Multiple Choice

Use the following to answer question:

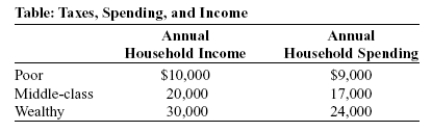

-(Table: Taxes,Spending,and Income) Use Table: Taxes,Spending,and Income.Suppose Governor Meridias decides to initiate a state tax of 5% on all sales.A poor household will spend _____% of its annual income on the sales tax,while a wealthy household will spend _____% of its annual income.

A) 4.5;4

B) 5;5

C) 5;3.5

D) 3.5;4.5

Correct Answer:

Verified

Correct Answer:

Verified

Q24: Use the following to answer question: <img

Q25: The FICA tax falls most heavily on

Q26: If the elasticity of demand is _

Q27: The _ rate on income represents the

Q28: Use the following to answer question: <img

Q30: A _ tax takes a larger share

Q31: Suppose Governor Meridias decides to initiate a

Q32: The government imposes a tax of $1,000

Q33: Lump-sum taxes promote economic efficiency but violate

Q34: Producers in a particular market will bear