Multiple Choice

Use the following to answer question:

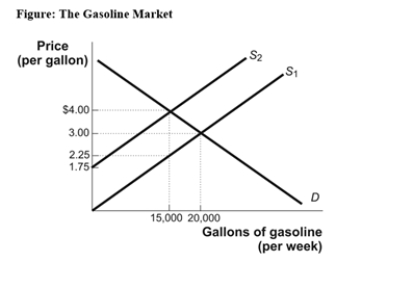

-(Figure: The Gasoline Market) Use Figure: The Gasoline Market.The pretax equilibrium price is $3,and the equilibrium quantity before tax is 20,000 gallons.An excise tax has been levied on each gallon of gasoline supplied by producers,shifting the supply curve upward.The total tax revenue collected by the government is equal to:

A) $1.50.

B) $15,000.

C) $26,250.

D) $30,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q185: Use the following to answer question: <img

Q186: If the demand for good X is

Q187: A principle suggesting that people with more

Q188: The price elasticity of demand for a

Q189: A tax system achieves equity when:<br>A)taxes are

Q191: Given any downward-sloping demand curve for a

Q192: According to the _ principle,those who can

Q193: Consumers in a particular market will bear

Q194: If demand and supply are both very

Q195: If demand is perfectly inelastic and the