Multiple Choice

Use the following to answer question:

-(Scenario: Choosing Insurance) Use Scenario: Choosing Insurance.For $900,the Ramirez family can buy insurance that will cover the full cost of repairs.If family members are risk-averse and maximize their expected utility,they will: Scenario: Choosing Insurance

The Ramirez family owns three cars and is considering buying insurance to cover the cost of repairs.They face two possible states: in state 1,their cars need no repairs and their income available for purchasing other goods and services is $50,000;in state 2,their cars need $10,000 worth of repairs and their income available for purchasing other goods and services is reduced to $40,000.The probability of repairs is 10%,while the probability of no repairs is 90%.

A) buy the insurance.

B) be indifferent between buying and not buying the insurance since their expected income for purchasing other goods and services is $49,100,regardless of what they do.

C) not buy the insurance,since buying it does not increase their expected income for purchasing other goods and services.

D) self-insure.

Correct Answer:

Verified

Correct Answer:

Verified

Q159: Two possible events are independent if they

Q160: Rhonda would like a better bicycle,and she

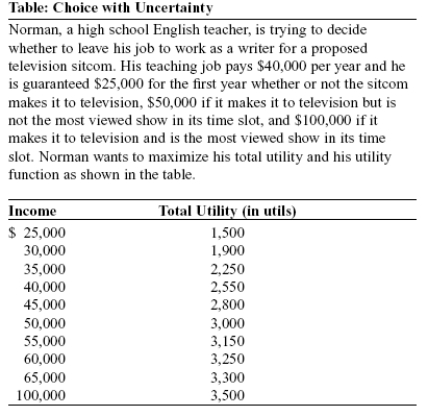

Q161: Use the following to answer question: <img

Q162: Use the following to answer question: <img

Q163: You insure your car against theft.Consequently,you rarely

Q165: Which statement regarding a warranty is NOT

Q166: (Scenario: Health Costs)Use Scenario: Health Costs.When Alan's

Q167: Use the following to answer question: <img

Q168: Risk-averse individuals are willing to pay a

Q169: (Scenario: Used-Car Market)Use Scenario: Used-Car Market.Adverse selection