Deck 14: Decision Making: Relevant Costs and Benefits

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

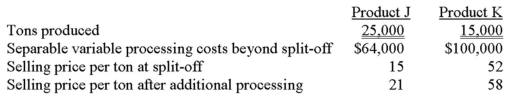

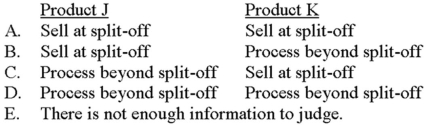

Question

Question

Question

Question

Question

Question

Question

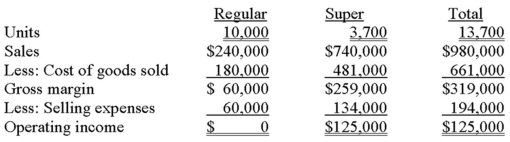

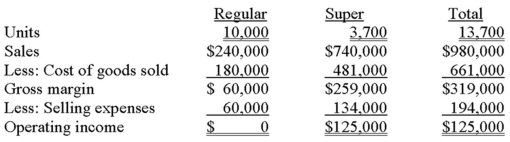

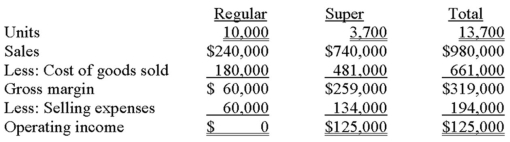

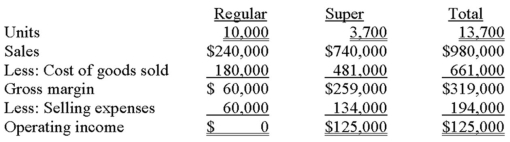

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/90

Play

Full screen (f)

Deck 14: Decision Making: Relevant Costs and Benefits

1

The term "opportunity cost" is best defined as the benefit associated with a rejected alternative when making a choice.

True

2

Which of the following costs can be ignored when making a decision?

A) Opportunity costs.

B) Differential costs.

C) Sunk costs.

D) Relevant costs.

E) All future costs.

A) Opportunity costs.

B) Differential costs.

C) Sunk costs.

D) Relevant costs.

E) All future costs.

C

3

A trade-off in a decision situation sometimes occurs between information:

A) accuracy and relevance.

B) relevance and uniqueness.

C) accuracy and timeliness.

D) sensitivity and accuracy.

E) sensitivity and relevance.

A) accuracy and relevance.

B) relevance and uniqueness.

C) accuracy and timeliness.

D) sensitivity and accuracy.

E) sensitivity and relevance.

C

4

An accounting information system should be designed to provide information that is useful. To be useful the information must be:

A) qualitative rather than quantitative.

B) unique and unavailable through other sources.

C) historical in nature and not purport to predict the future.

D) marginal between two alternatives.

E) relevant, accurate, and timely.

A) qualitative rather than quantitative.

B) unique and unavailable through other sources.

C) historical in nature and not purport to predict the future.

D) marginal between two alternatives.

E) relevant, accurate, and timely.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

5

Managerial accountants:

A) rarely become involved in an organization's decision-making activities.

B) make decisions that focus solely on an organization's accounting matters.

C) collect data and provide information so that decisions can be made.

D) often serve as a cross-functional team member, making a wide range of decisions.

E) collect data and provide information so that decisions can be made and often serve as a cross-functional team member, making a wide range of decisions.

A) rarely become involved in an organization's decision-making activities.

B) make decisions that focus solely on an organization's accounting matters.

C) collect data and provide information so that decisions can be made.

D) often serve as a cross-functional team member, making a wide range of decisions.

E) collect data and provide information so that decisions can be made and often serve as a cross-functional team member, making a wide range of decisions.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

6

Factors in a decision problem that cannot be expressed in numerical terms are:

A) qualitative in nature.

B) quantitative in nature.

C) predictive in nature.

D) sensitive in nature.

E) uncertain in nature.

A) qualitative in nature.

B) quantitative in nature.

C) predictive in nature.

D) sensitive in nature.

E) uncertain in nature.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

7

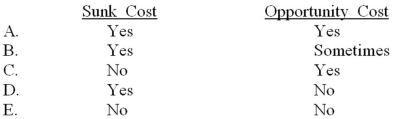

To be useful in decision making, information should possess which of the following characteristics?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

8

At which step or steps in the decision-making process do qualitative considerations generally have the greatest impact?

A) Specifying the criterion and identifying the alternatives.

B) Developing a decision model.

C) Collecting the data.

D) Making a decision.

E) Identifying the alternatives.

A) Specifying the criterion and identifying the alternatives.

B) Developing a decision model.

C) Collecting the data.

D) Making a decision.

E) Identifying the alternatives.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

9

A firm that decides to emphasize those goods with the highest contribution margin per unit may have made an incorrect decision when the company has capacity constraints in the form of limited resources.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

10

The City of Columbus should not consider the purchase price of its old vehicle when making the decision to replace it with a more cost effective new vehicle.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

11

The cost of inventory currently owned by a company is an example of a (n):

A) opportunity cost.

B) sunk cost.

C) relevant cost.

D) differential cost.

E) future cost.

A) opportunity cost.

B) sunk cost.

C) relevant cost.

D) differential cost.

E) future cost.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

12

The City of Miami is about to replace an old fire truck with a new vehicle in an effort to save maintenance and other operating costs. Which of the following items, all related to the transaction, would not be considered in the decision?

A) Purchase price of the new vehicle.

B) Purchase price of the old vehicle.

C) Savings in operating costs as a result of the new vehicle.

D) Proceeds from disposal of the old vehicle.

E) Future depreciation on the new vehicle.

A) Purchase price of the new vehicle.

B) Purchase price of the old vehicle.

C) Savings in operating costs as a result of the new vehicle.

D) Proceeds from disposal of the old vehicle.

E) Future depreciation on the new vehicle.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

13

The book value of equipment currently owned by a company is an example of a (n):

A) future cost.

B) differential cost.

C) comparative cost.

D) opportunity cost.

E) sunk cost.

A) future cost.

B) differential cost.

C) comparative cost.

D) opportunity cost.

E) sunk cost.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following best defines the concept of a relevant cost?

A) A past cost that is the same among alternatives.

B) A past cost that differs among alternatives.

C) A future cost that is the same among alternatives.

D) A future cost that differs among alternatives.

E) A cost that is based on past experience.

A) A past cost that is the same among alternatives.

B) A past cost that differs among alternatives.

C) A future cost that is the same among alternatives.

D) A future cost that differs among alternatives.

E) A cost that is based on past experience.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

15

The following costs are relevant to the decision situation cited except:

A) the cost of hiring a full-time staff attorney, in a decision to establish an in-house legal department or retain the services of a prominent law firm.

