Deck 7: Taxes

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/280

Play

Full screen (f)

Deck 7: Taxes

1

Use the following to answer questions :

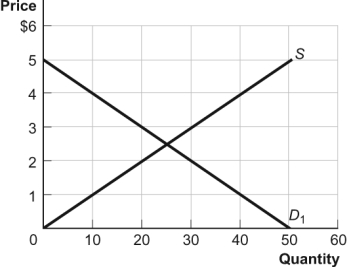

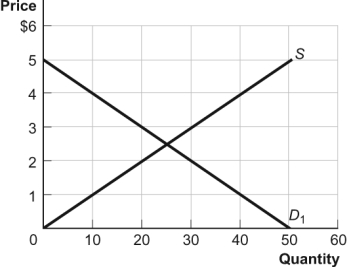

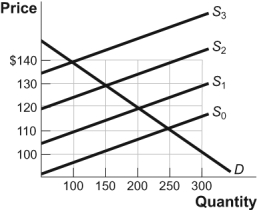

Figure: The Market for Productivity Apps

(Figure: The Market for Productivity Apps)Use Figure: The Market for Productivity Apps.If the government imposes a tax of $1 in this market,producers will receive _____ less per app and sell _____ fewer apps.

A) $1;5

B) $1;25

C) $0.50;5

D) $0.50;20

Figure: The Market for Productivity Apps

(Figure: The Market for Productivity Apps)Use Figure: The Market for Productivity Apps.If the government imposes a tax of $1 in this market,producers will receive _____ less per app and sell _____ fewer apps.

A) $1;5

B) $1;25

C) $0.50;5

D) $0.50;20

$0.50;5

2

Use the following to answer questions :

