Essay

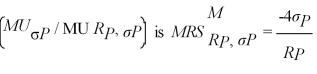

Mel and Christy are co-workers with different risk attitudes.Both have investments in the stock market and hold U.S.Treasury securities (which provide the risk free rate of return).Mel's marginal rate of substitution of return for risk  where RP is the individual's portfolio rate of return and σP is the individual's portfolio risk.Christy's

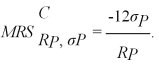

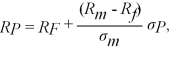

where RP is the individual's portfolio rate of return and σP is the individual's portfolio risk.Christy's  Each co-worker's budget constraint is

Each co-worker's budget constraint is  where Rj is the risk-free rate of return,Rm is the stock market rate of return,and σm is the stock market risk.Solve for each co-worker's optimal portfolio rate of return as a function of Rj,Rm and σm.

where Rj is the risk-free rate of return,Rm is the stock market rate of return,and σm is the stock market risk.Solve for each co-worker's optimal portfolio rate of return as a function of Rj,Rm and σm.

Correct Answer:

Verified

We know that the slope of the indifferen...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: Blanca would prefer a certain income of

Q10: In Eugene, Oregon, next year there is

Q33: Daring Dora holds 90% of her assets

Q36: Consider the following statements when answering this

Q40: Scenario 5.2:<br>Randy and Samantha are shopping for

Q42: What would best explain why a generally

Q73: Calculate the expected value of the following

Q123: Table 5.4<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3095/.jpg" alt="Table 5.4

Q131: Farmer Brown grows wheat on his farm

Q154: Steve has received a stock tip from