Essay

G.C. Donovan Company is a large pharmaceutical company located in the U.S., but with worldwide sales. Donovan has recently developed two new medications that have been licensed for sale in European Union countries. One medication is an over-the-counter cold preparation that effectively eliminates all cold symptoms, while the other is an antibiotic that is effective against drug resistant bacteria. A European firm, Demtech Limited, has developed drugs that are similar to Donovan's and will be ready for the European market at approximately the same time. Liability concerns make it unlikely that either firm will choose to market both new drugs at this time. Both firms do plan to market one of the drugs this year.

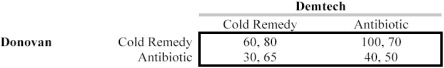

Donovan's managers consider their own lack of reputation among European physicians to be an important obstacle in the antibiotic market. Consequently, Donovan feels more comfortable marketing the cold preparation. Demtech, on the other hand, has an excellent reputation among physicians but little experience in over-the-counter drugs so that Demtech's competitive advantage is with the antibiotic. Should Demtech choose to market the cold remedy, it believes that its sales will increase if Donovan also enters the cold remedy market and advertises heavily. Similarly, Donovan anticipates that its sales in the antibiotic market would be enhanced if Demtech produces antibiotics, given Demtech's excellent reputation among physicians. In short, each firm believes that there are circumstances under which participation by the other firm will complement rather than compete with the firm's own sales. Profits in millions of dollars are given in the payoff matrix below.

a. Given the table above, does either firm have a dominant strategy? Is there a Nash equilibrium? (Explain the difference between a Nash equilibrium and a dominant strategy.)

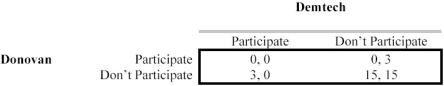

b. Pharmaceutical firms within the EU are attempting to organize a risk pool that would share liability risks for new drugs. Since Donovan and Demtech are among the largest pharmaceutical companies operating in Europe, the benefits of the risk pool depend upon the participation of the other firm. Increased profits achieved through reduced risk liability (measured in millions of dollars) are shown in the payoff matrix below.

Does either firm have an incentive to use participation in the risk pool as a bargaining device in the drug-marketing decision? If so, what would be the nature of the bargain? How credible is the firm's bargaining position? What could be done to make the bargaining position more credible?

Correct Answer:

Verified

a.

Demtech has a dominant strategy in th...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Demtech has a dominant strategy in th...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: In the game in Scenario 13.11, equilibrium

Q12: La Tortilla is the only producer of

Q41: Scenario 13.5<br>Consider the following game: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3095/.jpg"

Q53: Suppose a player in a game has

Q60: In a two-person bargaining situation it is:<br>A)

Q70: Scenario 13.12<br>Consider the game below: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3095/.jpg"

Q106: For infinitely repeated games in which the

Q112: Consider the Battle of the Sexes game:<br><img

Q127: Scenario 13.16<br>Consider the pricing game below: <img

Q133: An oligopolistic situation involving the possible creation