Essay

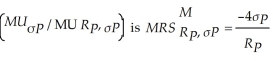

Mel and Christy are co-workers with different risk attitudes. Both have investments in the stock market and hold U.S. Treasury securities (which provide the risk free rate of return). Mel's marginal rate of substitution of return for risk  where

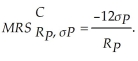

where  is the individual's portfolio rate of return and σP is the individual's portfolio risk. Christy's

is the individual's portfolio rate of return and σP is the individual's portfolio risk. Christy's  Each co-worker's budget constraint is

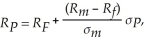

Each co-worker's budget constraint is  where

where  is the risk-free rate of return,

is the risk-free rate of return,  is the stock market rate of return, and

is the stock market rate of return, and  is the stock market risk. Solve for each co-worker's optimal portfolio rate of return as a function of

is the stock market risk. Solve for each co-worker's optimal portfolio rate of return as a function of  ,

,  and

and  .

.

Correct Answer:

Verified

We know that the slope of the indifferen...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q14: Consider the following information about job opportunities

Q15: Scenario 5.7:<br>As president and CEO of MegaWorld

Q16: Individuals who fully insure their house and

Q17: Any risk-averse individual would always:<br>A) take a

Q18: To optimally deter crime, law enforcement authorities

Q20: Jack is near retirement and worried that

Q21: An individual with a constant marginal utility

Q22: People often use probability statements to describe

Q23: Scenario 5.5:<br>Engineers at Jalopy Automotive have discovered

Q24: The slope of the budget line that