Deck 1: An Introduction to Accounting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/148

Play

Full screen (f)

Deck 1: An Introduction to Accounting

1

An asset source transaction increases a business's assets and the claims to assets.

True

Explanation: An asset source transaction increases a business's assets and either liabilities or equity, which make up claims to assets.

Explanation: An asset source transaction increases a business's assets and either liabilities or equity, which make up claims to assets.

2

The value created by a business may be called income or earnings.

True

Explanation: This is true. A business creates value by earning income.

Explanation: This is true. A business creates value by earning income.

3

A business and the person who owns the business are separate reporting entities.

True

Explanation: This is true. A business must report its income, assets, liabilities and equity separate from the owner of that business.

Explanation: This is true. A business must report its income, assets, liabilities and equity separate from the owner of that business.

4

An asset exchange transaction does not affect the total amount of claims to a company's assets.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

5

In a market, consumers are resource providers.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

6

Borrowing money from the bank is an example of an asset source transaction.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

7

Accounts are subclassifications of the various elements of the financial statements.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

8

The four financial statements prepared by a business bear no relationship to each other.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

9

In a market, a company that manufactures cars would be referred to as a conversion agent.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

10

Financial accounting information is usually more detailed than managerial accounting information.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

11

A business's creditors have a priority claim to its assets in the event of liquidation.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

12

Equity represents the future obligations of a business entity.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

13

The types of resources needed by a business are financial, physical, and capital resources.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

14

The Financial Accounting Standards Board is an agency of the US government with authority for establishing accounting standards for businesses in the US.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

15

A business's temporary accounts include revenues, expenses, and retained earnings.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

16

The accounting term "reliability" refers to information that is consistent from one accounting period to the next.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following groups has the primary responsibility for establishing generally accepted accounting principles for business entities in the United States?

A)Internal Revenue Service.

B)U.S. Congress.

C)Financial Accounting Standards Board.

D)International Accounting Standards BoarD.The Financial Accounting Standards Board is a privately funded group charged with establishing accounting standards for the U.S. It is not a branch of the U.S. government.

A)Internal Revenue Service.

B)U.S. Congress.

C)Financial Accounting Standards Board.

D)International Accounting Standards BoarD.The Financial Accounting Standards Board is a privately funded group charged with establishing accounting standards for the U.S. It is not a branch of the U.S. government.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

18

Both liabilities and equity are sources of a business's assets.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

19

Retained earnings reduces a company's commitment to use its assets for the benefit of its stockholders.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

20

The Jefferson Company is a manufacturer of antique reproduction furniture. Which term best describes Jefferson's role in society?

A)Consumer

B)Regulatory Agency

C)Conversion Agent

D)Resource Owner

A)Consumer

B)Regulatory Agency

C)Conversion Agent

D)Resource Owner

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is not an element of the financial statements?

A)Cash

B)Revenue

C)Assets

D)Distributions

A)Cash

B)Revenue

C)Assets

D)Distributions

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

22

"GAAP" stands for

A)Government Authorized Accounting Procedures

B)Generally Applied Accounting Procedures

C)Generally Accepted Accounting Principles

D)Generally Authorized Auditing Principles

A)Government Authorized Accounting Procedures

B)Generally Applied Accounting Procedures

C)Generally Accepted Accounting Principles

D)Generally Authorized Auditing Principles

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

23

As of December 31, 2013, Bloch Company had $3,800 of assets, $1,600 of liabilities and $700 of retained earnings. The balance in the common stock account on the December 31, 2013 balance sheet was

A)$2,900

B)$3,800

C)$1,500

D)none of the above

A)$2,900

B)$3,800

C)$1,500

D)none of the above

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

24

Which type of accounting information is intended to satisfy the needs of external users of accounting information?

A)Cost accounting

B)Financial accounting

C)Tax accounting

D)Managerial accounting

A)Cost accounting

B)Financial accounting

C)Tax accounting

D)Managerial accounting

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

25

During 2013, Bledsoe Company earned $6,700 of cash revenue, paid cash dividends of $950 to owners and paid $5,000 for cash expenses. Liabilities were unchanged. Which of the following accurately describes the effect of these events on the elements of the company's financial statements?

A)Assets increased by $7,700.

B)Assets increased by $750.

C)Equity increased by $2,700.

