Multiple Choice

Use the following to answer question:

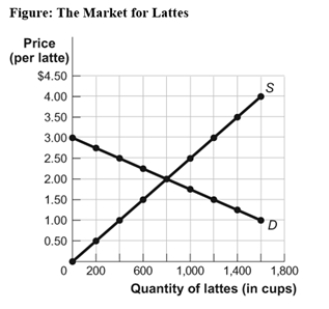

-(Figure: The Market for Lattes) Use Figure: The Market for Lattes.If the government assesses a tax of $0.75 on sellers of lattes,the price producers will receive for a latte after the tax will:

A) decrease from $2 to $1.75.

B) decrease from $2 to $1.50.

C) decrease from $2 to $1.25.

D) change,but we cannot determine by how much.

Correct Answer:

Verified

Correct Answer:

Verified

Q111: Assuming a normal upward-sloping supply curve and

Q112: An excise tax is levied on:<br>A)each unit

Q113: In the United States,taxes tend to be

Q114: Use the following to answer question: <img

Q115: Which tax BEST illustrates the benefits principle

Q117: When the imposition of an excise tax

Q118: A cost(s)NOT associated with the imposition of

Q119: The burden of a tax on a

Q120: A higher tax rate is more likely

Q121: As part of an anti-obesity program,the government