Deck 4: Journalizing and Posting Transactions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

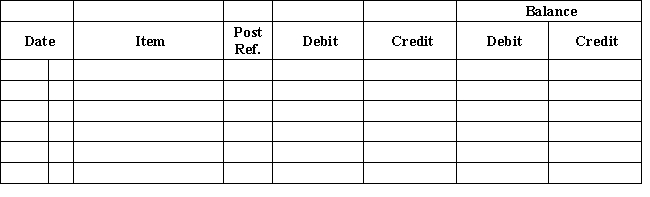

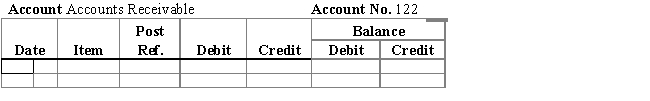

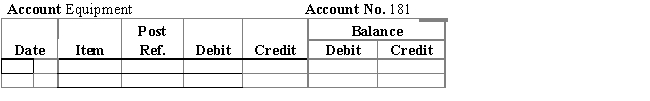

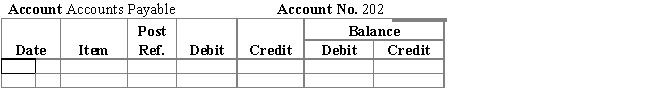

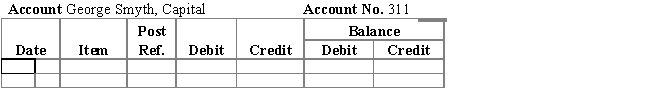

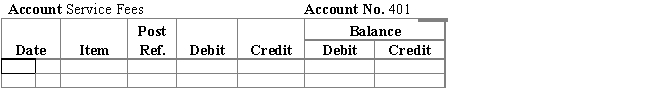

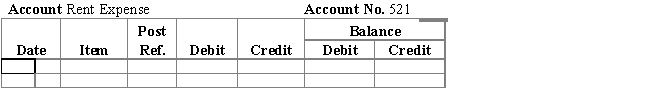

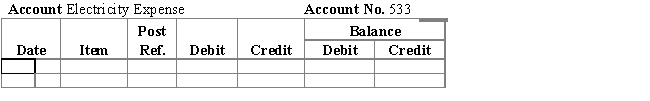

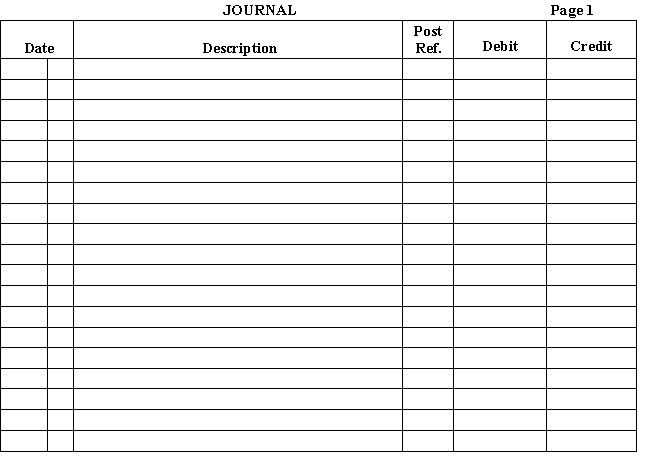

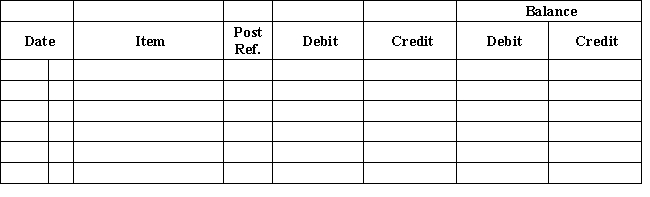

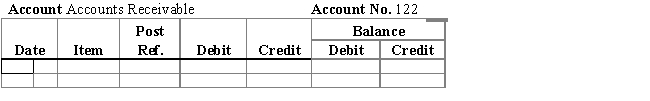

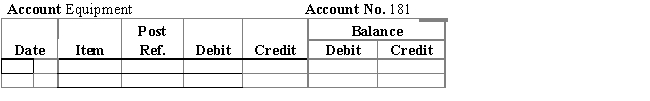

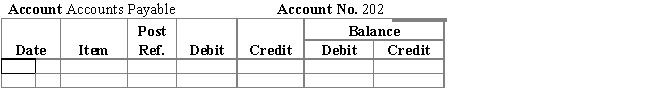