B) the remodeling cost of existing office space, in a firm's decision to stay at its current location or move to a new building.

C) the long-term salary costs demanded by Joe Torrez (a superstar) and Rip Moran (an average player) in baseball contract negotiations, in a decision that determines the amounts by which ticket prices must be raised.

D) the cost to enhance an airline's Web site, in a decision to expand existing service to either Salt Lake City or Phoenix.

E) the commissions that could be earned by a salesperson, in a decision that involves salesperson compensation methods (i.e., commissions or flat monthly salaries).

A) the cost of hiring a full-time staff attorney, in a decision to establish an in-house legal department or retain the services of a prominent law firm.

B) the remodeling cost of existing office space, in a firm's decision to stay at its current location or move to a new building.

C) the long-term salary costs demanded by Joe Torrez (a superstar) and Rip Moran (an average player) in baseball contract negotiations, in a decision that determines the amounts by which ticket prices must be raised.

D) the cost to enhance an airline's Web site, in a decision to expand existing service to either Salt Lake City or Phoenix.

E) the commissions that could be earned by a salesperson, in a decision that involves salesperson compensation methods (i.e., commissions or flat monthly salaries).

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

16

The concept of a relevant cost can be defined as a past cost that differs among alternatives.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

17

Allegiance, Inc. has $125,000 of inventory that suffered minor smoke damage from a fire in the warehouse. The company can sell the goods "as is" for $45,000; alternatively, the goods can be cleaned and shipped to the firm's outlet center at a cost of $23,000. There the goods could be sold for $80,000. What alternative is more desirable and what is the relevant cost for that alternative?

A) Sell "as is," $125,000.

B) Clean and ship to outlet center, $23,000.

C) Clean and ship to outlet center, $103,000.

D) Clean and ship to outlet center, $148,000.

E) Neither alternative is desirable, as both produce a loss for the firm.

A) Sell "as is," $125,000.

B) Clean and ship to outlet center, $23,000.

C) Clean and ship to outlet center, $103,000.

D) Clean and ship to outlet center, $148,000.

E) Neither alternative is desirable, as both produce a loss for the firm.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

18

Flowers Company is operating at capacity and wants to add a new service to its expanding business. The new service should be added as long as service revenues exceed the sum of variable costs and fixed costs.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

19

In early July, Mike Gottfried purchased a $70 ticket to the December 15 game of the Chicago Titans. (The Titans belong to the Midwest Football League and play their games outdoors on the shore of Lake Michigan.) Parking for the game was expected to cost approximately $22, and Gottfried would probably spend another $15 for a souvenir program and food. It is now December 14. The Titans were having a miserable season and the temperature was expected to peak at 5 degrees on game day. Mike therefore decided to skip the game and took his wife to the movies, with tickets and dinner costing $50. The sunk cost associated with this decision situation is:

A) $20.

B) $50.

C) $70.

D) $107.

E) None of the other answers are correct.

A) $20.

B) $50.

C) $70.

D) $107.

E) None of the other answers are correct.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

20

Consider the following costs and decision-making situations:

I) The cost of existing inventory, in a keep vs. disposal decision.

II) The cost of special electrical wiring, in an equipment acquisition decision.

III) The salary of a supervisor who will be transferred elsewhere in the organization, in a department-closure decision.

Which of the above costs is (are) relevant to the decision situation noted?

A) I only.

B) II only.

C) III only.

D) I and II.

E) II and III.

I) The cost of existing inventory, in a keep vs. disposal decision.

II) The cost of special electrical wiring, in an equipment acquisition decision.

III) The salary of a supervisor who will be transferred elsewhere in the organization, in a department-closure decision.

Which of the above costs is (are) relevant to the decision situation noted?

A) I only.

B) II only.

C) III only.

D) I and II.

E) II and III.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

21

Flowers Company is operating at capacity and desires to add a new service to its rapidly expanding business. The service should be added as long as service revenues exceed:

A) variable costs.

B) fixed costs.

C) the sum of variable costs and fixed costs.

D) the sum of variable costs and any related opportunity costs.

E) the sum of variable costs, fixed costs, and any related opportunity costs.

A) variable costs.

B) fixed costs.

C) the sum of variable costs and fixed costs.

D) the sum of variable costs and any related opportunity costs.

E) the sum of variable costs, fixed costs, and any related opportunity costs.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

22

A factory that makes a part has significant idle capacity. The factory's opportunity cost of making this part is equal to:

A) the variable manufacturing cost per unit.

B) the fixed manufacturing cost per unit.

C) the semivariable cost per unit.

D) the total manufacturing cost per unit.

E) zero.

A) the variable manufacturing cost per unit.

B) the fixed manufacturing cost per unit.

C) the semivariable cost per unit.

D) the total manufacturing cost per unit.

E) zero.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

23

An opportunity cost may be described as:

A) a forgone benefit.

B) a historical cost.

C) a specialized type of variable cost.

D) a specialized type of fixed cost.

E) a specialized type of semivariable cost.

A) a forgone benefit.

B) a historical cost.

C) a specialized type of variable cost.

D) a specialized type of fixed cost.

E) a specialized type of semivariable cost.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

24

Mueller has been approached about providing a new service to its clients. The company will bill clients $140 per hour; the related hourly variable and fixed operating costs will be $75 and $18, respectively. If all employees are currently working at full capacity on other client matters, the per-hour opportunity cost of being unable to provide this new service is:

A) $0.

B) $47.

C) $65.

D) $93.

E) $140.

A) $0.

B) $47.

C) $65.

D) $93.

E) $140.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

25

Torrey Pines is studying whether to outsource its Human Resources (H/R) activities. Salaried professionals who earn $390,000 would be terminated; in contrast, administrative assistants who earn $120,000 would be transferred elsewhere in the organization. Miscellaneous departmental overhead (e.g., supplies, copy charges, overnight delivery) is expected to decrease by $30,000, and $25,000 of corporate overhead, previously allocated to Human Resources, would be picked up by other departments. If Torrey Pines can secure needed H/R services locally for $410,000, how much would the company benefit by outsourcing?

A) $10,000.

B) $35,000.

C) $130,000.

D) $155,000.

E) Nothing, as it would be cheaper to keep the department open.

A) $10,000.

B) $35,000.

C) $130,000.

D) $155,000.

E) Nothing, as it would be cheaper to keep the department open.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following costs should be used when choosing between two decision alternatives?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following statements regarding costs and decision making is correct?

A) Fixed costs must be considered only on a per-unit basis.

B) Per-unit fixed cost amounts are valid only for make-or-buy decisions.

C) Per-unit fixed costs can be misleading because such amounts appear to behave as variable costs when, in actuality, the amounts are related to fixed expenditures.

D) Sunk costs can be misleading in make-or-buy decisions because these amounts appear to be relevant differential costs.

E) Opportunity costs should be ignored when evaluating decision alternatives.

A) Fixed costs must be considered only on a per-unit basis.

B) Per-unit fixed cost amounts are valid only for make-or-buy decisions.

C) Per-unit fixed costs can be misleading because such amounts appear to behave as variable costs when, in actuality, the amounts are related to fixed expenditures.

D) Sunk costs can be misleading in make-or-buy decisions because these amounts appear to be relevant differential costs.

E) Opportunity costs should be ignored when evaluating decision alternatives.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

28

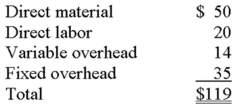

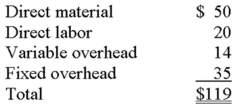

Gorski Corporation manufactures parts that are used in the production of washers and dryers. The following costs are associated with part no. 65: The company received a special-order inquiry from an appliance manufacturer in Spain for 15,000 units of part no. 65. Only $3 of fixed manufacturing will be incurred on the order, and the variable selling costs per unit will amount to only $5. Since Gorski has excess capacity, the minimum price that Gorski should charge the Spanish manufacturer is:

A) $96.

B) $99.

C) $105.

D) $108.

E) None of the other answers are correct.

A) $96.

B) $99.

C) $105.

D) $108.

E) None of the other answers are correct.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

29

The term "outsourcing" is most closely associated with:

A) special-order decisions.

B) make-or-buy decisions.

C) equipment replacement decisions.

D) decisions to process joint products beyond the split-off point.

E) decisions that involve limited resources.

A) special-order decisions.

B) make-or-buy decisions.

C) equipment replacement decisions.

D) decisions to process joint products beyond the split-off point.

E) decisions that involve limited resources.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

30

Maddox, a division of Stanley Enterprises, currently performs computer services for various departments of the firm. One of the services has created a number of operating problems, and management is exploring whether to outsource the service to a consultant. Traceable variable and fixed operating costs total $80,000 and $25,000, respectively, in addition to $18,000 of corporate administrative overhead allocated from Stanley. If Maddox were to use the outside consultant, fixed operating costs would be reduced by 70%. The irrelevant costs in Maddox's outsourcing decision total:

A) $17,500.

B) $18,000.

C) $25,000.

D) $25,500.

E) None of the other answers are correct.

A) $17,500.

B) $18,000.

C) $25,000.

D) $25,500.

E) None of the other answers are correct.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

31

Song, a division of Carolina Enterprises, currently makes 100,000 units of a product that has created a number of manufacturing problems. Song's costs follow. If Song were to discontinue production, fixed manufacturing costs would be reduced by 70%. The relevant cost of deciding whether the division should purchase the product from an outside supplier is:

A) $540,000.

B) $594,000.

C) $666,000.

D) $720,000.

E) $726,000.

A) $540,000.

B) $594,000.

C) $666,000.

D) $720,000.

E) $726,000.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

32

A special order generally should be accepted if:

A) its revenue exceeds allocated fixed costs, regardless of the variable costs associated with the order.

B) excess capacity exists and the revenue exceeds all variable costs associated with the order.

C) excess capacity exists and the revenue exceeds allocated fixed costs.

D) the revenue exceeds total costs, regardless of available capacity.

E) the revenue exceeds variable costs, regardless of available capacity.

A) its revenue exceeds allocated fixed costs, regardless of the variable costs associated with the order.

B) excess capacity exists and the revenue exceeds all variable costs associated with the order.

C) excess capacity exists and the revenue exceeds allocated fixed costs.

D) the revenue exceeds total costs, regardless of available capacity.

E) the revenue exceeds variable costs, regardless of available capacity.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

33

Susan is contemplating a job offer with an advertising agency where she will make $54,000 in her first year of employment. Alternatively, Susan can begin to work in her father's business where she will earn an annual salary of $38,000. If Susan decides to work with her father, the opportunity cost would be:

A) $0.

B) $38,000.

C) $54,000.

D) $92,000.

E) irrelevant in deciding which job offer to accept.

A) $0.

B) $38,000.

C) $54,000.

D) $92,000.

E) irrelevant in deciding which job offer to accept.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

34

Two months ago, Victory Corporation purchased 4,500 pounds of Hydrol, paying $15,300. The demand for this product has been very strong since the acquisition, with the market price jumping to $4.05 per pound. (Victory can buy or sell Hydrol at this price.) The company recently received a special-order inquiry, one that would require the use of 4,200 pounds of Hydrol. Which of the following is (are) relevant in deciding whether to accept the special order?

A) The 300-pound remaining inventory of Hydrol.

B) The $4.05 market price.

C) The $3.40 purchase price.

D) 4,500 pounds of Hydrol.

E) Two or more of the other factors are relevant.

A) The 300-pound remaining inventory of Hydrol.

B) The $4.05 market price.

C) The $3.40 purchase price.

D) 4,500 pounds of Hydrol.

E) Two or more of the other factors are relevant.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

35

S'Round Sound, Inc. reported the following results from the sale of 24,000 units of IT-54: Rhythm Company has offered to purchase 3,000 IT-54s at $16 each. Sound has available capacity, and the president is in favor of accepting the order. She feels it would be profitable because no variable selling costs will be incurred. The plant manager is opposed because the "full cost" of production is $17. Which of the following correctly notes the change in income if the special order is accepted?

A) $3,000 decrease.

B) $3,000 increase.

C) $12,000 decrease.

D) $12,000 increase.

E) None of the other answers are correct.

A) $3,000 decrease.

B) $3,000 increase.

C) $12,000 decrease.

D) $12,000 increase.

E) None of the other answers are correct.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

36

Snyder, Inc., which has excess capacity, received a special order for 4,000 units at a price of $15 per unit. Currently, production and sales are anticipated to be 10,000 units without considering the special order. Budget information for the current year follows. Cost of goods sold includes $30,000 of fixed manufacturing cost. If the special order is accepted, the company's income will:

A) increase by $2,000.

B) decrease by $2,000.

C) increase by $14,000.

D) decrease by $14,000.

E) None of the other answers are correct.

A) increase by $2,000.

B) decrease by $2,000.

C) increase by $14,000.

D) decrease by $14,000.

E) None of the other answers are correct.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

37

The term "opportunity cost" is best defined as:

A) the amount of money paid for an item.

B) the amount of money paid for an item, taking inflation into account.

C) the amount of money paid for an item, taking possible discounts into account.

D) the benefit associated with a rejected alternative when making a choice.

E) an irrelevant decision factor.

A) the amount of money paid for an item.

B) the amount of money paid for an item, taking inflation into account.

C) the amount of money paid for an item, taking possible discounts into account.

D) the benefit associated with a rejected alternative when making a choice.

