Essay

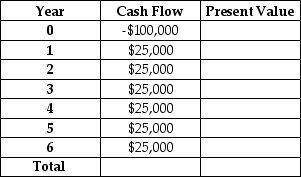

Ed's Electronic Devices has an asset beta of 1.2. The market rate of return is 12% and the risk-free rate of return is 2%. Ed is considering updating his production technology. If he does so, he expects the cash streams indicated in the table below. Given this information, should Ed update his production technology?

Correct Answer:

Verified

The present value of the cash flow is gi...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q119: The first term in an NPV calculation

Q120: Scenario 15.1:<br>This year Jacob Verytall signs a

Q121: An asset's beta can be used to

Q122: Sam has just entered college, and he

Q123: The user cost of an exhaustible resource

Q125: If the payment stream of a bond

Q126: You have been offered the opportunity to

Q127: The formula for finding the present value

Q128: Suppose you plan to retire in eight

Q129: Use the following statements to answer this