D)Both B and C

A)Assets increased by $7,700.

B)Assets increased by $750.

C)Equity increased by $2,700.

D)Both B and C

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

26

Which resource provider typically receives first priority when resources are divided as part of a business's liquidation?

A)The company's managers

B)Stockholders

C)Creditors

D)Owners

A)The company's managers

B)Stockholders

C)Creditors

D)Owners

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

27

Varghese Company paid cash to purchase land. As a result of this accounting event

A)total assets decreased.

B)total assets were unaffected.

C)total equity decreased.

D)none of these.

A)total assets decreased.

B)total assets were unaffected.

C)total equity decreased.

D)none of these.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

28

On January 1, 2013, Baird Company had beginning balances as follows: Assets = $2,250

Liabilities = $620

Common Stock = $800

During 2013, Baird paid dividends to its stockholders of $900. Given that ending retained earnings was $600, what was Baird's net income for the 2013 accounting period?

A)$770

B)$830

C)$1,250

D)$500

Liabilities = $620

Common Stock = $800

During 2013, Baird paid dividends to its stockholders of $900. Given that ending retained earnings was $600, what was Baird's net income for the 2013 accounting period?

A)$770

B)$830

C)$1,250

D)$500

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following items is an example of revenue?

A)Cash received from a bank loan

B)Cash received from customers at the time services were provided

C)Cash investments made by owners

D)All of these

A)Cash received from a bank loan

B)Cash received from customers at the time services were provided

C)Cash investments made by owners

D)All of these

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

30

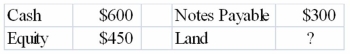

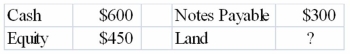

The balance sheet of the Chesapeake Company contained the following accounts and balances:  Based on the above information only, the amount or balance for Land must be

Based on the above information only, the amount or balance for Land must be

A)$450

B)$750

C)$150

D)$1,350

Based on the above information only, the amount or balance for Land must be

Based on the above information only, the amount or balance for Land must beA)$450

B)$750

C)$150

D)$1,350

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

31

Managerial accounting provides information primarily to which of the following groups or individuals?

A)Internal users

B)Shareholders

C)External users

D)Both A and B

A)Internal users

B)Shareholders

C)External users

D)Both A and B

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

32

If Boyd Company reported assets of $500 and liabilities of $200, Boyd's total claims totaled

A)$300.

B)$500.

C)$700.

D)none of the above.

A)$300.

B)$500.

C)$700.

D)none of the above.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

33

The total equity of Timberlake Company at the beginning of 2013 amounted to $5,500. During 2013 the company reported net income of $1,800 and paid a $500 dividend. If retained earnings at the end of 2013 is $2,200, what was beginning common stock?

A)$3,300

B)$2,800

C)$1,300

D)$4,600

A)$3,300

B)$2,800

C)$1,300

D)$4,600

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

34

The transaction, "earned cash revenue," affects which two accounts?

A)Revenue and Salaries Expense

B)Cash and Notes Payable

C)Cash and Revenue

D)Cash and Dividends

A)Revenue and Salaries Expense

B)Cash and Notes Payable

C)Cash and Revenue

D)Cash and Dividends

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following is NOT an asset use transaction?

A)Paying cash to purchase land

B)Paying cash expenses

C)Paying off the principal of a loan

D)All of the above are asset use transactions

A)Paying cash to purchase land

B)Paying cash expenses

C)Paying off the principal of a loan

D)All of the above are asset use transactions

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

36

A company mistakenly recorded a cash purchase of land as an expense. As a result of this error

A)Assets were understated and equity was overstated.

B)Assets and equity were understated.

C)Assets and equity were overstated.

D)Assets were overstated and equity was understateD.If the transaction had been recorded correctly, one asset (land) would have increased and another asset (cash) would have decreased, causing no net change in total assets. As the transaction was recorded, the asset cash decreased and the expense caused equity to decrease as well. Therefore, assets and equity were understated.

A)Assets were understated and equity was overstated.

B)Assets and equity were understated.

C)Assets and equity were overstated.

