Exam 7: Taxes

Exam 1: First Principles198 Questions

Exam 2: Economic Models295 Questions

Exam 3: Supply and Demand264 Questions

Exam 4: Consumer and Producer Surplus228 Questions

Exam 5: Price Controls and Quotas215 Questions

Exam 6: Elasticity88 Questions

Exam 7: Taxes280 Questions

Exam 8: International Trade261 Questions

Exam 9: Decision Making by Individuals and Firms165 Questions

Exam 10: The Rational Consumer197 Questions

Exam 11: Behind the Supply Curve- Inputs and Costs357 Questions

Exam 12: Perfect Competition and the Supply Curve341 Questions

Exam 13: Monopoly316 Questions

Exam 14: Oligopoly272 Questions

Exam 15: Monopolistic Competition246 Questions

Exam 16: Externalities194 Questions

Exam 17: Public Goods and Common Resources180 Questions

Exam 18: The Economics of the Welfare State125 Questions

Exam 19: Factor Markets and the Distribution of Income317 Questions

Exam 20: Uncertainty, risk, and Private Information150 Questions

Exam 21: Graphs in Economics62 Questions

Exam 22: Consumer Preferences153 Questions

Exam 23: Indifference Curve Analysis41 Questions

Select questions type

If the government wants to limit sales of a particular good,it may do so by imposing a quota.However,the same reduction in sales may be achieved by an appropriately chosen excise tax.

Free

(True/False)

4.8/5  (26)

(26)

Correct Answer:

True

A lump-sum tax,such as the fee for a driver's licence,does not take into consideration:

Free

(Multiple Choice)

4.8/5  (29)

(29)

Correct Answer:

C

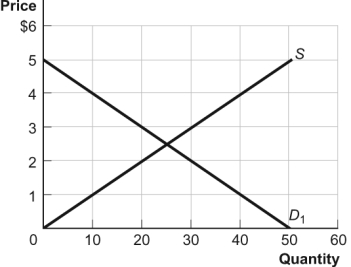

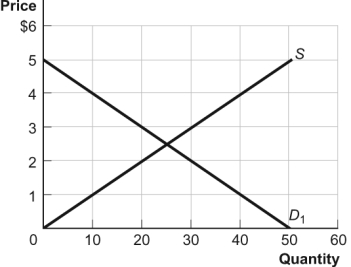

Use the following to answer questions :

Figure: The Market for Music Downloads  -(Figure: The Market for Music Downloads)Use Figure: The Market for Music Downloads.If the government imposes a tax of $3 in this market,the deadweight loss will equal:

-(Figure: The Market for Music Downloads)Use Figure: The Market for Music Downloads.If the government imposes a tax of $3 in this market,the deadweight loss will equal:

Free

(Multiple Choice)

4.8/5  (32)

(32)

Correct Answer:

B

If the government imposes a $5 excise tax on leather shoes and the price of leather shoes does not change:

(Multiple Choice)

4.8/5  (40)

(40)

If the government levies an excise tax in a market whose supply curve is perfectly inelastic,the burden of the tax will fall completely on the _____,and the deadweight loss will equal _____.

(Multiple Choice)

4.9/5  (33)

(33)

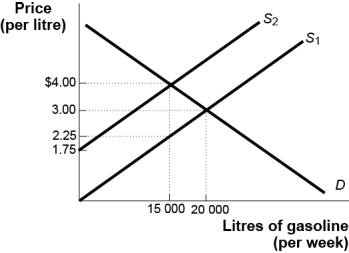

Use the following to answer questions :

Figure: The Gasoline Market  -(Figure: The Gasoline Market)Use Figure: The Gasoline Market.The pre-tax equilibrium price is $3,and the equilibrium quantity before tax is 20 000 litres.An excise tax has been levied on each litre of gasoline supplied by producers,shifting the supply curve upward.The total tax revenue collected by the government is equal to:

-(Figure: The Gasoline Market)Use Figure: The Gasoline Market.The pre-tax equilibrium price is $3,and the equilibrium quantity before tax is 20 000 litres.An excise tax has been levied on each litre of gasoline supplied by producers,shifting the supply curve upward.The total tax revenue collected by the government is equal to:

(Multiple Choice)

4.9/5  (40)

(40)

Use the following to answer questions :

\text {The market for good \mathrm { X } can be depicted with the following demand and supply equations:}

-(Scenario: The Market for Good X)Use Scenario: The Market for Good X.If a $1 per unit tax is imposed,the deadweight loss associated with the tax will be equal to (round all calculations to two decimal places):

(Multiple Choice)

4.8/5  (36)

(36)

If demand is perfectly inelastic,the deadweight loss caused by a tax will be zero.