E) an irrelevant decision factor.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

38

In early July, Jim Lopez purchased a $70 ticket to the December 15 game of the Chicago Titans. (The Titans belong to the Midwest Football League and play their games outdoors on the shore of Lake Michigan.) Parking for the game was expected to cost approximately $22, and Lopez would probably spend another $15 for a souvenir program and food. It is now December 14. The Titans were having a miserable season and the temperature was expected to peak at 5 degrees on game day. Jim is thinking about skipping the game and taking his wife to the movies and dinner, at a cost of $50. The amount of sunk cost that should influence Jim's decision to spend some time with his wife is:

A) $0.

B) $20.

C) $50.

D) $70.

E) None of the other answers are correct.

A) $0.

B) $20.

C) $50.

D) $70.

E) None of the other answers are correct.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

39

CompuTronics, a manufacturer of computer peripherals, has excess capacity. The company's Utah plant has the following per-unit cost structure for item no. 89: The traceable fixed administrative cost was incurred at the Utah plant; in contrast, the allocated administrative cost represents a "fair share" of CompuTronics' corporate overhead. Utah has been presented with a special order of 5,000 units of item no. 89 on which no selling cost will be incurred. The proper relevant cost in deciding whether to accept this special order would be:

A) $40.

B) $59.

C) $61.

D) $80.

E) None of the other answers are correct.

A) $40.

B) $59.

C) $61.

D) $80.

E) None of the other answers are correct.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

40

Tri-County, Inc. is studying whether to expand operations by adding a new product line. Which of the following choices correctly denotes the costs that should be considered in this decision?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

41

Product costs incurred after the split-off point in a joint processing environment are called:

A) separable processing costs.

B) joint product costs.

C) non-relevant costs.

D) scrap costs.

E) spoilage costs.

A) separable processing costs.

B) joint product costs.

C) non-relevant costs.

D) scrap costs.

E) spoilage costs.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

42

Lido manufactures A and B from a joint process (cost = $80,000). Ten thousand pounds of B can be sold at split-off for $15 per pound or processed further at an additional cost of $20,000 and later sold for $16. If Lido decides to process B beyond the split-off point, operating income will:

A) increase by $10,000.

B) increase by $20,000.

C) decrease by $10,000.

D) decrease by $20,000.

E) decrease by $58,000.

A) increase by $10,000.

B) increase by $20,000.

C) decrease by $10,000.

D) decrease by $20,000.

E) decrease by $58,000.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

43

Ortega Interiors provides design services to residential and commercial clients. The residential services produce a contribution margin of $450,000 and have traceable fixed operating costs of $480,000. Management is studying whether to drop the residential operation. If closed, the fixed operating costs will fall by $370,000 and Ortega's income will:

A) increase by $30,000.

B) increase by $80,000.

C) increase by $340,000.

D) decrease by $80,000.

E) decrease by $340,000.

A) increase by $30,000.

B) increase by $80,000.

C) increase by $340,000.

D) decrease by $80,000.

E) decrease by $340,000.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

44

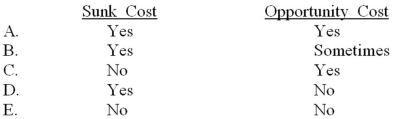

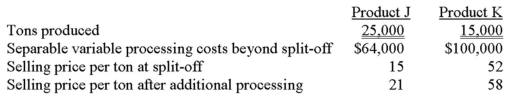

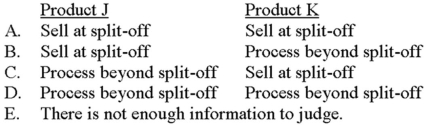

Indiana Corporation has $200,000 of joint processing costs and is studying whether to process J and K beyond the split-off point. Information about J and K follows.  If Indiana desires to maximize total company income, what should the firm do with regard to Products J and K?

If Indiana desires to maximize total company income, what should the firm do with regard to Products J and K?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

If Indiana desires to maximize total company income, what should the firm do with regard to Products J and K?

If Indiana desires to maximize total company income, what should the firm do with regard to Products J and K?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

45

Lido manufactures A and B from a joint process (cost = $80,000). Five thousand pounds of A can be sold at split-off for $20 per pound or processed further at an additional cost of $20,000 and then sold for $25 per pound. If Lido decides to process A beyond the split-off point, operating income will:

A) increase by $10,000.

B) increase by $20,000.

C) decrease by $10,000.

D) decrease by $20,000.

E) increase by $5,000.

A) increase by $10,000.

B) increase by $20,000.

C) decrease by $10,000.

D) decrease by $20,000.

E) increase by $5,000.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

46

Laredo manufactures Nuts and Bolts from a joint process (cost = $80,000). Five thousand pounds of Nuts can be sold at split-off for $20 per pound; ten thousand pounds of Bolts can be sold at split-off for $15 per pound. For product costing purposes Laredo allocates joint costs using the relative sales value method.

The amount of joint cost allocated to Nuts would be:

A) $32,000.

B) $40,000.

C) $48,000.

D) $60,000.

E) $80,000.

The amount of joint cost allocated to Nuts would be:

A) $32,000.

B) $40,000.

C) $48,000.

D) $60,000.

E) $80,000.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

47

A firm that decides to emphasize those goods with the highest contribution margin per unit may have made an incorrect decision when the company:

A) is highly automated.

B) has excess capacity.

C) has capacity constraints in the form of limited resources.

D) has a high fixed-cost structure.

E) has a high level of sunk costs.

A) is highly automated.

B) has excess capacity.

C) has capacity constraints in the form of limited resources.

D) has a high fixed-cost structure.

E) has a high level of sunk costs.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

48

Product costs incurred before the split-off point in a joint processing environment are called:

A) separable processing costs.

B) joint product costs.

C) non-relevant costs.

D) scrap costs.

E) spoilage costs.

A) separable processing costs.

B) joint product costs.

C) non-relevant costs.

D) scrap costs.

E) spoilage costs.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

49

When deciding whether to sell a product at the split-off point or process it further, joint costs are not usually relevant because:

A) such amounts do not help to increase sales revenue.

B) such amounts only slightly increase a company's sales margin.

C) such amounts are sunk and do not change with the decision.

D) the sales revenue does not decrease to the extent that it should, if compared with separable processing.

E) such amounts reflect opportunity costs.

A) such amounts do not help to increase sales revenue.

B) such amounts only slightly increase a company's sales margin.

C) such amounts are sunk and do not change with the decision.

D) the sales revenue does not decrease to the extent that it should, if compared with separable processing.

E) such amounts reflect opportunity costs.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

50

Occular is studying whether to drop a product because of ongoing losses. Costs that would be relevant in this situation would include variable manufacturing costs as well as:

A) factory depreciation.

