Deck 8: Liability Recognition and Related Expenses

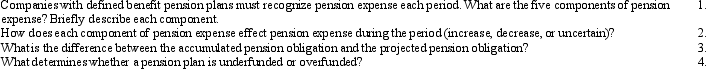

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/61

Play

Full screen (f)

Deck 8: Liability Recognition and Related Expenses

1

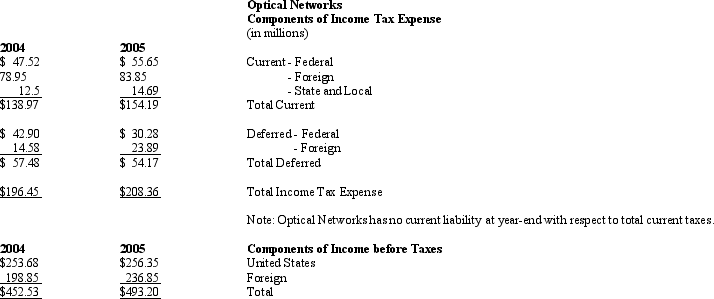

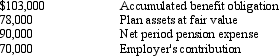

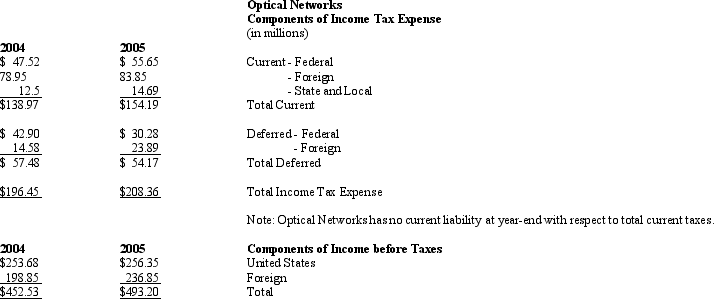

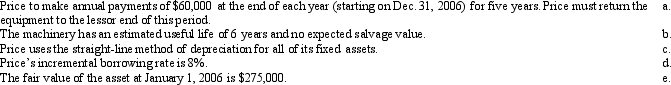

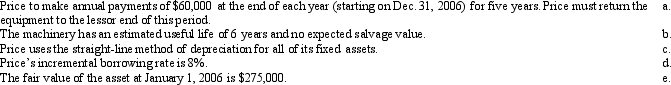

Optical Networks Optical Networks is a leading semiconductor company with operations in 17 different countries. Information about the company's taxes appears below:

Based on the information provided by Optical Networks how much cash did income taxes use during 2005?

Based on the information provided by Optical Networks how much cash did income taxes use during 2005?

A) $154.19 million

B) $54.17 million

C) $208.36 million

D) $284.84 million

Based on the information provided by Optical Networks how much cash did income taxes use during 2005?

Based on the information provided by Optical Networks how much cash did income taxes use during 2005?A) $154.19 million

B) $54.17 million

C) $208.36 million

D) $284.84 million

A

2

Which of the following is not a condition that requires capital lease accounting?

A) The lease term extends for more than 70% of the assets economic life.

B) The lease agreement transfers ownership of the leased asset to the lessee.

C) The lease agreement contains a bargain purchase option.

D) The present value of the minimum lease payments equals or exceeds 90% of the fair market value of the asset.

A) The lease term extends for more than 70% of the assets economic life.

B) The lease agreement transfers ownership of the leased asset to the lessee.

C) The lease agreement contains a bargain purchase option.

D) The present value of the minimum lease payments equals or exceeds 90% of the fair market value of the asset.

A

3

Which of the following is not one of the GAAP classifications for derivatives?

A) Speculative investment

B) Fair value hedge

C) Asset-Liability hedge

D) Cash flow hedge

A) Speculative investment

B) Fair value hedge

C) Asset-Liability hedge

D) Cash flow hedge

C

4

The accumulated benefit obligation measures

A) the pension obligation on the basis of the plan formula applied to years of service to date and based on existing salary levels.

B) an estimated total benefit at retirement and then computes the level cost that will be sufficient, together with interest expected to accumulate at the assumed rate, to provide the total benefits at retirement.

C) the pension obligation on the basis of the plan formula applied to years of service to date and based on future salary levels.

D) the shortest possible period for funding to maximize the tax deduction.

A) the pension obligation on the basis of the plan formula applied to years of service to date and based on existing salary levels.

B) an estimated total benefit at retirement and then computes the level cost that will be sufficient, together with interest expected to accumulate at the assumed rate, to provide the total benefits at retirement.

C) the pension obligation on the basis of the plan formula applied to years of service to date and based on future salary levels.

