Multiple Choice

Use the following to answer question:

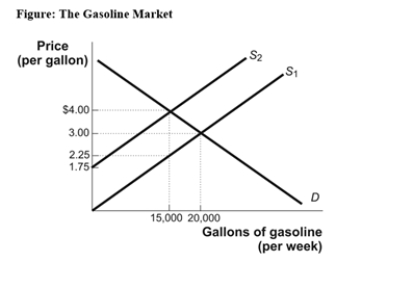

-(Figure: The Gasoline Market) Use Figure: The Gasoline Market.The pretax equilibrium price is $3,and the equilibrium quantity before tax is 20,000 gallons.An excise tax has been levied on each gallon of gasoline,shifting the supply curve upward.The deadweight loss from this tax is equal to:

A) $1.50.

B) $5,000.

C) $15,000.

D) $4,375.

Correct Answer:

Verified

Correct Answer:

Verified

Q271: If the government decides to impose a

Q272: If the demand curve is downward-sloping and

Q273: A progressive tax:<br>A)takes a larger share of

Q274: A tax system _ when it minimizes

Q275: Use the following to answer question: <img

Q277: A(n)_ tax tends to encourage consumption and

Q278: State governments levy excise taxes on cigarettes

Q279: Use the following to answer question: <img

Q280: Given any upward-sloping supply curve for a

Q281: Given any upward-sloping supply curve for a