Deck 6: Subsequent-Year Consolidations: General Approach

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/40

Play

Full screen (f)

Deck 6: Subsequent-Year Consolidations: General Approach

1

Singh Ltd. is a wholly owned subsidiary of Ross Co. At the beginning of 20X4, Ross acquired a machine for $350,000 and sold it to Singh for $437,500. The machine will be depreciated over five years using the straight-line method with no residual value.

-Seven years after Singh bought the machine from Ross, the machine is still in use. In preparing its consolidated financial statements, what entry should Ross make?

A)

B)

C)

D)No entry is required at this time.

-Seven years after Singh bought the machine from Ross, the machine is still in use. In preparing its consolidated financial statements, what entry should Ross make?

A)

B)

C)

D)No entry is required at this time.

B

2

Mallard Ltd. acquired 75% of the outstanding common shares of Teal Ltd. at December 31, 20X1, for $900,000. Mallard has recorded its investment using the cost method.

- At the end of 20X7, Mallard still had $40,000 of goods purchased from Teal in its inventory and Teal had $50,000 of goods purchased from Mallard in its inventory. Both companies had gross margins of 50% in their sales of goods to each other and both companies sold these goods in 20X8. What journal entry should be made for Mallard's 20X8 consolidated financial statements with respect to the goods purchased from Teal that were still in Mallard's opening inventory?

A)

B)

C)

D)No adjustment is required as the profits have been realized.

- At the end of 20X7, Mallard still had $40,000 of goods purchased from Teal in its inventory and Teal had $50,000 of goods purchased from Mallard in its inventory. Both companies had gross margins of 50% in their sales of goods to each other and both companies sold these goods in 20X8. What journal entry should be made for Mallard's 20X8 consolidated financial statements with respect to the goods purchased from Teal that were still in Mallard's opening inventory?

A)

B)

C)

D)No adjustment is required as the profits have been realized.

A

3

Cooper Ltd. acquired 70% of the common shares of Effy Ltd. at January 2, 20X1. At December 31, 20X3, Effy sold a machine to Cooper for $180,000. Effy had purchased the machine a few years earlier for $250,000. At the time of sale to Cooper, the machine had a carrying value of $150,000 and a remaining useful life of six years.

- Both companies do not claim depreciation for assets purchased in the second half of the year. For Cooper's December 31, 20X3, separate-entry financial statements, what net book value should be shown for the machine?

A)$125,000

B)$150,000

C)$180,000

D)$250,000

- Both companies do not claim depreciation for assets purchased in the second half of the year. For Cooper's December 31, 20X3, separate-entry financial statements, what net book value should be shown for the machine?

A)$125,000

B)$150,000

C)$180,000

D)$250,000

$180,000

4

Mallard Ltd. acquired 75% of the outstanding common shares of Teal Ltd. at December 31, 20X1, for $900,000. Mallard has recorded its investment using the cost method.

- In 20X8, Mallard sold goods to Teal for $260,000 at a gross margin of 30% and Teal sold goods to Mallard for $180,000 at a gross margin of 50%. At the end of 20X8, Mallard still had $60,000 in inventory of goods purchased from Teal and Teal still had $45,000 in inventory of goods purchased from Mallard. What adjustment should be made for Mallard's 20X8 consolidated financial statements with respect to goods sold to Teal that are still in ending inventory?

A)Decrease cost of sales by $13,500; decrease ending inventory by $10,125; increase non-controlling interest by $3,375.

B)Increase cost of sales by $13,500; decrease ending inventory by $10,125; increase non-controlling interest by $3,375.

C)Decrease cost of sales by $13,500; decrease ending inventory by $13,500.

D)Increase cost of sales by $13,500; decrease ending inventory by $13,500.

- In 20X8, Mallard sold goods to Teal for $260,000 at a gross margin of 30% and Teal sold goods to Mallard for $180,000 at a gross margin of 50%. At the end of 20X8, Mallard still had $60,000 in inventory of goods purchased from Teal and Teal still had $45,000 in inventory of goods purchased from Mallard. What adjustment should be made for Mallard's 20X8 consolidated financial statements with respect to goods sold to Teal that are still in ending inventory?

A)Decrease cost of sales by $13,500; decrease ending inventory by $10,125; increase non-controlling interest by $3,375.

B)Increase cost of sales by $13,500; decrease ending inventory by $10,125; increase non-controlling interest by $3,375.

C)Decrease cost of sales by $13,500; decrease ending inventory by $13,500.

D)Increase cost of sales by $13,500; decrease ending inventory by $13,500.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

5

Belzer Co. owns 70% of Sabo Ltd. At the beginning of 20X7, Sabo sold a piece of equipment to Belzer for a gain of $35,000. At that time, the equipment had an estimated useful life of seven years.

-Ten years later, Belzer is still using the equipment. In preparing its consolidated financial statements, Belzer should credit the equipment account by $35,000. What account(s)should be debited in this journal entry?

A)Opening consolidated retained earnings by $35,000

B)Opening consolidated retained earnings by $24,500 and NCI by $10,500

C)Depreciation expense by $35,000

D)Accumulated depreciation by $35,000

-Ten years later, Belzer is still using the equipment. In preparing its consolidated financial statements, Belzer should credit the equipment account by $35,000. What account(s)should be debited in this journal entry?

A)Opening consolidated retained earnings by $35,000

B)Opening consolidated retained earnings by $24,500 and NCI by $10,500

C)Depreciation expense by $35,000

D)Accumulated depreciation by $35,000

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

6

Grayson Ltd. acquired 60% of the outstanding common shares of Goldberg Ltd. for $480,000. At the date of acquisition, Goldberg's shareholders' equity was $625,000. The goodwill at 100% has been determined to be $90,000 under the entity method.

-What is the amount of the non-controlling interest that should be reported under the entity method?

A)$192,000

B)$250,000

C)$304,000

D)$320,000

-What is the amount of the non-controlling interest that should be reported under the entity method?

A)$192,000

B)$250,000

C)$304,000

D)$320,000

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

7

TLC Homecare Ltd. owns 100% of Errand Service for Seniors Ltd. (ESS). On January 2, 20X1, TLC bought 12 identical cars for $300,000. It promptly sold four of the cars to ESS for $112,000. ESS will amortize the cars over five years using the straight-line method. At December 31, 20X2, what is the net adjustment that should be made to accumulated depreciation in TLC's consolidated financial statements? Ignore income taxes.

A)$0

B)Reduction of $2,400

C)Reduction of $4,800

D)Reduction of $5,600

A)$0

B)Reduction of $2,400

C)Reduction of $4,800

D)Reduction of $5,600

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

8

Linville Ltd. owns 80% of the outstanding shares of Chance Co. On January 2, 20X1, Chance sold a machine to Linville for $270,000. Chance recorded a $45,000 gain on the sale. At the time of the sale, the machine had a remaining useful life of three years. Both companies use the straight-line method of depreciation. What amount should be shown for depreciation expense on Linville's consolidated statement of comprehensive income at December 31, 20X1?