B) avoidable fixed costs.

C) unavoidable fixed costs.

D) allocated corporate administrative costs.

E) general corporate advertising.

A) factory depreciation.

B) avoidable fixed costs.

C) unavoidable fixed costs.

D) allocated corporate administrative costs.

E) general corporate advertising.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

51

HiTech manufactures two products: Regular and Super. The results of operations for 20x1 follow.  Fixed manufacturing costs included in cost of goods sold amount to $3 per unit for Regular and $20 per unit for Super. Variable selling expenses are $4 per unit for Regular and $20 per unit for Super; remaining selling amounts are fixed.

Fixed manufacturing costs included in cost of goods sold amount to $3 per unit for Regular and $20 per unit for Super. Variable selling expenses are $4 per unit for Regular and $20 per unit for Super; remaining selling amounts are fixed.

Disregard the information in the previous question. If HiTech eliminates Regular and uses the available capacity to produce and sell an additional 1,500 units of Super, what would be the impact on operating income?

A) $28,000 increase

B) $45,000 increase

C) $55,000 increase

D) $85,000 increase

E) None of the other answers are correct.

Fixed manufacturing costs included in cost of goods sold amount to $3 per unit for Regular and $20 per unit for Super. Variable selling expenses are $4 per unit for Regular and $20 per unit for Super; remaining selling amounts are fixed.

Fixed manufacturing costs included in cost of goods sold amount to $3 per unit for Regular and $20 per unit for Super. Variable selling expenses are $4 per unit for Regular and $20 per unit for Super; remaining selling amounts are fixed.Disregard the information in the previous question. If HiTech eliminates Regular and uses the available capacity to produce and sell an additional 1,500 units of Super, what would be the impact on operating income?

A) $28,000 increase

B) $45,000 increase

C) $55,000 increase

D) $85,000 increase

E) None of the other answers are correct.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

52

The Shoe Department at the El Paso Department Store is being considered for closure. The following information relates to shoe activity: If 70% of the fixed operating costs are avoidable, should the Shoe Department be closed?

A) Yes, El Paso would be better off by $23,000.

B) Yes, El Paso would be better off by $50,000.

C) No, El Paso would be worse off by $13,000.

D) No, El Paso would be worse off by $40,000.

E) None of the answers are correct.

A) Yes, El Paso would be better off by $23,000.

B) Yes, El Paso would be better off by $50,000.

C) No, El Paso would be worse off by $13,000.

D) No, El Paso would be worse off by $40,000.

E) None of the answers are correct.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

53

HiTech manufactures two products: Regular and Super. The results of operations for 20x1 follow.  Fixed manufacturing costs included in cost of goods sold amount to $3 per unit for Regular and $20 per unit for Super. Variable selling expenses are $4 per unit for Regular and $20 per unit for Super; remaining selling amounts are fixed.

Fixed manufacturing costs included in cost of goods sold amount to $3 per unit for Regular and $20 per unit for Super. Variable selling expenses are $4 per unit for Regular and $20 per unit for Super; remaining selling amounts are fixed.

HiTech wants to drop the Regular product line. If the line is dropped, company-wide fixed manufacturing costs would fall by 10% because there is no alternative use of the facilities. What would be the impact on operating income if Regular is discontinued?

A) $0.

B) $10,400 increase.

C) $20,000 increase.

D) $39,600 decrease.

E) None of the other answers are correct.

Fixed manufacturing costs included in cost of goods sold amount to $3 per unit for Regular and $20 per unit for Super. Variable selling expenses are $4 per unit for Regular and $20 per unit for Super; remaining selling amounts are fixed.

Fixed manufacturing costs included in cost of goods sold amount to $3 per unit for Regular and $20 per unit for Super. Variable selling expenses are $4 per unit for Regular and $20 per unit for Super; remaining selling amounts are fixed.HiTech wants to drop the Regular product line. If the line is dropped, company-wide fixed manufacturing costs would fall by 10% because there is no alternative use of the facilities. What would be the impact on operating income if Regular is discontinued?

A) $0.

B) $10,400 increase.

C) $20,000 increase.

D) $39,600 decrease.

E) None of the other answers are correct.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

54

A company that is operating at full capacity should emphasize those products and services that have the:

A) lowest total per-unit costs.

B) highest contribution margin per unit.

C) highest contribution margin per unit of scarce resource.

D) highest operating income.

E) highest sales volume.

A) lowest total per-unit costs.

B) highest contribution margin per unit.

C) highest contribution margin per unit of scarce resource.

D) highest operating income.

E) highest sales volume.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

55

An architecture firm currently offers services that appeal to both individuals and commercial clients. If the firm decides to discontinue services to individuals because of ongoing losses, which of the following costs could the company likely avoid?

A) General corporate overhead that was allocated to individual clients.

B) Building depreciation.

C) Insurance.

D) Variable operating costs.

E) Monthly installment payments on general-purpose, computer drafting equipment.

A) General corporate overhead that was allocated to individual clients.

B) Building depreciation.

C) Insurance.

D) Variable operating costs.

E) Monthly installment payments on general-purpose, computer drafting equipment.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

56

Laredo manufactures Nuts and Bolts from a joint process (cost = $80,000). Five thousand pounds of Nuts can be sold at split-off for $20 per pound; ten thousand pounds of Bolts can be sold at split-off for $15 per pound. For product costing purposes Laredo allocates joint costs using the relative sales value method.

The amount of joint cost allocated to Bolts would be:

A) $32,000.

B) $40,000.

C) $48,000.

D) $60,000.

E) $80,000.

The amount of joint cost allocated to Bolts would be:

A) $32,000.

B) $40,000.

C) $48,000.

D) $60,000.

E) $80,000.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

57

Coastal Airlines has a significant presence at the San Jose International Airport and therefore operates the Emerald Club, which is across from gate 36 in terminal 1. The Emerald Club provides food and business services for the company's frequent flyers. Consider the following selected costs of Club operation:

1) Receptionist and supervisory salaries

2) Catering

3) Terminal depreciation (based on square footage)

4) Airport fees (computed as a percentage of club revenue)

5) Allocated Coastal administrative overhead

Management is exploring whether to close the club and expand the seating area for gate 36. Which of the preceding expenses would the airline classify as unavoidable?

A) 3.

B) 4.

C) 5.

D) 3, 5.

E) None of the answers are correct.

1) Receptionist and supervisory salaries

2) Catering

3) Terminal depreciation (based on square footage)

4) Airport fees (computed as a percentage of club revenue)

5) Allocated Coastal administrative overhead

Management is exploring whether to close the club and expand the seating area for gate 36. Which of the preceding expenses would the airline classify as unavoidable?

A) 3.

B) 4.

C) 5.

D) 3, 5.