D) the shortest possible period for funding to maximize the tax deduction.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

5

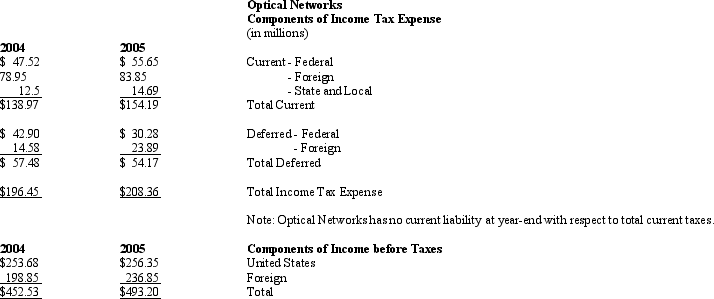

Optical Networks Optical Networks is a leading semiconductor company with operations in 17 different countries. Information about the company's taxes appears below:

Using the information provided by Optical Networks determine the combined effective tax rate for 2005.

Using the information provided by Optical Networks determine the combined effective tax rate for 2005.

A) 33.52%

B) 35.00%

C) 42.25%

D) 45.49%

Using the information provided by Optical Networks determine the combined effective tax rate for 2005.

Using the information provided by Optical Networks determine the combined effective tax rate for 2005.A) 33.52%

B) 35.00%

C) 42.25%

D) 45.49%

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

6

Panthers, Corp. implemented a defined-benefit pension plan for its employees on January 2, 2004. The following data are provided for year 2004, as of December 31, 2004.  What amount should Panthers record as additional minimum pension liability at December 31, 2004?

What amount should Panthers record as additional minimum pension liability at December 31, 2004?

A) $0

B) $5,000

C) $20,000

D) $45,000

What amount should Panthers record as additional minimum pension liability at December 31, 2004?

What amount should Panthers record as additional minimum pension liability at December 31, 2004?A) $0

B) $5,000

C) $20,000

D) $45,000

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

7

The projected benefit obligation measures

A) the pension obligation on the basis of the plan formula applied to years of service to date and based on existing salary levels.

B) an estimated total benefit at retirement and then computes the level cost that will be sufficient, together with interest expected to accumulate at the assumed rate, to provide the total benefits at retirement.

C) the pension obligation on the basis of the plan formula applied to years of service to date and based on future salary levels.

D) the shortest possible period for funding to maximize the tax deduction.

A) the pension obligation on the basis of the plan formula applied to years of service to date and based on existing salary levels.

B) an estimated total benefit at retirement and then computes the level cost that will be sufficient, together with interest expected to accumulate at the assumed rate, to provide the total benefits at retirement.

C) the pension obligation on the basis of the plan formula applied to years of service to date and based on future salary levels.

D) the shortest possible period for funding to maximize the tax deduction.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

8

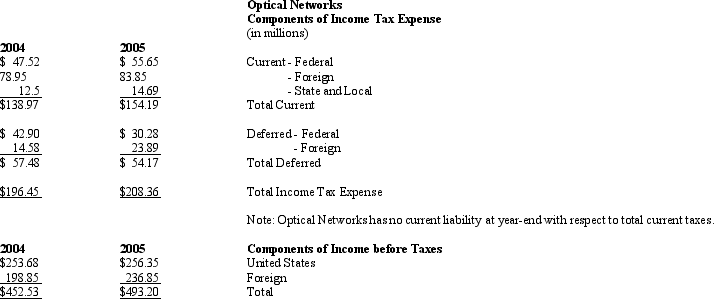

Optical Networks Optical Networks is a leading semiconductor company with operations in 17 different countries. Information about the company's taxes appears below:

Using the information provided by Optical Networks determine the federal effective tax rate for 2005.

Using the information provided by Optical Networks determine the federal effective tax rate for 2005.

A) 33.52%

B) 35.00%

C) 42.25%

D) 45.49%

Using the information provided by Optical Networks determine the federal effective tax rate for 2005.

Using the information provided by Optical Networks determine the federal effective tax rate for 2005.A) 33.52%

B) 35.00%

C) 42.25%

D) 45.49%

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following accounts would not be considered a reserve account?

A) Allowance of Doubtful Accounts

B) Estimated Warranty Liability

C) Prepaid Expense

D) Accumulated Depreciation

A) Allowance of Doubtful Accounts

B) Estimated Warranty Liability

C) Prepaid Expense

D) Accumulated Depreciation

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

10

Derivatives are financial instruments that derive their value from changes in any of the following underlyings except

