Deck 11: Current Liabilities and Payroll

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/221

Play

Full screen (f)

Deck 11: Current Liabilities and Payroll

1

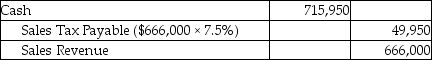

Modern Age Company made total cash sales in February of $666,000,which are subject to 7.5% sales tax.Prepare the summary entry to record the transaction.Omit explanation.

2

Which of the following is a characteristic of a current liability?

A)It creates a present obligation for future payment of cash or services.

B)It cannot be settled with services.

C)It is an avoidable obligation.

D)It occurs because of a future transaction or event.

A)It creates a present obligation for future payment of cash or services.

B)It cannot be settled with services.

C)It is an avoidable obligation.

D)It occurs because of a future transaction or event.

A

3

Any portion of a long-term liability that is due with the next year is reported as a current liability.

True

4

Mars Company had cash sales of $10,000.The state sales tax rate is 10.8%.What amount is debited to the Cash account?

A)$10,000

B)$11,080

C)$1080

D)$1000

A)$10,000

B)$11,080

C)$1080

D)$1000

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

5

Because amounts owed for products or services on account are typically due in 60 days,they are current liabilities.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

6

Amounts owed for products or services purchased on account are called ________.

A)accounts payable

B)unearned revenue

C)accrued expense

D)warranty payable

A)accounts payable

B)unearned revenue

C)accrued expense

D)warranty payable

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

7

The IFRS definitions of current and long-term liabilities are much different than the U.S.GAAP definitions.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

8

Current liabilities must be paid either in cash or with goods and services within one year or within the entity's operating cycle,if the cycle is longer than a year.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following accounts is credited by the seller when tax is collected on retail sales?

A)Accounts Payable

B)Payroll Tax

C)Sales Tax Payable

D)Unearned Revenue

A)Accounts Payable

B)Payroll Tax

C)Sales Tax Payable

D)Unearned Revenue

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

10

Sales revenue for a sporting goods store amounted to $526,000 for the current period.All sales are on account and are subject to a sales tax of 10%.Which of the following would be included in the journal entry to record the sales transaction?

A)a debit to Sales Revenue for $526,000

B)a credit to Accounts Receivable for $526,000

C)a debit to Sales Tax Payable for $52,600

D)a debit to Accounts Receivable for $578,600

A)a debit to Sales Revenue for $526,000

B)a credit to Accounts Receivable for $526,000

C)a debit to Sales Tax Payable for $52,600

D)a debit to Accounts Receivable for $578,600

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

11

Unearned revenue arises because the business receives goods or services before payment has been made.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

12

Sales tax is an expense of the business.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

13

Amounts owed for products or services purchased on account are accounts receivable.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

14

Sales Tax Payable is usually calculated as a percentage of the amount of the sale.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following would be included in the journal entry to record the payment of sales tax payable?

A)a debit to Sales Tax Payable

B)a credit to Sales Tax Expense

C)a debit to Sales Tax Expense

D)a credit to Sales Tax Payable

A)a debit to Sales Tax Payable

B)a credit to Sales Tax Expense

C)a debit to Sales Tax Expense

D)a credit to Sales Tax Payable

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

16

Barron Company sold goods for $883,500 on account.The company operates in a state that imposes a 9% sales tax.What is the amount of the sales tax payable to the state?

A)$79,515

B)$39,758

C)$19,879

D)$159,030

A)$79,515

B)$39,758

C)$19,879

D)$159,030

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following statements regarding Accounts Payable is incorrect?

A)The Accounts Payable account is decreased with a credit.

B)Accounts payable occur because the business receives the goods or services before payment has been made.

C)Because accounts payable are typically due in 30 days,they are current liabilities.

D)Accounts payable represent debts owed to creditors.

A)The Accounts Payable account is decreased with a credit.

B)Accounts payable occur because the business receives the goods or services before payment has been made.

C)Because accounts payable are typically due in 30 days,they are current liabilities.

