the next 20 years. If he can earn an annual compound rate of 8 percent on his deposits, the amount in the account upon retirement will be

A) $19,636.

B) $91,524.

C) $98,846.

D) $21,207.

A) $19,636.

B) $91,524.

C) $98,846.

D) $21,207.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

56

A lottery administrator has just completed the state's most recent $50 million lottery. Receipts from lottery sales were $50 million and the payout will be $5 million at the end of each year for 10 years. The expenses of running the lottery were $800,000. The state can earn an annual compound rate of 8 percent on any funds invested.

(a) Calculate the gross profit to the state from this lottery.

(b) Calculate the net profit to the state from this lottery (no taxes).

(a) Calculate the gross profit to the state from this lottery.

(b) Calculate the net profit to the state from this lottery (no taxes).

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

57

A generous benefactor to the local ballet plans to make a one-time endowment which would provide the ballet with $150,000 per year into perpetuity. The rate of interest is expected to be 5 percent for all future time periods. How large must the endowment be?

A) $ 300,000

B) $3,000,000

C) $ 750,000

D) $1,428,571

A) $ 300,000

B) $3,000,000

C) $ 750,000

D) $1,428,571

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

58

A college received a contribution to its endowment fund of $2 million. They can never touch the principal, but they can use the earnings. At an assumed interest rate of 9.5 percent, how much can the college earn to help its operations each year?

A) $95,000

B) $19,000

C) $190,000

D) $18,000

A) $95,000

B) $19,000

C) $190,000

D) $18,000

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

59

If the present value of a perpetual income stream is increasing, the discount rate must be

A) increasing.

B) decreasing.

C) changing unpredictably.

D) increasing proportionally.

A) increasing.

B) decreasing.

C) changing unpredictably.

D) increasing proportionally.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

60

Calculate the present value of an annuity of $3,900 each year for four years, assuming an opportunity cost of 10 percent.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

61

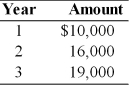

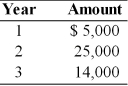

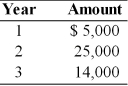

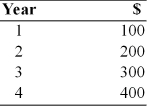

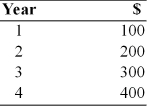

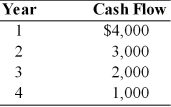

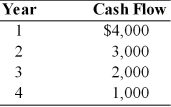

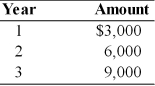

Find the future value at the end of year 3 of the following stream of cash flows received at the end of each year, assuming the firm can earn 8 percent on its investments.

A) $45,000

B) $53,396

C) $47,940

D) $56,690

A) $45,000

B) $53,396

C) $47,940

D) $56,690

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

62

Ashley is planning to attend college when she graduates from high school 7 years from now. She anticipates that she will need $10,000 at the beginning of each college year to pay for tuition and fees, and have some spending money. Ashley has made an arrangement with her father to do the household chores if her dad deposits $3,500 at the end of each year for the next 7 years in a bank account paying 8 percent interest. Will there be enough money in the account for Ashley to pay for her college expenses? Assume the rate of interest stays at 8 percent during the college years.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

63

$100 is received at the beginning of year 1, $200 is received at the beginning of year 2, and $300 is received at the beginning of year 3. If these cash flows are deposited at 12 percent, their combined future value at the end of year 3 is ________.

A) $1,536

B) $ 672

C) $ 727

D) $1,245

A) $1,536

B) $ 672

C) $ 727

D) $1,245

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

64

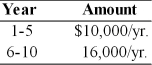

Find the present value of the following stream of cash flows, assuming that the firm's opportunity cost is 9 percent.

A) $ 13,252

B) $141,588

C) $ 10,972

D) $ 79,348

A) $ 13,252

B) $141,588

C) $ 10,972

D) $ 79,348

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

65

Calculate the present value of $800 received at the beginning of year 1, $400 received at the beginning of year 2, and $700 received at the beginning of year 3, assuming an opportunity cost of 9 percent.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

66

Find the present value of the following stream of cash flows, assuming that the firm's opportunity cost is 25 percent.