A) Stock prices

B) Percentage discount on accounts receivable

C) Interest rates

D) Commodity prices

A) Stock prices

B) Percentage discount on accounts receivable

C) Interest rates

D) Commodity prices

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

11

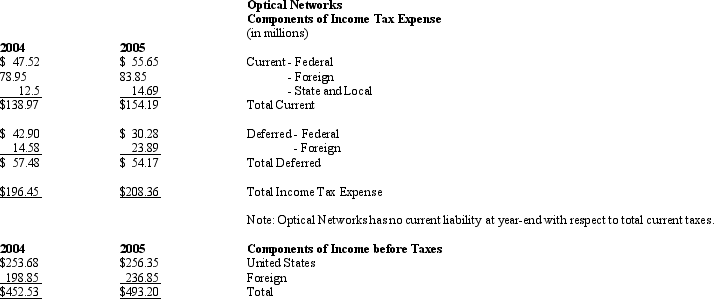

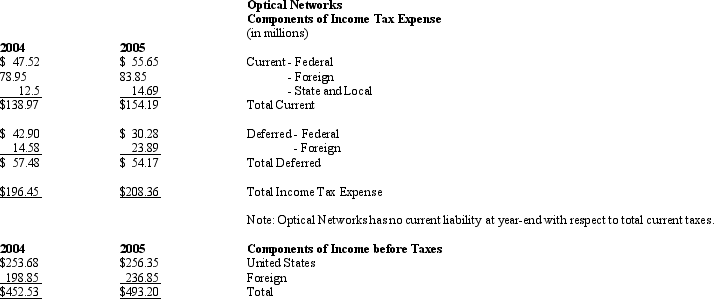

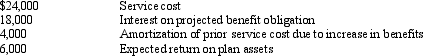

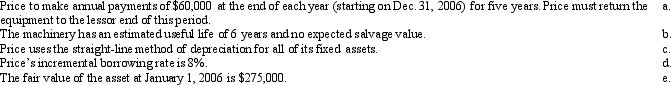

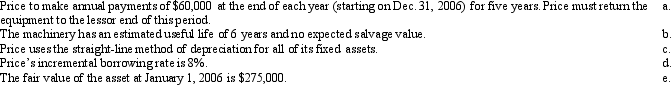

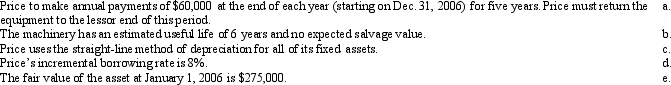

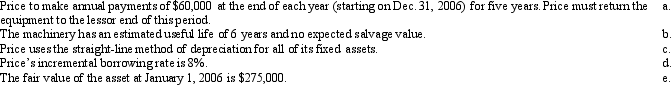

NOTE: The following multiple choice questions require present value information. On January 1, 2006, Price Corporation signed a five-year noncancelable lease for certain machinery. The terms of the lease called for:

What accounting method should Price use to account for the equipment lease?

What accounting method should Price use to account for the equipment lease?

A) Operating Lease method

B) Capital Lease method

C) Equipment Lease method

D) Lessee Accounting method

What accounting method should Price use to account for the equipment lease?

What accounting method should Price use to account for the equipment lease?A) Operating Lease method

B) Capital Lease method

C) Equipment Lease method

D) Lessee Accounting method

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

12

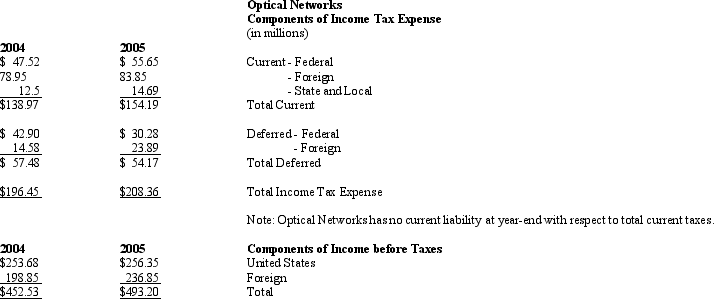

Optical Networks Optical Networks is a leading semiconductor company with operations in 17 different countries. Information about the company's taxes appears below:

Using the information provided by Optical Networks determine the foreign effective tax rate for 2005.

Using the information provided by Optical Networks determine the foreign effective tax rate for 2005.

A) 33.52%

B) 35.00%

C) 42.25%

D) 45.49%

Using the information provided by Optical Networks determine the foreign effective tax rate for 2005.

Using the information provided by Optical Networks determine the foreign effective tax rate for 2005.A) 33.52%

B) 35.00%

C) 42.25%

D) 45.49%

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

13

The major difference between accounting for pensions and the accounting for other postretirement benefits is that firms

A) do not need to report an excess of the accumulated benefits obligations over assets in a postretirement benefits fund as a liability on the balance sheet.

B) do not need to disclose any estimates used in calculating projected benefits.

C) postretirement benefits are normally not material for most companies and do not need to be disclosed.

D) do not need to set aside funds for future postretirement benefits as they do for pension benefits.

A) do not need to report an excess of the accumulated benefits obligations over assets in a postretirement benefits fund as a liability on the balance sheet.

B) do not need to disclose any estimates used in calculating projected benefits.

C) postretirement benefits are normally not material for most companies and do not need to be disclosed.

D) do not need to set aside funds for future postretirement benefits as they do for pension benefits.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following best describes the accounting treatment for derivative instruments not held for purposes of hedging?

A) Record as an asset or liability and recognize changes in fair value in other comprehensive income.

B) Do not record as an asset or liability, record income from the transaction at maturity and recognize in earnings.

C) Record as an asset or liability, recognize changes in fair value currently in earnings.

D) Record as an asset or liability if off-balance sheet risk is material.

