Essay

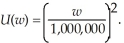

Marsha owns a boat that is harbored on the east coast of the United States. Currently, there is a hurricane that is approaching her harbor. If the hurricane strikes her harbor, her wealth will be diminished by the value of her boat, as it will be destroyed. The value of her boat is $250,000. It would cost Marsha $15,000 to move the boat to a harbor out of the path of the hurricane. Marsha's utility of wealth function is  Marsha's current wealth is $3 million including the value of the boat. Past evidence has influenced Marsha to believe that the hurricane will likely miss her harbor, and so she plans not to move her boat. Suppose the probability the hurricane will strike Marsha's harbor is 0.7. Calculate Marsha's expected utility given that she will not move her boat. Calculate Marsha's expected utility if she moves her boat. Which of the two options gives Marsha the highest expected utility?

Marsha's current wealth is $3 million including the value of the boat. Past evidence has influenced Marsha to believe that the hurricane will likely miss her harbor, and so she plans not to move her boat. Suppose the probability the hurricane will strike Marsha's harbor is 0.7. Calculate Marsha's expected utility given that she will not move her boat. Calculate Marsha's expected utility if she moves her boat. Which of the two options gives Marsha the highest expected utility?

Correct Answer:

Verified

If she will not move her boat,...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q112: The indifference curves of two investors are

Q113: Scenario 5.10:<br>Hillary can invest her family savings

Q114: Jonathan and Roberto enjoy playing poker. Jonathan's

Q115: Suppose your utility function for income that

Q116: Blanca has her choice of either a

Q118: Consider the following statements when answering this

Q119: The difference between the utility of expected

Q120: Calculate the expected value of the following

Q121: Joan Summers has $100,000 to invest and

Q122: The concept of a risk premium applies