A) $27,168

B) $35,200

C) $34,000

D) $32,500

A) $27,168

B) $35,200

C) $34,000

D) $32,500

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

67

Nico is 30 years old and will retire at age 65. He will receive retirement benefits but the benefits are not going to be enough to make a comfortable retirement life for him. Nico has estimated that an additional $25,000 a year over his retirement benefits will allow him to have a satisfactory life. How much should Nico deposit today in an account paying 6 percent interest to meet his goal? Assume Nico will have 15 years of retirement.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

68

The present value of $1,000 received at the end of year 1, $1,200 received at the end of year 2, and $1,300 received at the end of year 3, assuming an opportunity cost of 7 percent, is

A) $2,500.

B) $3,043

C) $6,516.

D) $2,856.

A) $2,500.

B) $3,043

C) $6,516.

D) $2,856.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

69

Last Christmas, Danny received an annual bonus of $1,500. These annual bonuses are expected to grow by 5 percent for the next 5 years. How much will Danny have at the end of the fifth year if he invests his Christmas bonuses (including the most recent bonus) in a project paying 8 percent per year?

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

70

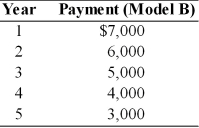

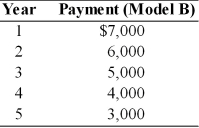

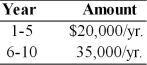

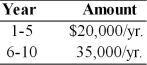

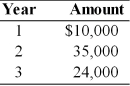

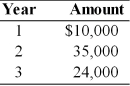

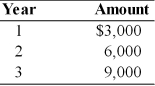

You are considering the purchase of new equipment for your company and you have narrowed down the possibilities to two models which perform equally well. However, the method of paying for the two models is different. Model A requires $5,000 per year payment for the next five years. Model B requires the following payment schedule. Which model should you buy if your opportunity cost is 8 percent?

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

71

During her four years at college, Hayley received the following amounts of money at the end of each year from her grandmother. She deposited her money in a saving account paying 6 percent rate of interest. How much money will Hayley have on graduation day?

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

72

Find the present value of the following stream of cash flows, assuming that the firm's opportunity cost is 14 percent.

A) $131,065

B) $ 19,830

C) $ 14,850

D) $120,820

A) $131,065

B) $ 19,830

C) $ 14,850

D) $120,820

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

73

You have provided your friend with a service worth $8,500. Your friend offers you the following cash flow instead of paying $8,500 today. Should you accept his offer if your opportunity cost is 8 percent?

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

74

You have been given a choice between two retirement policies as described below.

Policy A: You will receive equal annual payments of $10,000 beginning 35 years from now for 10 years.

Policy B: You will receive one lump-sum of $100,000 in 40 years from now.

Which policy would you choose? Assume rate of interest is 6 percent.

Policy A: You will receive equal annual payments of $10,000 beginning 35 years from now for 10 years.

Policy B: You will receive one lump-sum of $100,000 in 40 years from now.

Which policy would you choose? Assume rate of interest is 6 percent.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

75

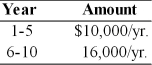

Find the present value of the following stream of cash flows, assuming that the firm's opportunity cost is 14 percent.

A) $121,256

B) $ 69,000

C) $ 60,513

D) $ 51,885

A) $121,256

B) $ 69,000

C) $ 60,513

D) $ 51,885

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

76

$1,200 is received at the beginning of year 1, $2,200 is received at the beginning of year 2, and $3,300 is received at the beginning of year 3. If these cash flows are deposited at 12 percent, their combined future value at the end of year 3 is ________.

A) $ 6,700

B) $17,000

C) $12,510

D) $ 8,141

A) $ 6,700

B) $17,000

C) $12,510

D) $ 8,141

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

77

Calculate the combined future value at the end of year 3 of $1,000 received at the end of year 1, $3,000 received at the end of year 2, and $5,000 received at the end of year 3, all sums deposited at 5 percent.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

78

Calculate the present value of $5,800 received at the end of year 1, $6,400 received at the end of year 2, and $8,700 at the end of year 3, assuming an opportunity cost of 13 percent.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

79

The present value of $100 received at the end of year 1, $200 received at the end of year 2, and $300 received at the end of year 3, assuming an opportunity cost of 13 percent, is

A) $ 453.

B) $ 416.

C) $1,181.

D) $ 500.

A) $ 453.

B) $ 416.

C) $1,181.

D) $ 500.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

80

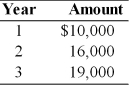

Find the future value at the end of year 3 of the following stream of cash flows received at the end of each year, assuming the firm can earn 17 percent on its investments.

A) $20,724

B) $20,127

C) $23,550

D) $23,350

A) $20,724

B) $20,127

C) $23,550

D) $23,350

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck