Deck 11: Variance Analysis: Revenue and Cost

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/68

Play

Full screen (f)

Deck 11: Variance Analysis: Revenue and Cost

1

The International Company makes and sells only one product. There are 2 divisions, one in France and one in Newcastle.

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

French Division Cost Structure

Newcastle Division Cost Structure

- All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the French Division budgeted to sell an additional 2,000 units in July (27,000 in total), then the total budgeted selling and administrative expenses per unit sold for July is

A)£5.15.

B)£5.48.

C)£5.69.

D)£5.95.

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

French Division Cost Structure

Newcastle Division Cost Structure

- All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the French Division budgeted to sell an additional 2,000 units in July (27,000 in total), then the total budgeted selling and administrative expenses per unit sold for July is

A)£5.15.

B)£5.48.

C)£5.69.

D)£5.95.

£5.69.

2

The International Company makes and sells only one product. There are 2 divisions, one in France and one in Newcastle.

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

French Division Cost Structure

Newcastle Division Cost Structure

-

All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the French Division budgeted to sell 25,000 units in July, then the total budgeted selling and administrative expenses per unit sold for July is

A)£2.65

B)£3.28

C)£5.93

D)£5.45

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

French Division Cost Structure

Newcastle Division Cost Structure

-

All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the French Division budgeted to sell 25,000 units in July, then the total budgeted selling and administrative expenses per unit sold for July is

A)£2.65

B)£3.28

C)£5.93

D)£5.45

£5.93

3

Noskey Corporation is a merchandising firm. Information pertaining to the company's sales revenue is presented in the following table.

Management estimates that 5% of credit sales are uncollectible. Of the credit sales that are collectible, 60% are collected in the month of sale and the remainder in the month following the sale. Purchases of inventory are equal to next month's cost of goods sold. The cost of goods sold is 30% of the selling price. All purchases of inventory are on account; 25% are paid in the month of purchase, and the remainder is paid in the month following the purchase.

- Noskey Corporation's budgeted total cash payments in July for inventory purchases are

A)£405,000

B)£283,500

C)£240,000

D)£168,000

Management estimates that 5% of credit sales are uncollectible. Of the credit sales that are collectible, 60% are collected in the month of sale and the remainder in the month following the sale. Purchases of inventory are equal to next month's cost of goods sold. The cost of goods sold is 30% of the selling price. All purchases of inventory are on account; 25% are paid in the month of purchase, and the remainder is paid in the month following the purchase.

- Noskey Corporation's budgeted total cash payments in July for inventory purchases are

A)£405,000

B)£283,500

C)£240,000

D)£168,000

£283,500

4

The Kafusi Company has the following budgeted sales:

The regular pattern of collection of credit sales is 30% in the month of sale, 60% in the month following the month of sale, and the remainder in the second month following the month of sale. There are no bad debts.

- The budgeted accounts receivable balance on May 31 would be

A)£210,000

B)£212,000

C)£180,000

D)£242,000

The regular pattern of collection of credit sales is 30% in the month of sale, 60% in the month following the month of sale, and the remainder in the second month following the month of sale. There are no bad debts.

- The budgeted accounts receivable balance on May 31 would be

A)£210,000

B)£212,000

C)£180,000

D)£242,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

5

The International Company makes and sells only one product. There are 2 divisions, one in France and one in Newcastle.

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

French Division Cost Structure

Newcastle Division Cost Structure

- All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the budgeted disbursements (including depreciation) for selling and administrative expenses for November total £154,180, how many units does the Newcastle Division plan to sell in November (rounded to the nearest whole unit)

A)51,000 units.

B)31,000 units.

C)28,000 units.

D)27,800 units.

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

French Division Cost Structure

Newcastle Division Cost Structure

- All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the budgeted disbursements (including depreciation) for selling and administrative expenses for November total £154,180, how many units does the Newcastle Division plan to sell in November (rounded to the nearest whole unit)

A)51,000 units.

B)31,000 units.

C)28,000 units.

D)27,800 units.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

6

The International Company makes and sells only one product. There are 2 divisions, one in France and one in Newcastle.

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

French Division Cost Structure

Newcastle Division Cost Structure

-All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the budgeted cash disbursements for selling and administrative expenses for November total £154,180, how many units does the French Division plan to sell in November (rounded to the nearest whole unit)

A)58,181 units

B)31,766 units

C)28,333 units

D)25,000 units

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

French Division Cost Structure

Newcastle Division Cost Structure

-All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the budgeted cash disbursements for selling and administrative expenses for November total £154,180, how many units does the French Division plan to sell in November (rounded to the nearest whole unit)

A)58,181 units

B)31,766 units

C)28,333 units

D)25,000 units

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

7

The International Company makes and sells only one product. There are 2 divisions, one in France and one in Newcastle.

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

French Division Cost Structure

Newcastle Division Cost Structure

- All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the French Division budgeted to sell an additional 2,000 units in July (27,000 in total), then the total budgeted selling and administrative expenses would increase by

A)£2,000.

B)£6,200.

C)£6,000.

D)£500.

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

French Division Cost Structure

Newcastle Division Cost Structure

- All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the French Division budgeted to sell an additional 2,000 units in July (27,000 in total), then the total budgeted selling and administrative expenses would increase by

A)£2,000.

B)£6,200.

C)£6,000.

D)£500.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

8

The International Company makes and sells only one product. There are 2 divisions, one in France and one in Newcastle.

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

French Division Cost Structure

Newcastle Division Cost Structure

- All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the budgeted disbursements (including depreciation) for selling and administrative expenses for November total £154,180, how many units does the French Division plan to sell in November (rounded to the nearest whole unit)

A)18,123 units.

B)35,126 units.

C)27,238 units.

D)10,000 units.

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

French Division Cost Structure

Newcastle Division Cost Structure

- All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the budgeted disbursements (including depreciation) for selling and administrative expenses for November total £154,180, how many units does the French Division plan to sell in November (rounded to the nearest whole unit)

A)18,123 units.

B)35,126 units.

C)27,238 units.

