Multiple Choice

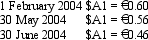

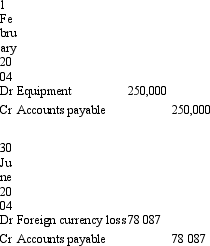

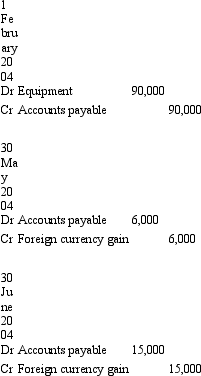

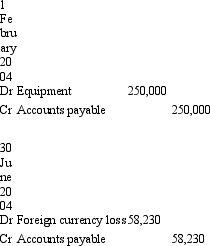

On 1 February 2004, Morinda Ltd completes a binding agreement to purchase a hydraulic lift from a manufacturer located in Germany. The cost of the equipment is €150,000. The construction of the lift is completed on 30 May 2004, and it is considered to be a qualifying asset according to AASB 123. The amount owing has not been paid by reporting date 30 June 2004. The following is information about the exchange rates:

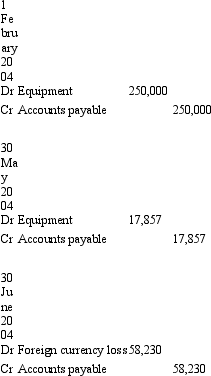

What entries are required to record the transaction and subsequent events in accordance with AASB 121 (rounded to the nearest whole $A) ?

A)

B)

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Which of the following items is within

Q7: It seems pointless to distinguish between different

Q11: The following items are in the financial

Q12: AASB 121 requires that the initial recognition

Q13: Emu Exports Ltd sold products to a

Q14: On 1 July 2005 Jarrets Ltd borrows

Q18: The effect of a fall in the

Q18: On 1 May 2005 Harriet's Importers Ltd

Q57: Monetary items are units of currency held

Q66: Inventory is an example of a monetary