A)$15,000

B)$72,000

C)$75,000

D)$90,000

A)$15,000

B)$72,000

C)$75,000

D)$90,000

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

9

Dixon Ltd. owns 60% of the common shares of Kelly Co. At the beginning of 20X1, Kelly sold a machine with a book value of $350,000 to Dixon for $410,000. When Dixon prepares its consolidated financial statements for 20X1, it credits the machine account by $60,000. What account(s)should it debit in this journal entry?

A)Retained earnings by $60,000

B)Investment in Kelly by $60,000

C)Retained earnings by $36,000 and NCI by $24,000

D)Investment in Kelly by $24,000 and NCI by $24,000

A)Retained earnings by $60,000

B)Investment in Kelly by $60,000

C)Retained earnings by $36,000 and NCI by $24,000

D)Investment in Kelly by $24,000 and NCI by $24,000

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

10

Chandler Ltd. owns 65% of Stork Co. and accounts for its investment using the cost method. During 20X3, Chandler sold its only land holding to Stork for a $25,000 profit. At the end of 20X4, Stork showed the land on its single-entity financial statement at a value of $100,000. What balance should Chandler show on its consolidated statement of financial position for the land?

A)$0

B)$75,000

C)$100,000

D)$125,000

A)$0

B)$75,000

C)$100,000

D)$125,000

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

11

Roslynn Ltd. is a subsidiary of Goodale Co. Roslynn sold a machine to Goodale for a $50,000 gain. Goodale has now sold the machine to an unrelated party for a $20,000 gain. At the time of the sale, $35,000 of the profit on the sale from Roslynn was still unrealized. For consolidation purposes, what is the amount of gain that must be recognized on the sale of the machine?

A)$15,000

B)$20,000

C)$30,000

D)$55,000

A)$15,000

B)$20,000

C)$30,000

D)$55,000

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

12

Singh Ltd. is a wholly owned subsidiary of Ross Co. At the beginning of 20X4, Ross acquired a machine for $350,000 and sold it to Singh for $437,500. The machine will be depreciated over five years using the straight-line method with no residual value.

-In preparing the consolidated financial statements for the second year after the sale to Singh, Ross made the following journal entry: What other adjustment must be made in preparing the consolidated financial statements?

A)

B)

C)

D)

-In preparing the consolidated financial statements for the second year after the sale to Singh, Ross made the following journal entry: What other adjustment must be made in preparing the consolidated financial statements?

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

13

Tooker Co. acquired 80% of the outstanding common shares of Vu Ltd. There were no fair value increments or goodwill that arose with the purchase. During 20X1, Tooker sold $7,000 of inventory to Vu for a gross profit of 40%. At the end of 20X1, $3,000 of the inventory is still in Vu's inventory. On their separate-entity income statements for 20X1, Tooker and Vu reported net income of $4,200 and $3,100, respectively. What is the non-controlling interest's share of consolidated net income at the end of 20X1?

A)$620

B)$840

C)$1,220

D)$1,460

A)$620

B)$840

C)$1,220

D)$1,460

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

14

Belzer Co. owns 70% of Sabo Ltd. At the beginning of 20X7, Sabo sold a piece of equipment to Belzer for a gain of $35,000. At that time, the equipment had an estimated useful life of seven years.

-Which of the following statements is true about calculating the NCI for the consolidated SFP?

A)The unrealized profit at the end of 20X7 must be deducted from the subsidiary's net carrying value before calculating the NCI.

B)The unrealized profit at the end of 20X7 must be added to the subsidiary's net carrying value before calculating the NCI.

C)The unrealized profit does not affect the NCI calculation because this is an upstream sale.

D)There is no unrealized profit in the transaction.

-Which of the following statements is true about calculating the NCI for the consolidated SFP?

A)The unrealized profit at the end of 20X7 must be deducted from the subsidiary's net carrying value before calculating the NCI.

B)The unrealized profit at the end of 20X7 must be added to the subsidiary's net carrying value before calculating the NCI.

C)The unrealized profit does not affect the NCI calculation because this is an upstream sale.

D)There is no unrealized profit in the transaction.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following adjustments is not a cumulative operations adjustment in the consolidation process?

A)Recognize the NCI's share of the subsidiary's retained earnings from the acquisition date to the beginning of the year of the consolidated financial statements.

B)Eliminate the gains and losses from intercompany transactions that have not been realized at the beginning of the year of the consolidated financial statements.

C)Eliminate the flow-through to retained earnings of fair-valued assets and liabilities on intercompany transactions that have since been sold to external parties.

D)Recognize the NCI in earnings.

A)Recognize the NCI's share of the subsidiary's retained earnings from the acquisition date to the beginning of the year of the consolidated financial statements.

B)Eliminate the gains and losses from intercompany transactions that have not been realized at the beginning of the year of the consolidated financial statements.

C)Eliminate the flow-through to retained earnings of fair-valued assets and liabilities on intercompany transactions that have since been sold to external parties.

D)Recognize the NCI in earnings.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

16

Grayson Ltd. acquired 60% of the outstanding common shares of Goldberg Ltd. for $480,000. At the date of acquisition, Goldberg's shareholders' equity was $625,000. The goodwill at 100% has been determined to be $90,000 under the entity method.

- What is the amount of Goldberg's fair value increments?

A)$54,000

B)$70,000

C)$85,000

D)$121,000

- What is the amount of Goldberg's fair value increments?

A)$54,000

B)$70,000

C)$85,000

D)$121,000

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

17

Mallard Ltd. acquired 75% of the outstanding common shares of Teal Ltd. at December 31, 20X1, for $900,000. Mallard has recorded its investment using the cost method.

- In 2008, Teal paid out dividends of $100,000. In preparing Mallard's consolidated financial statements, what elimination is required for the dividends?

A)Reduce dividends declared by $75,000; reduce dividend income by $75,000.

B)Reduce dividends declared by $100,000; reduce dividend income by $100,000.

C)Reduce dividends declared by $100,000; reduce dividend income by $75,000; reduce non-controlling interest by $25,000.

D)Reduce dividend declared by $100,000; reduce dividend income by $75,000; increase non-controlling interest by $25,000.

- In 2008, Teal paid out dividends of $100,000. In preparing Mallard's consolidated financial statements, what elimination is required for the dividends?

A)Reduce dividends declared by $75,000; reduce dividend income by $75,000.

B)Reduce dividends declared by $100,000; reduce dividend income by $100,000.

C)Reduce dividends declared by $100,000; reduce dividend income by $75,000; reduce non-controlling interest by $25,000.

D)Reduce dividend declared by $100,000; reduce dividend income by $75,000; increase non-controlling interest by $25,000.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

18

Arnez Ltd. acquired 70% of the outstanding common shares of Bedard Ltd. At the acquisition date, Bedard's net identifiable assets had a carrying value of $825,000 and a fair market value of $1,000,000. Arnez paid $910,000 for the acquisition. Under the entity method, what amount should be reported for the non-controlling interest on the consolidated statement of financial position?

