Multiple Choice

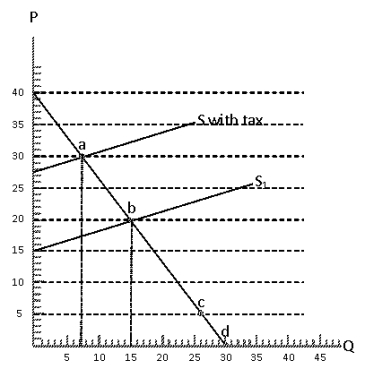

Exhibit 5-32

-Refer to Exhibit 5-32. The tax burden borne by producers is:

A) $5.50

B) $9.50

C) $14.50

D) $19.50

E) $20.50

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q4: If supply is more elastic than demand

Q13: If demand is more elastic than supply

Q15: If demand is elastic, a tax increase

Q16: If supply is more inelastic than demand

Q16: Exhibit 5-29 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4915/.jpg" alt="Exhibit 5-29

Q18: If demand is more inelastic than supply

Q19: On which of the following goods would

Q22: Exhibit 5-31 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4915/.jpg" alt="Exhibit 5-31

Q24: Exhibit 5-32 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4915/.jpg" alt="Exhibit 5-32

Q31: An excise tax will generate more revenue