Marketing 13th Edition by Gary Armstrong, Philip Kotler

Edition 13ISBN: 978-0134149530

Marketing 13th Edition by Gary Armstrong, Philip Kotler

Edition 13ISBN: 978-0134149530 Exercise 12

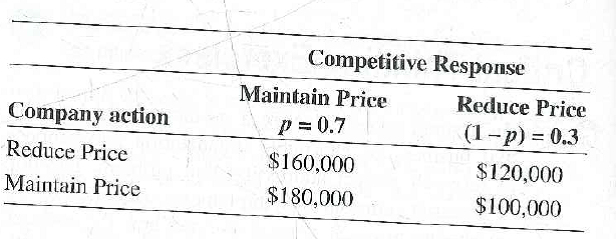

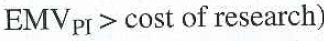

Conducting research is costly, and the costs must be weighed against the value of the information gathered. Consider a company faced with a competitor's price reduction. Should the company also reduce price in order to maintain market share, or should the company maintain its current price? The company has conducted some preliminary research showing the financial outcomes of each decision under two competitor responses: the competition maintains its price or the competition lowers its price further. The company feels pretty confident that the competitor cannot lower its price further and assigns that outcome a probability (p) of 0.7, which means the other outcome would have only a 30 percent chance of occurring (1 -p = 0.3). These outcomes are shown in the table below:

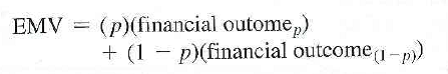

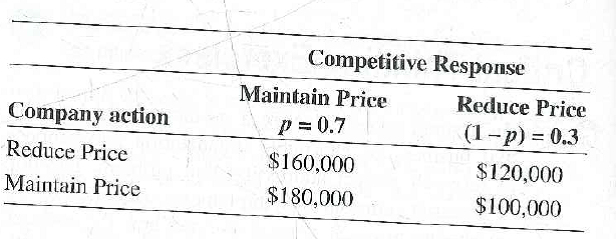

For example, if the company reduces its price and the competitor maintains its price, the company would realize $160,000, and so on. From this information, the expected monetary value (EMV) of each company action (reduce price or maintain price) can be determined using the following equation:

The company would select the action expected to deliver the greatest EMV. More information might be desirable, but is it worth the cost of acquiring it? One way to assess the value of additional information is to determine the expected value of perfect information

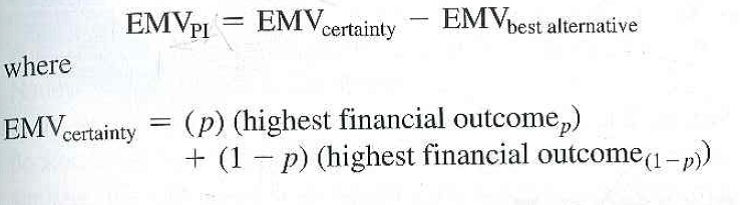

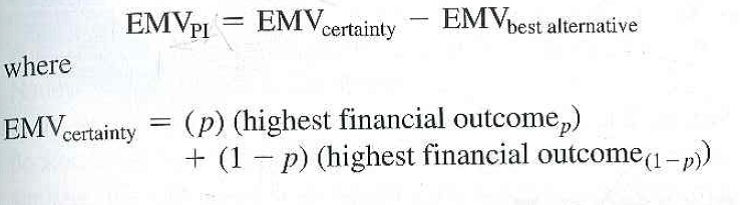

calculated using the following equation:

calculated using the following equation:

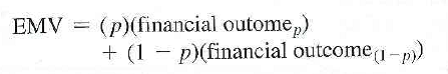

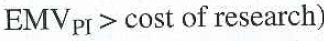

If the value of perfect information is more than the cost of conducting the research, then the research should be under-taken (that is,

However, if the value of the additional information is less than the cost of obtaining more information, the research should not be conducted.

However, if the value of the additional information is less than the cost of obtaining more information, the research should not be conducted.

Calculate the expected monetary value (EMV) of both company actions. Which action should the company take? (AACSB: Communication; Analytical Reasoning)

For example, if the company reduces its price and the competitor maintains its price, the company would realize $160,000, and so on. From this information, the expected monetary value (EMV) of each company action (reduce price or maintain price) can be determined using the following equation:

The company would select the action expected to deliver the greatest EMV. More information might be desirable, but is it worth the cost of acquiring it? One way to assess the value of additional information is to determine the expected value of perfect information

calculated using the following equation:

calculated using the following equation:

If the value of perfect information is more than the cost of conducting the research, then the research should be under-taken (that is,

However, if the value of the additional information is less than the cost of obtaining more information, the research should not be conducted.

However, if the value of the additional information is less than the cost of obtaining more information, the research should not be conducted. Calculate the expected monetary value (EMV) of both company actions. Which action should the company take? (AACSB: Communication; Analytical Reasoning)

Explanation

The term EMV refers to Expected Monetary...

Marketing 13th Edition by Gary Armstrong, Philip Kotler

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255