A) Record as an asset or liability and recognize changes in fair value in other comprehensive income.

B) Do not record as an asset or liability, record income from the transaction at maturity and recognize in earnings.

C) Record as an asset or liability, recognize changes in fair value currently in earnings.

D) Record as an asset or liability if off-balance sheet risk is material.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is not normally recognized as a liability on the balance sheet?

A) Warranties Payable.

B) Bonds payable.

C) Subscription Fees Received in Advance.

D) Employment Commitments.

A) Warranties Payable.

B) Bonds payable.

C) Subscription Fees Received in Advance.

D) Employment Commitments.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is not a distinguishing characteristic of a derivative instrument?

A) Derivative instruments have terms that require or permit net settlement.

B) Derivative instruments have a low initial net investment.

C) Derivative instruments are highly effective throughout their term.

D) Derivative instruments have one or more underlyings and notional amounts.

A) Derivative instruments have terms that require or permit net settlement.

B) Derivative instruments have a low initial net investment.

C) Derivative instruments are highly effective throughout their term.

D) Derivative instruments have one or more underlyings and notional amounts.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

17

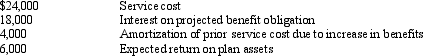

Presented below is pension information related to Paddle Corp. for the year 2004:  The amount of pension expense to be reported for 2004 is

The amount of pension expense to be reported for 2004 is

A) $36,000

B) $48,000

C) $54,000

D) $40,000

The amount of pension expense to be reported for 2004 is

The amount of pension expense to be reported for 2004 isA) $36,000

B) $48,000

C) $54,000

D) $40,000

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is not one of the three criteria for recognition of a liability?

A) The obligation involves a probable future sacrifice of resources at a specified or determinable date.

B) The firm is required to make a cash payment for the goods or services.

C) The firm has little or no discretion to avoid the transfer.

D) The transaction or event giving rise to the liability has already occurred.

A) The obligation involves a probable future sacrifice of resources at a specified or determinable date.

B) The firm is required to make a cash payment for the goods or services.

C) The firm has little or no discretion to avoid the transfer.

D) The transaction or event giving rise to the liability has already occurred.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

19

To calculate a company's average tax rate an analyst would

A) Divide income tax payable by income before taxes

B) Divide income tax expense by income before taxes

C) Multiply the statutory income tax rate by income before tax

D) Average a firm's Federal, State, Local and Foreign tax rates.

A) Divide income tax payable by income before taxes

B) Divide income tax expense by income before taxes

C) Multiply the statutory income tax rate by income before tax

D) Average a firm's Federal, State, Local and Foreign tax rates.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

20

A minimum liability for pension expense is reported when

A) the projected benefit obligation exceeds the fair value of pension plan assets.

B) the pension expense reported for the period is greater than the funding amount for the same period.

C) the accumulated benefit obligation exceeds the fair value of pension plan assets.

D) vested benefits exceed the fair value of pension plan assets.

A) the projected benefit obligation exceeds the fair value of pension plan assets.

B) the pension expense reported for the period is greater than the funding amount for the same period.

C) the accumulated benefit obligation exceeds the fair value of pension plan assets.

D) vested benefits exceed the fair value of pension plan assets.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

21

NOTE: The following multiple choice questions require present value information. On January 1, 2006, Price Corporation signed a five-year noncancelable lease for certain machinery. The terms of the lease called for:

At January 1, 2006 Price should record an asset and liability with respect to the equipment lease equal to

At January 1, 2006 Price should record an asset and liability with respect to the equipment lease equal to

A) $258,726

B) $239,562

C) $275,000

D) $0

At January 1, 2006 Price should record an asset and liability with respect to the equipment lease equal to

At January 1, 2006 Price should record an asset and liability with respect to the equipment lease equal toA) $258,726

B) $239,562

C) $275,000

D) $0

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

22

NOTE: The following multiple choice questions require present value information. On January 1, 2006, Price Corporation signed a five-year noncancelable lease for certain machinery. The terms of the lease called for:

Under which of the following conditions does the equipment lease qualify for capital lease accounting?

Under which of the following conditions does the equipment lease qualify for capital lease accounting?

A) The lease does not contain a bargain purchase option.

B) The lease term is equal to or greater than 75% of the asset's economic life.

C) The lease term is equal to or greater than 90% of the asset's economic life.

D) The lease does not transfer ownership to the lessee at the end of the lease term.

Under which of the following conditions does the equipment lease qualify for capital lease accounting?

Under which of the following conditions does the equipment lease qualify for capital lease accounting?A) The lease does not contain a bargain purchase option.

B) The lease term is equal to or greater than 75% of the asset's economic life.

C) The lease term is equal to or greater than 90% of the asset's economic life.