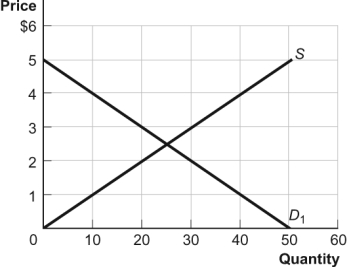

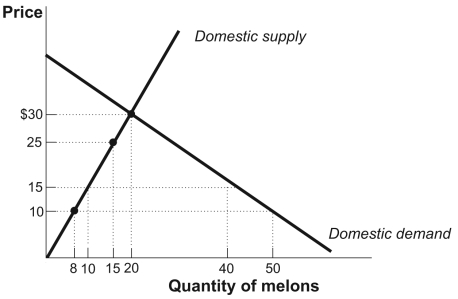

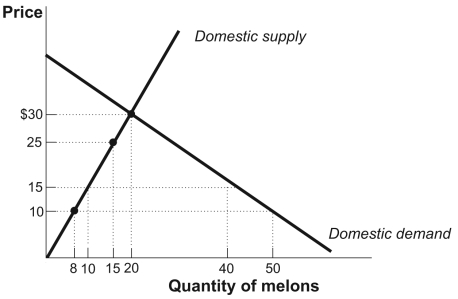

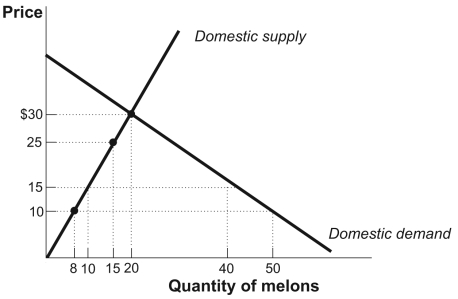

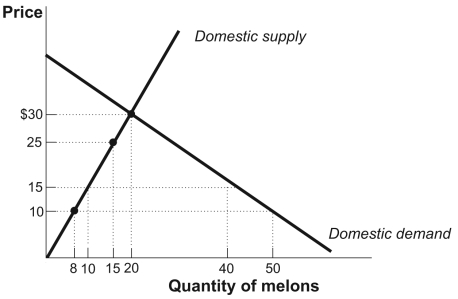

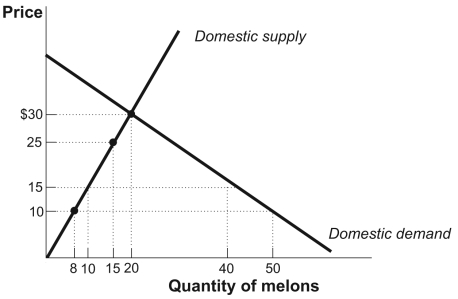

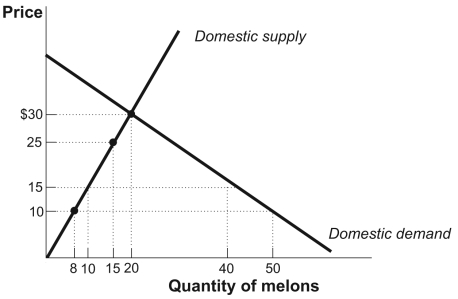

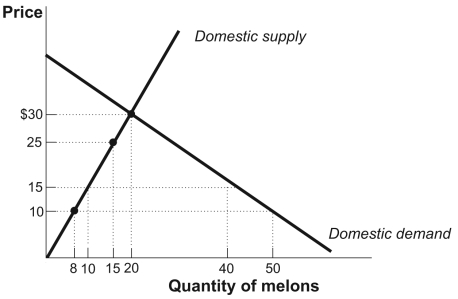

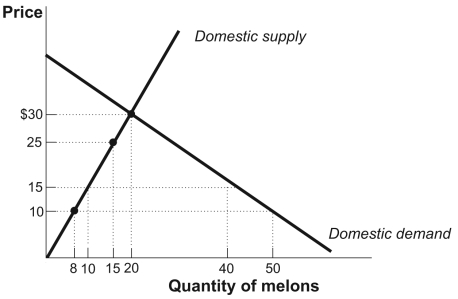

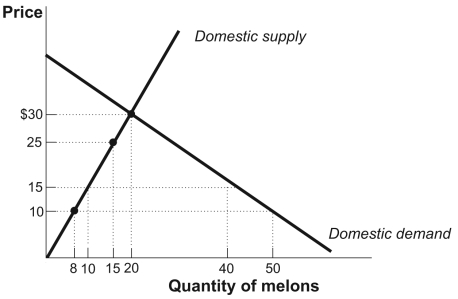

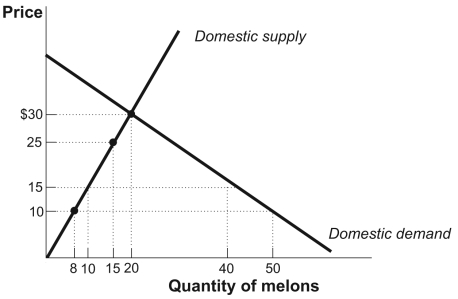

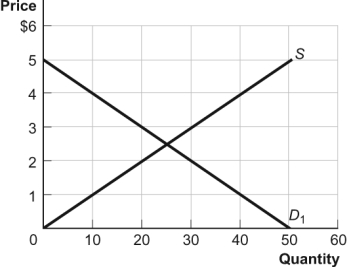

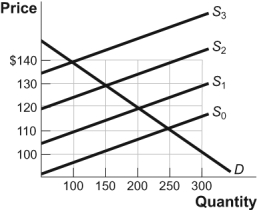

Figure: The Market for Melons in Russia II

An excise tax that the government collects from the producers of a good:

A) shifts the supply curve upward.

B) reduces revenue for the government.

C) has an effect similar to that of a tax subsidy.

D) shifts the supply curve downward.

Figure: The Market for Melons in Russia II

An excise tax that the government collects from the producers of a good:

A) shifts the supply curve upward.

B) reduces revenue for the government.

C) has an effect similar to that of a tax subsidy.

D) shifts the supply curve downward.

shifts the supply curve upward.

3

If the government imposes a $5 excise tax on leather shoes and the price of leather shoes does not change:

A) the government will receive less tax revenue than anticipated.

B) consumers are paying all of the tax.

C) producers are paying all of the tax.

D) consumers and producers are paying equal amounts of the tax.

A) the government will receive less tax revenue than anticipated.

B) consumers are paying all of the tax.

C) producers are paying all of the tax.

D) consumers and producers are paying equal amounts of the tax.

producers are paying all of the tax.

4

The burden of a tax on a good is said to fall completely on the consumers if the:

A) price paid by consumers for the good declines by the amount of the tax.

B) price paid by consumers for the good increases by the amount of the tax.

C) price paid by consumers does not change.

D) wages received by workers who produce the good increase by the amount of the tax.

A) price paid by consumers for the good declines by the amount of the tax.

B) price paid by consumers for the good increases by the amount of the tax.

C) price paid by consumers does not change.

D) wages received by workers who produce the good increase by the amount of the tax.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

5

Provincial governments levy excise taxes on alcohol because:

A) they want to subsidize alcohol production.

B) they want to encourage individuals to produce their own alcohol.

C) it discourages drinking alcohol while raising revenue for the government.

D) it is politically popular with religious groups.

A) they want to subsidize alcohol production.

B) they want to encourage individuals to produce their own alcohol.

C) it discourages drinking alcohol while raising revenue for the government.

D) it is politically popular with religious groups.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

6

Use the following to answer questions :

-(Table: The Market for Fried Twinkies)Use Table: The Market for Fried Twinkies.Of the $0.30 tax per fried Twinkie,consumers actually pay _____,while producers actually pay _____.

A) $0.30;$0.00

B) $0.15;$0.15

C) $0.20;$0.10

D) $0.00;$0.30

-(Table: The Market for Fried Twinkies)Use Table: The Market for Fried Twinkies.Of the $0.30 tax per fried Twinkie,consumers actually pay _____,while producers actually pay _____.

A) $0.30;$0.00

B) $0.15;$0.15

C) $0.20;$0.10

D) $0.00;$0.30

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

7

Use the following to answer questions :

Figure: The Market for Melons in Russia II

If an excise tax is imposed on automobiles and collected from consumers,the:

A) demand curve will shift downward by the amount of the tax.

B) supply curve will shift upward by the amount of the tax.

C) equilibrium quantity supplied will increase relative to the pre-tax level.

D) equilibrium quantity demanded will increase relative to the pre-tax level.

Figure: The Market for Melons in Russia II

If an excise tax is imposed on automobiles and collected from consumers,the:

A) demand curve will shift downward by the amount of the tax.

B) supply curve will shift upward by the amount of the tax.

C) equilibrium quantity supplied will increase relative to the pre-tax level.

D) equilibrium quantity demanded will increase relative to the pre-tax level.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

8

Use the following to answer questions :

Figure: The Market for Melons in Russia II

The incidence of a tax:

A) is a measure of the revenue the government receives from it.

B) refers to who writes the check to the government.

C) refers to how much of the tax is actually paid by consumers and producers.

D) is a measure of the deadweight loss from the tax.

Figure: The Market for Melons in Russia II

The incidence of a tax:

A) is a measure of the revenue the government receives from it.

B) refers to who writes the check to the government.

C) refers to how much of the tax is actually paid by consumers and producers.

D) is a measure of the deadweight loss from the tax.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

9

Use the following to answer questions :

Figure: The Market for Melons in Russia II

Suppose that the government imposes a $10 excise tax on the sale of sweaters by charging suppliers $10 for each sweater sold.If the demand curve is downward-sloping and the supply curve is upward-sloping:

A) the price of sweaters will increase by $10.

B) consumers of sweaters will bear the entire burden of the tax.