D)10,000 units.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

9

The International Company makes and sells only one product. There are 2 divisions, one in France and one in Newcastle.

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

French Division Cost Structure

Newcastle Division Cost Structure

- All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the French Division has budgeted to sell 20,000 units in October, then the total budgeted variable selling and administrative expenses for October will be

A)£53,000

B)£46,000

C)£66,250

D)£82,000

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

French Division Cost Structure

Newcastle Division Cost Structure

- All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the French Division has budgeted to sell 20,000 units in October, then the total budgeted variable selling and administrative expenses for October will be

A)£53,000

B)£46,000

C)£66,250

D)£82,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

10

The Kafusi Company has the following budgeted sales:

The regular pattern of collection of credit sales is 30% in the month of sale, 60% in the month following the month of sale, and the remainder in the second month following the month of sale. There are no bad debts.

- The budgeted cash receipts for July would be

A)£400,000.

B)£430,000.

C)£435,000.

D)£390,000.

The regular pattern of collection of credit sales is 30% in the month of sale, 60% in the month following the month of sale, and the remainder in the second month following the month of sale. There are no bad debts.

- The budgeted cash receipts for July would be

A)£400,000.

B)£430,000.

C)£435,000.

D)£390,000.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

11

The International Company makes and sells only one product. There are 2 divisions, one in France and one in Newcastle.

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

French Division Cost Structure

Newcastle Division Cost Structure

- All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the budgeted cash disbursements for selling and administrative expenses for November total £154,180, how many units does the Newcastle Division plan to sell in November (rounded to the nearest whole unit)

A)28,481 units.

B)33,606 units.

C)28,789 units.

D)15,100 units.

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

French Division Cost Structure

Newcastle Division Cost Structure

- All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the budgeted cash disbursements for selling and administrative expenses for November total £154,180, how many units does the Newcastle Division plan to sell in November (rounded to the nearest whole unit)

A)28,481 units.

B)33,606 units.

C)28,789 units.

D)15,100 units.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

12

A continuous (or perpetual) budget

A)is prepared for a range of activity so that the budget can be adjusted for changes in activity.

B)is a plan that is updated monthly or quarterly, dropping one period and adding another.

C)is a strategic plan that does not change.

D)is used in companies that experience no change in sales.

A)is prepared for a range of activity so that the budget can be adjusted for changes in activity.

B)is a plan that is updated monthly or quarterly, dropping one period and adding another.

C)is a strategic plan that does not change.

D)is used in companies that experience no change in sales.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

13

The International Company makes and sells only one product. There are 2 divisions, one in France and one in Newcastle.

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

French Division Cost Structure

Newcastle Division Cost Structure

-All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the Newcastle Division budgeted to sell an additional 2,000 units in July (27,000 in total), then the total budgeted selling and administrative expenses per unit sold for July is

A)£5.65.

B)£5.28.

C)£5.23.

D)£5.62.

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

French Division Cost Structure

Newcastle Division Cost Structure

-All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the Newcastle Division budgeted to sell an additional 2,000 units in July (27,000 in total), then the total budgeted selling and administrative expenses per unit sold for July is

A)£5.65.

B)£5.28.

C)£5.23.

D)£5.62.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

14

The International Company makes and sells only one product. There are 2 divisions, one in France and one in Newcastle.

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

French Division Cost Structure

Newcastle Division Cost Structure

- All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the Newcastle Division has budgeted to sell 24,000 units in September, then the total budgeted fixed selling and administrative expenses for September would be

A)£69,600.

B)£58,000.

C)£70,000.

D)£68,000.

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

French Division Cost Structure

Newcastle Division Cost Structure

- All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the Newcastle Division has budgeted to sell 24,000 units in September, then the total budgeted fixed selling and administrative expenses for September would be

A)£69,600.

B)£58,000.

C)£70,000.

D)£68,000.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

15

Noskey Corporation is a merchandising firm. Information pertaining to the company's sales revenue is presented in the following table.

Management estimates that 5% of credit sales are uncollectible. Of the credit sales that are collectible, 60% are collected in the month of sale and the remainder in the month following the sale. Purchases of inventory are equal to next month's cost of goods sold. The cost of goods sold is 30% of the selling price. All purchases of inventory are on account; 25% are paid in the month of purchase, and the remainder is paid in the month following the purchase.

- Noskey Corporation's budgeted total cash receipts in August are

A)£240,000.

B)£294,000.

C)£299,400.

D)£239,400.

Management estimates that 5% of credit sales are uncollectible. Of the credit sales that are collectible, 60% are collected in the month of sale and the remainder in the month following the sale. Purchases of inventory are equal to next month's cost of goods sold. The cost of goods sold is 30% of the selling price. All purchases of inventory are on account; 25% are paid in the month of purchase, and the remainder is paid in the month following the purchase.

- Noskey Corporation's budgeted total cash receipts in August are

A)£240,000.

B)£294,000.

C)£299,400.

D)£239,400.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

16

One benefit of budgeting is that it coordinates the activities of the entire organisation

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

17

The International Company makes and sells only one product. There are 2 divisions, one in France and one in Newcastle.

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

French Division Cost Structure

Newcastle Division Cost Structure

- All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the French Division has budgeted to sell 24,000 units in September, then the total budgeted fixed selling and administrative expenses for September would be

A)£63,600

B)£55,000

C)£70,000

D)£82,000

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

French Division Cost Structure

Newcastle Division Cost Structure

- All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the French Division has budgeted to sell 24,000 units in September, then the total budgeted fixed selling and administrative expenses for September would be

A)£63,600

B)£55,000

C)£70,000

D)£82,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

18

The International Company makes and sells only one product. There are 2 divisions, one in France and one in Newcastle.

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

French Division Cost Structure

Newcastle Division Cost Structure

- All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the Newcastle Division budgeted to sell 25,000 units in July, then the total budgeted selling and administrative expenses per unit sold for July is

A)£5.82

B)£4.28

C)£3.22

D)£4.75

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

French Division Cost Structure

Newcastle Division Cost Structure

- All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the Newcastle Division budgeted to sell 25,000 units in July, then the total budgeted selling and administrative expenses per unit sold for July is

A)£5.82

B)£4.28

C)£3.22

D)£4.75

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

19

The International Company makes and sells only one product. There are 2 divisions, one in France and one in Newcastle.

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

French Division Cost Structure

Newcastle Division Cost Structure

- All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the French Division has budgeted to sell 20,000 units in October, then the total budgeted variable selling and administrative expenses for October will be

A)£58,000.

B)£56,000.

C)£61,250.

D)£62,000.

The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

French Division Cost Structure

Newcastle Division Cost Structure

- All of these expenses (except depreciation) are paid in cash in the month they are incurred. If the French Division has budgeted to sell 20,000 units in October, then the total budgeted variable selling and administrative expenses for October will be

A)£58,000.

B)£56,000.

C)£61,250.

D)£62,000.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

20

Noskey Corporation is a merchandising firm. Information pertaining to the company's sales revenue is presented in the following table.

Management estimates that 5% of credit sales are uncollectible. Of the credit sales that are collectible, 60% are collected in the month of sale and the remainder in the month following the sale. Purchases of inventory are equal to next month's cost of goods sold. The cost of goods sold is 30% of the selling price. All purchases of inventory are on account; 25% are paid in the month of purchase, and the remainder is paid in the month following the purchase.

-Noskey Corporation's budgeted cash collections in July from June credit sales are

A)£144,000.

B)£136,800.

C)£96,000.

D)£91,200.

Management estimates that 5% of credit sales are uncollectible. Of the credit sales that are collectible, 60% are collected in the month of sale and the remainder in the month following the sale. Purchases of inventory are equal to next month's cost of goods sold. The cost of goods sold is 30% of the selling price. All purchases of inventory are on account; 25% are paid in the month of purchase, and the remainder is paid in the month following the purchase.

-Noskey Corporation's budgeted cash collections in July from June credit sales are

A)£144,000.

B)£136,800.

C)£96,000.

D)£91,200.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

21

Budgeted production needs are determined by

A)adding budgeted sales in units to the desired ending inventory in units and deducting the beginning inventory in units from this total.

B)adding budgeted sales in units to the beginning inventory in units and deducting the desired ending inventory in units from this total.

C)adding budgeted sales in units to the desired ending inventory in units.

D)deducting the beginning inventory in units from budgeted sales in units.

A)adding budgeted sales in units to the desired ending inventory in units and deducting the beginning inventory in units from this total.

B)adding budgeted sales in units to the beginning inventory in units and deducting the desired ending inventory in units from this total.

C)adding budgeted sales in units to the desired ending inventory in units.

D)deducting the beginning inventory in units from budgeted sales in units.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

22

When preparing a materials purchase budget, desired ending inventory is deducted from the total needs of the period to arrive at materials to be purchased

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

23

National Telephone Company has been forced by competition to put much more emphasis on planning and controlling its costs. Accordingly, the company's controller has suggested initiating a formal budgeting process. Which of the following steps will NOT help the company gain maximum acceptance by employees of the proposed budgeting system?

A)Implementing the change quickly

B)Including in departmental responsibility reports only those items that are under the department manager's control

C)Demonstrating top management support for the budgeting program

D)Ensuring that favourable deviations of actual results from the budget, as well as unfavourable deviations, are discussed with the responsible managers

A)Implementing the change quickly

B)Including in departmental responsibility reports only those items that are under the department manager's control

C)Demonstrating top management support for the budgeting program

D)Ensuring that favourable deviations of actual results from the budget, as well as unfavourable deviations, are discussed with the responsible managers

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

24

The following data have been taken from the budget reports of Brandon Company, a merchandising company.

Forty percent of purchases are paid for in cash at the time of purchase, and 30% are paid for in each of the next two months. Purchases for the previous November and December were £150,000 per month. Employee wages are 10% of sales for the month in which the sales occur. Operating expenses are 20% of the following month's sales. (July sales are budgeted to be £220,000.) Interest payments of £20,000 are paid quarterly in January and April. Brandon's cash disbursements for the month of April would be

A)£140,000.

B)£254,000.

C)£200,000.

D)£248,000.

Forty percent of purchases are paid for in cash at the time of purchase, and 30% are paid for in each of the next two months. Purchases for the previous November and December were £150,000 per month. Employee wages are 10% of sales for the month in which the sales occur. Operating expenses are 20% of the following month's sales. (July sales are budgeted to be £220,000.) Interest payments of £20,000 are paid quarterly in January and April. Brandon's cash disbursements for the month of April would be

A)£140,000.

B)£254,000.

C)£200,000.

D)£248,000.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following is not a benefit of budgeting?

A)It reduces the need for tracking actual cost activity.

B)It sets benchmarks for evaluation performance.

C)It uncovers potential bottlenecks.

D)It formalises a manager's planning efforts.

A)It reduces the need for tracking actual cost activity.

B)It sets benchmarks for evaluation performance.

C)It uncovers potential bottlenecks.

D)It formalises a manager's planning efforts.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

26

The Adams Company, a merchandising firm, has budgeted its activity for November according to the following information:* Sales at , all for cash

* Merchandise inventory on October 31 was .

* The cash balance November 1 was .

* Selling and administrative expenses are budgeted at for November and are paid for in cash.

* Budgeted depreciation for Nowember is .

* The planned merchandise inventory on November 31 is .

* The cost of goods sold is of the selling price.

* All purchases are paid for in cash.

-

The budgeted net income for November is

A)£50,000.

B)£ 68,000.

C)£ 75,000.

D)£135,000.

* Merchandise inventory on October 31 was .

* The cash balance November 1 was .

* Selling and administrative expenses are budgeted at for November and are paid for in cash.

* Budgeted depreciation for Nowember is .

* The planned merchandise inventory on November 31 is .

* The cost of goods sold is of the selling price.

* All purchases are paid for in cash.

-

The budgeted net income for November is

A)£50,000.

B)£ 68,000.