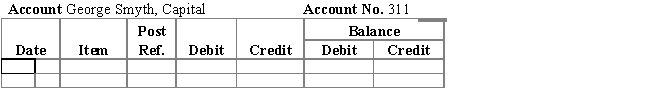

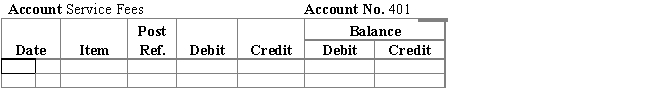

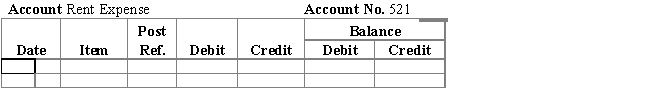

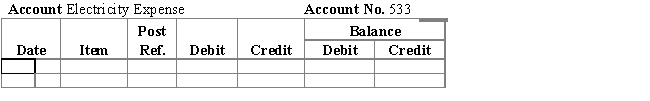

Question

Question

Question

Question

Question

Question

Question

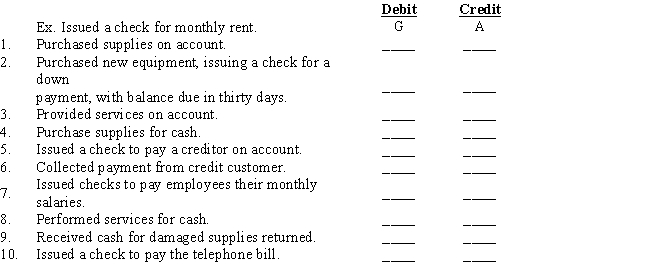

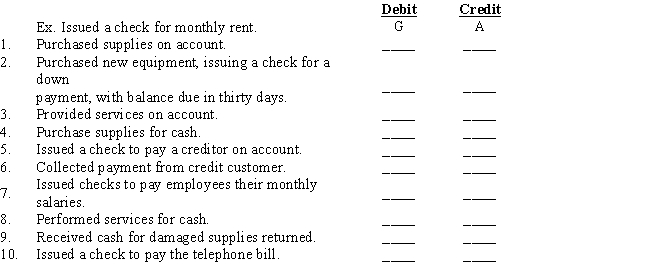

Question

Question

Question

Question

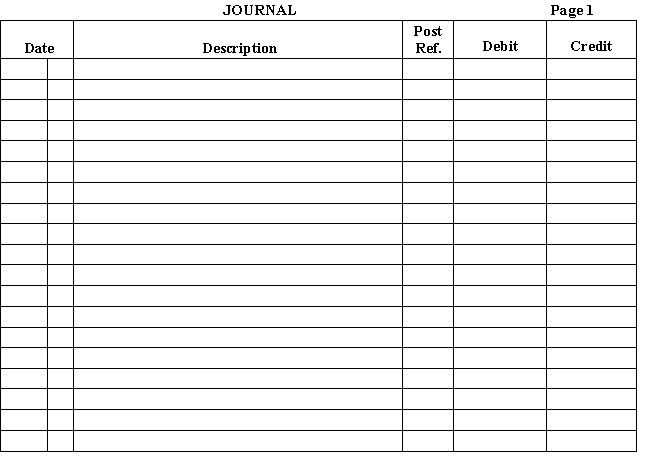

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/93

Play

Full screen (f)

Deck 4: Journalizing and Posting Transactions

1

The flow of data through the accounting information system includes analyzing transactions,journalizing,posting,and preparing a trial balance.

