Essay

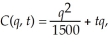

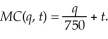

The manufacturing of paper products causes damage to a local river when the manufacturing plant produces more than 1,000 units in a period. To discourage the plant from producing more than 1,000 units, the local community is considering placing a tax on the plant. The long-run cost curve for the paper producing firm is:  where q is the number of units of paper produced and t is the per unit tax on paper production. The relevant marginal cost curve is:

where q is the number of units of paper produced and t is the per unit tax on paper production. The relevant marginal cost curve is:  If the manufacturing plant can sell all of its output for $2, what is the firm's optimal output if the tax is set at zero? What is the minimum tax rate necessary to ensure that the firm produces no more than 1,000 units? How much are the firm's profits reduced by the presence of a tax?

If the manufacturing plant can sell all of its output for $2, what is the firm's optimal output if the tax is set at zero? What is the minimum tax rate necessary to ensure that the firm produces no more than 1,000 units? How much are the firm's profits reduced by the presence of a tax?

Correct Answer:

Verified

In the absence of a tax, we know the pla...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q147: Homer's Boat Manufacturing cost function is: <img

Q148: The squishy industry is competitive and the

Q149: Scenario 8.2:<br>Yachts are produced by a perfectly

Q150: Three hundred firms supply the market for

Q151: Use the following statements to answer this

Q153: In the short run, a perfectly competitive

Q154: Suppose we plot the total revenue curve

Q155: The textbook for your class was not

Q156: Consider the following statements when answering this

Q157: When the price faced by a competitive