C)£ 75,000.

D)£135,000.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

27

The company is in the process of preparing a cash budget and must determine the expected cash collections by month. To this end, the following information has been assembled:Collections on credit sales:

in month of sale

in month following sale

in second month following sale

-

Assume that the accounts receivable balance on July 1 was £75,000. Of this amount, £60,000 represented uncollected June sales and £15,000 represented uncollected May sales. Given these data, the total cash collected during July would be

A)£150,000.

B)£235,000.

C)£215,000.

D)£200,000.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

28

The Jung Corporation's production budget calls for the following number of units to be produced each quarter for next year:

Each unit of product requires three pounds of direct material. The company's policy is to begin each quarter with an inventory of direct materials equal to 30% of that quarter's direct material requirements. Budgeted direct materials purchases for the third quarter would be

A)114,600 pounds.

B)89,400 pounds.

C)38,200 pounds.

D)29,800 pounds.

Each unit of product requires three pounds of direct material. The company's policy is to begin each quarter with an inventory of direct materials equal to 30% of that quarter's direct material requirements. Budgeted direct materials purchases for the third quarter would be

A)114,600 pounds.

B)89,400 pounds.

C)38,200 pounds.

D)29,800 pounds.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

29

The company is in the process of preparing a cash budget and must determine the expected cash collections by month. To this end, the following information has been assembled:Collections on credit sales:

in month of sale

in month following sale

in second month following sale

- What is the budgeted accounts receivable balance on May 30

A)£81,000.

B)£68,000.

C)£60,000.

D)£141,000.

in month of sale

in month following sale

in second month following sale

- What is the budgeted accounts receivable balance on May 30

A)£81,000.

B)£68,000.

C)£60,000.

D)£141,000.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

30

If the expected level of activity is appreciably above or below the company's present capacity, it may be desirable to adjust fixed costs in the budget

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following represents the correct order in which the indicated budget documents for a manufacturing company would be prepared

A)Sales budget, cash budget, direct materials budget, direct labour budget

B)Production budget, sales budget, direct materials budget, direct labour budget

C)Sales budget, cash budget, production budget, direct materials budget

D)Selling and administrative expense budget, cash budget, budgeted income statement, budgeted balance sheet

A)Sales budget, cash budget, direct materials budget, direct labour budget

B)Production budget, sales budget, direct materials budget, direct labour budget

C)Sales budget, cash budget, production budget, direct materials budget

D)Selling and administrative expense budget, cash budget, budgeted income statement, budgeted balance sheet

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

32

The Carlquist Company makes and sells a product called Product K. Each unit of Product K sells for £24 and has a unit variable cost of £18. The company has budgeted the following data for November:

If necessary, the company will borrow cash from a bank. The borrowing will be in multiples of £1,000 and will bear interest at 2% per month. All borrowing will take place at the beginning of the month. The November interest will be paid in cash during November.* Sales of , all in cash.

*A cash balance on November 1 of .

* Cash dis bursements (other than interest) during November of .

*A minimum cash balance on November 30 of .

The amount of cash that must be borrowed on November 1 to cover all cash disbursements and to obtain the desired November 30 cash balance is

A)£20,000.

B)£21,000.

C)£37,000.

D)£38,000.

If necessary, the company will borrow cash from a bank. The borrowing will be in multiples of £1,000 and will bear interest at 2% per month. All borrowing will take place at the beginning of the month. The November interest will be paid in cash during November.* Sales of , all in cash.

*A cash balance on November 1 of .

* Cash dis bursements (other than interest) during November of .

*A minimum cash balance on November 30 of .

The amount of cash that must be borrowed on November 1 to cover all cash disbursements and to obtain the desired November 30 cash balance is

A)£20,000.

B)£21,000.

C)£37,000.

D)£38,000.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

33

The company is in the process of preparing a cash budget and must determine the expected cash collections by month. To this end, the following information has been assembled:Collections on credit sales:

in month of sale

in month following sale

in second month following sale

- What is the budgeted accounts receivable balance on December 1

A)£ 80,000.

B)£140,000.

C)£ 94,500.

D)£131,300.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

34

Self-imposed budgets typically are

A)not subject to review by higher levels of management since to do so would contradict the participative aspect of the budgeting processing.

B)not subject to review by higher levels of management except in specific cases where the input of higher management is required.

C)subject to review by higher levels of management in order to prevent the budgets from becoming too loose.

D)not critical to the success of a budgeting program.

A)not subject to review by higher levels of management since to do so would contradict the participative aspect of the budgeting processing.

B)not subject to review by higher levels of management except in specific cases where the input of higher management is required.

C)subject to review by higher levels of management in order to prevent the budgets from becoming too loose.

D)not critical to the success of a budgeting program.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