D)Assets were overstated and equity was understateD.If the transaction had been recorded correctly, one asset (land) would have increased and another asset (cash) would have decreased, causing no net change in total assets. As the transaction was recorded, the asset cash decreased and the expense caused equity to decrease as well. Therefore, assets and equity were understated.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

37

If a company's total assets decreased while liabilities and common stock were unchanged, and no dividends were paid, then

A)cash flow from operating activities was greater than cash flow from investing activities.

B)retained earnings were less than net income during the period.

C)revenues were less than expenses.

D)the company must have purchased assets with cash.

A)cash flow from operating activities was greater than cash flow from investing activities.

B)retained earnings were less than net income during the period.

C)revenues were less than expenses.

D)the company must have purchased assets with cash.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

38

"IASB" stands for

A)Internal Accounting Standards Board

B)Internationally Authorized Statements Board

C)International Accounting Standards Board

D)Initial Accounting Statements Bureau

A)Internal Accounting Standards Board

B)Internationally Authorized Statements Board

C)International Accounting Standards Board

D)Initial Accounting Statements Bureau

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

39

At the end of 2013, retained earnings for the Bisk Company was $1,750. Revenue earned by the company in 2013 was $2,000, expenses paid during the period were $1,100, and dividends paid during the period were $500. Based on this information alone, retained earnings at the beginning of 2013 was

A)$850.

B)$2,150.

C)$1,350.

D)$4,000.

A)$850.

B)$2,150.

C)$1,350.

D)$4,000.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

40

Vandever Company's balance sheet reported assets of $42,000, liabilities of $15,000 and common stock of $12,000 as of December 31, 2012. If Retained Earnings on the December 31, 2013 balance sheet is $18,000 and Vandever paid a $14,000 dividend during 2013, then the amount of net income for 2013 was which of the following?

A)$17,000

B)$15,000

C)$3,000

D)None of these

A)$17,000

B)$15,000

C)$3,000

D)None of these

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

41

Grant Company purchased a delivery van for cash. The cash flow from this event should be shown on the statement of cash flows as

A)an operating activity that increases cash.

B)a financing activity that decreases cash.

C)an investing activity that decreases cash.

D)an operating activity that decreases cash.

A)an operating activity that increases cash.

B)a financing activity that decreases cash.

C)an investing activity that decreases cash.

D)an operating activity that decreases cash.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

42

Petras Company's net cash inflow from operating activities for 2012 is

A)$600.

B)$550.

C)$350.

D)$300.

A)$600.

B)$550.

C)$350.

D)$300.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

43

Which financial statement matches asset increases from operating a business with asset decreases from operating the business?

A)Balance sheet.

B)Statement of changes in equity.

C)Statement of cash flows.

D)Income statement.

A)Balance sheet.

B)Statement of changes in equity.

C)Statement of cash flows.

D)Income statement.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

44

Young Company provided services to a customer for $6,500 cash. As a result of this event,

A)total assets decreased.

B)total liabilities increased.

C)net income increased.

D)cash flow from financing activities increaseD.Providing services to a customer for cash increases assets and equity on the balance sheet. It also increases revenue, and therefore, net income on the income statement, and increases cash from operating activities on the statement of cash flows.

A)total assets decreased.

B)total liabilities increased.

C)net income increased.

D)cash flow from financing activities increaseD.Providing services to a customer for cash increases assets and equity on the balance sheet. It also increases revenue, and therefore, net income on the income statement, and increases cash from operating activities on the statement of cash flows.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

45

What is Yi's net cash flow from investing activities?

A)Inflow of $40,000

B)Outflow of $37,000

C)Inflow of $28,000

D)Outflow of $12,000

A)Inflow of $40,000

B)Outflow of $37,000

C)Inflow of $28,000

D)Outflow of $12,000

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following statements is true?

A)Balance sheet accounts are referred to as nominal accounts.

B)Balance sheet accounts are referred to as permanent accounts.

C)Dividends are permanent accounts.

D)All of these statements are true.

A)Balance sheet accounts are referred to as nominal accounts.

B)Balance sheet accounts are referred to as permanent accounts.

C)Dividends are permanent accounts.

