Multiple Choice

Use the following to answer question:

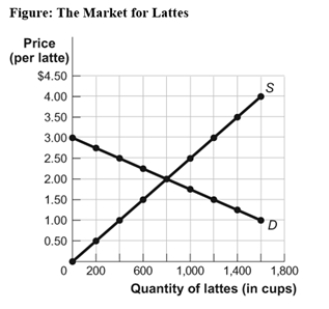

-(Figure: The Market for Lattes) Use Figure: The Market for Lattes.If the government assesses a tax of $0.75 on each latte,the price the consumer pays for a latte after the tax will:

A) increase from $2 to $2.75.

B) increase from $2 to $2.50.

C) increase from $2 to $2.25.

D) change,but we cannot determine by how much.

Correct Answer:

Verified

Correct Answer:

Verified

Q135: The amount of tax levied per unit

Q136: _ and _ taxes are the LARGEST

Q137: Use the following to answer question: <img

Q138: An efficient way to finance the provision

Q139: Economic analysis shows that workers pay _

Q141: A tax of $10 on an income

Q142: For a tax system to achieve equity,it

Q143: Recently,the government considered adding an excise tax

Q144: Use the following to answer question: <img

Q145: Suppose price elasticity of demand is relatively