True

2

Entering transactions in a journal is called posting.

False

3

An account in the chart of accounts is assigned a number at random.

False

4

A separate line in the two-column journal should be used for each account title.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

5

Information about cash disbursements can be obtained from check stubs and carbon copies of checks.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

6

The Description column of a two-column journal is used to enter the titles of the accounts affected by each

transaction,together with a description of the transaction.

transaction,together with a description of the transaction.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

7

A complete set of all the accounts used by a business is known as the general ledger.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

8

When the trial balance indicates that the ledger is in balance,you can assume there are no errors in the ledger.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

9

The ledger is a reliable source of information only when all of the transactions entered in the journal have been

posted.

posted.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

10

The posting reference,amount,and description are the three items of information about each transaction that should e entered in the ledger accounts.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

11

Source documents begin the process of entering transactions in the accounting system.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

12

To make the posting process easier,posting reference entries are made at the same time that transactions are

entered in the two-column journal.

entered in the two-column journal.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

13

The journal provides the information needed to transfer the debits and credits to the accounts in the ledger.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

14

It is permissible to enter information about a transaction in the ledger accounts first,before entering the information

in the journal.

in the journal.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

15

Source documents provide objective,verifiable evidence of business transactions.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

16

Copies of sales tickets or sales invoices issued to customers or clients provide information about sales of goods or

services.

services.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

17

The purpose of a journal is to provide a chronological record of all transactions completed by the business.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

18

The purpose of a trial balance is to prove that the totals of the debit and credit balances in the ledger accounts

are equal.

are equal.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

19

The main advantage of a two-column account is that it maintains a running balance.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

20

The chart of accounts includes the account titles in numerical order.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

21

Entering the account number in the Posting Reference column of the journal is the first step in the posting process.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

22

Each entry in the journal affects two or more accounts.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

23

A two-column journal has only two amount columns-one for the amount of the entry and one for the running balance.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

24

An erasure may suggest that you are hiding something.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

25

A trial balance can only be accurately prepared on the last day of the accounting period after all transactions have been entered.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

26

The process of copying the debits and credits from the journal to the ledger accounts is known as posting.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

27

The flow of financial data through the accounting information system does NOT include

A) analyzing transactions.

B) journalizing and posting transactions.

C) preparing a trial balance.

D) receiving payment for all accounts receivable.

A) analyzing transactions.

B) journalizing and posting transactions.

C) preparing a trial balance.

D) receiving payment for all accounts receivable.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

28

After posting journal information to the ledger accounts,a check mark should be entered in the Posting Reference column of the journal to indicate that the transaction item has been posted.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

29

The chart of accounts includes assets,liabilities,and owner's equity accounts only.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

30

Transactions which do not affect the cash account do not need to be entered in the journal,since they do not affect net income or loss.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

31

The general ledger is kept to supply management with desired information in summary form.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

32

No entries are made in the Posting Reference column in a two-column journal when journalizing.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

33

When entering titles of accounts in the two-column journal,the account to be credited is entered first and the account to be debited is entered second.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

34

Firms are more likely to use a four-column journal account than T accounts.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

35

In some cases,erasures are better for corrections than the ruling method.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

36

Source documents provide the input for the accounting process.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

37

Purchase invoices received from suppliers provide information about cash payments.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

38

Almost any document that provides information about a business transaction is included in the chart of accounts.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

39

All transactions must be posted before preparing a trial balance.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

40

A list of all the accounts used by a business is called a trial balance.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

41

Receipt stubs,carbon copies of receipts,cash register tapes,or memos of cash register totals provide information about

A) cash payments.

B) cash receipts.

C) accounts payable.

D) purchases of goods or services.

A) cash payments.

B) cash receipts.

C) accounts payable.

D) purchases of goods or services.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

42

Every entry in the journal should include all of the following EXCEPT

A) the title of each account affected.

B) the amounts.

C) a brief description.

D) the balance of the accounts affected.

A) the title of each account affected.

B) the amounts.

C) a brief description.