35

The effect of responsibility accounting is to personalise the accounting system

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

36

The production budget is typically prepared prior to the sales budget

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

37

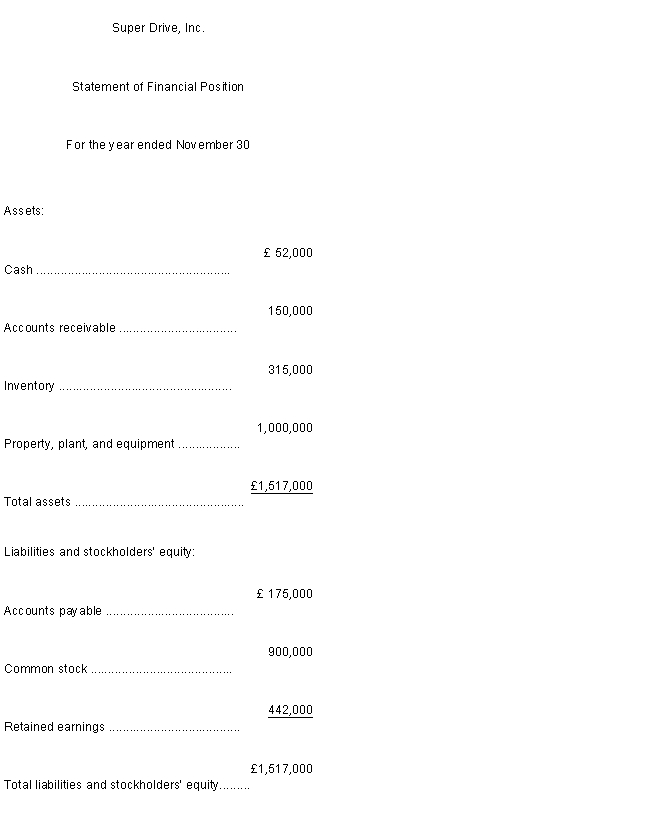

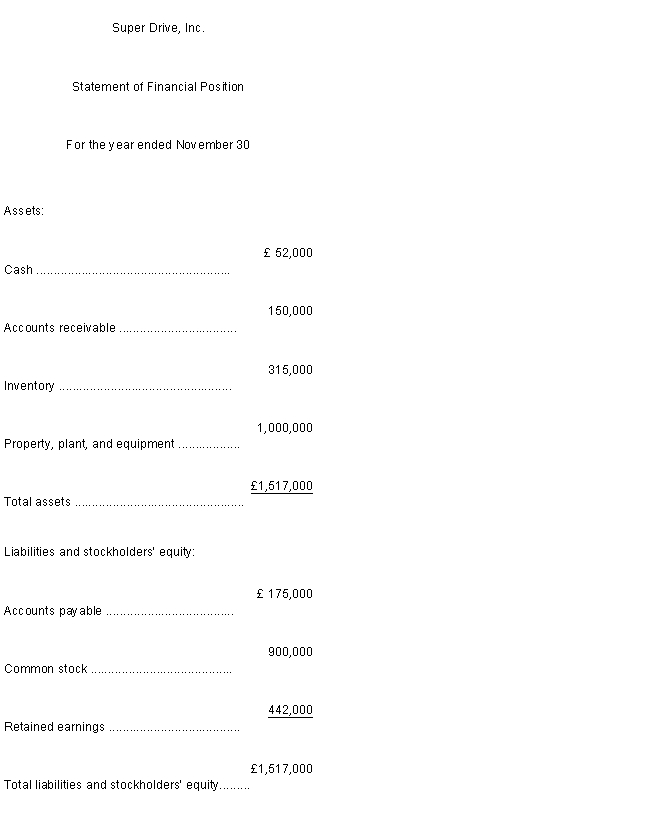

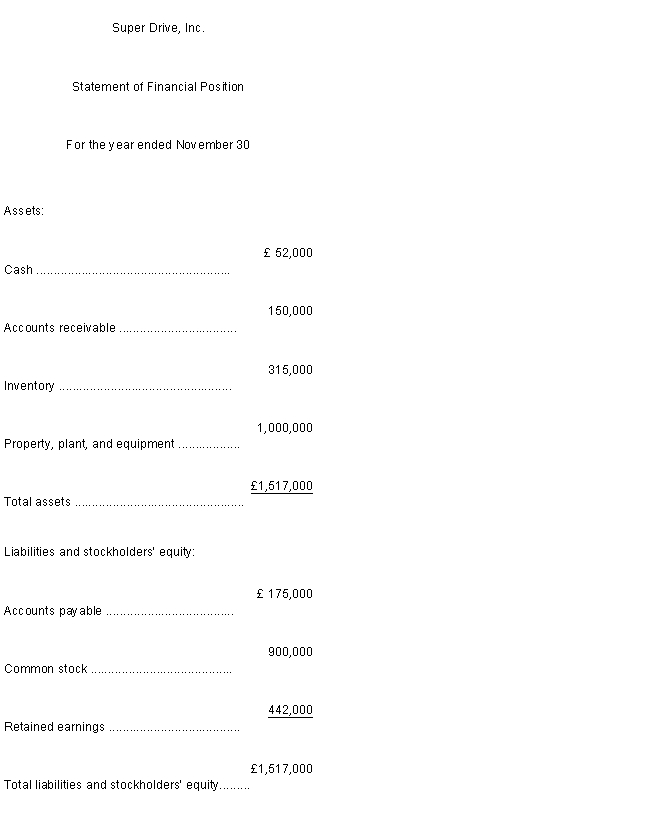

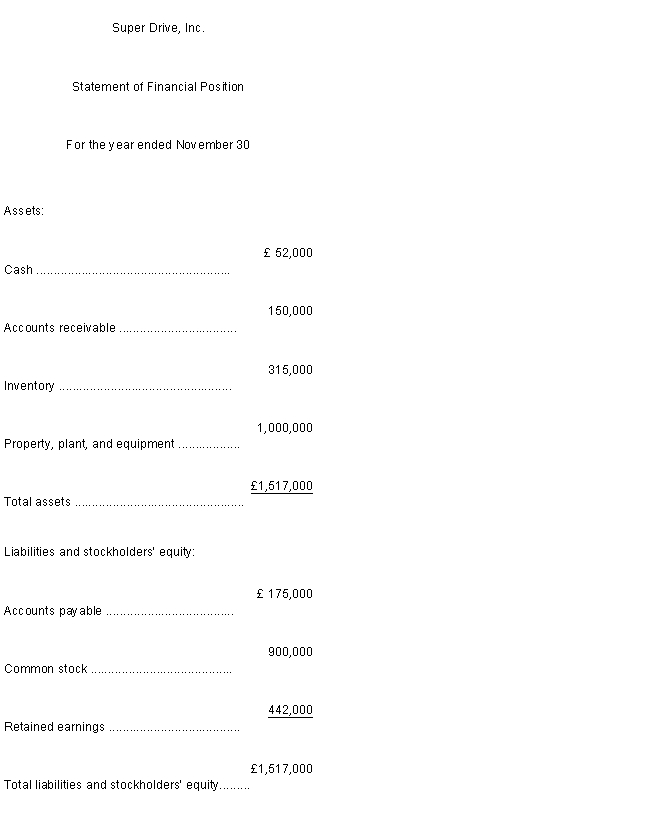

Super Drive is a computer hard drive manufacturer. The company's balance sheet for the fiscal year ended on November 30 appears below:

Additional information regarding Super Drive's operations appear below:*Sales are budgeted at for December and for the upcoming year.

