Multiple Choice

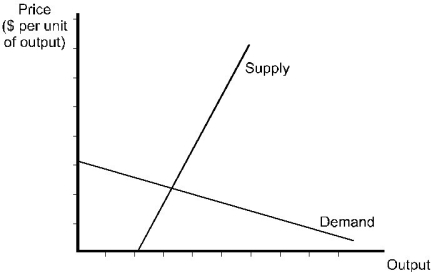

A specific tax will be imposed on a good. The supply and demand curves for the good are shown in the diagram below. Given this information, the burden of the tax:

A) is shared about evenly between consumers and producers.

B) falls mostly on consumers.

C) falls mostly on producers.

D) cannot be determined without more information on the price elasticities of supply and demand.

Correct Answer:

Verified

Correct Answer:

Verified

Q86: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3095/.jpg" alt=" Figure 9.3.1 -Refer

Q87: The benefit of a subsidy accrues mostly

Q88: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3095/.jpg" alt=" Figure 9.1.1 -Refer

Q89: A small decrease in a production quota

Q90: Which of the following policies could lead

Q92: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3095/.jpg" alt=" Figure 9.1.2 -Refer

Q93: The market for semiskilled labor can be

Q94: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3095/.jpg" alt=" Figure 9.4.2 -Refer

Q95: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3095/.jpg" alt=" Figure 9.5.1 -Refer

Q96: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3095/.jpg" alt=" Figure 9.2.1 -Refer