Multiple Choice

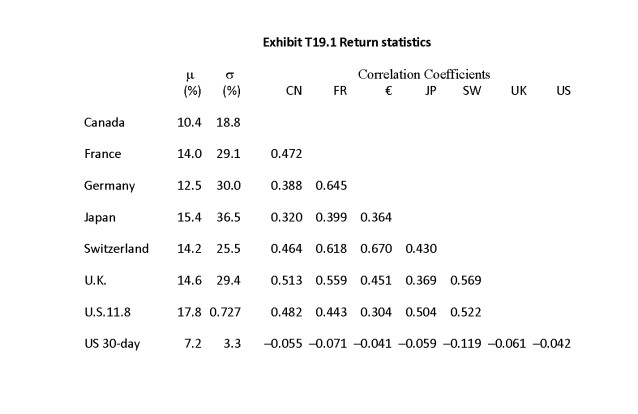

-Based on Exhibit T19.1, what is the Sharpe index of an equal-weighted portfolio of Canadian and French equities?

A) 0.138

B) 0.209

C) 0.236

D) 0.241

E) 0.288

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q12: The extent to which risk is reduced

Q13: The variance of foreign stock returns to

Q14: Which of a) through d) is FALSE?<br>A)

Q15: The benefits of international diversification are limited

Q16: What is the variance on the Indian

Q18: Correlations between national stock markets are fairly

Q19: The extent to which risk is reduced

Q20: The future benefits of risk reduction through

Q21: _ are not an impediment to the

Q22: The perfect market assumptions include each of