D)Accounts payable represent debts owed to creditors.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

18

Unearned revenues are current liabilities until they are earned.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

19

Restaurant Foods Company had cash sales of $598,000 during the month of August.Sales taxes of 6.5% were collected on the sales.Prepare the journal entry to record the sales revenue and sales tax for the month.Omit explanation.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

20

Venus Corp.sold goods,with a selling price of $17,221,for cash.The state sales tax rate is 8%.What amount is credited to the Sales Revenue account? (Round calculations to the nearest dollar. )

A)$17,221

B)$18,599

C)$1378

D)$15,843

A)$17,221

B)$18,599

C)$1378

D)$15,843

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

21

To compute the interest for notes payable,multiply principal times the annual rate of interest.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

22

Cash received in advance of providing goods or performing services is recorded as ________.

A)Unearned Revenue

B)Accrued Revenue

C)Service Revenue

D)Uncollected Revenue

A)Unearned Revenue

B)Accrued Revenue

C)Service Revenue

D)Uncollected Revenue

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

23

Short-term notes payable represent a written promise by the business to pay a debt,without the addition of interest,within one year or less.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

24

Jupiter Services sells service plans for commercial computer maintenance.The price for each service plan is $1,650 per year,paid in advance.On October 1,2018,a service plan was sold to a new customer for cash.Prepare the journal entry to record this transaction.Omit explanation.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

25

The journal entry for accrued interest on a note payable includes ________.

A)a debit to Interest Expense and credit to Cash

B)a debit to Interest Expense and credit to Interest Payable

C)a debit to Interest Payable and credit to Cash

D)a credit to Interest Expense and debit to Notes Payable

A)a debit to Interest Expense and credit to Cash

B)a debit to Interest Expense and credit to Interest Payable

C)a debit to Interest Payable and credit to Cash

D)a credit to Interest Expense and debit to Notes Payable

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

26

A $49,000,three-month,12% note payable was issued on December 1,2018.What is the amount of accrued interest on December 31,2018? (Do not round any intermediate calculations,and round your final answer to the nearest dollar. )

A)$490

B)$708

C)$354

D)$823

A)$490

B)$708

C)$354

D)$823

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

27

When a business records accrued interest expense on a note payable ________.

A)Interest Expense is credited

B)Note Payable is credited

C)Cash is debited

D)Interest Payable is credited

A)Interest Expense is credited

B)Note Payable is credited

C)Cash is debited

D)Interest Payable is credited

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

28

Fleetwood Company signed a three-year note payable for $59,000 at 7% annual interest.What is the interest expense for 2019 if the note was signed on August 1,2019? (Do not round any intermediate calculations,and round your final answer to the nearest dollar. )

A)$2065

B)$1721

C)$12,390

D)$4130

A)$2065

B)$1721

C)$12,390

D)$4130

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

29

Management Services sells service plans for commercial computer maintenance.The price for each plan is $1,350 per year,paid in advance.On October 1,2019,a service plan was sold to a new customer for cash,and the plan covers the period October 1,2019 to September 30,2020.Prepare the December 31,2019 adjusting entry.Round to two decimal places.Omit explanation.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

30

When borrowing cash from a bank,the business is required to sign a promissory note stating that the business will pay the principal plus interest at a specified maturity date.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following liabilities is created when a company receives cash for services to be provided in the future?

A)Unearned Revenue

B)Accrued Liability

C)Accounts Payable

D)Estimated Warranty Payable

A)Unearned Revenue

B)Accrued Liability

C)Accounts Payable

D)Estimated Warranty Payable

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

32

A $54,000,four-month,12% note payable was issued on October 1,2018.Which of the following would be included in the journal entry required on the note's maturity date by the borrower? (Do not round any intermediate calculations,and round your final answer to the nearest dollar. )

A)a credit to Note payable for $56,160

B)a credit to Cash for $54,000

C)a debit to Interest expense for $540

D)a debit to Interest payable for $540

A)a credit to Note payable for $56,160

B)a credit to Cash for $54,000

C)a debit to Interest expense for $540

D)a debit to Interest payable for $540

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following correctly describes the accounting treatment for interest payable?

A)It is shown on the balance sheet as a current liability.

B)It is shown on the income statement as an operating expense.

C)It is shown on the balance sheet as a current asset.

D)It is shown on the balance sheet as a long-term liability.

A)It is shown on the balance sheet as a current liability.

B)It is shown on the income statement as an operating expense.

C)It is shown on the balance sheet as a current asset.

D)It is shown on the balance sheet as a long-term liability.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

34

Norwood Company signs a $11,000,8.5%,six-month note dated November 1,2018.The interest expense recorded for this note in 2018 will be ________.(Do not round any intermediate calculations,and round your final answer to the nearest dollar. )

A)$935

B)$156

C)$468

D)$312

A)$935

B)$156

C)$468

D)$312

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

35

On April 1,2019,Orbit Services received $8000 in advance of performing the services from a customer for three months of service - April,May and June.What would be the journal entry to adjust the accounts at the end of May? (Do not round any intermediate calculations,and round your final answer to the nearest dollar. )

A)Debit Service Revenue $2667,and credit Unearned Revenue $2667.

B)Debit Unearned Revenue $5333,and credit Service Revenue $5333.

C)Debit Unearned Revenue $8000,and credit Service Revenue $8000.

D)Debit Service Revenue $5333,and credit Accounts Receivable $5333.

A)Debit Service Revenue $2667,and credit Unearned Revenue $2667.

B)Debit Unearned Revenue $5333,and credit Service Revenue $5333.

C)Debit Unearned Revenue $8000,and credit Service Revenue $8000.

D)Debit Service Revenue $5333,and credit Accounts Receivable $5333.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following accounts will be credited by the borrower when a promissory note is issued?

A)Note Payable

B)Note Receivable

C)Interest Payable

D)Cash

A)Note Payable

B)Note Receivable

C)Interest Payable

D)Cash

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

37

A $45,000,two-month,9% note payable was issued on December 1,2018.What is the amount of interest expense recorded in the year 2019? (Round the final calculation to the nearest dollar. )

A)$4050

B)$338

C)$675

D)$45,675

A)$4050

B)$338

C)$675

D)$45,675

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

38

On August 31,2018,Allright Services received $3,500 in advance of performing the service.Which journal entry is needed to record the receipt of cash?

A)Debit Unearned Revenue $3,500,and credit Cash $3,500.

B)Debit Cash $3,500,and credit Service Revenue $3,500.

C)Debit Unearned Revenue $3,500,and credit Service Revenue $3,500.

D)Debit Cash $3,500,and credit Unearned Revenue $3,500.

A)Debit Unearned Revenue $3,500,and credit Cash $3,500.

B)Debit Cash $3,500,and credit Service Revenue $3,500.

C)Debit Unearned Revenue $3,500,and credit Service Revenue $3,500.

D)Debit Cash $3,500,and credit Unearned Revenue $3,500.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

39

Solutions Services sells service plans for commercial computer maintenance.The price for each plan is $1,350 per year,paid in advance.On October 1,2018,a service plan was sold to a new customer for cash,and the plan covers the period October 1,2018 to September 30,2019.Adjusting entries are made on December 31 of each year.Prepare the journal entry for September 30,2019.Round to two decimal places.Omit explanation.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

40

Unearned revenue,for services to be performed in six months,appears on the balance sheet as ________.

A)long-term investments

B)current liabilities

C)current assets

D)long-term assets

A)long-term investments

B)current liabilities

C)current assets

D)long-term assets

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

41

Benefits are extra compensation items that are not paid directly to an employee.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following is pay over and above base salary,usually paid for exceptional performance?

A)FICA

B)benefits

C)wages

D)bonuses

A)FICA

B)benefits

C)wages

D)bonuses

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

43

Maywood Company recently signed a $350,000,six-month note on August 22,2019.The interest rate is 7%.How much interest will be due at maturity?

A)$10,208

B)$24,500

C)$12,250

D)$8167

A)$10,208

B)$24,500

C)$12,250

D)$8167

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

44

On December 31,2018,Barry Company borrowed $500,000 by signing a five-year,8% note payable.The note is payable in five yearly installments of $100,000 plus interest,due at the end of every year beginning on December 31,2019.What amount represents the current portion of Long-term Notes Payable at December 31,2018?

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

45

Mario worked 48 hours during the work week.He earns wages of $18 per hour for straight time (40 hours).The company pays time-and-half for overtime.Mario's gross pay is $864.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

46

Peter earns $14.50 per hour for straight time (40 hours),and the company pays him time-and-a-half for overtime.He worked 46 hours at his job during the first week of March 2018.What was Peter's gross pay for the week?