D) the balance of the accounts affected.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

43

For EVERY transaction,the accountant enters the

A) year,month,and day.

B) month and day.

C) day.

D) year and day.

A) year,month,and day.

B) month and day.

C) day.

D) year and day.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

44

The transaction to record payment for delivery equipment that was purchased on account in the previous month would include

A) debiting Cash and crediting Accounts Receivable.

B) debiting Cash and crediting Accounts Payable.

C) debiting Accounts Payable and crediting Cash.

D) debiting Delivery Equipment and crediting Cash.

A) debiting Cash and crediting Accounts Receivable.

B) debiting Cash and crediting Accounts Payable.

C) debiting Accounts Payable and crediting Cash.

D) debiting Delivery Equipment and crediting Cash.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

45

The month in the journal is recorded

A) with every transaction.

B) as the first entry on a page.

C) for the first and last transaction of the month.

D) for the last transaction of the month.

A) with every transaction.

B) as the first entry on a page.

C) for the first and last transaction of the month.

D) for the last transaction of the month.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

46

The simplest form of journal is one with

A) four columns.

B) three columns.

C) two columns.

D) one column.

A) four columns.

B) three columns.

C) two columns.

D) one column.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

47

A chart of accounts does NOT include

A) assets.

B) liabilities.

C) owner's equity.

D) names of suppliers.

A) assets.

B) liabilities.

C) owner's equity.

D) names of suppliers.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

48

Sales revenue received in cash is entered by

A) debiting Cash and crediting Sales Revenue.

B) debiting Sales Revenue and crediting Cash.

C) debiting Cash and crediting Accounts Payable.

D) debiting Accounts Payable and crediting Cash.

A) debiting Cash and crediting Sales Revenue.

B) debiting Sales Revenue and crediting Cash.

C) debiting Cash and crediting Accounts Payable.

D) debiting Accounts Payable and crediting Cash.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

49

The steps in the journalizing process include all of the following EXCEPT

A) enter the balance.

B) enter the debit.

C) enter the date.

D) enter the credit.

A) enter the balance.

B) enter the debit.

C) enter the date.

D) enter the credit.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

50

Journalizing does NOT include

A) debiting account(s)that are affected.

B) crediting account(s)that are affected.

C) posting the debits and credits to the accounts.

D) entering the date.

A) debiting account(s)that are affected.

B) crediting account(s)that are affected.

C) posting the debits and credits to the accounts.

D) entering the date.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

51

Purchase invoices received from suppliers provide information about

A) cash receipts.

B) sales of goods.

C) purchases of goods or services.

D) cash payments.

A) cash receipts.

B) sales of goods.

C) purchases of goods or services.

D) cash payments.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

52

A chronological record of financial transactions expressed as debits and credits to accounts is provided by the

A) ledger.

B) journal.

C) balance sheet.

D) trial balance.

A) ledger.

B) journal.

C) balance sheet.

D) trial balance.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

53

Because the first formal accounting record of a transaction is made in a journal from source document information, a journal is commonly referred to as a(n)

A) ledger.

B) account.

C) cross-reference.

D) book of original entry.

A) ledger.

B) account.

C) cross-reference.

D) book of original entry.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

54

If the owner of a company invested cash in a business enterprise,the transaction would include

A) debiting Cash and crediting Capital.

B) debiting Capital and crediting Cash.

C) debiting Cash and crediting Revenue.

D) debiting Revenue and crediting Cash.

A) debiting Cash and crediting Capital.

B) debiting Capital and crediting Cash.

C) debiting Cash and crediting Revenue.

D) debiting Revenue and crediting Cash.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

55

When delivery equipment is purchased on account,the transaction to be entered by the purchaser includes

A) debiting Delivery Equipment and crediting Accounts Payable.

B) debiting Delivery Expense and crediting Cash.

C) debiting Delivery Expense and crediting Accounts Payable.

D) debiting Delivery Equipment and crediting Cash.

A) debiting Delivery Equipment and crediting Accounts Payable.

B) debiting Delivery Expense and crediting Cash.

