Essay

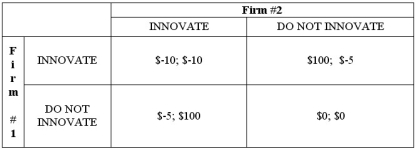

Two firms in a local market compete in the manufacture of cyberwidgets. Each firm must decide if they will engage in product research to innovate their version of the cyberwidget. The pay-offs of each firm's strategy is a function of the strategy of their competitor as well. The pay-off matrix is presented below.

Firm #2 chooses to innovate with probability 20/21. If Firm #1 does the same, what is the expected pay-off? Is this a Mixed Strategy Nash Equilibrium? Suppose, instead, that firm #2 innovates with probability 2/3. Should player #1 always innovate?

Correct Answer:

Verified

If firm #1 does the same, the expected p...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q28: Which of the following are examples of

Q36: There are two independent dealers for Sporto

Q44: Relative to a simultaneous-move situation, the loss

Q54: A maximin strategy:<br>A) maximizes the minimum gain

Q65: Scenario 13.17<br>Consider the entry-deterrence game below. The

Q85: A strategy A is "dominant" for a

Q87: When cost and demand are stable over

Q89: Scenario 13.14<br>Consider the game below: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2894/.jpg"

Q95: It can be rational to play tit-for-tat

Q117: Scenario 13.15<br>Consider the pricing game below: <img