Multiple Choice

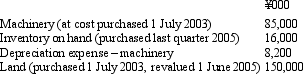

Aus Co Ltd has a foreign operation based in Japan. The following information was extracted from the foreign operation's accounts for the period ended 30 June 2005:

Exchange rate information is:

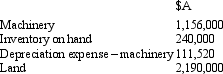

What is the amount at which each item would be translated (rounded to the nearest $A) ?

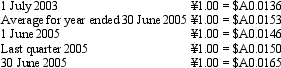

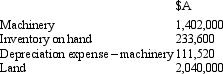

A)

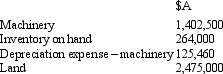

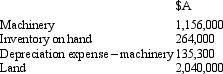

B)

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Ramikin Co is a fully owned subsidiary

Q6: Aus Co Ltd has a foreign operation

Q7: The translation approach required by AASB 121

Q18: AASB 121 specifies that post-acquisition movements in

Q20: Distributions from retained profits are translated at<br>A)

Q29: In the process of consolidating the translated

Q31: The amount of a foreign operation's post-acquisition

Q35: If the exchange rate for US dollars

Q39: In translating the accounts of a foreign

Q41: As prescribed in AASB 121,in translating the