C) the price of sweaters will increase by less than $10.

D) the price of sweaters will decrease by $10.

Figure: The Market for Melons in Russia II

Suppose that the government imposes a $10 excise tax on the sale of sweaters by charging suppliers $10 for each sweater sold.If the demand curve is downward-sloping and the supply curve is upward-sloping:

A) the price of sweaters will increase by $10.

B) consumers of sweaters will bear the entire burden of the tax.

C) the price of sweaters will increase by less than $10.

D) the price of sweaters will decrease by $10.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

10

Assuming a normal upward-sloping supply curve and downward-sloping demand curve,if the government imposes a $5 excise tax on leather shoes and collects the tax from the suppliers,the price of leather shoes will:

A) increase by $5.

B) increase by more than $5.

C) increase by less than $5.

D) increase,but we cannot determine by how much.

A) increase by $5.

B) increase by more than $5.

C) increase by less than $5.

D) increase,but we cannot determine by how much.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

11

If an excise tax is imposed on beer and collected from the producers,the _____ curve will shift _____ by the amount of the tax.

A) demand;upward

B) demand;downward

C) supply;upward

D) supply;downward

A) demand;upward

B) demand;downward

C) supply;upward

D) supply;downward

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

12

If the government imposes a $5 excise tax on leather shoes and the price of leather shoes increases by $2:

A) the government will receive less tax revenue than anticipated.

B) consumers are paying more of the tax than the producers.

C) producers are paying more of the tax than are the consumers.

D) the quantity of shoes sold will increase.

A) the government will receive less tax revenue than anticipated.

B) consumers are paying more of the tax than the producers.

C) producers are paying more of the tax than are the consumers.

D) the quantity of shoes sold will increase.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

13

The burden of a tax on a good is said to fall completely on the producers if the:

A) price paid by consumers for the good declines by the amount of the tax.

B) price paid by consumers for the good increases by the amount of the tax.

C) price paid by consumers does not change.

D) wages received by workers who produce the good increase by the amount of the tax.

A) price paid by consumers for the good declines by the amount of the tax.

B) price paid by consumers for the good increases by the amount of the tax.

C) price paid by consumers does not change.

D) wages received by workers who produce the good increase by the amount of the tax.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

14

Use the following to answer questions :

Figure: The Market for Melons in Russia II

Recently,the government considered adding an excise tax on CDs that can be used to record music and CD players that can record discs.If this tax were enacted,the MOST likely effect would be:

A) that consumers would pay a higher price and producers would sell fewer of these CDs and CD players than before the tax.

B) no change in consumption or the prices paid by consumers of these CDs and CD players.

C) that consumers would pay a lower price and producers would receive a higher price for these CDs and CD players than before the tax.

D) an increase in economic activity due to the tax.

Figure: The Market for Melons in Russia II

Recently,the government considered adding an excise tax on CDs that can be used to record music and CD players that can record discs.If this tax were enacted,the MOST likely effect would be:

A) that consumers would pay a higher price and producers would sell fewer of these CDs and CD players than before the tax.

B) no change in consumption or the prices paid by consumers of these CDs and CD players.

C) that consumers would pay a lower price and producers would receive a higher price for these CDs and CD players than before the tax.

D) an increase in economic activity due to the tax.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

15

Use the following to answer questions :

-(Table: The Market for Fried Twinkies)Use Table: The Market for Fried Twinkies.The government decides to tax fried Twinkies at a rate of $0.30 per Twinkie and collect that tax from the producers.According to the table,consumers will pay _____ per Twinkie and buy _____ Twinkies after the tax.

A) $1.20;8 000

B) $1.30;7 000

C) $1.40;6 000

D) $1.50;5 000

-(Table: The Market for Fried Twinkies)Use Table: The Market for Fried Twinkies.The government decides to tax fried Twinkies at a rate of $0.30 per Twinkie and collect that tax from the producers.According to the table,consumers will pay _____ per Twinkie and buy _____ Twinkies after the tax.

A) $1.20;8 000

B) $1.30;7 000

C) $1.40;6 000

D) $1.50;5 000

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

16

Use the following to answer questions :

Figure: The Market for Productivity Apps

(Figure: The Market for Productivity Apps)Use Figure: The Market for Productivity Apps.If the government imposes a tax of $1 in this market,consumers will pay _____ more per app and purchase _____ fewer apps.

A) $1;5

B) $1;25

C) $0.50;5

D) $0.50;20

Figure: The Market for Productivity Apps

(Figure: The Market for Productivity Apps)Use Figure: The Market for Productivity Apps.If the government imposes a tax of $1 in this market,consumers will pay _____ more per app and purchase _____ fewer apps.

A) $1;5

B) $1;25

C) $0.50;5

D) $0.50;20

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

17

If an excise tax is imposed on wine and collected from the consumers,the _____ curve will shift _____ by the amount of the tax.

A) demand;upward

B) demand;downward

C) supply;upward

D) supply;downward

A) demand;upward

B) demand;downward

C) supply;upward

D) supply;downward

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

18

Use the following to answer questions :

-(Table: The Market for Fried Twinkies)Use Table: The Market for Fried Twinkies.The government decides to tax fried Twinkies at a rate of $0.30 per Twinkie and collect that tax from the producers.After paying the tax,producers will receive _____ per Twinkie,and they will sell _____ Twinkies after the tax.

A) $1.10;3 000

B) $1.20;5 000

C) $1.30;7 000

D) $1.50;5 000

-(Table: The Market for Fried Twinkies)Use Table: The Market for Fried Twinkies.The government decides to tax fried Twinkies at a rate of $0.30 per Twinkie and collect that tax from the producers.After paying the tax,producers will receive _____ per Twinkie,and they will sell _____ Twinkies after the tax.