A)$210,000

B)$247,000

C)$300,000

D)$390,000

A)$210,000

B)$247,000

C)$300,000

D)$390,000

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

19

Pal Co. owns 70% of the outstanding common shares of Sadd Ltd. Sadd sold an asset to Pal at a loss. There is no evidence of impairment in the value of the asset sold to Pal. Which of the following statements about the loss is true?

A)The loss should not be eliminated because this is an upstream sale.

B)The loss should not be eliminated because there is no impairment in the value of the asset.

C)The loss should not be eliminated because Pal does not own 100% of Sadd.

D)The loss should be eliminated.

A)The loss should not be eliminated because this is an upstream sale.

B)The loss should not be eliminated because there is no impairment in the value of the asset.

C)The loss should not be eliminated because Pal does not own 100% of Sadd.

D)The loss should be eliminated.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

20

A few years ago, Locke Ltd. purchased a machine from its wholly owned subsidiary, Dubois Ltd., for $90,000. Locke has just sold the machine to an unrelated party for a $15,000 gain. At the time of the sale, there was still an unrealized gain of $50,000 from the purchase from Dubois. With this sale of the asset to the unrelated party, what is the amount of gain that should be recognized on Locke's consolidated financial statements?

A)$15,000

B)$50,000

C)$55,000

D)$65,000

A)$15,000

B)$50,000

C)$55,000

D)$65,000

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

21

Bowen Limited purchased 60% of Sloch Co. when Sloch's reported retained earnings were $330,000 and its share capital was $200,000. Bowen also owns 80% in Zeek Limited, which was purchased when Zeek reported retained earnings of $575,000 and had share capital of $270,000. For each acquisition, the purchase price was equal to the fair value of the identifiable net assets, which was the same as the carrying value of their carrying values.

An analysis of the changes in retained earnings of the three companies at December 31, 20X7, was: Sloch sells product to Bowen that is used in Bowen's production. Bowen will then sell part of its products to Zeek.

Intercompany profits included on sales from Sloch to Bowen were $25,000 included in January 1, 20X7, inventory, and $40,000 included in December 31, 20X7, inventory.

Intercompany profits included on sales from Bowen to Zeek were $31,000 included in January 1, 20X7, inventory, and $35,000 included in December 31, 20X7, inventory.

During 20X5, Bowen sold a building to Zeek for a gain of $300,000. The building had a remaining life of 25 years. During 20X7, Sloch sold a building to Bowen for a gain of $75,000. This building has a useful remaining life of 15 years. Full depreciation was recorded in the year of acquisition by each company and no depreciation was recorded in the year of sale.

Required:

Calculate the consolidated retained earnings and balance of the non-controlling interest at December 31, 20X7.

An analysis of the changes in retained earnings of the three companies at December 31, 20X7, was: Sloch sells product to Bowen that is used in Bowen's production. Bowen will then sell part of its products to Zeek.

Intercompany profits included on sales from Sloch to Bowen were $25,000 included in January 1, 20X7, inventory, and $40,000 included in December 31, 20X7, inventory.

Intercompany profits included on sales from Bowen to Zeek were $31,000 included in January 1, 20X7, inventory, and $35,000 included in December 31, 20X7, inventory.

During 20X5, Bowen sold a building to Zeek for a gain of $300,000. The building had a remaining life of 25 years. During 20X7, Sloch sold a building to Bowen for a gain of $75,000. This building has a useful remaining life of 15 years. Full depreciation was recorded in the year of acquisition by each company and no depreciation was recorded in the year of sale.

Required:

Calculate the consolidated retained earnings and balance of the non-controlling interest at December 31, 20X7.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

22

Fox Co. acquired 60% of Sox Co. for $900,000. At the acquisition date, Sox had net assets with a book value of $950,000 and a fair value of $1,200,000. What is the amount of goodwill that should be reported on the consolidated SFP under the parent-company extension method and under the entity method?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

23

On January 1, 20X5, PX's shareholders' equity was as follows:

GL held 90% of the 8,000 outstanding shares of PX on January 1, 20X5, and its investment in PX account had a balance of $252,000 on that date. GL accounts for its investment in its subsidiary by the equity method using the entity approach. At the time of acquisition of PX, the only fair value increment arising was due to the patent, which had a remaining life of five years on January 1, 20X5.

The following transactions took place subsequent to January 1, 20X5:

• During 20X5, PX reported a net income of $80,000 (earned equally throughout the year).

• PX declared dividends of $10,000 on September 1.

• During 20X6, PX reported a net income of $76,000 and paid dividends of $16,000 on December 1.

• During 20X6, PX sold equipment to GL for $140,000. At the time, the net book value of the equipment to PX was $100,000. There are four years remaining on the useful life of the equipment. Both companies record a full year of depreciation expense in the year of the purchase and no depreciation in the year of a sale.

Required:

Assuming that no value is assigned to patents on the separate-entity financial statements for GL and PX, calculate patents on the consolidated balance sheet at December 31, 20X6.

Calculate the allocation of the consolidated net income to the non-controlling interest for each of 20X5 and 20X6.

GL held 90% of the 8,000 outstanding shares of PX on January 1, 20X5, and its investment in PX account had a balance of $252,000 on that date. GL accounts for its investment in its subsidiary by the equity method using the entity approach. At the time of acquisition of PX, the only fair value increment arising was due to the patent, which had a remaining life of five years on January 1, 20X5.

The following transactions took place subsequent to January 1, 20X5:

• During 20X5, PX reported a net income of $80,000 (earned equally throughout the year).

• PX declared dividends of $10,000 on September 1.

• During 20X6, PX reported a net income of $76,000 and paid dividends of $16,000 on December 1.

• During 20X6, PX sold equipment to GL for $140,000. At the time, the net book value of the equipment to PX was $100,000. There are four years remaining on the useful life of the equipment. Both companies record a full year of depreciation expense in the year of the purchase and no depreciation in the year of a sale.

Required:

Assuming that no value is assigned to patents on the separate-entity financial statements for GL and PX, calculate patents on the consolidated balance sheet at December 31, 20X6.

