Exam 8: Liability Recognition and Related Expenses

Exam 1: Overview of Financial Reporting, Financial Statement Analysis, and Valuation67 Questions

Exam 2: Asset and Liability Valuation and Income Measurement49 Questions

Exam 3: Income Flows Versus Cash Flows: Key Relationships in the Dynamics of a Business55 Questions

Exam 4: Profitability Analysis69 Questions

Exam 5: Risk Analysis63 Questions

Exam 6: Quality of Accounting Information and Adjustments to Reported Financial Statement Data52 Questions

Exam 7: Revenue Recognition and Related Expenses52 Questions

Exam 8: Liability Recognition and Related Expenses61 Questions

Exam 9: Intercorporate Entities55 Questions

Exam 10: Forecasting Financial Statements41 Questions

Exam 11: Risk-Adjusted Expected Rates of Return and the Dividends Valuation Approach30 Questions

Exam 12: Valuation: Cash-Flow-Based Approaches41 Questions

Exam 13: Valuation: Earnings-Based Approaches47 Questions

Exam 14: Valuation: Market-Based Approaches50 Questions

Select questions type

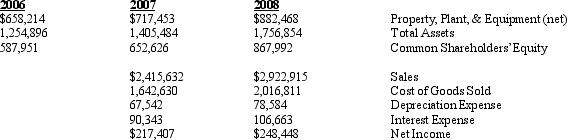

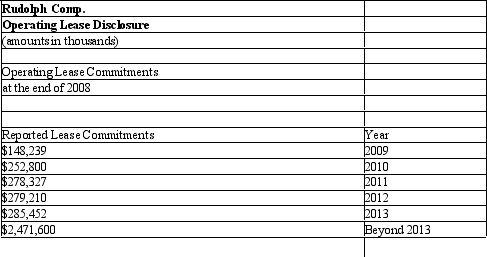

NOTE: These multiple choice questions require present value information. Rudolph Corporation manufactures Christmas decorations and supplies throughout the world. The company owns property, plant, and equipment and also enters into operating leases for certain facilities. Assume that Randolph's incremental borrowing rate is 8%. The company's tax rate is 40%. Listed below is selected financial data for Rudolph and a portion of the company's operating lease footnote.

Using the information provided by Rudolph Corporation calculate the present value of the operating leases.

Using the information provided by Rudolph Corporation calculate the present value of the operating leases.

Free

(Multiple Choice)

4.7/5  (34)

(34)

Correct Answer:

A

One criteria that must be satisfied for a firm to recognize an obligation is that the transaction or event giving rise to the obligation has already ____________________.

Free

(Short Answer)

4.9/5  (38)

(38)

Correct Answer:

occurred

A minimum liability for pension expense is reported when

Free

(Multiple Choice)

4.8/5  (37)

(37)

Correct Answer:

C

A security that has both equity and debt characteristics is referred to as a ______________________________.

(Short Answer)

4.8/5  (33)

(33)

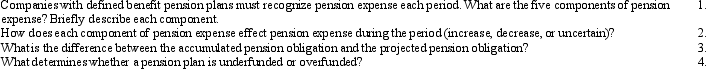

Please answer the following questions about defined benefit pension plans:

(Essay)

4.8/5  (38)

(38)

The lessor in a capital lease recognizes both a(n) ____________________ and ____________________ equal to the present value of all future cash flows.

(Short Answer)

4.8/5  (35)

(35)

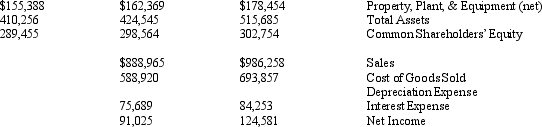

NOTE: This problem requires present value information.

Paperclip Company manufactures office equipment and supplies throughout the U.S. The company owns property, plant, and equipment and also enters into operating leases for certain facilities. The company's tax rate is 35%. Listed below is selected financial data for Paperclip and the company's operating lease disclosure.

Papercli Conl.

Operating Lease Dischsure

(amounts in thousands)

Operating Lease Comunitments

at the end of 2005

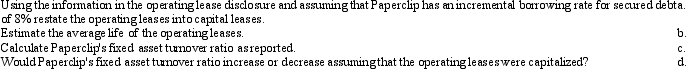

Reported Lease Commitments Year \ 25,239 2006 \ 52,800 2007 78,924 2008 \ 48,760 2009 \ 45,678 2010 \ 212,000 Beyond 2011 As an analyst you wish to restate Paperclip's operating leases into capital leases. Required:

Papercli Conl.

Operating Lease Dischsure

(amounts in thousands)

Operating Lease Comunitments

at the end of 2005

Reported Lease Commitments Year \ 25,239 2006 \ 52,800 2007 78,924 2008 \ 48,760 2009 \ 45,678 2010 \ 212,000 Beyond 2011 As an analyst you wish to restate Paperclip's operating leases into capital leases. Required:

(Essay)

4.8/5  (36)

(36)

A ____________________ lease arrangement is one in which the lessee assumes the risks and enjoys the rewards of ownership.

(Short Answer)

4.9/5  (34)

(34)

When firms use derivatives effectively to manage risks, the net gain or loss each period should be relatively ____________________.

(Short Answer)

4.7/5  (36)

(36)

____________________ differences arise from revenues and expenses that GAAP requires firms to include in income before taxes but that the income tax law excludes from taxable income.

(Short Answer)

4.9/5  (32)

(32)

Dividing a company's income tax expense by its book income before income taxes provides the company's ___________________________________.

(Short Answer)

4.8/5  (28)

(28)

The major difference between accounting for pensions and the accounting for other postretirement benefits is that firms

(Multiple Choice)

4.8/5  (42)

(42)

Gains and losses on cash flow hedges affect earnings ____________________ than those on fair value hedges.

(Short Answer)

4.7/5  (36)

(36)

Assume that you are currently negotiating a lease transaction in the role of the lessee. Discuss whether you would rather structure the lease as an operating lease or a capital lease and why. In addition, provide the conditions that would require that the lease be accounted for as a capital lease.

(Essay)

4.9/5  (36)

(36)

Deferred tax assets result in future tax ____________________ when temporary differences reverse.

(Short Answer)

4.9/5  (40)

(40)

One of the conditions that must be met to recognize an estimated loss from a contingency is that the amount of loss can be estimated with ________________________________________.

(Short Answer)

4.8/5  (43)

(43)

Income tax expense consists of two components, the ____________________ portion and the ____________________ portion.

(Short Answer)

4.9/5  (32)

(32)

Showing 1 - 20 of 61

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)