Exam 5: Time Value of Money

Exam 1: The Role of Managerial Finance133 Questions

Exam 2: The Financial Market Environment91 Questions

Exam 3: Financial Statements and Ratio Analysis209 Questions

Exam 4: Cash Flow and Financial Planning185 Questions

Exam 5: Time Value of Money173 Questions

Exam 6: Interest Rates and Bond Valuation224 Questions

Exam 7: Stock Valuation188 Questions

Exam 8: Risk and Return190 Questions

Exam 9: The Cost of Capital137 Questions

Exam 10: Capital Budgeting Techniques167 Questions

Exam 11: Capital Budgeting Cash Flows and Risk Refinements195 Questions

Exam 12: Leverage and Capital Structure217 Questions

Exam 13: Payout Policy130 Questions

Exam 14: Working Capital and Current Assets Management340 Questions

Exam 15: Current Liabilities Management171 Questions

Select questions type

Time-value of money is based on the belief that a dollar that will be received at some future date is worth more than a dollar today.

Free

(True/False)

4.7/5  (31)

(31)

Correct Answer:

False

The rate of interest actually paid or earned, also called the annual percentage rate (APR), is the ________ interest rate.

Free

(Multiple Choice)

4.9/5  (37)

(37)

Correct Answer:

A

How much would Sophie have in her account at the end of 10 years if she deposit $2,000 into the account today if she earned 8 percent interest and interest is compounded continuously?

Free

(Multiple Choice)

4.8/5  (33)

(33)

Correct Answer:

C

A generous philanthropist plans to make a one-time endowment to a renowned heart research center which would provide the facility with $250,000 per year into perpetuity. The rate of interest is expected to be 8 percent for all future time periods. How large must the endowment be?

(Multiple Choice)

4.8/5  (33)

(33)

The future value of an ordinary annuity of $1,000 each year for 10 years, deposited at 3 percent, is

(Multiple Choice)

4.8/5  (37)

(37)

Congratulations! You have just won the lottery! However, the lottery bureau has just informed you that you can take your winnings in one of two ways. Choice X pays $1,000,000. Choice Y pays $1,750,000 at the end of five years from now. Using a discount rate of 5 percent, based on present values, which would you choose? Using the same discount rate of 5 percent, based on future values, which would you choose? What do your results suggest as a general rule for approaching such problems? (Make your choices based purely on the time value of money.)

(Essay)

4.9/5  (37)

(37)

A beach house in southern California now costs $350,000. Inflation is expected to cause this price to increase at 5 percent per year over the next 20 years before Eric and Karinna retire from successful careers in commercial art. How large an equal annual end-of-year deposit must be made into an account paying an annual rate of interest of 13 percent in order to buy the beach house upon retirement?

(Multiple Choice)

4.9/5  (38)

(38)

The annual percentage yield (APY) is the effective rate of interest that must be disclosed to customers by banks on their savings products as a result of "truth in savings laws."

(True/False)

4.9/5  (39)

(39)

If a United States Savings bond can be purchased for $14.60 and has a maturity value at the end of 25 years of $100, what is the annual rate of return on the bond?

(Multiple Choice)

4.8/5  (31)

(31)

Calculate the present value of an annuity of $3,900 each year for four years, assuming an opportunity cost of 10 percent.

(Essay)

4.8/5  (34)

(34)

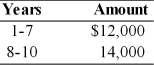

Calculate the present value of the following stream of cash flows, assuming that the firm's opportunity cost is 15 percent.

(Essay)

4.9/5  (32)

(32)

Alexis owns stock in a company which has consistently paid a growing dividend over the last 10 years. The first year Alexis owned the stock, she received $4.50 per share and in the 10th year, she received $4.92 per share. What is the growth rate of the dividends over the last 10 years?

(Multiple Choice)

4.9/5  (38)

(38)

A local brokerage firm is offering a zero coupon certificate of deposit for $10,000. At maturity, three years from now, the investor will receive $14,000. What is the rate of return on this investment?

(Multiple Choice)

4.7/5  (29)

(29)

The New York Soccer Association would like to accumulate $10,000 by the end of 4 years from now to finance a big soccer weekend for its members. The Association currently has $2,500 and wishes to raise the balance by arranging annual fund-raising events. How much money should they raise at each annual fund-raising event assuming 8 percent rate of interest?

(Essay)

4.8/5  (25)

(25)

Everything else being equal, the longer the period of time, the lower the present value.

(True/False)

4.7/5  (29)

(29)

What annual rate of return would Jia need to earn if she deposits $20,000 per year into an account beginning one year from today in order to have a total of $1,000,000 in 30 years?

(Multiple Choice)

4.7/5  (28)

(28)

For any interest rate and for any period of time, the more frequently interest is compounded, the greater the amount of money that has to be invested today in order to accumulate a given future amount.

(True/False)

4.7/5  (36)

(36)

A ski chalet at Peak n' Peak now costs $250,000. Inflation is expected to cause this price to increase at 5 percent per year over the next 10 years before Chris and Julie retire from successful investment banking careers. How large an equal annual end-of-year deposit must be made into an account paying an annual rate of interest of 13 percent in order to buy the ski chalet upon retirement?

(Multiple Choice)

4.9/5  (33)

(33)

Future value increases with increases in the interest rate or the period of time funds are left on deposit.

(True/False)

4.8/5  (32)

(32)

Showing 1 - 20 of 173

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)