Calculate the allocation of the consolidated net income to the non-controlling interest for each of 20X5 and 20X6.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

24

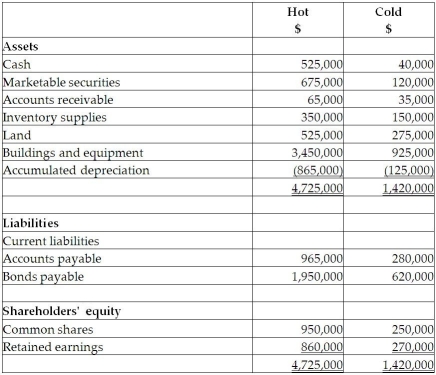

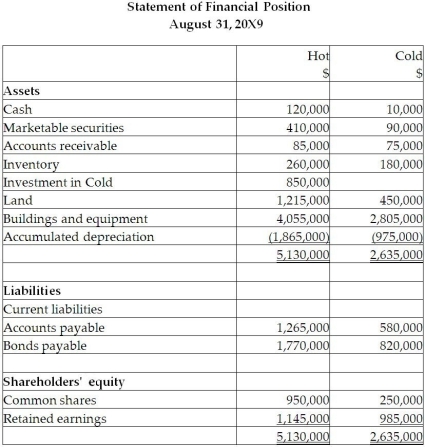

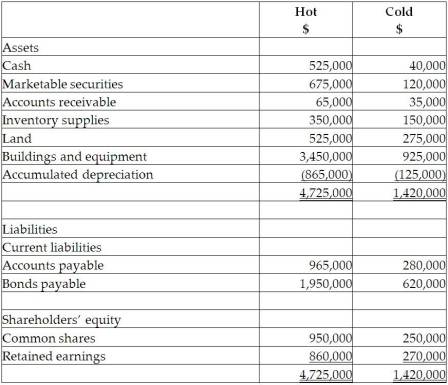

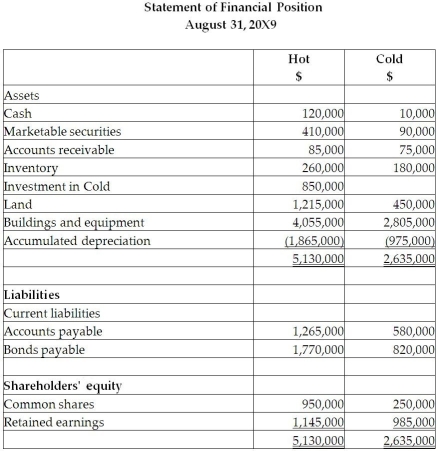

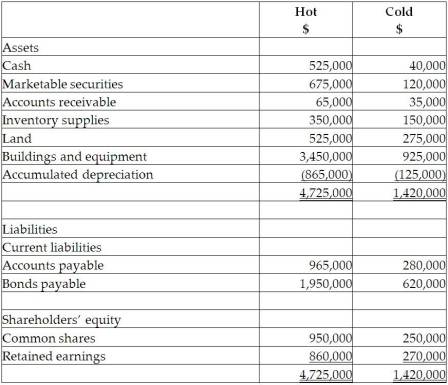

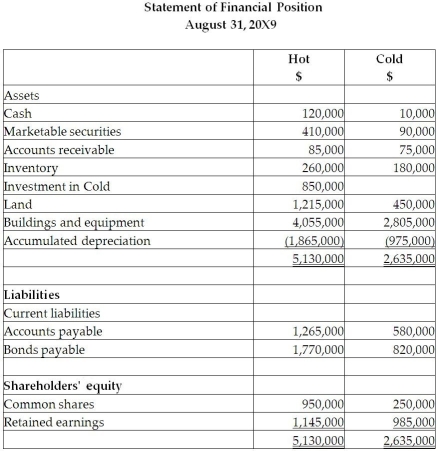

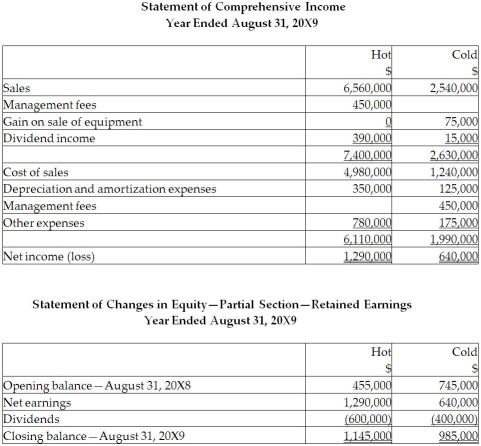

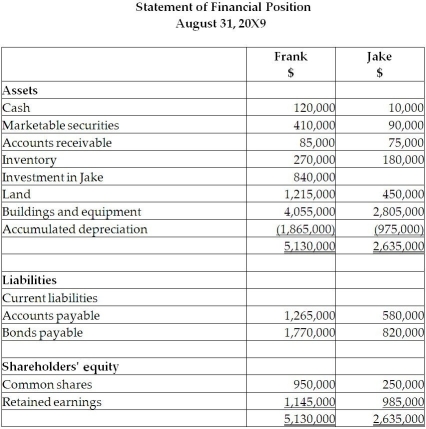

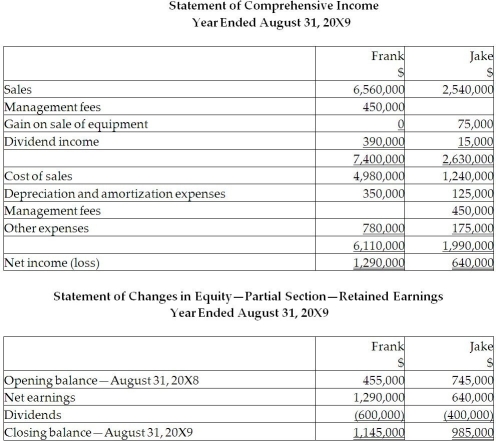

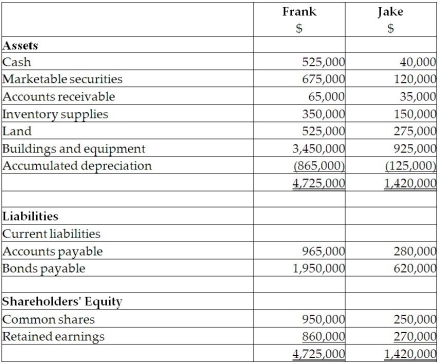

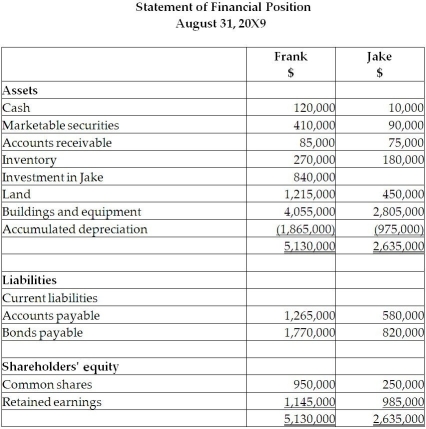

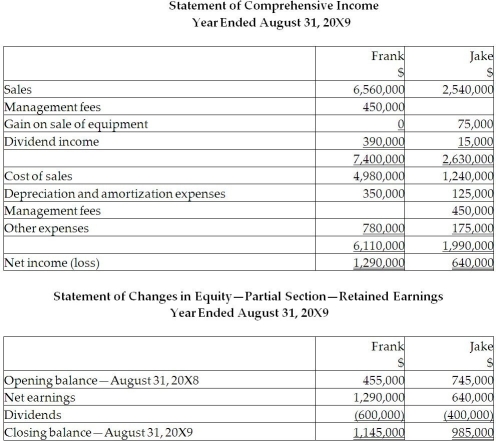

On September 1, 20X5, Hot Limited decided to buy 80% of the shares outstanding of Cold Inc. for $850,000. Hot paid for this acquisition by using cash of $500,000 and marketable securities for the remaining amount. The balances showing on the statement of financial position for the two companies at August 31, 20X5, are as follows:  After a review of the financial assets and liabilities, Hot determines that some of the assets of Cold have fair values different from their carrying values. These items are listed below:

After a review of the financial assets and liabilities, Hot determines that some of the assets of Cold have fair values different from their carrying values. These items are listed below:

• Inventory has a fair value of $130,000.