E) None of the answers are correct.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

58

Summers Corporation is composed of five divisions. Each division is allocated a share of Summers's overhead to make divisional managers aware of the cost of running the corporate headquarters. The following information relates to the Metro Division: If the Metro Division is closed, 100% of the traceable fixed operating costs can be eliminated. What will be the impact on Summers's overall profitability if the Metro Division is closed?

A) Decrease by $200,000.

B) Decrease by $500,000.

C) Decrease by $2,100,000.

D) Decrease by $2,400,000.

E) None of the answers are correct.

A) Decrease by $200,000.

B) Decrease by $500,000.

C) Decrease by $2,100,000.

D) Decrease by $2,400,000.

E) None of the answers are correct.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

59

Laredo manufactures Nuts and Bolts from a joint process (cost = $80,000). Five thousand pounds of Nuts can be sold at split-off for $20 per pound; ten thousand pounds of Bolts can be sold at split-off for $15 per pound. For product costing purposes Laredo allocates joint costs using the relative sales value method.

The amount of joint cost allocated to Nuts and Bolts, respectively, would be:

A) $32,000 and $40,000.

B) $32,000 and $48,000.

C) $48,000 and $32,000.

D) $40,000 and $32,000.

E) $40,000 and $40,000.

The amount of joint cost allocated to Nuts and Bolts, respectively, would be:

A) $32,000 and $40,000.

B) $32,000 and $48,000.

C) $48,000 and $32,000.

D) $40,000 and $32,000.

E) $40,000 and $40,000.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

60

Fester Company is considering whether to sell Retox at the split-off point or subject it to further processing and produce a more refined product known as Retox-F. Consider the following items:

I) The selling price of Retox-F.

II) The joint processing cost of Retox.

III) The separable cost of producing Retox-F.

Which of the above items is (are) relevant to Foster's decision to process Retox into Retox-F?

A) I only

B) II only

C) III only

D) I and II

E) I and III

I) The selling price of Retox-F.

II) The joint processing cost of Retox.

III) The separable cost of producing Retox-F.

Which of the above items is (are) relevant to Foster's decision to process Retox into Retox-F?

A) I only

B) II only

C) III only

D) I and II

E) I and III

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

61

Johnstone Company makes two products: Carpet Kleen and Floor Deodorizer. Operating information from the previous year follows. Fixed costs of $20,000 per year are presently allocated equally between both products. If the product mix were to change, total fixed costs would remain the same.

Assuming there is unlimited demand for both products and Johnson has 10,000 machine hours available, how many units of each product should be produced and sold?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

Assuming there is unlimited demand for both products and Johnson has 10,000 machine hours available, how many units of each product should be produced and sold?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

62

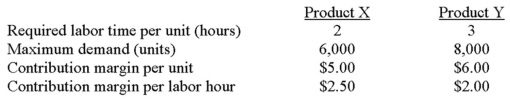

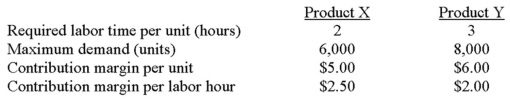

Smythe Manufacturing has 27,000 labor hours available for producing X and Y. Consider the following information: If Smythe follows proper managerial accounting practices, how many units of Product Y should it produce?

A) 8,000.

B) 4,500.

C) 6,000.

D) 5,000.

E) 1,500.

A) 8,000.

B) 4,500.

C) 6,000.

D) 5,000.

E) 1,500.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

63

Phanatix, Inc. produces a variety of products that carry the logos of teams in the Southern Football League (SFL). The company recently paid the league $85,000 for the rights to market a popular player jersey and immediately began production. The following information is available:

Number of jerseys manufactured: 25,000

Cost of jerseys manufactured: $625,000

Amount of manufacturing costs paid to-date: $410,000

Number of jerseys sold to-date: 0

Estimated future marketing costs: $330,000

Anticipated selling price per jersey: $42

The SFL is about to file a lawsuit to stop jersey sales and is demanding another $50,000 from Phanatix for the manufacturing rights. Conversations with Phanatix's attorneys indicate that the league has a strong case and is likely to win the suit. If this situation arises, Phanatix will be unable to recover any amounts paid to the SFL.

Required:

Phanatix's sales department anticipates very strong demand and a sellout of all jerseys manufactured.

A. Determine the overall profitability of the jersey product line if Phanatix settles the disagreement with the SFL and the anticipated sellout occurs.

B. Should the company pay the additional $50,000 demanded by the league or should the jersey program be dropped? Show computations to support your answer.

Number of jerseys manufactured: 25,000

Cost of jerseys manufactured: $625,000

Amount of manufacturing costs paid to-date: $410,000

Number of jerseys sold to-date: 0

Estimated future marketing costs: $330,000

Anticipated selling price per jersey: $42

The SFL is about to file a lawsuit to stop jersey sales and is demanding another $50,000 from Phanatix for the manufacturing rights. Conversations with Phanatix's attorneys indicate that the league has a strong case and is likely to win the suit. If this situation arises, Phanatix will be unable to recover any amounts paid to the SFL.

Required:

Phanatix's sales department anticipates very strong demand and a sellout of all jerseys manufactured.

A. Determine the overall profitability of the jersey product line if Phanatix settles the disagreement with the SFL and the anticipated sellout occurs.

B. Should the company pay the additional $50,000 demanded by the league or should the jersey program be dropped? Show computations to support your answer.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

64

Smythe Manufacturing has 27,000 labor hours available for producing X and Y. Consider the following information: If Smythe follows proper managerial accounting practices, which of the following production schedules should the company set?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

65

Buchnell Manufacturing has 31,000 labor hours available for producing M and N. Consider the following information: If Buchnell follows proper managerial accounting practices in terms of setting a production schedule, how much contribution margin would the company expect to generate?

A) $31,450.

B) $63,100.

C) $66,700.

D) $78,100.

E) None of the other answers are correct.

A) $31,450.

B) $63,100.

C) $66,700.

D) $78,100.

E) None of the other answers are correct.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

66

Prudence Corporation manufactures two products: X and Y. The company has 4,000 hours of machine time available and can sell no more than 800 units of product X. Other pertinent data follow. Which of the following is Prudence's objective function?

A) Maximize Z = 2X + 3Y.

B) Maximize Z = 8X + 19Y.

C) Maximize Z = 5X + 14Y.

D) Maximize Z = 1.50X + 7.75Y.

E) Minimize Z = 6.50X + 11.25Y.

A) Maximize Z = 2X + 3Y.

B) Maximize Z = 8X + 19Y.

C) Maximize Z = 5X + 14Y.

D) Maximize Z = 1.50X + 7.75Y.

E) Minimize Z = 6.50X + 11.25Y.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

67

A constraint function in a linear-programming problem might focus on:

A) sales dollars.

B) labor hours.

