Multiple Choice

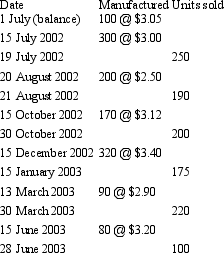

Oblong Ltd manufactures cardboard boxes for a variety of purposes. The following information relates to the production of the extra large packing boxes used by removalists for the period ended 30 June 2003.

The company uses a perpetual inventory system. The net realisable value per extra large cardboard box is $3.15 at the end of the period. What are the costs of sales and the value of ending inventory for Oblong Ltd assuming the FIFO cost-flow assumption is used?

A) Cost of sales: $3,460.40 Ending inventory: $380.00

B) Cost of sales: $3,453.90 Ending inventory: $386.50

C) Cost of sales: $3,459.41 Ending inventory: $380.99

D) Cost of sales: $3,453.90 Ending inventory: $393.75

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: In addition to the cost-flow assumption,the system

Q7: The cost of inventory is defined by

Q11: Using the periodic system of inventory:<br>A) Gives

Q35: Kensington Ltd is an importer and retailer

Q37: Circle Ltd manufactures polystyrene trays for a

Q38: Big Games for Big Kids sell a

Q43: Consistent with positive accounting theory,an entity close

Q47: Standard costs are able to be used

Q55: FIFO method is an income decreasing inventory

Q58: Which accounting policy for manufacturing fixed costs