• The building has a fair value of $1,090,000. The remaining useful life of the building is 20 years.

• A trademark has a fair value of $300,000. The trademark is estimated to have a useful life of 15 years.

• The bonds payable have a fair value of $720,000 and are due on August 31, 20X9.

During the 20X9 fiscal year, the following events occurred:

1. Hot sold merchandise to Cold for $200,000. Profit margin on these sales was 30%. Cold still has inventory on hand of $70,000. Included in the opening inventory of Cold for 20X9 is merchandise purchased from Hot in 20X8 for $150,000. The gross profit margin on these sales was 30%

2. Cold sold merchandise to Hot for $500,000. The gross margin on these sales was 40%. At the end of the year, $180,000 of this was still in Hot's inventory and Hot still owed $100,000 on these sales. Included in the opening inventory of Hot for 20X9 was merchandise purchased from Cold in 20X8 for $230,000. The profit margin on these sales was 30%.

3. During 20X9, Cold sold to Hot equipment resulting in a gain to Cold of $75,000. At the time, the original cost and accumulated depreciation to date for the equipment on Cold's books were $510,000 and 160,000. The remaining useful life for this equipment is 15 years. Depreciation is fully recorded in the year of purchase, and no depreciation is recorded in the year of disposal by both companies.

4. During 20X9, Cold paid management fees of $450,000 to Hot.

5. During 20X9, Cold paid dividends of $400,000 and Hot paid dividends of $600,000. Required:

Required:

Prepare the consolidated statement of financial position for Hot at August 31, 20X9. Calculate the closing balance for the retained earnings and the non-controlling interest. The company used the entity method to determine goodwill for this acquisition.

After a review of the financial assets and liabilities, Hot determines that some of the assets of Cold have fair values different from their carrying values. These items are listed below:

After a review of the financial assets and liabilities, Hot determines that some of the assets of Cold have fair values different from their carrying values. These items are listed below:• Inventory has a fair value of $130,000.

• The building has a fair value of $1,090,000. The remaining useful life of the building is 20 years.

• A trademark has a fair value of $300,000. The trademark is estimated to have a useful life of 15 years.

• The bonds payable have a fair value of $720,000 and are due on August 31, 20X9.

During the 20X9 fiscal year, the following events occurred:

1. Hot sold merchandise to Cold for $200,000. Profit margin on these sales was 30%. Cold still has inventory on hand of $70,000. Included in the opening inventory of Cold for 20X9 is merchandise purchased from Hot in 20X8 for $150,000. The gross profit margin on these sales was 30%

2. Cold sold merchandise to Hot for $500,000. The gross margin on these sales was 40%. At the end of the year, $180,000 of this was still in Hot's inventory and Hot still owed $100,000 on these sales. Included in the opening inventory of Hot for 20X9 was merchandise purchased from Cold in 20X8 for $230,000. The profit margin on these sales was 30%.

3. During 20X9, Cold sold to Hot equipment resulting in a gain to Cold of $75,000. At the time, the original cost and accumulated depreciation to date for the equipment on Cold's books were $510,000 and 160,000. The remaining useful life for this equipment is 15 years. Depreciation is fully recorded in the year of purchase, and no depreciation is recorded in the year of disposal by both companies.

4. During 20X9, Cold paid management fees of $450,000 to Hot.

5. During 20X9, Cold paid dividends of $400,000 and Hot paid dividends of $600,000.

Required:

Required:Prepare the consolidated statement of financial position for Hot at August 31, 20X9. Calculate the closing balance for the retained earnings and the non-controlling interest. The company used the entity method to determine goodwill for this acquisition.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

25

Prawn Corporation owns 80% of the outstanding voting shares of Shrimp Corporation, having acquired its interest January 1, 20X3, for $100,000. At the time of the acquisition, Shrimp Corporation had a shareholders' equity totalling $50,000, made up of retained earnings of $30,000 and common shares of $20,000. The following accounts had fair values higher (or lower)than its carrying values:

Inventory fair value is higher than carrying value.

Equipment fair value is higher than carrying value

Land fair value is lower than carrying value.

The equipment had a remaining useful life at the time of acquisition of five years.

The company uses the entity approach to determine the amount of goodwill. Prawn accounts for its investment in Shrimp using the cost method.

Statement of Comprehensive Income

Year Ended December 31,

(in thousands of \$'s) Statement of Changes in Equity-Partial-Retained Earnings Section

Year Ended December 31, 20X6

(In thousands of \$'s)

Additional Information:

1. Shrimp had reported a gain of $50,000, relating to land (40%)and building (60%)sold to Prawn on January 3, 20X6. These separate properties had not been owned on January 1, 20X3. Remaining useful life was expected to be 10 years at that time.

2. Shrimp sold other land to a non-related company at a gain of $20,000 on June 30, 20X6.

3. Intercompany sales and inventory data for 20X5 and 20X6:

Profit margins on sales by Prawn to Shrimp are 40%.

Profit margins on sales by Shrimp to Prawn are at 30%.

Required:

Prepare a complete consolidated statement of comprehensive income for the year ending December 31, 20X6.

Inventory fair value is higher than carrying value.

Equipment fair value is higher than carrying value

Land fair value is lower than carrying value.

The equipment had a remaining useful life at the time of acquisition of five years.

The company uses the entity approach to determine the amount of goodwill. Prawn accounts for its investment in Shrimp using the cost method.

Statement of Comprehensive Income

Year Ended December 31,

(in thousands of \$'s) Statement of Changes in Equity-Partial-Retained Earnings Section

Year Ended December 31, 20X6

(In thousands of \$'s)

Additional Information:

1. Shrimp had reported a gain of $50,000, relating to land (40%)and building (60%)sold to Prawn on January 3, 20X6. These separate properties had not been owned on January 1, 20X3. Remaining useful life was expected to be 10 years at that time.

2. Shrimp sold other land to a non-related company at a gain of $20,000 on June 30, 20X6.

3. Intercompany sales and inventory data for 20X5 and 20X6:

Profit margins on sales by Prawn to Shrimp are 40%.

Profit margins on sales by Shrimp to Prawn are at 30%.

Required:

Prepare a complete consolidated statement of comprehensive income for the year ending December 31, 20X6.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

26

Basil Ltd. has an 80% interest in a joint venture. Under IFRS, what is attributed to the Basil?

A)80% of the realized and unrealized gains and losses arising from upstream sales

B)80% of the realized and unrealized gains and losses arising from downstream sales

C)100% of the realized and unrealized gains and losses arising from upstream sales

D)100% of the realized and unrealized gains and losses arising from downstream sales

A)80% of the realized and unrealized gains and losses arising from upstream sales

B)80% of the realized and unrealized gains and losses arising from downstream sales

C)100% of the realized and unrealized gains and losses arising from upstream sales

D)100% of the realized and unrealized gains and losses arising from downstream sales

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

27

Prawn Corporation owns 80% of the outstanding voting shares of Shrimp Corporation, having acquired its interest January 1, 20X3, for $100,000. At the time of the acquisition, Shrimp Corporation had a shareholders' equity totalling $50,000, made up for retained earnings of $30,000 and common shares of $20,000. The following accounts had fair values higher (or lower)than its carrying values:

Inventory fair value is higher than carrying value.

Equipment fair value is higher than carrying value

Land fair value is lower than carrying value. The equipment had a remaining useful life at the time of acquisition of five years.

The company uses the entity approach to determine the amount of goodwill. Prawn accounts for its investment in Shrimp using the cost method.

Statement of Comprehensive Income

Year Ended December 3,

(In thousands of s)

Statement of Changes in Equity-Partial-Retained Earnings section

Year Ended December 3,20X6

(In thousands of s) The balance of the land and buildings at December 31, 20X6, for Prawn totalled $895,000 and for Shrimp totalled $450,000.

Additional Information:

1. Shrimp had reported a gain of $50,000, relating to land (40%)and building (60%)sold to Prawn on January 3, 20X6. These separate properties had not been owned on January 1, 20X3. Remaining useful life was expected to be 10 years at that time.

2. Shrimp sold other land to a non-related company at a gain of $20,000 on June 30, 20X6.

3. Intercompany sales and inventory data for 20X5 and 20X6:

Profit margins on sales by Prawn to Shrimp are 40%.

Profit margins on sales by Shrimp to Prawn are at 30%.

Required:

Calculate the following consolidated balance as at December 31, 20X6:

a. Retained earnings

b. Land and buildings

Inventory fair value is higher than carrying value.

Equipment fair value is higher than carrying value

Land fair value is lower than carrying value. The equipment had a remaining useful life at the time of acquisition of five years.

The company uses the entity approach to determine the amount of goodwill. Prawn accounts for its investment in Shrimp using the cost method.

Statement of Comprehensive Income

Year Ended December 3,

(In thousands of s)

Statement of Changes in Equity-Partial-Retained Earnings section

Year Ended December 3,20X6

(In thousands of s) The balance of the land and buildings at December 31, 20X6, for Prawn totalled $895,000 and for Shrimp totalled $450,000.

Additional Information:

1. Shrimp had reported a gain of $50,000, relating to land (40%)and building (60%)sold to Prawn on January 3, 20X6. These separate properties had not been owned on January 1, 20X3. Remaining useful life was expected to be 10 years at that time.

2. Shrimp sold other land to a non-related company at a gain of $20,000 on June 30, 20X6.

3. Intercompany sales and inventory data for 20X5 and 20X6:

Profit margins on sales by Prawn to Shrimp are 40%.

Profit margins on sales by Shrimp to Prawn are at 30%.

Required:

Calculate the following consolidated balance as at December 31, 20X6:

a. Retained earnings

b. Land and buildings

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

28

Lobes Co. owns 65% of Banes Limited. During 20X5, Banes sold equipment to Lobes for a gain of $150,000, recognizing a gain on sale (before taxes)of $75,000. Lobes determined that the equipment had a useful life of 10 years, and took a full year's deprecation in 20X5. On April 1, 20X8, Lobes sold the equipment to an unaffiliated company for $110,000. Ignore any taxes.

Required:

Prepare the appropriate consolidation adjustments relating to the equipment for each year ending December 31, 20X5, to 20X8.

Required:

Prepare the appropriate consolidation adjustments relating to the equipment for each year ending December 31, 20X5, to 20X8.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

29

When investments in associate or joint ventures are reported using the equity method, IFRS requires the application of ________.

A)proprietary theory

B)parent-company theory

C)parent-company extension theory

D)entity theory

A)proprietary theory

B)parent-company theory

C)parent-company extension theory

D)entity theory

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

30

Bowen Limited purchased 60% of Sloch Co. when Sloch's reported retained earnings were $330,000. Bowen also owns 80% in Zeek Limited, which was purchased when Zeek reported retained earnings of $575,000. For each acquisition, the purchase price was equal to the fair value of the identifiable net assets, which was the same as the carrying value of their carrying values.

An analysis of the changes in retained earnings of the three companies during the year 20X7 gives the following results: Sloch sells product to Bowen that is used in Bowen's production. Bowen will then sell part of its products to Zeek.

Intercompany profits on sales from Sloch to Bowen were $25,000 included in January 1, 20X7, inventory, and $40,000 included in December 31, 20X7, inventory.

Intercompany profits included on sales from Bowen to Zeek were $31,000 included in January 1, 20X7, inventory, and $35,000 included in December 31, 20X7 inventory.

During 20X5, Bowen sold a building to Zeek for a gain of $300,000. The building had a remaining life of 25 years. During 20X7, Sloch sold a building to Bowen for a gain of $75,000. This building has a useful remaining life of 15 years. Full depreciation was recorded in the year of acquisition by each company and no depreciation was recorded in the year of sale.

Required:

Calculate the consolidated net income for the year ended December 31, 20X6. Determine the allocation between the NCI and owners of the parent.

An analysis of the changes in retained earnings of the three companies during the year 20X7 gives the following results: Sloch sells product to Bowen that is used in Bowen's production. Bowen will then sell part of its products to Zeek.

Intercompany profits on sales from Sloch to Bowen were $25,000 included in January 1, 20X7, inventory, and $40,000 included in December 31, 20X7, inventory.

Intercompany profits included on sales from Bowen to Zeek were $31,000 included in January 1, 20X7, inventory, and $35,000 included in December 31, 20X7 inventory.

During 20X5, Bowen sold a building to Zeek for a gain of $300,000. The building had a remaining life of 25 years. During 20X7, Sloch sold a building to Bowen for a gain of $75,000. This building has a useful remaining life of 15 years. Full depreciation was recorded in the year of acquisition by each company and no depreciation was recorded in the year of sale.

Required:

Calculate the consolidated net income for the year ended December 31, 20X6. Determine the allocation between the NCI and owners of the parent.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

31

On the consolidated statement of financial position, which balances differ between the parent-company extension method and the entity method?

A)Retained earnings and goodwill

B)Retained earnings and non-controlling interest

C)Goodwill and non-controlling interest

D)Common shares and retained earnings

A)Retained earnings and goodwill

B)Retained earnings and non-controlling interest

C)Goodwill and non-controlling interest

D)Common shares and retained earnings

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

32

In calculating the non-controlling interest in earnings, what is one of the adjustments that must be made to the subsidiary's separate-entity earnings before the NCI percentage can be applied?

A)Adjust for only realized profits from upstream sales.

B)Adjust for only unrealized profits from upstream sales.

C)Adjust for both realized and unrealized profits from upstream sales.

D)Adjust for both realized and unrealized profits from downstream sales.

A)Adjust for only realized profits from upstream sales.

B)Adjust for only unrealized profits from upstream sales.

C)Adjust for both realized and unrealized profits from upstream sales.

D)Adjust for both realized and unrealized profits from downstream sales.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

33

Farm owns 70% of the common shares of XL and accounts for its investment using the cost method. In 20X6, Farm purchased equipment from XL for $300,000. The equipment had been purchased by XL for $420,000 in 20X2, had accumulated depreciation of $168,000 and a six-year remaining life at December 31, 20X5. Both companies record a full year of depreciation expense in the year of the purchase and no depreciation in the year of a sale.

Required:

Indicate the consolidation adjustments to the following accounts for the years ended 20X6, 20X8, and 20X11:

• Depreciation expense

• Net book value of equipment

• Non-controlling interest on statement of comprehensive income

• Non-controlling interest on statement of financial position

• Retained earnings, end of year

Required:

Indicate the consolidation adjustments to the following accounts for the years ended 20X6, 20X8, and 20X11:

• Depreciation expense

• Net book value of equipment

• Non-controlling interest on statement of comprehensive income

• Non-controlling interest on statement of financial position

• Retained earnings, end of year

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

34

Tooker Co. acquired 80% of the outstanding common shares of Vu Ltd. There were no fair value increments or goodwill that arose with the purchase. During 20X1, Tooker sold $7,000 of inventory to Vu for a gross profit of 40%. At the end of 20X1, $3,000 of the inventory is still in Vu's inventory. On their separate-entity income statements for 20X1, Tooker and Vu reported the following: Vu sold all the goods from Tooker that were in its opening inventory. There were no sales between Tooker and Vu in 20X2. What is the non-controlling interest's share of consolidated net income at the end of 20X2?

A)$580

B)$1,620

C)$1,860

D)$2,100

A)$580

B)$1,620

C)$1,860

D)$2,100

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

35

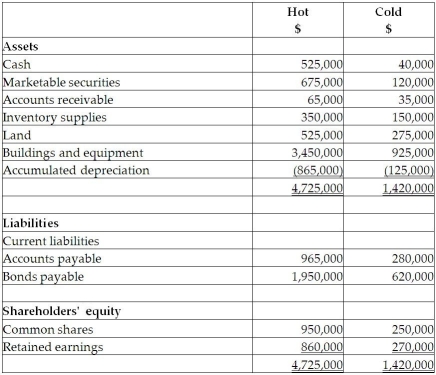

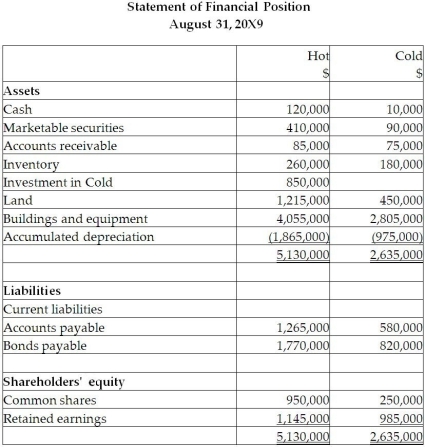

On September 1, 20X5, Hot Limited decided to buy 80% of the shares outstanding of Cold Inc. for $850,000. Hot paid for this acquisition by using cash of $500,000 and marketable securities for the remaining amount. The balances showing on the statement of financial position for the two companies at August 31, 20X5, are as follows:  After a review of the financial assets and liabilities, Hot determines that some of the assets of Cold have fair values different from their carrying values. These items are listed below:

After a review of the financial assets and liabilities, Hot determines that some of the assets of Cold have fair values different from their carrying values. These items are listed below:

• Inventory has a fair value of $130,000.

• The building has a fair value of $1,090,000. The remaining useful life of the building is 20 years.

• A trademark has a fair value of $300,000. The trademark is estimated to have a useful life of 15 years.

• The bonds payable have a fair value of $720,000 and are due on August 31, 20X9.

During the 20X9 fiscal year, the following events occurred:

1. Hot sold merchandise to Cold for $200,000. Profit margin on these sales was 30%. Cold still has inventory on hand of $70,000. Included in the opening inventory of Cold for 20X9 is merchandise purchased from Hot in 20X8 for $150,000. The gross profit margin on these sales was 30%

2. Cold sold merchandise to Hot for $500,000. The gross margin on these sales was 40%. At the end of the year, $180,000 of this was still in Hot's inventory. Included in the opening inventory of Hot for 20X9 was merchandise purchased from Cold in 20X8 for $230,000. The profit margin on these sales was 30%.

3. During 20X9, Cold sold to Hot equipment resulting in a gain to Cold of $75,000. At the time, the original cost and accumulated depreciation to date for the equipment on Cold's books were $510,000 and 160,000. The remaining useful life for this equipment is 15 years. Depreciation is fully recorded in the year of purchase and no depreciation is recorded in the year of disposal by both companies.

4. During 20X9, Cold paid management fees of $450,000 to Hot.

5. During 20X9, Cold paid dividends of $400,000 and Hot paid dividends of $600,000.

Required:

Required:

Prepare the consolidated statement of comprehensive income and the consolidated statement of changes in equity-partial section for retained earnings for Hot at August 31, 20X9.

Calculate the non-controlling interest's portion of net earnings for the year. Calculate the opening retained earnings balance at August 31, 20X8.

The company uses the parent-company extension approach to determining goodwill.

After a review of the financial assets and liabilities, Hot determines that some of the assets of Cold have fair values different from their carrying values. These items are listed below:

After a review of the financial assets and liabilities, Hot determines that some of the assets of Cold have fair values different from their carrying values. These items are listed below:• Inventory has a fair value of $130,000.

• The building has a fair value of $1,090,000. The remaining useful life of the building is 20 years.

• A trademark has a fair value of $300,000. The trademark is estimated to have a useful life of 15 years.

• The bonds payable have a fair value of $720,000 and are due on August 31, 20X9.

During the 20X9 fiscal year, the following events occurred:

1. Hot sold merchandise to Cold for $200,000. Profit margin on these sales was 30%. Cold still has inventory on hand of $70,000. Included in the opening inventory of Cold for 20X9 is merchandise purchased from Hot in 20X8 for $150,000. The gross profit margin on these sales was 30%

2. Cold sold merchandise to Hot for $500,000. The gross margin on these sales was 40%. At the end of the year, $180,000 of this was still in Hot's inventory. Included in the opening inventory of Hot for 20X9 was merchandise purchased from Cold in 20X8 for $230,000. The profit margin on these sales was 30%.

3. During 20X9, Cold sold to Hot equipment resulting in a gain to Cold of $75,000. At the time, the original cost and accumulated depreciation to date for the equipment on Cold's books were $510,000 and 160,000. The remaining useful life for this equipment is 15 years. Depreciation is fully recorded in the year of purchase and no depreciation is recorded in the year of disposal by both companies.

4. During 20X9, Cold paid management fees of $450,000 to Hot.

5. During 20X9, Cold paid dividends of $400,000 and Hot paid dividends of $600,000.

Required:

Required:Prepare the consolidated statement of comprehensive income and the consolidated statement of changes in equity-partial section for retained earnings for Hot at August 31, 20X9.