(True/False)

4.9/5  (33)

(33)

Eli has annual earnings of $100 000,and Molly has annual earnings of $50 000.Each consumer goes to the mall and purchases a microwave oven for $100,and each pays an additional 7%,or $7,in sales tax.This tax is:

(Multiple Choice)

4.7/5  (28)

(28)

Determining who actually pays the cost imposed by a tax is the study of:

(Multiple Choice)

4.8/5  (40)

(40)

Suppose that Justin Trudeau initiates a revision of the federal income tax structure such that the tax rate is 10% on all income up to $50 000.Any income above $50 000 is not taxed.This payroll tax will be:

(Multiple Choice)

4.8/5  (32)

(32)

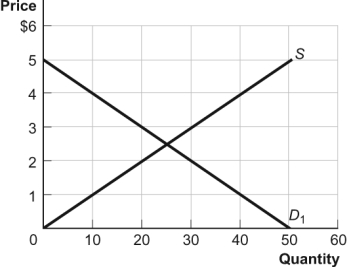

Use the following to answer questions :

Figure: The Market for Productivity Apps  -(Figure: The Market for Productivity Apps)Use Figure: The Market for Productivity Apps.If the government imposes a tax of $1 in this market,consumers will pay _____ more per app and purchase _____ fewer apps.

-(Figure: The Market for Productivity Apps)Use Figure: The Market for Productivity Apps.If the government imposes a tax of $1 in this market,consumers will pay _____ more per app and purchase _____ fewer apps.

(Multiple Choice)

4.8/5  (43)

(43)

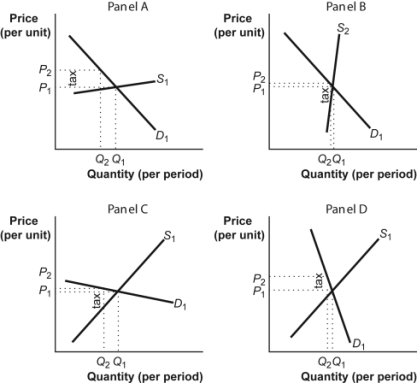

Use the following to answer questions :

Figure: Tax Incidence  -(Figure: Tax Incidence)Use Figure: Tax Incidence.Producers are likely to bear more of the burden of an excise tax in the situations illustrated by panels:

-(Figure: Tax Incidence)Use Figure: Tax Incidence.Producers are likely to bear more of the burden of an excise tax in the situations illustrated by panels:

(Multiple Choice)

4.9/5  (32)

(32)

The burden of a tax on a good is said to fall completely on the producers if the:

(Multiple Choice)

4.8/5  (43)

(43)

Tax structure refers to what a tax is levied on (e.g. ,income,property,profits),and tax base refers to the base (or lowest)rate of taxation on a particular tax structure.

(True/False)

4.8/5  (37)

(37)

If the elasticity of demand is _____ and the elasticity of supply is _____,tax revenue is likely to decrease if the tax rate is increased.

(Multiple Choice)

4.9/5  (36)

(36)

Determining who bears the burden of the tax is a question about:

(Multiple Choice)

4.8/5  (31)

(31)

Use the following to answer questions :

Figure: The Market for Music Downloads  -(Figure: The Market for Music Downloads)Use Figure: The Market for Music Downloads.If the government imposes a tax of $3 in this market,the government will receive tax revenue of:

-(Figure: The Market for Music Downloads)Use Figure: The Market for Music Downloads.If the government imposes a tax of $3 in this market,the government will receive tax revenue of:

(Multiple Choice)

4.8/5  (37)

(37)

An analysis of the effect of excise taxes on markets allows us to conclude that:

(Multiple Choice)

4.8/5  (35)

(35)

Showing 1 - 20 of 280

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)