Essay

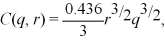

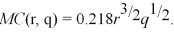

The squishy industry is competitive and the market price is $0.80.Apu's long-run cost function is:  where r is the price Apu pays to lease a squishy machine and q is squishy output.The long-run marginal cost curve is:

where r is the price Apu pays to lease a squishy machine and q is squishy output.The long-run marginal cost curve is:  What is Apu's optimal output if the price Apu pays to lease a squishy machine is $1.10? Suppose the lease price of squishy machines falls by $0.55.What happens to Apu's optimal output if the market price for a squishy remains at $0.80? Did profits increase for Apu when the lease rate of squishy machines fell?

What is Apu's optimal output if the price Apu pays to lease a squishy machine is $1.10? Suppose the lease price of squishy machines falls by $0.55.What happens to Apu's optimal output if the market price for a squishy remains at $0.80? Did profits increase for Apu when the lease rate of squishy machines fell?

Correct Answer:

Verified

The profit maximizing output level is wh...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3095/.jpg" alt=" Figure 8.5.1 -The

Q11: Scenario 8.2:<br>Yachts are produced by a perfectly

Q46: Consider the following statements when answering this

Q50: If the market price for a competitive

Q62: Consider the following diagram where a perfectly

Q83: Table 8.1<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3095/.jpg" alt="Table 8.1

Q99: In a constant-cost industry, price always equals:<br>A)

Q105: Suppose all firms have constant marginal costs

Q107: Suppose the state legislature in your state

Q159: Short-run supply curves for perfectly competitive firms