D)All of these statements are true.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

47

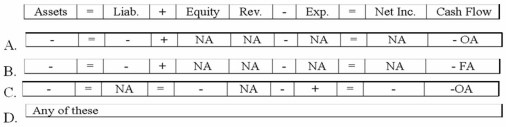

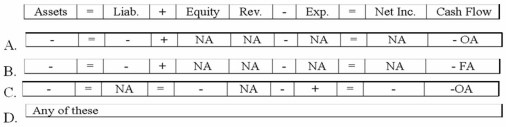

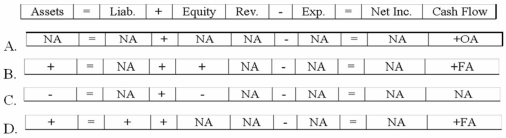

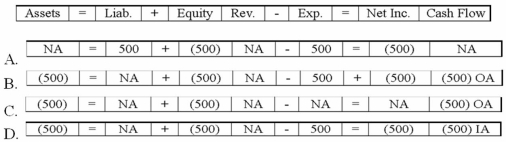

Which of the following describes the effects of an asset use transaction on a company's financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following items appears in the investing activities section of the statement of cash flows?

A)Cash outflow for the purchase of a computer.

B)Cash inflow from the issuance of common stock.

C)Cash outflow for the payment of dividends.

D)Cash inflow from interest revenue.

A)Cash outflow for the purchase of a computer.

B)Cash inflow from the issuance of common stock.

C)Cash outflow for the payment of dividends.

D)Cash inflow from interest revenue.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

49

What is Yi's cash flow from financing activities?

A)Inflow of $37,000

B)Outflow of $15,000

C)Inflow of $47,000

D)Outflow of $3,000

A)Inflow of $37,000

B)Outflow of $15,000

C)Inflow of $47,000

D)Outflow of $3,000

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

50

Borrowing cash from the bank is an example of which type of transaction?

A)Asset exchange

B)Claims use

C)Asset use

D)Asset source

A)Asset exchange

B)Claims use

C)Asset use

D)Asset source

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following financial statements provides information about a company as of a specific point in time?

A)Income statement

B)Statement of changes in equity

C)Statement of cash flows

D)Balance sheet

A)Income statement

B)Statement of changes in equity

C)Statement of cash flows

D)Balance sheet

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

52

Based on this information, the amount of expenses on Greenway's income statement was

A)$7,000.

B)$7,750.

C)$14,000.

D)$3,250.

A)$7,000.

B)$7,750.

C)$14,000.

D)$3,250.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

53

Jacks Company had a net increase in cash from operating activities of $8,000 and a net decrease in cash from financing activities of $1,000. If the beginning and ending cash balances for the company were $3,000 and $11,000, then net cash change from investing activities was:

A)an outflow or decrease of $1,000.

B)an inflow or increase of $2,000.

C)an inflow or increase of $1,000.

D)zero.

A)an outflow or decrease of $1,000.

B)an inflow or increase of $2,000.

C)an inflow or increase of $1,000.

D)zero.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

54

In which section of a statement of cash flows would the payment of cash dividends be reported?

A)Financing activities.

B)Operating activities.

C)Purchasing activities.

D)Investing activities.

A)Financing activities.

B)Operating activities.

C)Purchasing activities.

D)Investing activities.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

55

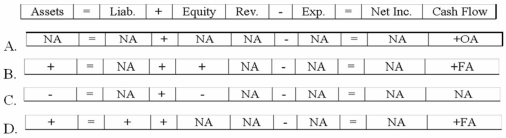

Which of the following could describe the effects of an asset exchange transaction on a company's financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

56

The amount of liabilities reported on the end-of-period balance sheet was

A)$10,750.

B)$11,250.

C)$8,000.

D)$8,750.

A)$10,750.

B)$11,250.

C)$8,000.

D)$8,750.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

57

Callahan Company earned $1,500 of cash revenue, paid $1,000 for cash expenses, and paid a $200 cash dividend to its owners. Which of the following statements is true?

A)The net cash flow from operating activities was $500.

B)The net cash flow from investing activities was an outflow or decrease of $200.

C)The net cash flow from operating activities was $300.

D)Cash flows from financing activities were unchangeD.Cash revenue and cash expenses are operating activities. Paying dividends is a financing activity. $1,500 revenue - $1,000 expense = $500 cash inflow from operating activities.

A)The net cash flow from operating activities was $500.

B)The net cash flow from investing activities was an outflow or decrease of $200.

C)The net cash flow from operating activities was $300.

D)Cash flows from financing activities were unchangeD.Cash revenue and cash expenses are operating activities. Paying dividends is a financing activity. $1,500 revenue - $1,000 expense = $500 cash inflow from operating activities.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

58

During 2013, Chi Company earned $950 of cash revenue, paid $600 of cash expenses, and paid a $100 cash dividend to its owners. Based on this information alone,

A)net income amounted to $350.

B)total assets increased by $250.

C)cash inflow from operating activities was $350.

D)all of these are correct.

A)net income amounted to $350.

B)total assets increased by $250.

C)cash inflow from operating activities was $350.

D)all of these are correct.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

59

What is Yi's net cash flow from operating activities?

A)Inflow of $5,000

B)Inflow of $8,000

C)Inflow of $17,000

D)Inflow of $33,000

A)Inflow of $5,000

B)Inflow of $8,000

C)Inflow of $17,000

D)Inflow of $33,000

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

60

Retained Earnings at the beginning and ending of the accounting period was $300 and $700, respectively. If revenues were $1,100 and dividends paid to stockholders were $200, expenses for the period must have been

A)$500.

B)$400.

C)$900.

D)$700.

A)$500.

B)$400.

C)$900.

D)$700.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

61

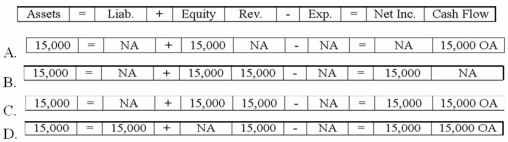

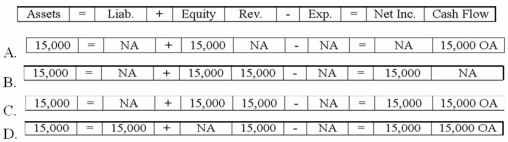

Falcon Company earned $15,000 of cash revenue. Which of the following choices accurately reflects how this event affects the company's financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

62

The total in Petras' retained earnings account BEFORE closing in 2012 is

A)$0.

B)$300.

C)$350.

D)none of the above

A)$0.

B)$300.

C)$350.

D)none of the above

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

63

Richardson Company paid $850 cash for rent expense. As a result of this business event,

A)Total assets decreased.

B)Liabilities decreased.

C)The net cash flow from operating activities decreased.

D)Both A and C are correct.

A)Total assets decreased.

B)Liabilities decreased.

C)The net cash flow from operating activities decreased.

D)Both A and C are correct.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

64

Mineola Company paid $30,000 cash to purchase land. As a result of this business event,

A)Total equity was not affected.

B)The net cash flow from investing activities decreased.

C)Total assets were not affected.

D)All of the above are correct.

A)Total equity was not affected.

B)The net cash flow from investing activities decreased.

C)Total assets were not affected.

D)All of the above are correct.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

65

The amount of total equity on Petras' 2012 balance sheet is

A)$1,250.

B)$900.

C)$300.

D)$1,300.

A)$1,250.

B)$900.

C)$300.

D)$1,300.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

66

The amount of retained earnings on La Paz's 2012 balance sheet was

A)$3,100.

B)$2,700.

C)$300.

D)$700.

A)$3,100.

B)$2,700.

C)$300.

D)$700.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

67

Dividends paid by a company are shown on the

A)income statement.

B)statement of changes in stockholders' equity.

C)statement of cash flows.

D)both b and C.Although the dividends account is a temporary account, dividends are not included on the income statement. They are, however, reported as a deduction from retained earnings on the statement of changes in stockholders' equity and as a cash outflow for financing activities on the statement of cash flows.

A)income statement.

B)statement of changes in stockholders' equity.

C)statement of cash flows.

D)both b and C.Although the dividends account is a temporary account, dividends are not included on the income statement. They are, however, reported as a deduction from retained earnings on the statement of changes in stockholders' equity and as a cash outflow for financing activities on the statement of cash flows.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

68

George Company was started on January 1, 2013, when it acquired $8,000 cash by issuing common stock. During 2013, the company earned cash revenues of $3,500, paid cash expenses of $2,750, and paid a cash dividend of $300. Based on this information,

A)The December 31, 2013 balance sheet would show total equity of $11,500.

B)The 2013 income statement would show net income of $450.

C)The 2013 statement of cash flows would show net cash inflow from operating activities of $750.