A) $1.10;3 000

B) $1.20;5 000

C) $1.30;7 000

D) $1.50;5 000

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

19

Use the following to answer questions :

-(Table: The Market for Fried Twinkies)Use Table: The Market for Fried Twinkies.As a result of the $0.30 tax per fried Twinkie,the government will receive total tax revenue of:

A) $500.

B) $1 000.

C) $1 500.

D) The total is impossible to calculate.

-(Table: The Market for Fried Twinkies)Use Table: The Market for Fried Twinkies.As a result of the $0.30 tax per fried Twinkie,the government will receive total tax revenue of:

A) $500.

B) $1 000.

C) $1 500.

D) The total is impossible to calculate.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

20

Use the following to answer question 10:

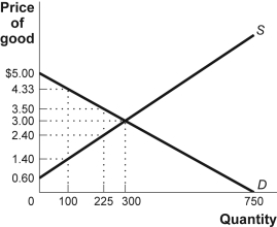

Figure: An Excise Tax

(Figure: An Excise Tax)Use Figure: An Excise Tax.If an excise tax equal to $1.10 is imposed on this good,then the price paid by consumers will:

A) rise by $1.10.

B) rise by $1.33.

C) not rise.

D) rise by $0.50.

Figure: An Excise Tax

(Figure: An Excise Tax)Use Figure: An Excise Tax.If an excise tax equal to $1.10 is imposed on this good,then the price paid by consumers will:

A) rise by $1.10.

B) rise by $1.33.

C) not rise.

D) rise by $0.50.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

21

As part of an anti-obesity program,the government levies an excise tax on high-fat foods.We expect consumers to pay almost all of this tax if demand is _____ and supply is _____.

A) inelastic;inelastic

B) inelastic;elastic

C) elastic;elastic

D) elastic;inelastic

A) inelastic;inelastic

B) inelastic;elastic

C) elastic;elastic

D) elastic;inelastic

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

22

Use the following to answer question 26:

Figure: Market for Hotel Rooms

(Figure: The Market for Hotel Rooms)Use Figure: The Market for Hotel Rooms.Suppose that with no tax the equilibrium price is $110 and the equilibrium quantity is 250.If the municipal government levies a tax of $30 per night on each hotel room rented,the new equilibrium price will equal _____ and the new equilibrium quantity will equal _____.

A) $140;100

B) $130;150

C) $120;200

D) $110;250

Figure: Market for Hotel Rooms

(Figure: The Market for Hotel Rooms)Use Figure: The Market for Hotel Rooms.Suppose that with no tax the equilibrium price is $110 and the equilibrium quantity is 250.If the municipal government levies a tax of $30 per night on each hotel room rented,the new equilibrium price will equal _____ and the new equilibrium quantity will equal _____.

A) $140;100

B) $130;150

C) $120;200

D) $110;250

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

23

Determining who actually pays the cost imposed by a tax is the study of:

A) public interest theory.

B) rational choice theory.

C) tax incidence.

D) budget analysis.

A) public interest theory.

B) rational choice theory.

C) tax incidence.

D) budget analysis.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

24

Suppose that the government imposes a $10 per month tax on cell phone service.If the demand curve for cell phone service is perfectly inelastic and the supply curve is upward-sloping,the monthly price for cell phone service will increase by:

A) $5.

B) less than $10.

C) $10.

D) $0.

A) $5.

B) less than $10.

C) $10.

D) $0.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

25

Suppose that the government imposes a $4 per month excise tax on cable TV.If the demand for cable TV is perfectly inelastic and the supply curve is elastic (but not perfectly elastic),then the price of cable TV will:

A) increase by more than $4.

B) increase by exactly $4.

C) increase by less than $4.

D) remain constant.

A) increase by more than $4.

B) increase by exactly $4.

C) increase by less than $4.

D) remain constant.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

26

Tax incidence refers to:

A) who writes the cheque to the government.

B) who really pays the tax.

C) the deadweight loss from the tax.

D) the total revenue that the government collects from the tax.

A) who writes the cheque to the government.

B) who really pays the tax.

C) the deadweight loss from the tax.

D) the total revenue that the government collects from the tax.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

27

An excise tax is levied on:

A) each unit of a good or service that is sold.

B) earnings.

C) the ownership of real estate.

D) the inheritance of assets.

A) each unit of a good or service that is sold.

B) earnings.

C) the ownership of real estate.

D) the inheritance of assets.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

28

Suppose that the government imposes a $9 per month tax on cell phone service.If the demand curve for cell phone service is perfectly elastic and the supply curve is upward-sloping,the monthly price for cell phone service will:

A) increase by $4.50.

B) increase by more than $9.

C) increase by $9.

D) not change.

A) increase by $4.50.

B) increase by more than $9.

C) increase by $9.

D) not change.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

29

Determining who bears the burden of the tax is a question about:

A) tax incidence.

B) externality analysis.

C) public interest theory.

D) public choice theory.

A) tax incidence.

B) externality analysis.

C) public interest theory.

D) public choice theory.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

30

Taxes on the purchase of specific items such as gasoline,cigarettes,or alcoholic beverages are called _____ taxes.

A) personal income

B) excise

C) property

D) sales

A) personal income

B) excise

C) property

D) sales

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

31

If demand is perfectly inelastic and the supply curve is upward-sloping,then the burden of an excise tax is:

A) borne entirely by consumers.

B) borne entirely by producers.

C) shared by consumers and producers,with the burden falling mainly on consumers.

D) shared by consumers and producers,with the burden falling mainly on producers.

A) borne entirely by consumers.

B) borne entirely by producers.

C) shared by consumers and producers,with the burden falling mainly on consumers.

