Essay

Donna is considering the option of becoming a co-owner in a business. Her investment choices are to hold a risk free asset that has a return of  and co-ownership of the business, which has a rate of return of

and co-ownership of the business, which has a rate of return of  and a level of risk of

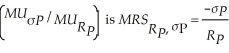

and a level of risk of  . Donna's marginal rate of substitution of return for risk

. Donna's marginal rate of substitution of return for risk  where

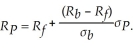

where  is Donna's portfolio rate of return and σP is her optimal portfolio risk. Donna's budget constraint is given by

is Donna's portfolio rate of return and σP is her optimal portfolio risk. Donna's budget constraint is given by  Solve for Donna's optimal portfolio rate of return and risk as a function of

Solve for Donna's optimal portfolio rate of return and risk as a function of  ,

,  and

and  . Suppose the table below lists the relevant rates of returns and risks. Use this table to determine Donna's optimal rate or return and risk.

. Suppose the table below lists the relevant rates of returns and risks. Use this table to determine Donna's optimal rate or return and risk.

Investment Rate of Return Risk

Risk Free 0.06 0

Business 0.25 0.39

Correct Answer:

Verified

To find Donna's optimal portfolio return...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q99: John Brown's utility of income function is

Q100: Which of these is NOT a generally

Q101: The information in the table below describes

Q102: C and S Metal Company produces stainless

Q103: John Smith is considering the purchase of

Q105: An investment opportunity has two possible outcomes.

Q106: Table 5.4<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3095/.jpg" alt="Table 5.4

Q107: An investment opportunity has two possible outcomes,

Q108: Because of the relationship between an asset's

Q109: Tom Wilson is the operations manager for