C) debiting Delivery Expense and crediting Accounts Payable.

D) debiting Delivery Equipment and crediting Cash.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

56

Purchase invoices received from suppliers provide information about

A) cash payments.

B) cash receipts.

C) sales of goods or services.

D) purchases of goods or services.

A) cash payments.

B) cash receipts.

C) sales of goods or services.

D) purchases of goods or services.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

57

The accounts in the chart of accounts are arranged in

A) alphabetical order.

B) numerical order.

C) chronological order.

D) the order they are created.

A) alphabetical order.

B) numerical order.

C) chronological order.

D) the order they are created.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

58

Copies of sales tickets or sales invoices issued to customers or clients provide information about

A) sales of goods or services.

B) purchases of goods or services.

C) cash receipts.

D) cash payments.

A) sales of goods or services.

B) purchases of goods or services.

C) cash receipts.

D) cash payments.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

59

Forms and papers that provide information about a business transaction are called

A) ledgers.

B) accounts.

C) source documents.

D) journals.

A) ledgers.

B) accounts.

C) source documents.

D) journals.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

60

The Posting Reference column of the journal provides a cross-reference between the

A) ledger and accounts.

B) journal and ledger.

C) ledger and financial statements.

D) journal and financial statements.

A) ledger and accounts.

B) journal and ledger.

C) ledger and financial statements.

D) journal and financial statements.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

61

Instead of T accounts,businesses are more likely to use a

A) chart of accounts.

B) balance sheet.

C) four-column account.

D) special journal.

A) chart of accounts.

B) balance sheet.

C) four-column account.

D) special journal.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

62

Cash is used to pay for a car for personal use by the owner.The transaction includes

A) debiting Cash and crediting Drawing.

B) debiting Drawing and crediting Cash.

C) debiting Capital and crediting Cash.

D) debiting Car Expense and crediting Cash.

A) debiting Cash and crediting Drawing.

B) debiting Drawing and crediting Cash.

C) debiting Capital and crediting Cash.

D) debiting Car Expense and crediting Cash.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

63

Transactions and journal entries are shown below.Read the transaction and determine if the correct journal entry

has been made.If a correction is necessary,use the ruling method to make the correction.

a Bert Hollis, the owner, invested in the business.

b. Hollis paid the monthly rent of .

c. Hollis paid cash to Union Electric for monthly utilities, .

d. Hollis made payment on account for office supplies purchased previously, .

e. A customer made a payment on account, .

has been made.If a correction is necessary,use the ruling method to make the correction.

a Bert Hollis, the owner, invested in the business.

b. Hollis paid the monthly rent of .

c. Hollis paid cash to Union Electric for monthly utilities, .

d. Hollis made payment on account for office supplies purchased previously, .

e. A customer made a payment on account, .

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

64

George Smyth opened a computer repair business on Apr.1,20--.During the first month of operations,the firm had

the following transactions.Record these transactions on page 1 of the general journal.Omit explanations.

Post appropriate transactions to the general ledger.

?

Apr. 1 George Smyth invested cash in the business.

2 Paid rent for April, .

8 Bought equipment for and issued a check for as a down payment.

12 Performed services for in cash, and on credit.

19 Paid electric bill, .

25 Recerved on account from credit customers. ?

?

?

?

?

?

?

?

?

?

?

?

?

?

?

?

?

?

??

??

?

?

?

?

?

?

?

the following transactions.Record these transactions on page 1 of the general journal.Omit explanations.

Post appropriate transactions to the general ledger.

?

Apr. 1 George Smyth invested cash in the business.

2 Paid rent for April, .

8 Bought equipment for and issued a check for as a down payment.

12 Performed services for in cash, and on credit.

19 Paid electric bill, .

25 Recerved on account from credit customers. ?

?

?

?

?

??

?

?

? ?

??

?

??

?

? ??

???

?

??

?

??

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

65

Transactions and journal entries are shown below.Read the transaction and determine if the correct journal entry

has been made.If a correction is necessary,prepare a correcting entry.

has been made.If a correction is necessary,prepare a correcting entry.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

66

To find an error,you should do all of the following EXCEPT

A) double-check every entry.