C) variable costs.

D) fixed costs.

E) qualitative factors.

A) sales dollars.

B) labor hours.

C) variable costs.

D) fixed costs.

E) qualitative factors.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

68

When using a graphical solution to a linear programming problem, the optimal solution will lie in an area commonly known as the:

A) region of maximization.

B) feasible region.

C) objective region.

D) constraint region.

E) curvilinear region.

A) region of maximization.

B) feasible region.

C) objective region.

D) constraint region.

E) curvilinear region.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following characteristics would best explain the use of probabilities and expected values in a decision analysis?

A) Limited resources.

B) Uncertainty.

C) Inflation.

D) Multiple products and services.

E) Production bottlenecks.

A) Limited resources.

B) Uncertainty.

C) Inflation.

D) Multiple products and services.

E) Production bottlenecks.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

70

Wright Enterprises, which produces various goods, has limited processing hours at its manufacturing plant. The following data apply to product no. 607:

Sales price per unit: $9.60

Variable cost per unit: $6.20

Process time per unit: 4 hours

Management is now studying whether to devote the firm's limited hours to product no. 607 or to other products. What key dollar amount should management focus on when determining no. 607's "value" to the firm and deciding the best course of action to follow?

A) $0.85.

B) $2.40.

C) $3.40.

D) $6.20.

E) $9.60.

Sales price per unit: $9.60

Variable cost per unit: $6.20

Process time per unit: 4 hours

Management is now studying whether to devote the firm's limited hours to product no. 607 or to other products. What key dollar amount should management focus on when determining no. 607's "value" to the firm and deciding the best course of action to follow?

A) $0.85.

B) $2.40.

C) $3.40.

D) $6.20.

E) $9.60.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

71

Waltherboro Company recently discontinued the manufacture of product J15. The standard costs for this product were:

There are 800 units of this product in finished-goods inventory. The units are technologically obsolete, and the following alternatives are being considered:

1. Dispose of as scrap. The proceeds from the sale will equal the cost of transportation to the disposal site.

2. Sell to an exporter for sale in a developing country. The sales price to the exporter would be $12 per unit.

3. Remanufacture the products to convert them into model J16, a model that normally sells for $200. The additional cost to convert the J15 units would be $45; the standard cost to manufacture J16 is $125. Presently, there is sufficient capacity to manufacture product J16 directly or to do the necessary conversion work on J15.

Required:

A. Determine the current carrying value of the J15 inventory.

B. Evaluate each alternative and determine the financial benefit to Waltherboro if the alternative is pursued.

There are 800 units of this product in finished-goods inventory. The units are technologically obsolete, and the following alternatives are being considered:

1. Dispose of as scrap. The proceeds from the sale will equal the cost of transportation to the disposal site.

2. Sell to an exporter for sale in a developing country. The sales price to the exporter would be $12 per unit.

3. Remanufacture the products to convert them into model J16, a model that normally sells for $200. The additional cost to convert the J15 units would be $45; the standard cost to manufacture J16 is $125. Presently, there is sufficient capacity to manufacture product J16 directly or to do the necessary conversion work on J15.

Required:

A. Determine the current carrying value of the J15 inventory.

B. Evaluate each alternative and determine the financial benefit to Waltherboro if the alternative is pursued.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

72

Johnstone Company makes two products: Carpet Kleen and Floor Deodorizer. Operating information from the previous year follows. Fixed costs of $20,000 per year are presently allocated equally between both products. If the product mix were to change, total fixed costs would remain the same.

The contribution margin per machine hour for Floor Deodorizer is:

A) $0.25.

B) $2.00.

C) $4.00.

D) $5.00.

E) $20.00.

The contribution margin per machine hour for Floor Deodorizer is:

A) $0.25.

B) $2.00.

C) $4.00.

D) $5.00.

E) $20.00.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

73

Consider the following statements about relevant costing and activity-based costing:

I) The concept of relevant costs and benefits cannot be used in conjunction with an activity-based costing system.

II) The concept of relevant costs and benefits must be modified for use with an activity-based costing system.

III) Generally speaking, the decision maker can better associate relevant costs with the activities that drive them under an activity-based costing system than under a conventional product-costing system.

Which of the above statements is (are) true?

A) I only.

B) II only.

C) III only.

D) I and II.

E) II and III.

I) The concept of relevant costs and benefits cannot be used in conjunction with an activity-based costing system.

II) The concept of relevant costs and benefits must be modified for use with an activity-based costing system.

III) Generally speaking, the decision maker can better associate relevant costs with the activities that drive them under an activity-based costing system than under a conventional product-costing system.

Which of the above statements is (are) true?

A) I only.

B) II only.

C) III only.

D) I and II.

E) II and III.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

74

A technique that is useful in exploring what would happen if a key decision prediction or assumption proved wrong is termed:

A) sensitivity analysis.

B) uncertainty analysis.

C) project analysis.

D) linear programming.

E) the theory of constraints.

A) sensitivity analysis.

B) uncertainty analysis.

C) project analysis.

D) linear programming.

E) the theory of constraints.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

75

Smythe Manufacturing has 27,000 labor hours available for producing X and Y. Consider the following information:  If Smythe follows proper managerial accounting practices, how many units of Product X should it produce?

If Smythe follows proper managerial accounting practices, how many units of Product X should it produce?

A) 5,000.

B) 1,500.

C) 8,000.

D) 4,500.

E) 6,000.

If Smythe follows proper managerial accounting practices, how many units of Product X should it produce?

If Smythe follows proper managerial accounting practices, how many units of Product X should it produce?A) 5,000.

B) 1,500.

C) 8,000.

D) 4,500.

E) 6,000.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

76

Cornwall Corporation manufactures faucets. Several weeks ago, the company received a special-order inquiry from Yates, Inc. Yates desires to market a faucet similar to Cornwall's model no. 55 and has offered to purchase 3,000 units. The following data are available:

• Cost data for Cornwall's model no. 55 faucet: direct materials, $45; direct labor, $30 (2 hours at $15 per hour); and manufacturing overhead, $70 (2 hours at $35 per hour).

• The normal selling price of model no. 55 is $180; however, Yates has offered Cornwall only $115 because of the large quantity it is willing to purchase.

• Yates requires a design modification that will allow a $4 reduction in direct-material cost.

• Cornwall's production supervisor notes that the company will incur $8,700 in additional set-up costs and will have to purchase a $3,300 special device to manufacture these units. The device will be discarded once the special order is completed.

• Total manufacturing overhead costs are applied to production at the rate of $35 per labor hour. This figure is based, in part, on budgeted yearly fixed overhead of $624,000 and planned production activity of 24,000 labor hours.

• Cornwall will allocate $5,000 of existing fixed administrative costs to the order as "¼part of the cost of doing business."

Required:

A. One of Cornwall's staff accountants wants to reject the special order because "financially, it's a loser." Do you agree with this conclusion if Cornwall currently has excess capacity? Show calculations to support your answer.

B. If Cornwall currently has no excess capacity, should the order be rejected from a financial perspective? Briefly explain.

C. Assume that Cornwall currently has no excess capacity. Would outsourcing be an option that Cornwall could consider if management truly wanted to do business with Yates? Briefly discuss, citing several key considerations for Cornwall in your answer.

• Cost data for Cornwall's model no. 55 faucet: direct materials, $45; direct labor, $30 (2 hours at $15 per hour); and manufacturing overhead, $70 (2 hours at $35 per hour).

• The normal selling price of model no. 55 is $180; however, Yates has offered Cornwall only $115 because of the large quantity it is willing to purchase.

• Yates requires a design modification that will allow a $4 reduction in direct-material cost.

• Cornwall's production supervisor notes that the company will incur $8,700 in additional set-up costs and will have to purchase a $3,300 special device to manufacture these units. The device will be discarded once the special order is completed.

• Total manufacturing overhead costs are applied to production at the rate of $35 per labor hour. This figure is based, in part, on budgeted yearly fixed overhead of $624,000 and planned production activity of 24,000 labor hours.

• Cornwall will allocate $5,000 of existing fixed administrative costs to the order as "¼part of the cost of doing business."

Required:

A. One of Cornwall's staff accountants wants to reject the special order because "financially, it's a loser." Do you agree with this conclusion if Cornwall currently has excess capacity? Show calculations to support your answer.

B. If Cornwall currently has no excess capacity, should the order be rejected from a financial perspective? Briefly explain.

C. Assume that Cornwall currently has no excess capacity. Would outsourcing be an option that Cornwall could consider if management truly wanted to do business with Yates? Briefly discuss, citing several key considerations for Cornwall in your answer.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

77

St. Joseph Hospital has been hit with a number of complaints about its food service from patients, employees, and cafeteria customers. These complaints, coupled with a very tight local labor market, have prompted the organization to contact Nationwide Institutional Food Service (NIFS) about the possibility of an outsourcing arrangement.

The hospital's business office has provided the following information for food service for the year just ended: food costs, $890,000; labor, $85,000; variable overhead, $35,000; allocated fixed overhead, $60,000; and cafeteria net income, $80,000.

Conversations with NIFS personnel revealed the following information:

• NIFS will charge St. Joseph Hospital $14 per day for each patient served. Note: This figure has been "marked up" by NIFS to reflect the firm's cost of operating the hospital cafeteria.

• St. Joseph's 250-bed facility operates throughout the year and typically has an average occupancy rate of 70%.

• Labor is the primary driver for variable overhead. If an outsourcing agreement is reached, hospital labor costs will drop by 90%. NIFS plans to use St. Joseph facilities for meal preparation.

• Cafeteria net income is expected to increase by 15% because NIFS will offer an improved menu selection.

Required:

A. What is meant by the term "outsourcing"?

B. Should St. Joseph outsource its food-service operation to NIFS?

C. What factors, other than dollars, should St. Joseph consider before making the final decision?

The hospital's business office has provided the following information for food service for the year just ended: food costs, $890,000; labor, $85,000; variable overhead, $35,000; allocated fixed overhead, $60,000; and cafeteria net income, $80,000.

Conversations with NIFS personnel revealed the following information:

• NIFS will charge St. Joseph Hospital $14 per day for each patient served. Note: This figure has been "marked up" by NIFS to reflect the firm's cost of operating the hospital cafeteria.

• St. Joseph's 250-bed facility operates throughout the year and typically has an average occupancy rate of 70%.

• Labor is the primary driver for variable overhead. If an outsourcing agreement is reached, hospital labor costs will drop by 90%. NIFS plans to use St. Joseph facilities for meal preparation.

• Cafeteria net income is expected to increase by 15% because NIFS will offer an improved menu selection.

Required:

A. What is meant by the term "outsourcing"?

B. Should St. Joseph outsource its food-service operation to NIFS?

C. What factors, other than dollars, should St. Joseph consider before making the final decision?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

78

Linear programming would be used by decision makers when there are:

A) limited resources for labor.

B) scarce resources for machine hours.

C) scarce resources for both labor and machine hours.

D) multiple scarce resources.

E) limited resources for material.

A) limited resources for labor.

B) scarce resources for machine hours.

C) scarce resources for both labor and machine hours.

D) multiple scarce resources.

E) limited resources for material.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

79

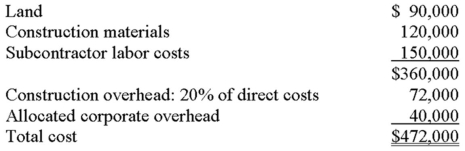

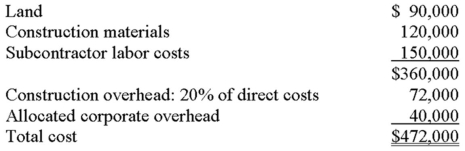

George Jettson builds custom homes in Cincinnati. Jettson was approached not too long ago by a client about a potential project, and he submitted a bid of $590,000, derived as follows:

Jettson adds a 25% profit margin to all jobs, computed on the basis of total cost. In this client's case the profit margin amounted to $118,000 ($472,000 × 25%), producing a bid price of $590,000. Assume that 60% of construction overhead is fixed.

Required:

A. Suppose that business is presently very slow, and the client countered with an offer on this home of $455,000. Should Jettson accept the client's offer? Why?

B. If Jettson has more business than he can handle, how much should he be willing to accept for the home? Why?

Jettson adds a 25% profit margin to all jobs, computed on the basis of total cost. In this client's case the profit margin amounted to $118,000 ($472,000 × 25%), producing a bid price of $590,000. Assume that 60% of construction overhead is fixed.

Required:

A. Suppose that business is presently very slow, and the client countered with an offer on this home of $455,000. Should Jettson accept the client's offer? Why?

B. If Jettson has more business than he can handle, how much should he be willing to accept for the home? Why?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

80

Prudence Corporation manufactures two products: X and Y. The company has 4,000 hours of machine time available and can sell no more than 800 units of product X. Other pertinent data follow. Which of the following is a constraint function of Prudence?

A) Maximize Z = 5X + 14Y.

B) Minimize Z = 6.50X + 11.25Y.

C) X ? 800.

D) 2X ? 4,000; 3Y ? 4,000.

E) 2X + 3Y ? 4,000.

A) Maximize Z = 5X + 14Y.

B) Minimize Z = 6.50X + 11.25Y.

C) X ? 800.

D) 2X ? 4,000; 3Y ? 4,000.

E) 2X + 3Y ? 4,000.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck