Multiple Choice

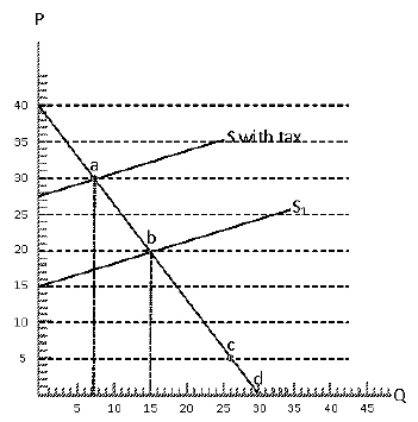

Exhibit 5-32  Refer to Exhibit 5-32.The tax burden borne by consumers is:

Refer to Exhibit 5-32.The tax burden borne by consumers is:

A) $50

B) $60

C) $70

D) $75

E) $80

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q15: If demand is elastic, a tax increase

Q16: If supply is more inelastic than demand

Q17: Historically salt has been one of the

Q18: If demand is more inelastic than supply

Q19: On which of the following goods would

Q21: If there is a $1 per box

Q22: The more elastic is the supply, the

Q23: The more price elastic is demand, the

Q24: For which of the following goods would

Q25: If supply is elastic, the imposition of