B) find the difference between debits and credits.

C) erase questionable entries.

D) retrace any math computations.

A) double-check every entry.

B) find the difference between debits and credits.

C) erase questionable entries.

D) retrace any math computations.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

67

Prepare general journal entries to record the following transactions.Omit explanations.

?

?

Jan. 3 Paid office rent, .

4 Bought a truck costing , making a down payment of .

6 Paid wages, .

7 Received cash from customers for services performed.

10 Paid owed on last month's bills.

12 Billed credit customers, .

17 Received from credit customers.

19 Tayl or Gordon, the owner, withdrew .

23 Paid on amount owed for truck.

29 Received bill for utilities expense, .

?

?

Jan. 3 Paid office rent, .

4 Bought a truck costing , making a down payment of .

6 Paid wages, .

7 Received cash from customers for services performed.

10 Paid owed on last month's bills.

12 Billed credit customers, .

17 Received from credit customers.

19 Tayl or Gordon, the owner, withdrew .

23 Paid on amount owed for truck.

29 Received bill for utilities expense, .

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

68

Organize a chart of accounts,using correct headings from the list of account titles below:

Accounts Payable

Accounts Receivable

Building

Cash

Equipment

Insurance Expense

Prepaid Insurance

Rent Expense

Service Fees

Dunlop,Capital

Dunlop,Drawing

Supplies

Wage Expense

Wages Payable

Accounts Payable

Accounts Receivable

Building

Cash

Equipment

Insurance Expense

Prepaid Insurance

Rent Expense

Service Fees

Dunlop,Capital

Dunlop,Drawing

Supplies

Wage Expense

Wages Payable

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

69

The payment of a utility bill (like electricity)for the month would include

A) debiting Capital and crediting Accounts Payable.

B) debiting Cash and crediting Utilities Expense.

C) debiting Utilities Expense and crediting Accounts Payable.

D) debiting Utilities Expense and crediting Cash.

A) debiting Capital and crediting Accounts Payable.

B) debiting Cash and crediting Utilities Expense.

C) debiting Utilities Expense and crediting Accounts Payable.

D) debiting Utilities Expense and crediting Cash.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

70

Corrections in accounts should be made by

A) correction fluid.

B) neat erasure.

C) the ruling method.

D) a permanent marker.

A) correction fluid.

B) neat erasure.

C) the ruling method.

D) a permanent marker.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

71

The following transactions occurred at Forever Green Lawn Service.Identify which account would be debited and

credited to record each transaction.Write the identifying letters in the proper columns.The first transaction has been

completed as an example.

?

?

A. Cash

B. Accounts Receivable

C. Supplies

D. Equipment

E. Accounts Payable

F. Fees Income

G. Rent Expense

H. Salaries Expense

I. Telephone Expense

credited to record each transaction.Write the identifying letters in the proper columns.The first transaction has been

completed as an example.

?

?

A. Cash

B. Accounts Receivable

C. Supplies

D. Equipment

E. Accounts Payable

F. Fees Income

G. Rent Expense

H. Salaries Expense

I. Telephone Expense

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

72

Corrections in accounts should NOT be

A) traceable.

B) initialed.

C) ruled.

D) covered completely.

A) traceable.

B) initialed.

C) ruled.

D) covered completely.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

73

Prepare general journal entries to record the following transactions.Omit the explanations after each entry.

Mar. 1 J. Lynch invested in a neighborhood movie house. Land, ; building, ; and equipment, ; totaling .

2 Rental expense for the movies shown for the month, on account.

5 Ticket sales for the month, cash.

8 Wages paid for the month, .

12 Purchased a new popcorn machine, on account.

17 Paid monthly fee to maintenance company, .

23 Rented the theater to an organization for a night. Billed them .

30 Paid on the amount owed for the new popcorn machine.

Mar. 1 J. Lynch invested in a neighborhood movie house. Land, ; building, ; and equipment, ; totaling .