A)$667.00

B)$671.50

C)$710.50

D)$1000.50

A)$667.00

B)$671.50

C)$710.50

D)$1000.50

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

47

If a long-term debt is paid in installments,the business will report the current portion of the note payable as a current liability.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

48

On October 1,2019,Norway Company borrowed $225,000 by signing a nine-month,8% note payable.Interest was accrued on December 31,2019.Prepare the journal entry on July,1,2020,the date the note was paid.Omit explanation.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

49

The current portion of notes payable is the amount of the principal that is payable more than one year from the balance sheet date.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

50

On December 31,2018,Globe Company borrowed $500,000 by signing a five-year,8% note payable.The note is payable in five yearly installments of $100,000 plus interest,due at the end of every year beginning on December 31,2019.Which portion is classified as the long-term portion of Notes Payable at December 31,2018?

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

51

On July 1,2018,Sanchez Company purchased merchandise inventory for $350,000 by signing a note payable.The note is for 6 months and bears interest at a rate of 8%.Prepare the journal entry for this transaction,using a perpetual inventory system.Omit explanation.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

52

At the maturity of a note payable,a borrower will pay ________.

A)the principal plus interest

B)the principal amount only

C)the interest amount only

D)the principal minus interest

A)the principal plus interest

B)the principal amount only

C)the interest amount only

D)the principal minus interest

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

53

A journal entry is prepared to reclassify the current portion of a note payable.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

54

Extra compensation items that are not paid directly to an employee are called ________.

A)bonuses

B)benefits

C)wages

D)commissions

A)bonuses

B)benefits

C)wages

D)commissions

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

55

The current portion of long-term notes payable is ________.

A)the amount of principal that will be paid within five years

B)typically included with the long-term liabilities on the balance sheet

C)recorded as an adjusting entry

D)reclassified as current for reporting purposes on the balance sheet

A)the amount of principal that will be paid within five years

B)typically included with the long-term liabilities on the balance sheet

C)recorded as an adjusting entry

D)reclassified as current for reporting purposes on the balance sheet

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

56

________ is pay stated as a percentage of a sale amount.

A)Salary

B)Wage

C)Commission

D)Bonus

A)Salary

B)Wage

C)Commission

D)Bonus

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

57

On September 1,2018,Tri-Cities Company borrowed $125,000 by signing a nine-month,7.2% note payable.Prepare the journal entry to accrue interest expense on December 31,2018.Omit explanation.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

58

Retirement compensation is a benefit because the employer sets aside money for the employee's future retirement.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

59

________ is a pay amount stated at an hourly rate.

A)Salary

B)Wage

C)Commission

D)Bonus

A)Salary

B)Wage

C)Commission

D)Bonus

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

60

On June 30,2019,Development Company purchased merchandise inventory for $500,000 by signing a six-month,8% note payable.Prepare the journal entry for the payment of the note on December 30,2019.Omit explanation.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

61

Regarding net pay,which of the following statements is incorrect?

A)The net pay amount is not important for accounting purposes.

B)The amount of compensation that the employee actually takes home is net pay.

C)The employer either writes a paycheck to each employee for his or her net pay or directly deposits the employee's net pay into the employee's bank account.

D)Net pay equals gross pay minus all deductions.

A)The net pay amount is not important for accounting purposes.

B)The amount of compensation that the employee actually takes home is net pay.

C)The employer either writes a paycheck to each employee for his or her net pay or directly deposits the employee's net pay into the employee's bank account.

D)Net pay equals gross pay minus all deductions.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following is required to be deducted from employees' paychecks?

A)federal income tax

B)SUTA

C)FUTA

D)charitable contributions

A)federal income tax

B)SUTA

C)FUTA

D)charitable contributions

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

63

Regarding gross and net pay,which of the following statements is correct?

A)Gross pay minus all deductions such as income tax withheld equals net pay.

B)Net pay represents the total salaries and wages expense to the employer.

C)For most businesses,gross pay equals net pay.

D)Employers are required to deposit net pay into the employee's bank account.

A)Gross pay minus all deductions such as income tax withheld equals net pay.

B)Net pay represents the total salaries and wages expense to the employer.

C)For most businesses,gross pay equals net pay.

D)Employers are required to deposit net pay into the employee's bank account.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

64

All earnings are subject to Medicare tax.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following taxes has a ceiling on the amount of annual earnings subject to tax?

A)FICA-OASDI taxes

B)sales tax

C)federal income tax

D)FICA-Medicare taxes

A)FICA-OASDI taxes

B)sales tax

C)federal income tax

D)FICA-Medicare taxes

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

66

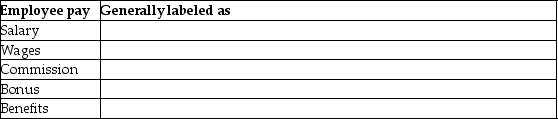

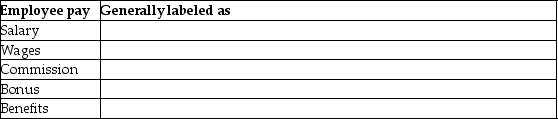

There are numerous ways to label an employee's pay.Complete the table to show how each type of employee pay is generally labeled.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

67

The employee federal and state income tax and Social Security tax are optional payroll deductions.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

68

Tony's gross pay for the month is $2700.Tony's deduction for federal income tax is based on a rate of 21%.Tom has no voluntary deductions.Tony's year-to-date pay is under the limit for OASDI.What is the amount of FICA tax withheld from Tony's pay? (Assume a FICA-OASDI Tax of 6.2% and FICA-Medicare Tax of 1.45%.Do not round any intermediate calculations,and round your final answer to the nearest cent. )

A)$773.55

B)$206.55

C)$567.00

D)$387.45

A)$773.55

B)$206.55

C)$567.00

D)$387.45

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

69

Brad's gross pay for the month is $15,400.His deduction for federal income tax is based on a rate of 18%.He has no voluntary deductions.His year-to-date pay is under the limit for OASDI.What is Brad's net pay? (Assume a FICA-OASDI Tax of 6.2% and FICA-Medicare Tax of 1.45%.Do not round any intermediate calculations,and round your final answer to the nearest dollar. )

A)$11,450

B)$15,400

C)$14,222

D)$12,628

A)$11,450

B)$15,400

C)$14,222

D)$12,628

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

70

The employer is required to directly deposit the employee's take-home pay into the employee's bank account.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

71

Amy's gross pay for the week is $870.00.Her deduction for federal income tax is based on a rate of 25%.She has voluntary deductions of $245.00.Her year-to-date pay is under the limit for OASDI.What is her net pay? (Assume a FICA-OASDI Tax of 6.2% and FICA-Medicare Tax of 1.45%.(Round all calculations to the nearest cent. )

A)$407.50

B)$652.50

C)$585.94

D)$340.94

A)$407.50

B)$652.50

C)$585.94

D)$340.94

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

72

Federal income taxes are ________.

A)deducted to arrive at an employee's gross pay

B)added to arrive at an employee's net pay

C)deducted to arrive at an employee's net pay

D)not borne by the employee

A)deducted to arrive at an employee's gross pay

B)added to arrive at an employee's net pay

C)deducted to arrive at an employee's net pay

D)not borne by the employee

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

73

Hank earns $24.00 per hour with time-and-a-half for hours in excess of 40 per week.He worked 50 hours at his job during the first week of March 2018.Hank pays income taxes at 15% and 7.65% for OASDI and Medicare.All of his income is taxable under FICA.Determine Hank's net pay for the week.(Do not round any intermediate calculations,and round your final answer to the nearest cent. )

A)$1122.00

B)$1021.02

C)$835.80

D)$799.80

A)$1122.00

B)$1021.02

C)$835.80

D)$799.80

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

74

Andrew,an employee of Super Retailer,Inc. ,has gross salary for March of $5,500.The entire amount is under the OASDI limit of $118,500 and thus subject to FICA.The total amount of employee FICA tax is $841.50.(Assume a FICA-OASDI Tax of 6.2% and FICA-Medicare Tax of 1.45%. )

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

75

Gross pay is the total amount of compensation earned by an employee after the deductions are made.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

76

Gross pay is the total amount of salary,wages,commissions,and bonuses earned by an employee during a pay period,after taxes or any other deductions.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

77

Net pay is the total amount of compensation that an employee takes home after the deductions are made.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

78

The old age,survivors,and disability insurance component of FICA tax is imposed on the entire amount of an individual employee's earnings.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

79

Income taxes are withheld from the employee's paycheck.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck

80

Social Security (FICA)tax is withheld from the employees' pay and matched by the employer.

Unlock Deck

Unlock for access to all 221 flashcards in this deck.

Unlock Deck

k this deck