*Collections are expected to be in the month of sale and in the month following sale. There are no bad debts.

*80\% of the disk drive components are purchased in the month prior to the month of the sale, and are purchased in the month of the sale. Purchased components comprise of the cost of goods sold.

*Payment for components purchased is made in the month following the purchase.

*Assume that the cost of goods sold is of sales.

-

The budgeted cash collections for the upcoming December should be

A)£208,000.

B)£520,000.

C)£402,000.

D)£462,000.

Additional information regarding Super Drive's operations appear below:*Sales are budgeted at for December and for the upcoming year.

*Collections are expected to be in the month of sale and in the month following sale. There are no bad debts.

*80\% of the disk drive components are purchased in the month prior to the month of the sale, and are purchased in the month of the sale. Purchased components comprise of the cost of goods sold.

*Payment for components purchased is made in the month following the purchase.

*Assume that the cost of goods sold is of sales.

-

The budgeted cash collections for the upcoming December should be

A)£208,000.

B)£520,000.

C)£402,000.

D)£462,000.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

38

Super Drive is a computer hard drive manufacturer. The company's balance sheet for the fiscal year ended on November 30 appears below:

Additional information regarding Super Drive's operations appear below:*Sales are budgeted at for December and for the upcoming year.

*Collections are expected to be in the month of sale and in the month following sale. There are no bad debts.

*80\% of the disk drive components are purchased in the month prior to the month of the sale, and are purchased in the month of the sale. Purchased components comprise of the cost of goods sold.

*Payment for components purchased is made in the month following the purchase.

*Assume that the cost of goods sold is of sales.

- The budgeted gross margin for the month ending December 31 would be

A)£416,000.

B)£104,000.

C)£134,000.

D)£536,000.

Additional information regarding Super Drive's operations appear below:*Sales are budgeted at for December and for the upcoming year.

*Collections are expected to be in the month of sale and in the month following sale. There are no bad debts.

*80\% of the disk drive components are purchased in the month prior to the month of the sale, and are purchased in the month of the sale. Purchased components comprise of the cost of goods sold.

*Payment for components purchased is made in the month following the purchase.

*Assume that the cost of goods sold is of sales.

- The budgeted gross margin for the month ending December 31 would be

A)£416,000.

B)£104,000.

C)£134,000.

D)£536,000.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

39

The Adams Company, a merchandising firm, has budgeted its activity for November according to the following information:* Sales at , all for cash

* Merchandise inventory on October 31 was .

* The cash balance November 1 was .

* Selling and administrative expenses are budgeted at for November and are paid for in cash.

* Budgeted depreciation for Nowember is .

* The planned merchandise inventory on November 31 is .

* The cost of goods sold is of the selling price.

* All purchases are paid for in cash.

-

The budgeted cash receipts for November are

A)£315,000.

B)£450,000.

C)£135,000.

D)£475,000.

* Merchandise inventory on October 31 was .

* The cash balance November 1 was .

* Selling and administrative expenses are budgeted at for November and are paid for in cash.

* Budgeted depreciation for Nowember is .

* The planned merchandise inventory on November 31 is .

* The cost of goods sold is of the selling price.

* All purchases are paid for in cash.

-

The budgeted cash receipts for November are

A)£315,000.

B)£450,000.

C)£135,000.

D)£475,000.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

40

The company is in the process of preparing a cash budget and must determine the expected cash collections by month. To this end, the following information has been assembled:Collections on credit sales:

in month of sale

in month following sale

in second month following sale

-

Assume that the accounts receivable balance on January 1 is £70,000. Of this amount, £60,000 represents uncollected December sales and £10,000 represents uncollected November sales. Given these data, the total cash collected during January would be

A)£270,000.

B)£420,000.

C)£345,000.

D)£360,000.

in month of sale

in month following sale

in second month following sale

-

Assume that the accounts receivable balance on January 1 is £70,000. Of this amount, £60,000 represents uncollected December sales and £10,000 represents uncollected November sales. Given these data, the total cash collected during January would be

A)£270,000.

B)£420,000.

C)£345,000.

D)£360,000.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following is not correct regarding the manufacturing overhead budget?

A)Total budgeted cash disbursements for manufacturing overhead is equal to the total of budgeted variable and fixed manufacturing overhead.

B)Manufacturing overhead costs should be broken down by cost behaviour.

C)The manufacturing overhead budget should provide a schedule of all costs of production other than direct materials and direct labour.

D)A schedule showing budgeted cash disbursements for manufacturing overhead should be prepared for use in developing the cash budget.

A)Total budgeted cash disbursements for manufacturing overhead is equal to the total of budgeted variable and fixed manufacturing overhead.

B)Manufacturing overhead costs should be broken down by cost behaviour.

C)The manufacturing overhead budget should provide a schedule of all costs of production other than direct materials and direct labour.

D)A schedule showing budgeted cash disbursements for manufacturing overhead should be prepared for use in developing the cash budget.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

42

Zero-based budgeting

A)does not adjust costs for the expected level of activity.

B)is used when no increases in budgets are allowed.

C)requires that all programs be justified and prioritised.

D)assumes that departments are entitled to at least the current level of spending.

A)does not adjust costs for the expected level of activity.

B)is used when no increases in budgets are allowed.

C)requires that all programs be justified and prioritised.

D)assumes that departments are entitled to at least the current level of spending.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

43

Shocker Company's sales budget shows quarterly sales for the next year as follows:

Company policy is to have a finished goods inventory at the end of each quarter equal to 20% of the next quarter's sales. Budgeted production for the second quarter of the next year would be

A)7,200 units.

B)8,000 units.

C)8,800 units.

D)8,400 units.

Company policy is to have a finished goods inventory at the end of each quarter equal to 20% of the next quarter's sales. Budgeted production for the second quarter of the next year would be

A)7,200 units.