2 Rental expense for the movies shown for the month, on account.

5 Ticket sales for the month, cash.

8 Wages paid for the month, .

12 Purchased a new popcorn machine, on account.

17 Paid monthly fee to maintenance company, .

23 Rented the theater to an organization for a night. Billed them .

30 Paid on the amount owed for the new popcorn machine.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

74

Almost any document that provides information about a business transaction can be called a(n)____________________.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

75

In the two-column general journal page below,each capital letter represents a part of a journal entry.Write the proper letter next to the item in the list below to identify the proper part of the journal entry.

-1. Ledger account number of account credited

2. Month

3. Explanation

4. Title of account debited

5. Year

6. Day of the month

7. Title of account credited

8. Amount of debit

9. Amount of credit

10. Ledger account number of account debited

-1. Ledger account number of account credited

2. Month

3. Explanation

4. Title of account debited

5. Year

6. Day of the month

7. Title of account credited

8. Amount of debit

9. Amount of credit

10. Ledger account number of account debited

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

76

If cash is paid for worker salaries,the transaction includes

A) debiting Salaries Expense and crediting Cash.

B) debiting Salaries Expense and crediting Accounts Payable.

C) debiting Salaries Expense and crediting Capital.

D) debiting Cash and crediting Salaries Expense.

A) debiting Salaries Expense and crediting Cash.

B) debiting Salaries Expense and crediting Accounts Payable.

C) debiting Salaries Expense and crediting Capital.

D) debiting Cash and crediting Salaries Expense.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

77

The Item column in the general ledger is used to describe special entries not including the following entries?

A) Adjusting entries

B) Reversing entries

C) Correcting entries

D) Forwarding entries

A) Adjusting entries

B) Reversing entries

C) Correcting entries

D) Forwarding entries

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

78

Prepare a corrected trial balance by changing incorrect amounts and placing each amount in the proper column.

a.

Be sure all accounts have been listed with the appropriate debit or credit balance and check column totals.

b.

The debits to the Cash account are $37,421,and the credits are $34,381.

c.

A $500 payment to a creditor was entered in the journal,but was not posted to the Accounts Payable account.Cash was properly posted.

d.

The Advertising Expense total has a transposition error of $90.

e.

Accounts Receivable contains a slide error.

a.

Be sure all accounts have been listed with the appropriate debit or credit balance and check column totals.

b.

The debits to the Cash account are $37,421,and the credits are $34,381.

c.

A $500 payment to a creditor was entered in the journal,but was not posted to the Accounts Payable account.Cash was properly posted.

d.

The Advertising Expense total has a transposition error of $90.

e.

Accounts Receivable contains a slide error.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

79

Prepare a corrected trial balance by changing incorrect amounts and placing each amount in the proper column.

?

a.

Be sure all accounts have been listed with the appropriate debit or credit balance and check column totals.

b.

The debits to the Cash account are $36,796,and the credits are $29,009.

c.

A $600 payment to a creditor was entered in the journal,but was not posted to the Accounts Payable account.Cash was properly posted.

d.

The Advertising Expense total has a transposition error of $81.

e.

Accounts Receivable contains a slide error.

?

a.

Be sure all accounts have been listed with the appropriate debit or credit balance and check column totals.

b.

The debits to the Cash account are $36,796,and the credits are $29,009.

c.

A $600 payment to a creditor was entered in the journal,but was not posted to the Accounts Payable account.Cash was properly posted.

d.

The Advertising Expense total has a transposition error of $81.

e.

Accounts Receivable contains a slide error.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

80

Posting from the journal to the ledger does NOT involve which of the following steps?

A) Enter the date of each transaction in the accounts.

B) Enter the amount of each transaction in the accounts.

C) Enter the page of the journal from which each transaction is posted in the accounts.

D) Enter the description of the entry.

A) Enter the date of each transaction in the accounts.

B) Enter the amount of each transaction in the accounts.

C) Enter the page of the journal from which each transaction is posted in the accounts.

D) Enter the description of the entry.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck