Marketing 13th Edition by Gary Armstrong, Philip Kotler

Edition 13ISBN: 978-0134149530

Marketing 13th Edition by Gary Armstrong, Philip Kotler

Edition 13ISBN: 978-0134149530 Exercise 3

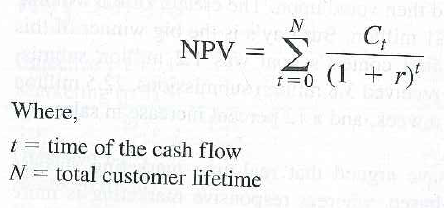

How much are you worth to a given company if you continue to purchase its brand for the rest of your life? Many marketers are grappling with that question, but it's not easy to determine how much a customer is worth to a company over his or her lifetime. Calculating customer lifetime value can be very complicated. Intuitively, however, it can be a fairly simple net present value calculation, which incorporates the concept of the time value of money. To determine a basic customer lifetime value, each stream of profit (C, the net cash flow after costs are subtracted) is discounted back to its present value (PV) and then summed. The basic equation for calculating net present value (NPV) is:

r = discount rate

= net cash flow (the profit) at time t (The initial cost of acquiring a customer would be a negative net cash flow at time 0.)

= net cash flow (the profit) at time t (The initial cost of acquiring a customer would be a negative net cash flow at time 0.)

NPV can be calculated easily on most financial calculators or by using one of the calculators available on the Internet, such as the one found at www.investopedia.com/calculator/ NetPresentValue.aspx.

Assume that a customer shops at a local grocery store spending an average of $200 a week, resulting in a retailer prof-it of $10 each week from this customer. Assuming the shopper visits the store all 52 weeks of the year, calculate the customer lifetime value if this shopper remains loyal over a 10-year life span. Also assume a 5 percent annual interest rate and no initial, cost to acquire the customer. (AACSB: Communication; Analytic Reasoning)

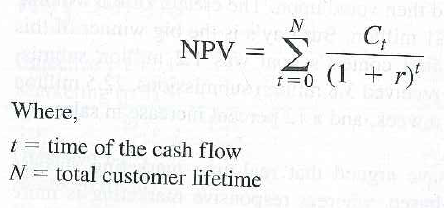

r = discount rate

= net cash flow (the profit) at time t (The initial cost of acquiring a customer would be a negative net cash flow at time 0.)

= net cash flow (the profit) at time t (The initial cost of acquiring a customer would be a negative net cash flow at time 0.) NPV can be calculated easily on most financial calculators or by using one of the calculators available on the Internet, such as the one found at www.investopedia.com/calculator/ NetPresentValue.aspx.

Assume that a customer shops at a local grocery store spending an average of $200 a week, resulting in a retailer prof-it of $10 each week from this customer. Assuming the shopper visits the store all 52 weeks of the year, calculate the customer lifetime value if this shopper remains loyal over a 10-year life span. Also assume a 5 percent annual interest rate and no initial, cost to acquire the customer. (AACSB: Communication; Analytic Reasoning)

Explanation

The business can maximize its profits by

Marketing 13th Edition by Gary Armstrong, Philip Kotler

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255