Multiple Choice

Use the following to answer question:

-(Scenario: Choosing Insurance) Use Scenario: Choosing Insurance.For $1,000,the Ramirez family can buy insurance that will cover the full cost of repairs.If family members are risk-averse and want to maximize their expected utility,they will: Scenario: Choosing Insurance

The Ramirez family owns three cars and is considering buying insurance to cover the cost of repairs.They face two possible states: in state 1,their cars need no repairs and their income available for purchasing other goods and services is $50,000;in state 2,their cars need $10,000 worth of repairs and their income available for purchasing other goods and services is reduced to $40,000.The probability of repairs is 10%,while the probability of no repairs is 90%.

A) buy the insurance.

B) be indifferent between buying and not buying the insurance since their expected income for purchasing other goods and services is $49,000,regardless of what they do.

C) buy the insurance as long as the utility of having a certain income of $48,000 to buy goods and services other than car repairs is higher than the utility associated with their expected income without insurance.

D) self-insure.

Correct Answer:

Verified

Correct Answer:

Verified

Q69: Use the following to answer question:<br>Figure: Differences

Q70: The Baker family is faced with two

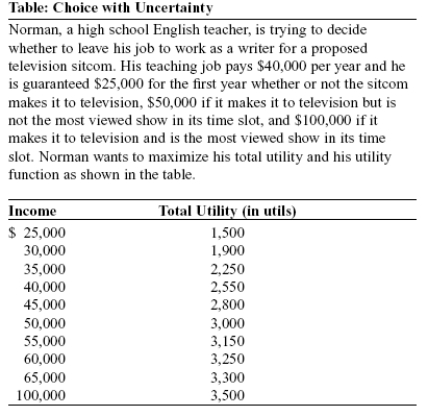

Q71: Use the following to answer question: <img

Q72: Use the following to answer question: <img

Q73: An efficient market for risk,such as an

Q75: Micah is considering turning pro before his

Q76: Fire insurance policies include deductibles:<br>A)because,when it comes

Q77: Use the following to answer question: <img

Q78: The future price of one share of

Q79: McDonald's and other fast-food chains rely mainly