Multiple Choice

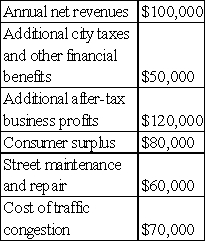

The following table gives the estimated costs and benefits of a proposed public convention center.

Table 11-1

-Two mutually exclusive projects,expected to last indefinitely,are being compared.Program A has annual profits and consumer surplus of $10 million and a one-time capital expenditure of $50 million.Program B has consumer surplus of $15 million and a one-time capital expenditure of $100 million.Using net present value as a criterion,which alternative should be selected?

A) If the discount rate is 12%,Program B should be selected.

B) If the discount rate is less than 10%,Program B should be selected.

C) If the discount rate is 22%,neither program should be selected.

D) The programs have the same net present value regardless of the discount rate used.

E) Answers b and c are both correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: The Federal Communications Commission (FCC) is trying

Q15: When consumers possess imperfect information or misinformation:<br>A)

Q16: What is the economic reasoning behind granting

Q25: Suppose the yearly interest rate is given

Q25: Which of the following is a source

Q26: When deciding among mutually exclusive projects,a public

Q28: Figure 11-1 shows the marginal internal cost

Q33: What is meant by predatory pricing?<br>A)It occurs

Q34: Which of the following is true of

Q35: The city council of Anderson is evaluating