D) The lease does not transfer ownership to the lessee at the end of the lease term.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

23

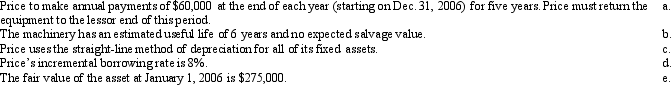

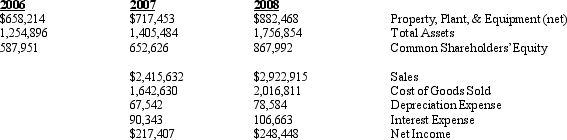

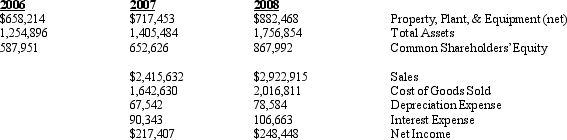

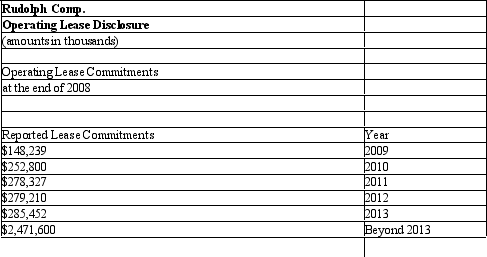

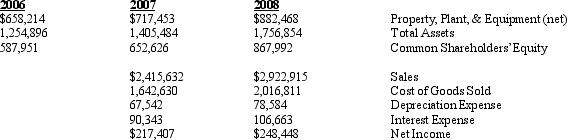

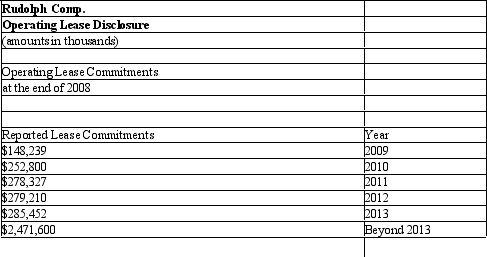

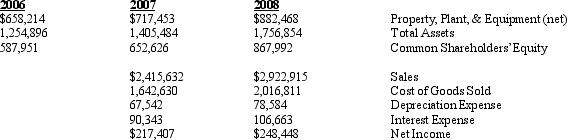

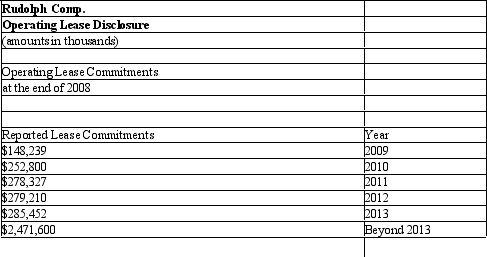

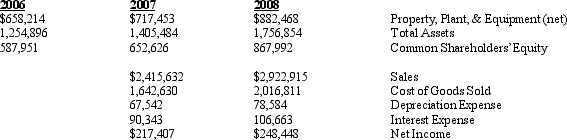

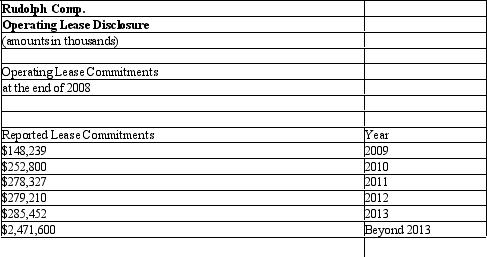

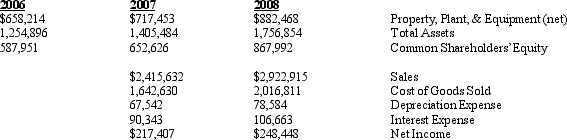

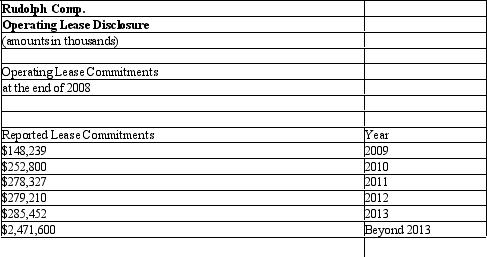

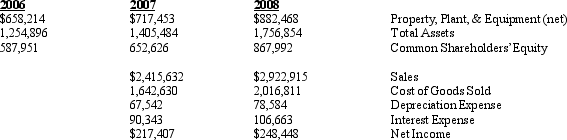

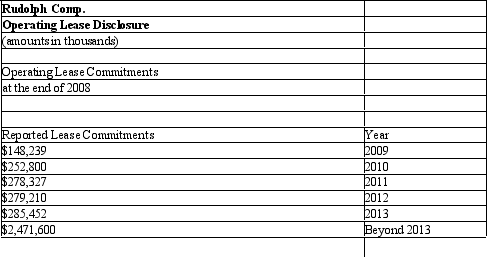

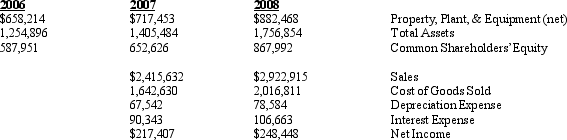

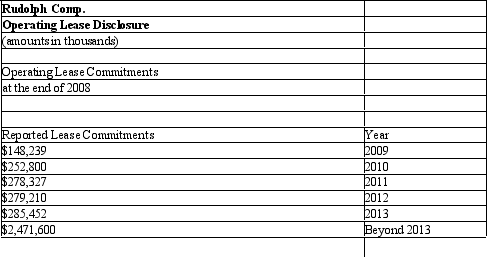

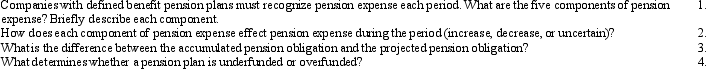

NOTE: These multiple choice questions require present value information. Rudolph Corporation manufactures Christmas decorations and supplies throughout the world. The company owns property, plant, and equipment and also enters into operating leases for certain facilities. Assume that Randolph's incremental borrowing rate is 8%. The company's tax rate is 40%. Listed below is selected financial data for Rudolph and a portion of the company's operating lease footnote.

Using the information provided by Rudolph Corporation estimate the average life of the operating leases.

Using the information provided by Rudolph Corporation estimate the average life of the operating leases.

A) 8.66 years

B) 13.66 years

C) 10 years

D) Not able to determine

Using the information provided by Rudolph Corporation estimate the average life of the operating leases.

Using the information provided by Rudolph Corporation estimate the average life of the operating leases.A) 8.66 years

B) 13.66 years

C) 10 years

D) Not able to determine

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

24

NOTE: These multiple choice questions require present value information. Rudolph Corporation manufactures Christmas decorations and supplies throughout the world. The company owns property, plant, and equipment and also enters into operating leases for certain facilities. Assume that Randolph's incremental borrowing rate is 8%. The company's tax rate is 40%. Listed below is selected financial data for Rudolph and a portion of the company's operating lease footnote.

Using the information provided by Rudolph Corporation calculate the present value of the operating leases.

Using the information provided by Rudolph Corporation calculate the present value of the operating leases.

A) $2,155,843

B) $2,024,945

C) $1,482,390

D) $2,854,452

Using the information provided by Rudolph Corporation calculate the present value of the operating leases.

Using the information provided by Rudolph Corporation calculate the present value of the operating leases.A) $2,155,843

B) $2,024,945

C) $1,482,390

D) $2,854,452

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

25

NOTE: These multiple choice questions require present value information. Rudolph Corporation manufactures Christmas decorations and supplies throughout the world. The company owns property, plant, and equipment and also enters into operating leases for certain facilities. Assume that Randolph's incremental borrowing rate is 8%. The company's tax rate is 40%. Listed below is selected financial data for Rudolph and a portion of the company's operating lease footnote.

Using the information provided by Rudolph Corporation calculate the company's 2008 fixed asset ratio.

Using the information provided by Rudolph Corporation calculate the company's 2008 fixed asset ratio.

A) 3.0

B) 3.65

C) 3.23

D) 5.21

Using the information provided by Rudolph Corporation calculate the company's 2008 fixed asset ratio.

Using the information provided by Rudolph Corporation calculate the company's 2008 fixed asset ratio.A) 3.0

B) 3.65

C) 3.23

D) 5.21

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

26

Gains and losses on cash flow hedges affect earnings ____________________ than those on fair value hedges.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

27

Analysts concerns with postretirement benefits include all of the following except

A) should the underfunded postretirement benefit obligation be added to liabilities in assessing risk?

B) How reasonable are the firms' assumptions regarding health care cost increases?

C) Is the postretirement benefit fund adequately paying benefits.

D) Is the postretirement benefit fund generating returns consistent with the expected rate of return?

A) should the underfunded postretirement benefit obligation be added to liabilities in assessing risk?

B) How reasonable are the firms' assumptions regarding health care cost increases?

C) Is the postretirement benefit fund adequately paying benefits.

D) Is the postretirement benefit fund generating returns consistent with the expected rate of return?

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

28

An agreement in which a purchaser agrees to pay specified amounts periodically to a seller for products or services is known as a ________________________________________.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

29

One of the conditions that must be met to recognize an estimated loss from a contingency is that the amount of loss can be estimated with ________________________________________.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

30

One criteria that must be satisfied for a firm to recognize an obligation is that the transaction or event giving rise to the obligation has already ____________________.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

31

Liabilities requiring the future delivery of goods or services appear on the balance sheet at the ______________________________ of those goods and services.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

32

A ____________________ lease arrangement is one in which the lessee assumes the risks and enjoys the rewards of ownership.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

33

Derivative instruments acquired to hedge exposure to variability in expected future cash are _________________________ hedges.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

34

A derivative has one or more ____________________, which are a specified interest rate, commodity price, foreign exchange rate, or other variable.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

35

Under an operating lease agreement the lessee recognizes ______________________________ each period that the leased asset is used.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

36

NOTE: The following multiple choice questions require present value information. On January 1, 2006, Price Corporation signed a five-year noncancelable lease for certain machinery. The terms of the lease called for:

For the year ended December 31, 2006 Price should record depreciation expense for the leased equipment equal to

For the year ended December 31, 2006 Price should record depreciation expense for the leased equipment equal to

A) $55,000

B) $39,927

C) $47,912

D) $0

For the year ended December 31, 2006 Price should record depreciation expense for the leased equipment equal to

For the year ended December 31, 2006 Price should record depreciation expense for the leased equipment equal toA) $55,000

B) $39,927

C) $47,912

D) $0

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following calculations is used to determine the amount of the liability reported on the balance sheet for underfunding?