B)8,000 units.

C)8,800 units.

D)8,400 units.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

44

Trumbull Company budgeted sales on account of £120,000 for July, £211,000 for August, and £198,000 for September. Collection experience indicates that none of the budgeted sales will be collected in the month of the sale, 60% will be collected the month after the sale, 36% in the second month, and 4% will be uncollectible. The cash receipts from accounts receivable that should be budgeted for September would be

A)£169,800.

B)£147,960.

C)£197,880.

D)£194,760.

A)£169,800.

B)£147,960.

C)£197,880.

D)£194,760.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

45

The Khaki Company has the following budgeted sales data:

The regular pattern of collection of credit sales is 40% in the month of sale, 50% in the month following sale, and the remainder in the second month following the month of sale. There are no bad debts. The budgeted cash receipts for April would be

A)£350,000.

B)£320,000.

C)£313,000.

D)£383,000.

The regular pattern of collection of credit sales is 40% in the month of sale, 50% in the month following sale, and the remainder in the second month following the month of sale. There are no bad debts. The budgeted cash receipts for April would be

A)£350,000.

B)£320,000.

C)£313,000.

D)£383,000.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

46

Zero-based budgeting requires managers to justify all costs of programs as if these programs were being proposed for the first time

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

47

The budgeted amount of raw materials to be purchased is determined by

A)adding the desired ending inventory of raw materials to the raw materials needed to meet the production schedule.

B)subtracting the beginning inventory of raw materials from the raw materials needed to meet the production schedule.

C)adding the desired ending inventory of raw materials to the raw materials needed to meet the production schedule and subtracting the beginning inventory of raw materials.

D)adding the beginning inventory of raw materials to the raw materials needed to meet the production schedule and subtracting the desired ending inventory of raw materials.

A)adding the desired ending inventory of raw materials to the raw materials needed to meet the production schedule.

B)subtracting the beginning inventory of raw materials from the raw materials needed to meet the production schedule.

C)adding the desired ending inventory of raw materials to the raw materials needed to meet the production schedule and subtracting the beginning inventory of raw materials.

D)adding the beginning inventory of raw materials to the raw materials needed to meet the production schedule and subtracting the desired ending inventory of raw materials.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following statements is not correct?

A)The sales budget is the starting point in preparing the master budget.

B)The sales budget is constructed by multiplying the expected sales in units by the sales price.

C)The sales budget generally is accompanied by a computation of expected cash receipts for the forthcoming budget period.

D)The cash budget must be prepared prior to the sales budget since managers want to know the expected cash collections on sales made to customers in prior periods before projecting sales for the current perioD.

A)The sales budget is the starting point in preparing the master budget.

B)The sales budget is constructed by multiplying the expected sales in units by the sales price.

C)The sales budget generally is accompanied by a computation of expected cash receipts for the forthcoming budget period.

D)The cash budget must be prepared prior to the sales budget since managers want to know the expected cash collections on sales made to customers in prior periods before projecting sales for the current perioD.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

49

Shown below is the sales forecast for Cooper Inc. for the first four months of the coming year.

On average, 50% of credit sales are paid for in the month of the sale, 30% in the month following sale, and the remainder is paid two months after the month of the sale. Assuming there are no bad debts, the expected cash inflow in March is

A)£138,000.

B)£122,000.

C)£119,000.

D)£108,000.

On average, 50% of credit sales are paid for in the month of the sale, 30% in the month following sale, and the remainder is paid two months after the month of the sale. Assuming there are no bad debts, the expected cash inflow in March is

A)£138,000.

B)£122,000.

C)£119,000.

D)£108,000.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following represents the normal sequence in which the indicated budgets are prepared

A)Direct materials, cash, sales

B)Production, cash, income statement

C)Sales, balance sheet, direct labour

D)Production, manufacturing overhead, sales

A)Direct materials, cash, sales

B)Production, cash, income statement

C)Sales, balance sheet, direct labour

D)Production, manufacturing overhead, sales

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

51

Both variable and fixed manufacturing overhead costs are included in the manufacturing overhead budget

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

52

One difficulty with self-imposed budgets is that they are not subject to any type of review

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

53

Berol Company plans to sell 200,000 units of finished product in July and anticipates a growth rate in sales of 5% per month. The desired monthly ending inventory in units of finished product is 80% of the next month's estimated sales. There are 150,000 finished units in inventory on June 30.

Berol Company's production requirement in units of finished product for the three-month period ending September 30 is

A)712,025 units.

B)630,500 units.

C)664,000 units.

D)665,720 units.

Berol Company's production requirement in units of finished product for the three-month period ending September 30 is

A)712,025 units.

B)630,500 units.

C)664,000 units.

D)665,720 units.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

54

Paradise Company budgets on an annual basis for its fiscal year. The following beginning and ending inventory levels (in units) are planned for next year.

* Three pounds of raw materials are needed to produce each unit of finished product.

If Paradise Company plans to sell 480,000 units during next year, the number of units it would have to manufacture during the year would be

A)440,000 units.

B)480,000 units.

C)510,000 units.

D)450,000 units.

* Three pounds of raw materials are needed to produce each unit of finished product.

If Paradise Company plans to sell 480,000 units during next year, the number of units it would have to manufacture during the year would be

A)440,000 units.

B)480,000 units.

C)510,000 units.

