Essay

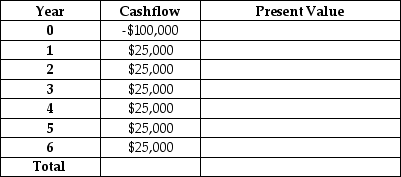

Ed's Electronic Devices has an asset beta of 0.6. The market rate of return is 12% and the risk-free rate of return is 2%. Ed is considering updating his production technology. If he does so, he expects the cash streams indicated in the table below. Given this information, should Ed update his production technology?

Correct Answer:

Verified

The present value of the cash flow is gi...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q99: Joel has $20,000 he would like to

Q100: Robert is considering purchasing a new or

Q101: Scenario 15.4:<br>Consider the following information:<br>You are considering

Q102: Suppose you are an attorney, and you

Q103: Len is putting in a new swimming

Q105: David Adams purchased an art collection for

Q106: The opportunity cost of capital for a

Q107: A perpetual payment of $10,000, offered for

Q108: Relative to a perfectly competitive market for

Q109: Scenario 15.6:<br>Consider the following decision that Eileen