D) shared by consumers and producers,with the burden falling mainly on producers.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

32

Suppose that the government levies a $4 per month excise tax on cable TV.If the demand for cable TV is relatively (but not perfectly)inelastic and the supply curve is relatively (but not perfectly)elastic,then the price of cable TV will:

A) increase by more than $4.

B) increase by exactly $4.

C) increase by less than $4.

D) remain constant.

A) increase by more than $4.

B) increase by exactly $4.

C) increase by less than $4.

D) remain constant.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

33

An excise tax is levied on suppliers.The incidence of the tax:

A) is typically on the consumer more than the producer.

B) is typically on the producer more than the consumer.

C) is typically split equally between the producer and the consumer.

D) cannot be determined without more information.

A) is typically on the consumer more than the producer.

B) is typically on the producer more than the consumer.

C) is typically split equally between the producer and the consumer.

D) cannot be determined without more information.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

34

The burden of a tax on a good falls at least partially on consumers if the:

A) price paid by consumers for the good declines.

B) price paid by consumers for the good increases.

C) wages received by workers who produce the good decline.

D) wages received by workers who produce the good increase.

A) price paid by consumers for the good declines.

B) price paid by consumers for the good increases.

C) wages received by workers who produce the good decline.

D) wages received by workers who produce the good increase.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

35

Prior to any taxes,the equilibrium price of gasoline is $3 per litre.Then,a $1 per litre tax is levied.As a result,the price of gasoline rises to $3.75 per litre.The incidence of the $1 tax is _____ paid by consumers and _____ paid by producers.

A) $0.25;$0.75

B) $0.50;$0.50

C) $0;$1.00

D) $0.75;$0.25

A) $0.25;$0.75

B) $0.50;$0.50

C) $0;$1.00

D) $0.75;$0.25

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

36

Provincial governments levy excise taxes on cigarettes because:

A) they want to subsidize tobacco farming.

B) they want to discourage cigarette smuggling.

C) it is an easy way to raise tax revenue while discouraging smoking.

D) they want to minimize the tax burden on consumers.

A) they want to subsidize tobacco farming.

B) they want to discourage cigarette smuggling.

C) it is an easy way to raise tax revenue while discouraging smoking.

D) they want to minimize the tax burden on consumers.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

37

Which tax is an excise tax?

A) a tax of $0.41 per litre of gas

B) a tax of 12.4% of your wages

C) a tax on the value of your property

D) a one-time municipal per capita tax of $50

A) a tax of $0.41 per litre of gas

B) a tax of 12.4% of your wages

C) a tax on the value of your property

D) a one-time municipal per capita tax of $50

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

38

Suppose that the absolute value of the price elasticity of demand for yachts equals 4.04,while the price elasticity of supply for yachts equals 0.22.If the federal government reinstates a luxury tax on yachts,who will pay more of the tax?

A) Yacht builders will pay more.

B) Yacht buyers will pay more.

C) Yacht builders and buyers will pay equally.

D) It's impossible to tell without additional information.

A) Yacht builders will pay more.

B) Yacht buyers will pay more.

C) Yacht builders and buyers will pay equally.

D) It's impossible to tell without additional information.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

39

If the demand curve is downward-sloping and supply is perfectly elastic,then the burden of an excise tax is:

A) borne entirely by consumers.

B) borne entirely by producers.

C) shared by consumers and producers,with the burden falling mainly on consumers.

D) shared by consumers and producers,with the burden falling mainly on producers.

A) borne entirely by consumers.

B) borne entirely by producers.

C) shared by consumers and producers,with the burden falling mainly on consumers.

D) shared by consumers and producers,with the burden falling mainly on producers.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

40

Tax incidence analysis seeks to determine:

A) who sends the tax payment to the government.

B) who actually pays the tax.

C) who ultimately gets the tax revenue.

D) whether a tax is in the benefits-received category or the ability-to-pay category.

A) who sends the tax payment to the government.

B) who actually pays the tax.

C) who ultimately gets the tax revenue.

D) whether a tax is in the benefits-received category or the ability-to-pay category.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

41

When the government imposes an excise tax in a market with a downward-sloping demand curve and an upward-sloping supply curve:

A) consumer surplus falls.

B) producer surplus falls.

C) a deadweight loss occurs.

D) consumer surplus falls,producer surplus falls,and a deadweight loss occurs.

A) consumer surplus falls.

B) producer surplus falls.

C) a deadweight loss occurs.

D) consumer surplus falls,producer surplus falls,and a deadweight loss occurs.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

42

The price elasticity of demand for a particular cancer drug is zero,and the price elasticity of supply is 0.50.If a $1 excise tax is levied on producers,how much of this tax will eventually be paid by consumers?

A) $0

B) $1

C) $0.50

D) $1.50

A) $0

B) $1

C) $0.50

D) $1.50

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

43

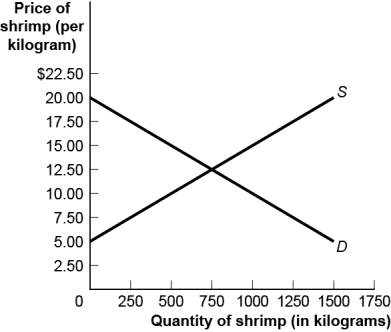

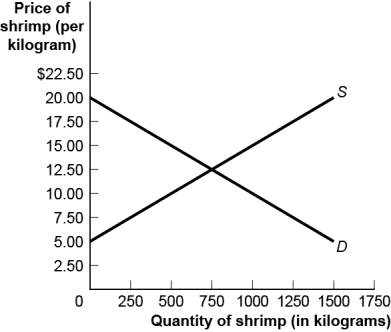

Use the following to answer questions :

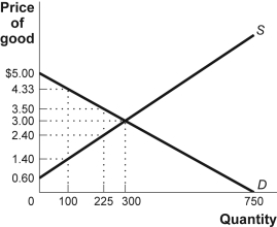

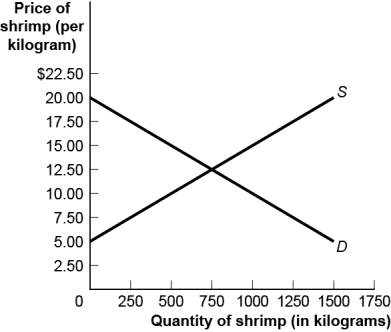

Figure: The Shrimp Market

(Figure: The Shrimp Market)Use Figure: The Shrimp Market.If the government wants to limit shrimp sales to 250 kilograms,it can impose a _____ excise tax on sellers,and the total tax revenue generated will be _____.

