Multiple Choice

Use the following to answer question:

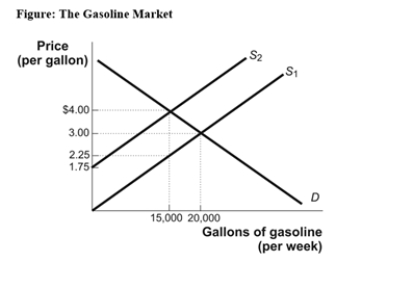

-(Figure: The Gasoline Market) Use Figure: The Gasoline Market.The pretax equilibrium price is $3,and the equilibrium quantity before tax is 20,000 gallons.An excise tax has been levied on each gallon of gasoline supplied by producers,shifting the supply curve upward.What is the tax rate?

A) $1.75 per gallon

B) $1 per gallon

C) $2.50

D) $0.50

Correct Answer:

Verified

Correct Answer:

Verified

Q222: If the marginal tax rate is less

Q223: A tax is progressive if the tax

Q224: Use the following to answer question: <img

Q225: If the government levies an excise tax

Q226: Deadweight losses arising from an excise tax

Q228: The _ principle implies that people with

Q229: An excise tax is levied on suppliers.The

Q230: Overall,the taxes collected by the federal government

Q231: The evidence suggests that taken collectively,taxes in

Q232: If the government imposes a per-unit tax