D)The 2013 statement of cash flows would show a net cash flow from financing activities of $8,000.

A)The December 31, 2013 balance sheet would show total equity of $11,500.

B)The 2013 income statement would show net income of $450.

C)The 2013 statement of cash flows would show net cash inflow from operating activities of $750.

D)The 2013 statement of cash flows would show a net cash flow from financing activities of $8,000.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

69

The net cash flow from financing activities on La Paz's 2013 statement of cash flows was

A)$1,440 inflow

B)$1,440 outflow

C)$500 inflow

D)$140 outflow

A)$1,440 inflow

B)$1,440 outflow

C)$500 inflow

D)$140 outflow

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

70

Liabilities are shown on the

A)income statement.

B)balance sheet.

C)statement of cash flows.

D)statement of changes in stockholders' equity.

A)income statement.

B)balance sheet.

C)statement of cash flows.

D)statement of changes in stockholders' equity.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

71

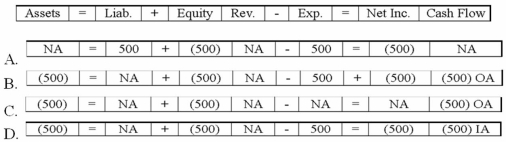

Freed Company paid $500 cash for salary expenses. Which of the following choices accurately reflects how this event affects the company's financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

72

The amount of retained earnings on Petras's 2013 balance sheet is

A)$915.

B)$890.

C)$590.

D)$690.

A)$915.

B)$890.

C)$590.

D)$690.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

73

Expenses are shown on the

A)balance sheet.

B)income statement.

C)statement of changes in stockholders' equity.

D)both b and C.Expenses and revenues are reported on the income statement. Only permanent accounts are shown on the balance sheet. Net income is shown on the statement of stockholders' equity, but expenses are not.

A)balance sheet.

B)income statement.

C)statement of changes in stockholders' equity.

D)both b and C.Expenses and revenues are reported on the income statement. Only permanent accounts are shown on the balance sheet. Net income is shown on the statement of stockholders' equity, but expenses are not.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

74

As of December 31, 2012, Montross Company had $400 cash. During 2013, Montross earned $1,200 of cash revenue and paid $800 of cash expenses. The amount of cash shown on the 2013 balance sheet would be

A)$300.

B)$800.

C)$1,100.

D)$2,400.

A)$300.

B)$800.

C)$1,100.

D)$2,400.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

75

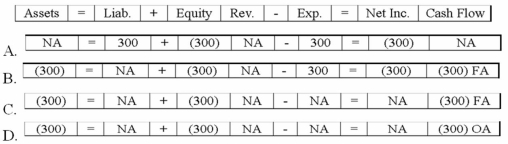

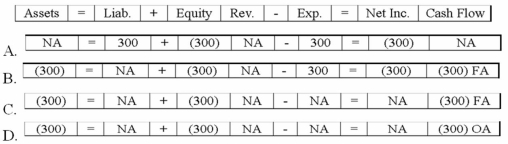

Jiminez Company paid a $300 cash dividend. Which of the following choices accurately reflects how this event affects the company's financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

76

The amount of assets on Petras's 2013 balance sheet is

A)$2,165.

B)$390.

C)$2,065.

D)$395.

A)$2,165.

B)$390.

C)$2,065.

D)$395.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following items would appear in the cash flow from the financing activities section of a statement of cash flows?

A)Paid cash for expenses.

B)Loaned cash to another company.

C)Sold land for cash.

D)Paid cash for dividends.

A)Paid cash for expenses.

B)Loaned cash to another company.

C)Sold land for cash.

D)Paid cash for dividends.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

78

The net cash inflow from financing activities on Petras's 2013 statement of cash flows is

A)$5.

B)$325.

C)$225.

D)$955.

A)$5.

B)$325.

C)$225.

D)$955.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

79

The amount of liabilities on La Paz's 2013 balance sheet was

A)$900.

B)$500.

C)($1,300).

D)$240.

A)$900.

B)$500.

C)($1,300).

D)$240.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

80

The amount of total assets on La Paz's 2012 balance sheet was

A)$6,000.

B)$5,500.

C)$800.

D)$3,800.

A)$6,000.

B)$5,500.

C)$800.

D)$3,800.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck