Multiple Choice

Use the following to answer question:

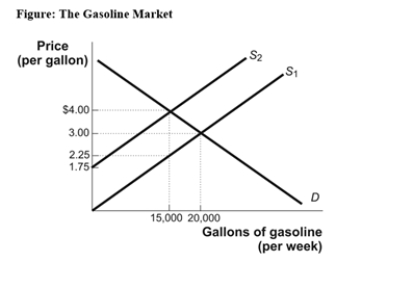

-(Figure: The Gasoline Market) Use Figure: The Gasoline Market.The pretax equilibrium price is $3,and the equilibrium quantity before tax is 20,000 gallons.An excise tax has been levied on each gallon of gasoline supplied by producers.Based on the graph,the incidence of the tax on suppliers is:

A) $1.50.

B) $1.

C) $0.75.

D) $15,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q60: Which tax reflects the ability-to-pay principle?<br>A)the federal

Q61: If an excise tax is imposed on

Q62: Assume the same upward supply curve for

Q63: Use the following to answer question: <img

Q64: A tax of $20 on an income

Q66: _ tax does NOT distort incentives and

Q67: Use the following to answer question: <img

Q68: Cigarette taxes have eliminated the wedge between

Q69: Paying a tax of $20 on an

Q70: A tax that takes a _ percentage