A) $5;$2 500

B) $7.50;$7 500

C) $10;$2 500

D) The answer cannot be determined from the information provided.

Figure: The Shrimp Market

(Figure: The Shrimp Market)Use Figure: The Shrimp Market.If the government wants to limit shrimp sales to 250 kilograms,it can impose a _____ excise tax on sellers,and the total tax revenue generated will be _____.

A) $5;$2 500

B) $7.50;$7 500

C) $10;$2 500

D) The answer cannot be determined from the information provided.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

44

If demand and supply are both very elastic,a decrease in the rate of an excise tax will likely:

A) decrease government revenue.

B) increase government revenue.

C) not affect government revenue.

D) make demand and supply both inelastic.

A) decrease government revenue.

B) increase government revenue.

C) not affect government revenue.

D) make demand and supply both inelastic.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

45

Demand for Gala apples is relatively elastic compared to the supply of Gala apples,so if a tax is imposed on the consumers of Gala apples,the tax incidence:

A) is typically on consumers more than producers.

B) is typically on producers more than consumers.

C) is typically split equally between consumers and producers.

D) cannot be determined without more information.

A) is typically on consumers more than producers.

B) is typically on producers more than consumers.

C) is typically split equally between consumers and producers.

D) cannot be determined without more information.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

46

Taxable income is found by:

A) the amount a worker has to pay in income.

B) determining who pays the burden of the tax.

C) determining income after subtracting exemptions and deductions.

D) what is left after source deductions on your paycheque.

A) the amount a worker has to pay in income.

B) determining who pays the burden of the tax.

C) determining income after subtracting exemptions and deductions.

D) what is left after source deductions on your paycheque.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

47

The deadweight loss from an excise tax comes about because:

A) the number of transactions in the market is smaller than the no-tax equilibrium.

B) some mutually beneficial transactions do not take place.

C) a quota rent exists.

D) the number of transactions in the market is reduced and some mutually beneficial transactions do not take place.

A) the number of transactions in the market is smaller than the no-tax equilibrium.

B) some mutually beneficial transactions do not take place.

C) a quota rent exists.

D) the number of transactions in the market is reduced and some mutually beneficial transactions do not take place.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

48

By law,the federal government sets the brackets for the marginal tax rates at:

A) 17% on the first $45 916 of taxable income;24.5% on the next $45 915;32% on the next $50 522;37% on the next $60 447;and a top rate of 45% on his or her income,if any,over $202 800.

B) 15% on the first $45 916 of taxable income;20.5% on the next $45 915;26% on the next $50 522;29% on the next $60 447;and a top rate of 33% on his or her income,if any,over $202 800.

C) 15% on the first $45 000 of taxable income;20.5% on the next $45 000;26% on the next $50 000;29% on the next $60 000;and a top rate of 33% on his or her income,if any,over $200 000.

D) 17% on the first $45 000 of taxable income;24.5% on the next $45 000;32% on the next $50 000;37% on the next $60 000;and a top rate of 45% on his or her income,if any,over $200 000.

A) 17% on the first $45 916 of taxable income;24.5% on the next $45 915;32% on the next $50 522;37% on the next $60 447;and a top rate of 45% on his or her income,if any,over $202 800.

B) 15% on the first $45 916 of taxable income;20.5% on the next $45 915;26% on the next $50 522;29% on the next $60 447;and a top rate of 33% on his or her income,if any,over $202 800.

C) 15% on the first $45 000 of taxable income;20.5% on the next $45 000;26% on the next $50 000;29% on the next $60 000;and a top rate of 33% on his or her income,if any,over $200 000.

D) 17% on the first $45 000 of taxable income;24.5% on the next $45 000;32% on the next $50 000;37% on the next $60 000;and a top rate of 45% on his or her income,if any,over $200 000.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

49

If the elasticity of demand is _____ and the elasticity of supply is _____,tax revenue is likely to decrease if the tax rate is increased.

A) 3.3;2.1

B) 3.3;0.5

C) 0.2;2.1

D) 0.2;0.5

A) 3.3;2.1

B) 3.3;0.5

C) 0.2;2.1

D) 0.2;0.5

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

50

If demand and supply are both very inelastic,a decrease in the rate of an excise tax will likely:

A) decrease government revenue.

B) increase government revenue.

C) not affect government revenue.

D) make demand and supply both elastic.

A) decrease government revenue.

B) increase government revenue.

C) not affect government revenue.

D) make demand and supply both elastic.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

51

The demand for food is very inelastic compared to the supply of food,so if a tax is imposed on the consumers of food,the tax incidence:

A) is typically on consumers more than producers.

B) is typically on producers more than consumers.

C) is typically split equally between consumers and producers.

D) cannot be determined without more information.

A) is typically on consumers more than producers.

B) is typically on producers more than consumers.

C) is typically split equally between consumers and producers.

D) cannot be determined without more information.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

52

A higher rate is MOST likely to decrease the amount of revenue that the government collects from an excise tax if demand is _____ and supply is _____.

