Multiple Choice

Use the following to answer question:

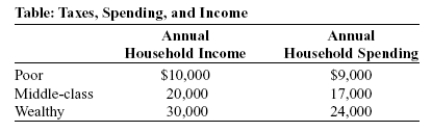

-(Table: Taxes,Spending,and Income) Use Table: Taxes,Spending,and Income.Suppose Governor Meridias initiates a tax of 10% on all income up to $50,000.Income above $50,000 is not taxed.An individual earning $75,000 will have a average tax rate of _____%.

A) 10

B) 0

C) 6.67

D) 5

Correct Answer:

Verified

Correct Answer:

Verified

Q164: Use the following to answer question: <img

Q165: Use the following to answer question: <img

Q166: A lump-sum tax,such as the fee for

Q167: Sales taxes are considered to be:<br>A)an unfair

Q168: Use the following to answer question: <img

Q170: Use the following to answer question: <img

Q171: Taxation according to the ability-to-pay principle is

Q172: A tax system achieves efficiency when it

Q173: Which tax BEST illustrates the ability-to-pay principle

Q174: Which tax is an excise tax?<br>A)a tax