Multiple Choice

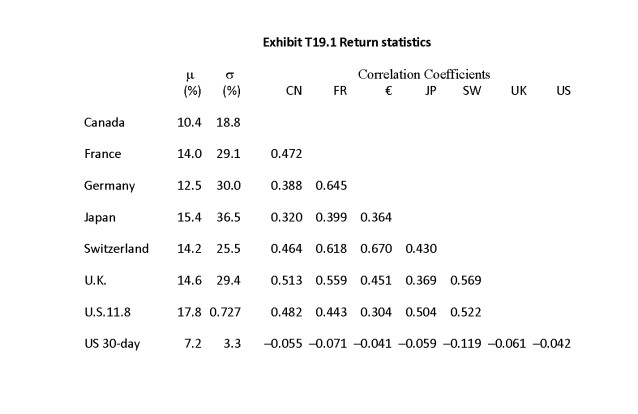

-Based on Exhibit T19.1, what is the Sharpe index of an equal-weighted portfolio of Japanese and Swiss equities?

A) 0.138

B) 0.209

C) 0.236

D) 0.241

E) 0.288

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: The variance of foreign bond returns to

Q2: Suppose E[r<sub>A</sub>] = 14.8%, <span

Q3: The correlation between returns on companies in

Q4: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3181/.jpg" alt=" -Based on Exhibit

Q5: Which of the following could account for

Q7: American depository receipts pay dividends in dollars

Q8: Frictionless financial markets could have which of

Q9: As the number of assets held in

Q10: Which of a) through d) is FALSE?<br>A)

Q11: You live in London and have invested