A) elastic;elastic

B) elastic;inelastic

C) inelastic;elastic

D) inelastic;inelastic

A) elastic;elastic

B) elastic;inelastic

C) inelastic;elastic

D) inelastic;inelastic

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

53

If the government removed the excise tax on gasoline,assuming that neither demand nor supply is perfectly inelastic,which effect would NOT occur?

A) an increase in consumer surplus

B) an increase in producer surplus

C) a decrease in producer surplus

D) an increase in total surplus

A) an increase in consumer surplus

B) an increase in producer surplus

C) a decrease in producer surplus

D) an increase in total surplus

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

54

If the elasticity of demand is _____ and the elasticity of supply is _____,tax revenue is likely to increase if the tax rate is increased.

A) 3.3;2.1

B) 3.3;0.5

C) 0.2;2.1

D) 0.2;0.5

A) 3.3;2.1

B) 3.3;0.5

C) 0.2;2.1

D) 0.2;0.5

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

55

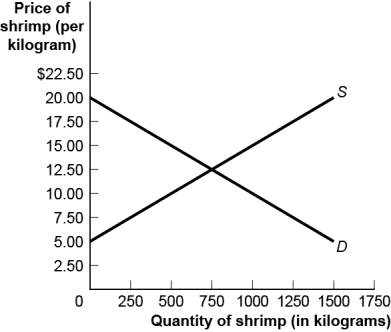

Use the following to answer questions :

Figure: The Shrimp Market

(Figure: The Shrimp Market)Use Figure: The Shrimp Market.If the government wants to limit shrimp sales to 500 kilograms,it can impose a _____ excise tax on sellers,and the total tax revenue generated will be _____.

A) $5;$2 500

B) $7.50;$7 500

C) $10;$2 500

D) The answer cannot be determined from the information provided.

Figure: The Shrimp Market

(Figure: The Shrimp Market)Use Figure: The Shrimp Market.If the government wants to limit shrimp sales to 500 kilograms,it can impose a _____ excise tax on sellers,and the total tax revenue generated will be _____.

A) $5;$2 500

B) $7.50;$7 500

C) $10;$2 500

D) The answer cannot be determined from the information provided.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

56

A higher tax rate is more likely to increase tax revenue if the price elasticity of demand is _____ and the price elasticity of supply is _____.

A) high;high

B) low;low

C) low;high

D) high;low

A) high;high

B) low;low

C) low;high

D) high;low

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

57

The amount of money a Canadian owes in federal income taxes is found by applying marginal tax rates on _____ "brackets" of income.

A) exactly half of

B) very little of

C) successively higher

D) none of the

A) exactly half of

B) very little of

C) successively higher

D) none of the

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

58

An excise tax causes inefficiency if the number of transactions in a market is reduced as a result of the tax.Because the tax discourages mutually beneficial transactions,there is a(n)_____ from a tax.

A) quota rent

B) deadweight loss

C) increased consumer surplus

D) increased producer surplus

A) quota rent

B) deadweight loss

C) increased consumer surplus

D) increased producer surplus

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

59

The amount of tax levied per unit of good or service is called the tax:

A) incidence.

B) rate.

C) revenue.

D) surplus.

A) incidence.

B) rate.

C) revenue.

D) surplus.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

60

If the government removed all excise taxes on cigarettes,which effect would NOT occur?

A) a decrease in producer surplus

B) an increase in producer surplus

C) an increase in consumer surplus

D) an increase in total surplus

A) a decrease in producer surplus

B) an increase in producer surplus

C) an increase in consumer surplus

D) an increase in total surplus

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

61

If demand is downward-sloping and supply is upward-sloping,which statement about the effects of an excise tax is INCORRECT?

A) The lower the elasticity of supply relative to the elasticity of demand,the lower the burden of the tax borne by suppliers.

B) An excise tax causes a deadweight loss because consumer and producer surpluses are reduced by more than the revenue the government collects.

C) An excise tax drives a wedge between the price paid by consumers and the price received by producers.

D) An excise tax is inefficient because it distorts incentives at the margin for both consumers and producers.

A) The lower the elasticity of supply relative to the elasticity of demand,the lower the burden of the tax borne by suppliers.

B) An excise tax causes a deadweight loss because consumer and producer surpluses are reduced by more than the revenue the government collects.

C) An excise tax drives a wedge between the price paid by consumers and the price received by producers.

D) An excise tax is inefficient because it distorts incentives at the margin for both consumers and producers.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

62

If the main purpose of a tax is to decrease the amount of a harmful activity,such as underage drinking,the government should impose it on harmful activities whose supply is _____ and demand is _____.

A) elastic;elastic

B) inelastic;inelastic

C) elastic;inelastic

D) inelastic;elastic

A) elastic;elastic

B) inelastic;inelastic

C) elastic;inelastic

D) inelastic;elastic

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

63

The government wants to levy a $1 excise tax on a product but wants to minimize the deadweight loss.The deadweight loss will be LEAST when the demand curve is _____ and the supply curve is _____.

A) elastic;elastic

B) elastic;inelastic

C) inelastic;elastic

D) inelastic;inelastic

A) elastic;elastic

B) elastic;inelastic

C) inelastic;elastic

D) inelastic;inelastic

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

64

If the government wants to minimize the deadweight loss from taxes,it should tax goods for which the:

A) price elasticity of demand is high.

B) price elasticity of demand is low.

C) price elasticity of supply is high.

D) demand is high.

A) price elasticity of demand is high.

B) price elasticity of demand is low.

C) price elasticity of supply is high.

D) demand is high.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

65

An analysis of the effect of excise taxes on markets allows us to conclude that:

A) when the price elasticity of supply is equal to zero,an excise tax falls entirely on the consumers.

B) when the price elasticity of demand is lower than the price elasticity of supply,an excise tax falls mainly on the producers.

C) whether the tax is levied on consumers or producers,the quantity sold will be the same.

