Exam 11: Current Liabilities and Payroll

Exam 1: Accounting and the Business Environment246 Questions

Exam 2: Recording Business Transactions219 Questions

Exam 3: The Adjusting Process225 Questions

Exam 4: Completing the Accounting Cycle208 Questions

Exam 5: Merchandising Operations301 Questions

Exam 6: Merchandise Inventory199 Questions

Exam 7: Accounting Information Systems164 Questions

Exam 8: Internal Control and Cash258 Questions

Exam 9: Receivables233 Questions

Exam 10: Plant Assets, natural Resources, and Intangibles212 Questions

Exam 11: Current Liabilities and Payroll221 Questions

Exam 12: Partnerships171 Questions

Exam 13: Corporations277 Questions

Exam 14: Long-Term Liabilities207 Questions

Exam 15: Investments193 Questions

Exam 16: The Statement of Cash Flows183 Questions

Exam 17: Financial Statement Analysis161 Questions

Select questions type

Fast Bikes Company offers warranties on all their bikes.They estimate warranty expense at 3.5% of sales.At the beginning of 2018,the Estimated Warranty Payable account had a credit balance of $1900.During the year,Fast Bikes had $296,000 in sales and had to pay out $5900 in warranty payments.At the end of the year,what is the ending balance in the Estimated Warranty Payable accounts?

Free

(Multiple Choice)

4.8/5  (28)

(28)

Correct Answer:

A

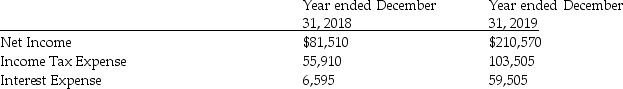

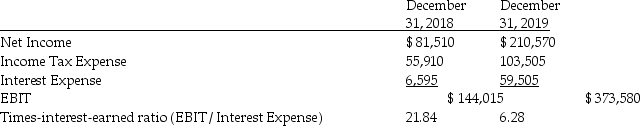

The information related to Jazz Music Company is given below:

Calculate the times-interest-earned ratio for each year.Round all calculations to two decimal places.

Calculate the times-interest-earned ratio for each year.Round all calculations to two decimal places.

Free

(Essay)

4.9/5  (34)

(34)

Correct Answer:

Cash received in advance of providing goods or performing services is recorded as ________.

Free

(Multiple Choice)

4.9/5  (31)

(31)

Correct Answer:

A

If the likelihood of a future event is reasonably possible,how should the company report the contingency?

(Essay)

4.9/5  (46)

(46)

Which of the following columns is typically included in a payroll register?

(Multiple Choice)

4.8/5  (35)

(35)

When a company co-signs a note payable for another entity,a current liability must be recorded.

(True/False)

4.9/5  (30)

(30)

Which of the following would be included in the journal entry to record the payment of sales tax payable?

(Multiple Choice)

4.9/5  (33)

(33)

What is a contingent liability? Provide two examples of contingencies.

(Essay)

4.8/5  (42)

(42)

Mars Company had cash sales of $10,000.The state sales tax rate is 10.8%.What amount is debited to the Cash account?

(Multiple Choice)

4.9/5  (40)

(40)

A contingency was evaluated at year-end.Management felt it was probable that this would become an actual liability and the amount could be reasonably estimated.If this is reported on the balance sheet,it could be considered a violation of generally accepted accounting principles.

(True/False)

4.9/5  (34)

(34)

Tony's gross pay for the month is $2700.Tony's deduction for federal income tax is based on a rate of 21%.Tom has no voluntary deductions.Tony's year-to-date pay is under the limit for OASDI.What is the amount of FICA tax withheld from Tony's pay? (Assume a FICA-OASDI Tax of 6.2% and FICA-Medicare Tax of 1.45%.Do not round any intermediate calculations,and round your final answer to the nearest cent. )

(Multiple Choice)

4.9/5  (42)

(42)

When determining how businesses record or do not record contingent liabilities,which is NOT one of the three likelihoods that that are considered?

(Multiple Choice)

4.9/5  (34)

(34)

Sales Tax Payable is usually calculated as a percentage of the amount of the sale.

(True/False)

5.0/5  (46)

(46)

Because a company usually does not know the amount of the year-end bonus at year-end,no liability is recorded.

(True/False)

4.9/5  (36)

(36)

Which of the following liabilities is created when a company receives cash for services to be provided in the future?

(Multiple Choice)

4.9/5  (37)

(37)

Norwood Company signs a $11,000,8.5%,six-month note dated November 1,2018.The interest expense recorded for this note in 2018 will be ________.(Do not round any intermediate calculations,and round your final answer to the nearest dollar. )

(Multiple Choice)

4.8/5  (35)

(35)

Which of the following deductions is paid by both the employer and employee?

(Multiple Choice)

4.9/5  (31)

(31)

The expense for warranty costs is recorded in the period ________.

(Multiple Choice)

4.8/5  (34)

(34)

Showing 1 - 20 of 221

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)