A) Plan assets less projected benefit obligation.

B) Projected benefit obligation less plan assets.

C) Plan assets less accumulated benefit obligation.

D) Accumulated benefit obligation less plan assets.

A) Plan assets less projected benefit obligation.

B) Projected benefit obligation less plan assets.

C) Plan assets less accumulated benefit obligation.

D) Accumulated benefit obligation less plan assets.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

38

NOTE: These multiple choice questions require present value information. Rudolph Corporation manufactures Christmas decorations and supplies throughout the world. The company owns property, plant, and equipment and also enters into operating leases for certain facilities. Assume that Randolph's incremental borrowing rate is 8%. The company's tax rate is 40%. Listed below is selected financial data for Rudolph and a portion of the company's operating lease footnote.

Assuming that Rudolph Corporation was required to capitalize its operating lease how would the company's fixed asset ratio change under this assumption.

Assuming that Rudolph Corporation was required to capitalize its operating lease how would the company's fixed asset ratio change under this assumption.

A) increase

B) decrease

C) no effect

D) unable to determine

Assuming that Rudolph Corporation was required to capitalize its operating lease how would the company's fixed asset ratio change under this assumption.

Assuming that Rudolph Corporation was required to capitalize its operating lease how would the company's fixed asset ratio change under this assumption.A) increase

B) decrease

C) no effect

D) unable to determine

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

39

A security that has both equity and debt characteristics is referred to as a ______________________________.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

40

The lessor in a capital lease recognizes both a(n) ____________________ and ____________________ equal to the present value of all future cash flows.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

41

____________________ differences result from including revenues and expenses in income before taxes in a different period than those items affect taxable income.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

42

The _____________________________________________ is equal to the actuarial present value of amounts that the employer expects to pay to retired employees based on the employees' service to date and using expected future salary amounts.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

43

Income tax expense consists of two components, the ____________________ portion and the ____________________ portion.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

44

____________________ differences arise from revenues and expenses that GAAP requires firms to include in income before taxes but that the income tax law excludes from taxable income.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

45

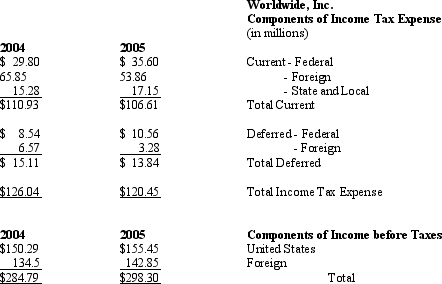

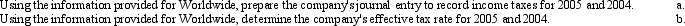

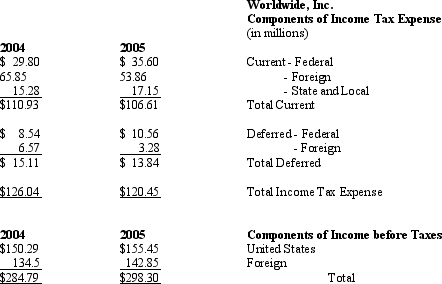

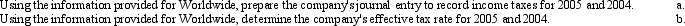

Worldwide, Inc. provides consulting services globally. The company pays taxes to the nation where revenues are earned. Information about the company's taxes are presented below:

Required:

Required:

Required:

Required:

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

46

Assume that you are currently negotiating a lease transaction in the role of the lessee. Discuss whether you would rather structure the lease as an operating lease or a capital lease and why. In addition, provide the conditions that would require that the lease be accounted for as a capital lease.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

47

Derivative instruments acquired to hedge exposure may be classified as either a fair value hedge or a cash flow hedge. Distinguish between the two types of hedges.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

48

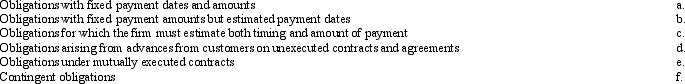

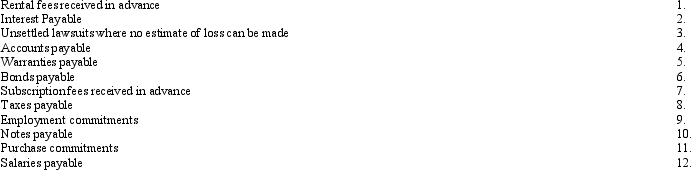

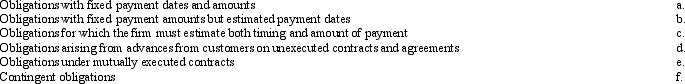

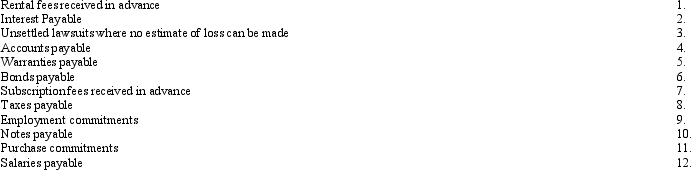

Listed below are 12 accounting liabilities, place each in one of the following six categories:

In addition, determine which liabilities would be recognized on the balance sheet as liabilities and those that would not be recognized.

