Multiple Choice

Bondi Ltd is a small sports shop. At the beginning of the period, Bondi Ltd had 30 tennis racquets on hand costing $50 each. On 31 October 2009, the shop sold 20 racquets to a tennis instructor for $80. A delivery of 50 racquets was received on 15 November 2009 at $50 but received 2% discount if the account is paid within 30 days. What are the appropriate journal entries to recognise above transactions using the periodic system?

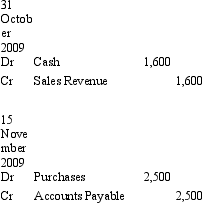

A)

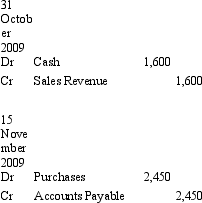

B)

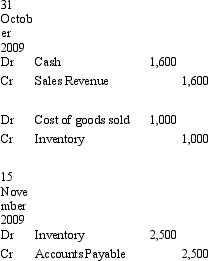

C)

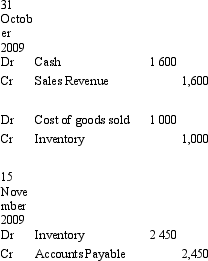

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: AASB 102 provides that not-for-profit entities:<br>A) Must

Q13: The valuation of inventories may be on

Q19: Standard costs may be used to arrive

Q19: AASB 102 on inventories does not apply

Q33: Use of the LIFO method has been

Q35: Kensington Ltd is an importer and retailer

Q47: Standard costs are able to be used

Q50: Randwick Ltd has a year-end of 30

Q58: Which accounting policy for manufacturing fixed costs

Q69: Some biological assets may be covered by