Calculate the non-controlling interest's portion of net earnings for the year. Calculate the opening retained earnings balance at August 31, 20X8.

The company uses the parent-company extension approach to determining goodwill.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

36

A parent company can record its investment in a subsidiary using either the cost or the equity method. Which account will appear on the financial statements under the equity method, but not under the cost method?

A)Investment in subsidiary

B)Unamortized fair value adjustments

C)Equity earnings of subsidiary

D)Goodwill

A)Investment in subsidiary

B)Unamortized fair value adjustments

C)Equity earnings of subsidiary

D)Goodwill

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

37

The calculation of the NCI on the consolidated SFP starts with the NCI's share of the subsidiary's net assets at the SFP date. Which of the following is not an adjustment that should be made in calculating the ending NCI balance?

A)Unamortized acquisitional fair value adjustments

B)Unrealized profit from upstream sales of capital assets

C)Unrealized profit from upstream sales of inventory

D)Unrealized profit from downstream sales of inventory

A)Unamortized acquisitional fair value adjustments

B)Unrealized profit from upstream sales of capital assets

C)Unrealized profit from upstream sales of inventory

D)Unrealized profit from downstream sales of inventory

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

38

A parent company uses the equity method to record its investment in its subsidiary. To check the balance of the consolidated retained earnings, what amount should be added to the parent company's separate-entity retained earnings?

A)Balance of the equity in the earnings of the subsidiary account

B)Net income from the subsidiary company's separate-entity statement of income

C)Balance of the investment account

D)Increase in the balance of the investment account

A)Balance of the equity in the earnings of the subsidiary account

B)Net income from the subsidiary company's separate-entity statement of income

C)Balance of the investment account

D)Increase in the balance of the investment account

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

39

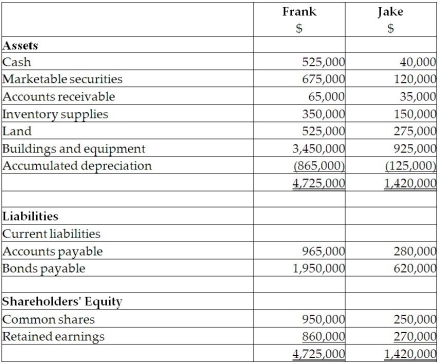

On September 1, 20X5, Frank Limited decided to buy 70% of the shares outstanding of Jake Inc. for $840,000. Frank paid for this acquisition by using cash of $500,000 and marketable securities for the remaining amount. The balances showing on the statement of financial position for the two companies at August 31, 20X5, are as follows:  After a review of the financial assets and liabilities, Frank determines that some of the assets of Jake have fair values different from their carrying values. These items are listed below:

After a review of the financial assets and liabilities, Frank determines that some of the assets of Jake have fair values different from their carrying values. These items are listed below:

• Inventory has a fair value of $130,000.

• The building has a fair value of $1,090,000. The remaining useful life of the building is 20 years.

• A customer list has a fair value of $200,000. The trademark is estimated to have a useful life of 10 years.

• The bonds payable have a fair value of $720,000 and are due on August 31, 20X9.

During the 20X9 fiscal year, the following events occurred:

1. Frank sold merchandise to jake for . Profit margin on these sales . Jake still has Inventory on hand of . Included in the opening inventory of Jake for is merchandise purchased from Frank in for . The gross profit mar gin on these sales was

2. Jake sold merchandise to Frank for . The gross margin on these sales was . At the end of the year, of this was still in Frank's inventory. Included in the opening inventory of Frank for was merchandise purchased from Jake in for . The profit margin on these sales was .

3. During , Jake sold to Frank equipment resulting in a gain to Jake of . At the time, the original cost and accumulated depreciation to date for the equipment on the Jake's books were and 160,000 . The remaining useful life for this equipment is 15 years. Depreciation is fully recorded in the year of purchase and no depreciation is recorded in the year of disposal by both companies.

4. During , Jake paid management fees of to Frank.

5. During 20X9, lake paid dividends of and Frank paid dividends of .

Required:

Required:

Calculate the balance in the investment in Jake account at August 31, 20X9, if the company accounted for this subsidiary using the equity basis.

Calculate the balance in the investment in Jake account at August 31, 20X9, if the company accounted for Jake as an associate using the proprietary theory basis for the equity method.

Explain the difference between the two balances.

Goodwill is determined using the parent-company extension approach.

After a review of the financial assets and liabilities, Frank determines that some of the assets of Jake have fair values different from their carrying values. These items are listed below:

After a review of the financial assets and liabilities, Frank determines that some of the assets of Jake have fair values different from their carrying values. These items are listed below:• Inventory has a fair value of $130,000.

• The building has a fair value of $1,090,000. The remaining useful life of the building is 20 years.

• A customer list has a fair value of $200,000. The trademark is estimated to have a useful life of 10 years.

• The bonds payable have a fair value of $720,000 and are due on August 31, 20X9.

During the 20X9 fiscal year, the following events occurred:

1. Frank sold merchandise to jake for . Profit margin on these sales . Jake still has Inventory on hand of . Included in the opening inventory of Jake for is merchandise purchased from Frank in for . The gross profit mar gin on these sales was

2. Jake sold merchandise to Frank for . The gross margin on these sales was . At the end of the year, of this was still in Frank's inventory. Included in the opening inventory of Frank for was merchandise purchased from Jake in for . The profit margin on these sales was .

3. During , Jake sold to Frank equipment resulting in a gain to Jake of . At the time, the original cost and accumulated depreciation to date for the equipment on the Jake's books were and 160,000 . The remaining useful life for this equipment is 15 years. Depreciation is fully recorded in the year of purchase and no depreciation is recorded in the year of disposal by both companies.

4. During , Jake paid management fees of to Frank.

5. During 20X9, lake paid dividends of and Frank paid dividends of .

Required:

Required:Calculate the balance in the investment in Jake account at August 31, 20X9, if the company accounted for this subsidiary using the equity basis.

Calculate the balance in the investment in Jake account at August 31, 20X9, if the company accounted for Jake as an associate using the proprietary theory basis for the equity method.

Explain the difference between the two balances.

Goodwill is determined using the parent-company extension approach.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

40

Cooper Ltd. acquired 70% of the common shares of Effy Ltd. at January 2, 20X1. At December 31, 20X3, Effy sold a machine to Cooper for $180,000. Effy had purchased the machine a few years earlier for $250,000. At the time of sale to Cooper, the machine had a carrying value of $150,000 and a remaining useful life of six years.

- Both companies do not claim amortization for assets purchased in the second half of the year. For Cooper's December 31, 20X3, consolidated financial statements, what net book value should be shown for the machine?

A)$125,000

B)$150,000

C)$180,000

D)$250,000

- Both companies do not claim amortization for assets purchased in the second half of the year. For Cooper's December 31, 20X3, consolidated financial statements, what net book value should be shown for the machine?

A)$125,000

B)$150,000

C)$180,000

D)$250,000

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck