Essay

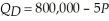

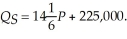

The market demand and supply functions for imported cars are:  and

and  The legislature is considering a tariff (a tax on imported goods) equal to $2,000 per unit to aid domestic car manufacturers. If the tariff is implemented, calculate the loss in producer surplus. How many units of cars are imported? Suppose that instead of a tariff, importers agree to voluntarily restrict their imports to this level. If they do and no tariff is implemented, calculate producer surplus in this scenario. Do you expect importers will be more in favor of a tariff or a voluntary quota?

The legislature is considering a tariff (a tax on imported goods) equal to $2,000 per unit to aid domestic car manufacturers. If the tariff is implemented, calculate the loss in producer surplus. How many units of cars are imported? Suppose that instead of a tariff, importers agree to voluntarily restrict their imports to this level. If they do and no tariff is implemented, calculate producer surplus in this scenario. Do you expect importers will be more in favor of a tariff or a voluntary quota?

Correct Answer:

Verified

First we must determine the market equil...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q126: When the government imposes a specific tax

Q127: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3095/.jpg" alt=" Figure 9.5.1 -Refer

Q128: The Clinton administration has recommended an increase

Q129: Consider the following statements when answering this

Q130: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3095/.jpg" alt=" Figure 9.1.1 -Refer

Q132: Consider the following statements when answering this

Q133: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3095/.jpg" alt=" Figure 9.3.1 -Refer

Q134: As illustrated in the textbook, the government

Q135: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3095/.jpg" alt=" Figure 9.1.2 -Refer

Q136: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3095/.jpg" alt=" Figure 9.4.2 -Refer