D) when the price elasticity of demand is higher than the price elasticity of supply,an excise tax falls mainly on the consumers.

A) when the price elasticity of supply is equal to zero,an excise tax falls entirely on the consumers.

B) when the price elasticity of demand is lower than the price elasticity of supply,an excise tax falls mainly on the producers.

C) whether the tax is levied on consumers or producers,the quantity sold will be the same.

D) when the price elasticity of demand is higher than the price elasticity of supply,an excise tax falls mainly on the consumers.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

66

Given any downward-sloping demand curve for a good,the more inelastic the supply curve,the _____ equilibrium output will fall and the _____ will be the deadweight loss when the government imposes an excise tax.

A) more;smaller

B) more;larger

C) less;smaller

D) less;larger

A) more;smaller

B) more;larger

C) less;smaller

D) less;larger

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

67

The deadweight loss from an excise tax is largest if demand is _____ and supply is _____.

A) elastic;inelastic

B) inelastic;elastic

C) inelastic;inelastic

D) elastic;elastic

A) elastic;inelastic

B) inelastic;elastic

C) inelastic;inelastic

D) elastic;elastic

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

68

If the demand for luxury yachts is very elastic,then a yacht tax would lead to:

A) a large deadweight loss.

B) no deadweight loss.

C) a small deadweight loss.

D) a large amount of tax revenue but no deadweight loss.

A) a large deadweight loss.

B) no deadweight loss.

C) a small deadweight loss.

D) a large amount of tax revenue but no deadweight loss.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

69

Excise taxes that raise the MOST revenue and cause the LEAST deadweight loss are likely to be levied on goods for which demand is _____ and supply is _____.

A) inelastic;elastic

B) inelastic;inelastic

C) elastic;inelastic

D) elastic;elastic

A) inelastic;elastic

B) inelastic;inelastic

C) elastic;inelastic

D) elastic;elastic

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

70

Given any upward-sloping supply curve for a good,the more inelastic the demand curve,the _____ equilibrium output will fall and the _____ will be the deadweight loss when the government imposes an excise tax.

A) more;smaller

B) more;larger

C) less;smaller

D) less;larger

A) more;smaller

B) more;larger

C) less;smaller

D) less;larger

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

71

If the government levies an excise tax in a market whose demand curve is perfectly inelastic,the burden of the tax will fall completely on the _____,and the deadweight loss will equal _____.

A) consumers;zero

B) producers;zero

C) consumers;the tax revenue

D) producers;the tax revenue

A) consumers;zero

B) producers;zero

C) consumers;the tax revenue

D) producers;the tax revenue

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

72

A tax leads to a(n)_____ in consumer surplus and a(n)_____ in producer surplus.

A) increase;increase

B) increase;decrease

C) decrease;increase

D) decrease;decrease

A) increase;increase

B) increase;decrease

C) decrease;increase

D) decrease;decrease

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

73

Given any downward-sloping demand curve for a good,the more price-elastic the supply curve,the _____ equilibrium output will fall and the _____ will be the deadweight loss when the government imposes an excise tax.

A) more;smaller

B) more;larger

C) less;smaller

D) less;larger

A) more;smaller

B) more;larger

C) less;smaller

D) less;larger

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

74

Assume the same upward supply curve for each of the following goods.Considering demand only,a tax on _____ would result in the LARGEST deadweight loss.

A) gasoline

B) medicine

C) restaurant meals

D) tobacco

A) gasoline

B) medicine

C) restaurant meals

D) tobacco

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

75

If the government decides to impose a $700 tax on Canadian citizens vacationing abroad,then the deadweight loss from this tax will be:

A) relatively small.

B) relatively large.

C) zero.

D) absorbed by foreign governments.

A) relatively small.

B) relatively large.

C) zero.

D) absorbed by foreign governments.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

76

If you want to reduce the inefficiency costs of taxation,you should devise taxes to fall on goods for which the supply is _____ and the demand is _____.

A) elastic;elastic

B) inelastic;inelastic

C) elastic;inelastic

D) inelastic;elastic

A) elastic;elastic

B) inelastic;inelastic

C) elastic;inelastic

D) inelastic;elastic

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

77

If the government levies an excise tax in a market whose supply curve is perfectly inelastic,the burden of the tax will fall completely on the _____,and the deadweight loss will equal _____.

A) consumers;zero

B) producers;zero

C) consumers;the tax revenue

D) producers;the tax revenue

A) consumers;zero

B) producers;zero

C) consumers;the tax revenue

D) producers;the tax revenue

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

78

The burden of a tax system comes from its:

A) effect on elasticity.

B) effect on marginal incentives.

C) inequity.

D) government revenue.

A) effect on elasticity.

B) effect on marginal incentives.

C) inequity.

D) government revenue.

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

79

Given any upward-sloping supply curve for a good,the more elastic the demand curve,the _____ equilibrium output will fall and the _____ will be the deadweight loss when the government imposes an excise tax.

A) more;smaller

B) more;larger

C) less;smaller

D) less;larger

A) more;smaller

B) more;larger

C) less;smaller

D) less;larger

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck

80

The number of seats in a football stadium is fixed at 70 000.The city decides to impose a tax of $10 per ticket.In response,the team management raises the ticket price from $30 to $40 and still sells all 70 000 tickets.The tax caused a change in the consumer surplus of _____,a change in the producer surplus of _____,and a deadweight loss of _____.

A) -$10;$0;$10

B) -$700 000;$0;$700 000

C) -$10;$0;$0

D) -$700 000;$0;$0

A) -$10;$0;$10

B) -$700 000;$0;$700 000

C) -$10;$0;$0

D) -$700 000;$0;$0

Unlock Deck

Unlock for access to all 280 flashcards in this deck.

Unlock Deck

k this deck