In addition, determine which liabilities would be recognized on the balance sheet as liabilities and those that would not be recognized.

In addition, determine which liabilities would be recognized on the balance sheet as liabilities and those that would not be recognized.

In addition, determine which liabilities would be recognized on the balance sheet as liabilities and those that would not be recognized.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

49

Many firms use derivative instruments to hedge exposure to changes in the fair value an asset or liability or to hedge exposure to variability in expected future cash flows. As an analyst examining the financial reports of a company that uses derivative instruments to hedge, what questions should be asked when thinking about derivatives and accounting quality?

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

50

Please answer the following questions about defined benefit pension plans:

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

51

When firms use derivatives effectively to manage risks, the net gain or loss each period should be relatively ____________________.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

52

Deferred tax liabilities result in future tax ____________________ when temporary differences reverse.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

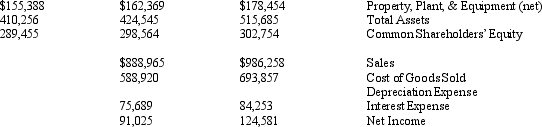

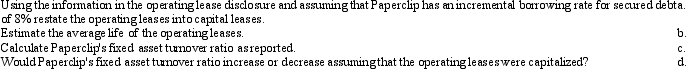

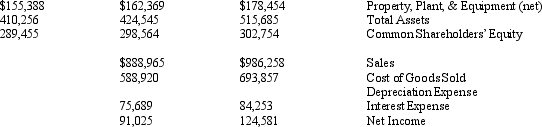

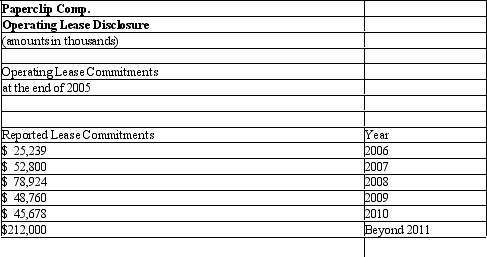

53

NOTE: This problem requires present value information.

Paperclip Company manufactures office equipment and supplies throughout the U.S. The company owns property, plant, and equipment and also enters into operating leases for certain facilities. The company's tax rate is 35%. Listed below is selected financial data for Paperclip and the company's operating lease disclosure.

As an analyst you wish to restate Paperclip's operating leases into capital leases. Required:

As an analyst you wish to restate Paperclip's operating leases into capital leases. Required:

Paperclip Company manufactures office equipment and supplies throughout the U.S. The company owns property, plant, and equipment and also enters into operating leases for certain facilities. The company's tax rate is 35%. Listed below is selected financial data for Paperclip and the company's operating lease disclosure.

As an analyst you wish to restate Paperclip's operating leases into capital leases. Required:

As an analyst you wish to restate Paperclip's operating leases into capital leases. Required:

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

54

Dividing a company's income tax expense by its book income before income taxes provides the company's ___________________________________.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

55

____________________ over sufficiently long time periods equals cash inflows minus cash outflows from operating, investing, and financing activities

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

56

GAAP requires firms to report the assets and liabilities of defined benefit plans _______________________________________________________.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

57

Derivative instruments acquired to hedge exposure to changes in the fair value of an asset or liability are ______________________________ hedges.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

58

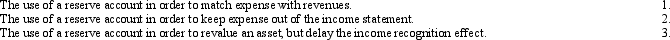

Accountants use reserve accounts for various reasons, for each of the scenarios below describe a specific account example that matches the scenario.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

59

Differences between income before taxes and taxable income result are either ____________________ or ____________________.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

60

Deferred tax assets result in future tax ____________________ when temporary differences reverse.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

61

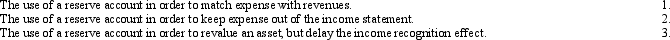

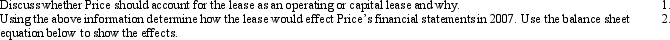

NOTE: The following problem requires present value information.

On January 1, 2006, Price Corporation signed a five-year noncancelable lease for certain machinery. The terms of the lease called for:

Required:

Required:

On January 1, 2006, Price Corporation signed a five-year noncancelable lease for certain machinery. The terms of the lease called for:

Required:

Required:

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck