Essay

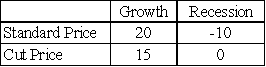

Firm X is currently selling a consumer good at a standard price,but is also considering cutting its price.The main risk facing the firm concerns the course of the economy in the near-term: whether the economy will grow at a steady pace (G)or whether it will experience a recession (R).The table below shows the firm's possible profit results (in $ millions).Finally,the firm judges that there is a 70% chance of growth and a 30% chance of a recession.

(a)Firm X must make its decision now (before knowing the future course of the economy).Which pricing policy maximizes its expected profit?

(a)Firm X must make its decision now (before knowing the future course of the economy).Which pricing policy maximizes its expected profit?

Correct Answer:

Verified

After a positive macro forecast,cutting ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Explain how Bayes Theorem is used to

Q7: Kevin goes trick-or-treating on Halloween. His neighbor

Q10: Stake Gold Mines has the option to

Q27: If Pr(a)= 0.5 and Pr(b)= 0.3,then the

Q30: Buyer A has offered $20,000 for a

Q31: Oliver undergoes a standard medical test while

Q32: The test result B has no

Q33: A price cut would increase the firm's

Q36: A high-tech firm is pursuing research and

Q37: A middle manager is an avid runner