D)450,000 units.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

55

Planning and control are essentially the same thing

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

56

Self-imposed budgets are those that are prepared by top management and then assigned to other managers within the organisation

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

57

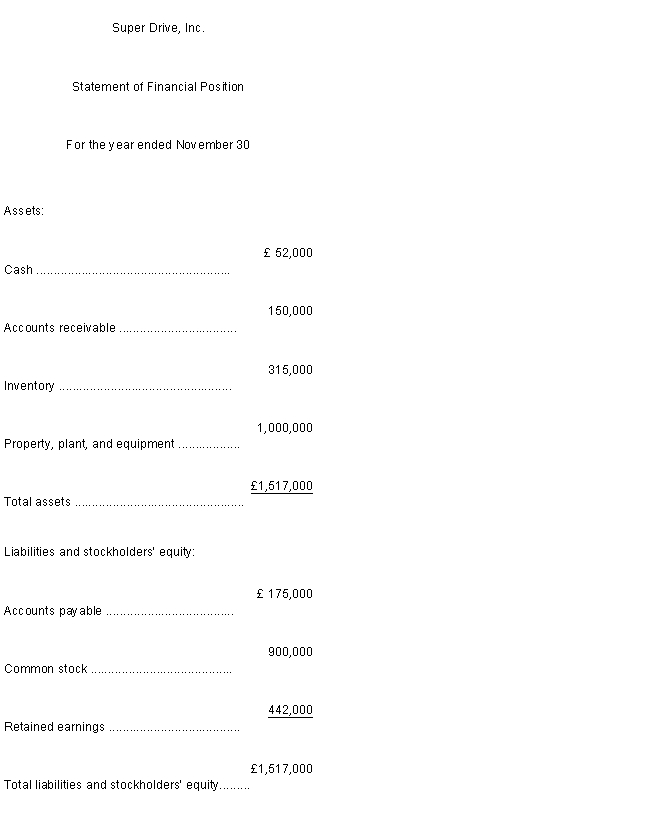

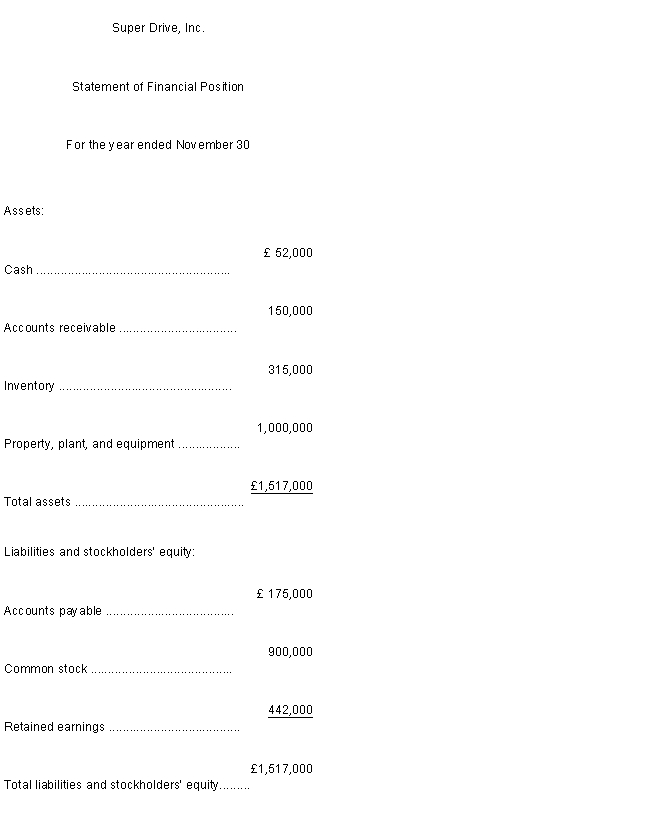

Super Drive is a computer hard drive manufacturer. The company's balance sheet for the fiscal year ended on November 30 appears below:

Additional information regarding Super Drive's operations appear below:*Sales are budgeted at for December and for the upcoming year.

*Collections are expected to be in the month of sale and in the month following sale. There are no bad debts.

*80\% of the disk drive components are purchased in the month prior to the month of the sale, and are purchased in the month of the sale. Purchased components comprise of the cost of goods sold.

*Payment for components purchased is made in the month following the purchase.

*Assume that the cost of goods sold is of sales.

-

The balance in accounts payable on the budgeted balance sheet for December 31 should be

A)£161,280.

B)£326,400.

C)£165,120.

D)£403,200.

Additional information regarding Super Drive's operations appear below:*Sales are budgeted at for December and for the upcoming year.

*Collections are expected to be in the month of sale and in the month following sale. There are no bad debts.

*80\% of the disk drive components are purchased in the month prior to the month of the sale, and are purchased in the month of the sale. Purchased components comprise of the cost of goods sold.

*Payment for components purchased is made in the month following the purchase.

*Assume that the cost of goods sold is of sales.

-

The balance in accounts payable on the budgeted balance sheet for December 31 should be

A)£161,280.

B)£326,400.

C)£165,120.

D)£403,200.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

58

Prestwich Company has budgeted production for next year as follows

Two pounds of material A are required for each unit produced. The company has a policy of maintaining a stock of material A on hand at the end of each quarter equal to 25% of the next quarter's production needs for materialA. A total of 30,000 pounds of material A are on hand to start the year. Budgeted purchases of material A for the second quarter would be:

A)82,500 pounds.

B)165,000 pounds.

C)200,000 pounds.

D)205,000 pounds.

Two pounds of material A are required for each unit produced. The company has a policy of maintaining a stock of material A on hand at the end of each quarter equal to 25% of the next quarter's production needs for materialA. A total of 30,000 pounds of material A are on hand to start the year. Budgeted purchases of material A for the second quarter would be:

A)82,500 pounds.

B)165,000 pounds.

C)200,000 pounds.

D)205,000 pounds.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

59

In the selling and administrative budget, the non-cash charges (such as depreciation) are added to the total budgeted selling and administrative expenses to determine the expected cash disbursements for selling and administrative expenses

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

60

Both planning and control are needed for an effective budgeting system

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

61

Discuss the conflict that exists between the figures used for planning and motivation in budgets. Is there a solution?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

62

"I can't see the point of budgeting. All we do is estimate and so we can never be right." Discuss

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

63

Why are people important in budgeting? Explain

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

64

Explain the principle of responsibility in budgeting.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

65

"I can't see the point of budgeting. All we do is estimate and so we can never be right." Discuss

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

66

Explain the 6 major functions of budgets

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

67

Describe the basic process of budgeting (with diagrams)

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

68

The master budget is a network consisting of many separate budgets that are interdependent

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck